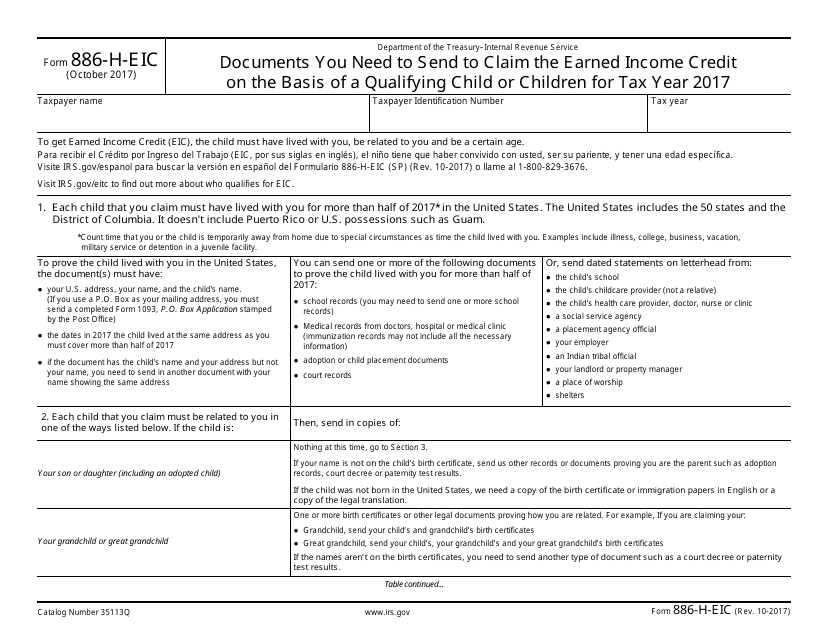

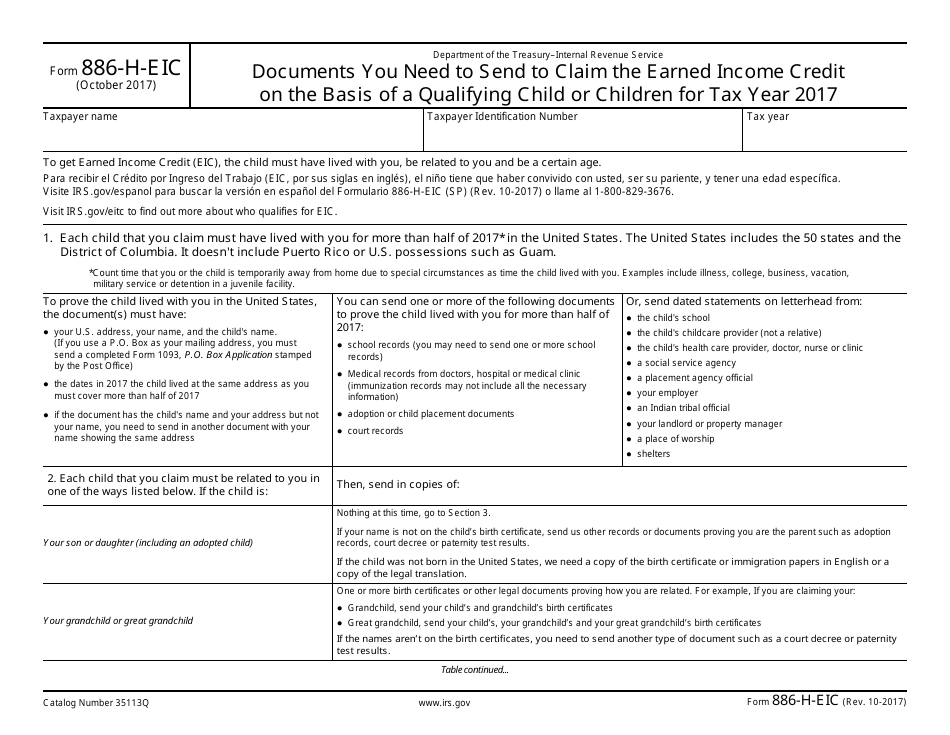

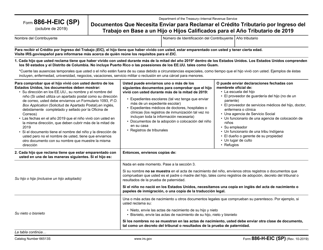

IRS Form 886-H-EIC Documents You Need to Send to Claim the Earned Income Credit on the Basis of a Qualifying Child or Children

What Is IRS Form 886-H-EIC?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on October 1, 2017. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 886-H-EIC?

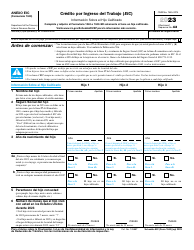

A: IRS Form 886-H-EIC is a form used to claim the Earned Income Credit (EIC) on the basis of a qualifying child or children.

Q: What is the Earned Income Credit (EIC)?

A: The Earned Income Credit (EIC) is a tax credit for low to moderate-income individuals and families.

Q: What is a qualifying child?

A: A qualifying child is a child who meets the criteria set by the IRS for the Earned Income Credit.

Q: Why do I need to send documents with IRS Form 886-H-EIC?

A: You need to send documents to support your claim for the Earned Income Credit on the basis of a qualifying child or children.

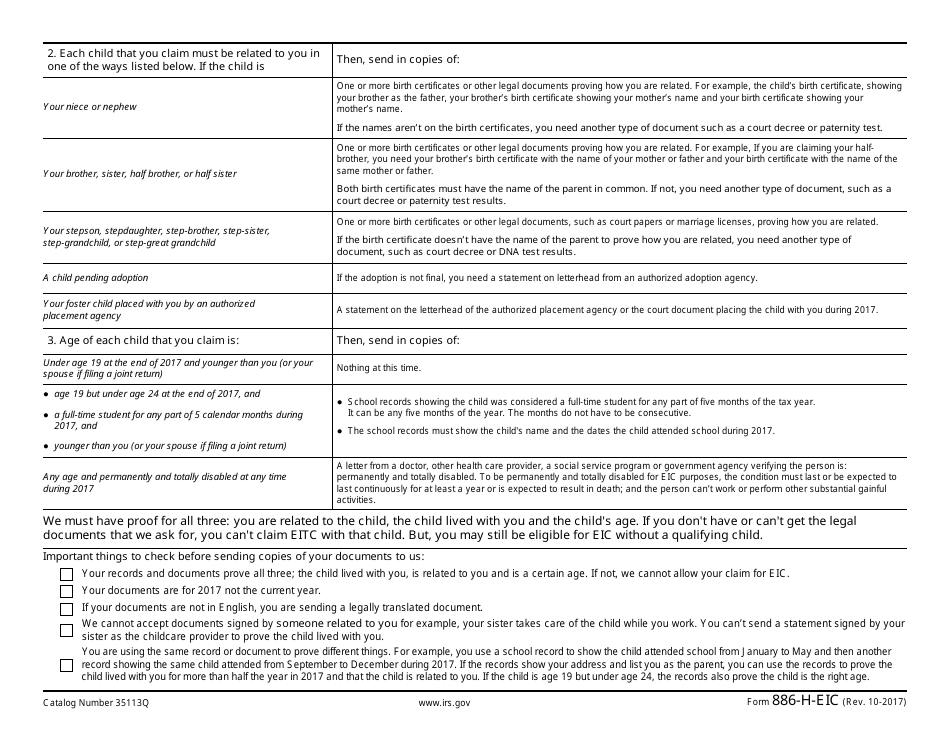

Q: What documents do I need to send with IRS Form 886-H-EIC?

A: You may need to send documents such as birth certificates, social security cards, and school records to prove the eligibility of the qualifying child or children.

Q: Can I claim the Earned Income Credit without a qualifying child?

A: Yes, there is a separate form (Form 886-H-EIC) for claiming the Earned Income Credit without a qualifying child.

Q: Is the Earned Income Credit refundable?

A: Yes, the Earned Income Credit is a refundable tax credit, which means it can increase your tax refund or reduce the amount of tax you owe.

Q: What is the income limit for the Earned Income Credit?

A: The income limit to qualify for the Earned Income Credit depends on your filing status, the number of qualifying children, and your adjusted gross income.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 886-H-EIC through the link below or browse more documents in our library of IRS Forms.