Instructions for IRS Form W-14 Certificate of Foreign Contracting Party Receiving Federal Procurement Payments

This document contains official instructions for IRS Form W-14 , Certificate of Foreign Contracting Party Receiving Federal Procurement Payments - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form W-14 is available for download through this link.

FAQ

Q: What is IRS Form W-14?

A: IRS Form W-14 is the Certificate of Foreign Contracting Party Receiving Federal Procurement Payments.

Q: Who should use IRS Form W-14?

A: Foreign contracting parties who receive federal procurement payments should use IRS Form W-14.

Q: What is the purpose of IRS Form W-14?

A: The purpose of IRS Form W-14 is to certify foreign contracting parties to receive federal procurement payments.

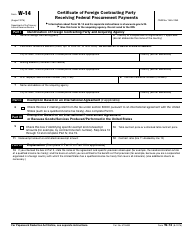

Q: What information do I need to provide on IRS Form W-14?

A: You will need to provide your identifying information, details about the contract, and certification of your eligibility.

Q: Are there any special requirements for completing IRS Form W-14?

A: Yes, there are specific instructions for completing IRS Form W-14, so make sure to carefully follow them.

Q: Do I need to submit any supporting documents with IRS Form W-14?

A: Yes, you may need to submit supporting documentation to verify your eligibility as a foreign contracting party.

Q: Is IRS Form W-14 used for all types of federal procurement payments?

A: No, IRS Form W-14 is specifically used for foreign contracting parties receiving federal procurement payments.

Q: What should I do with IRS Form W-14 once it is completed?

A: You should keep a copy of IRS Form W-14 for your records and provide the original to the appropriate government agency.

Q: Are there any deadlines for filing IRS Form W-14?

A: There may be specific deadlines for filing IRS Form W-14, so make sure to check the instructions or consult with the relevant agency.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.