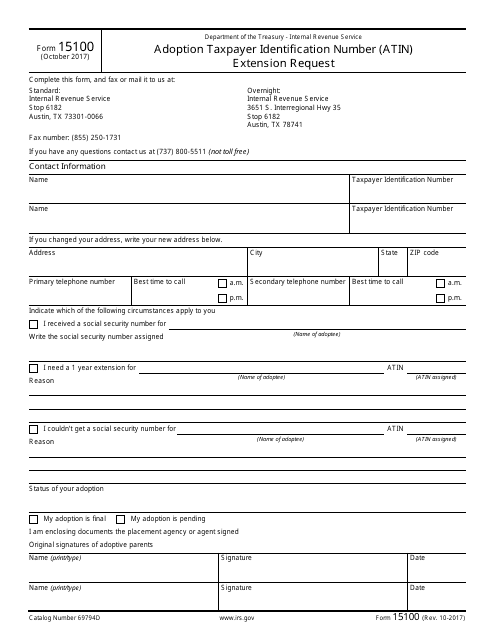

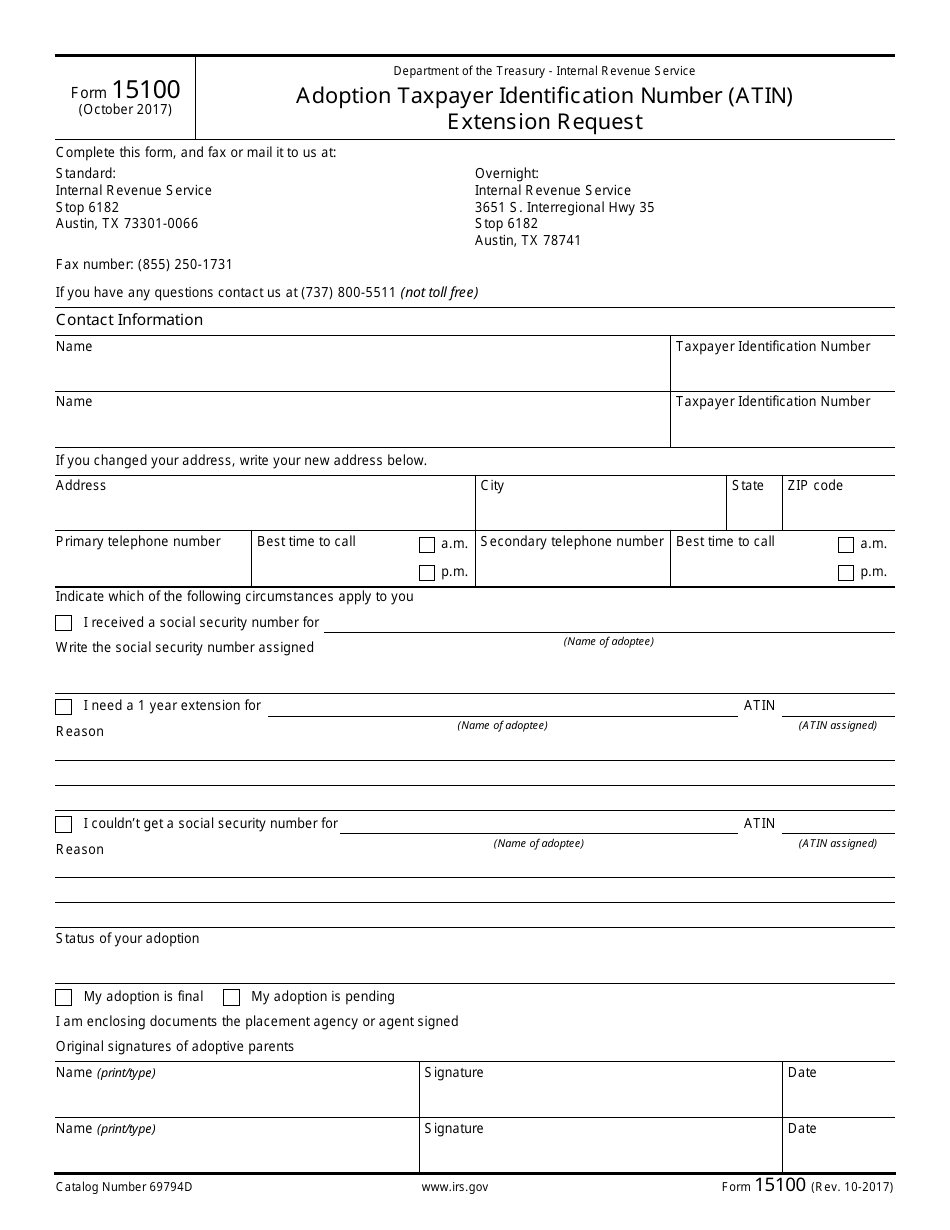

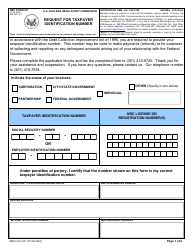

IRS Form 15100 Adoption Taxpayer Identification Number (Atin) Extension Request

What Is IRS Form 15100?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on October 1, 2017. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 15100?

A: IRS Form 15100 is the Adoption Taxpayer Identification Number (ATIN) Extension Request form.

Q: What is the purpose of IRS Form 15100?

A: The purpose of IRS Form 15100 is to request an extension for the Adoption Taxpayer Identification Number (ATIN).

Q: Who needs to file IRS Form 15100?

A: Anyone who needs an extension for the Adoption Taxpayer Identification Number (ATIN) should file IRS Form 15100.

Q: Is there a fee for filing IRS Form 15100?

A: No, there is no fee for filing IRS Form 15100.

Q: Is IRS Form 15100 eligible for electronic filing?

A: No, IRS Form 15100 is not eligible for electronic filing. It must be printed and mailed to the IRS.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- A Spanish version of IRS Form 15100 is available for spanish-speaking filers;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 15100 through the link below or browse more documents in our library of IRS Forms.