This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 14765

for the current year.

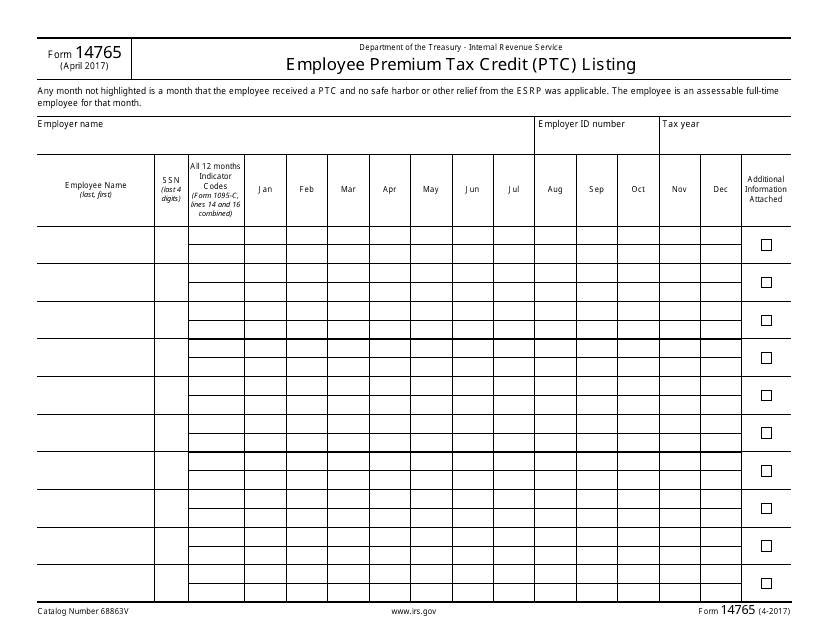

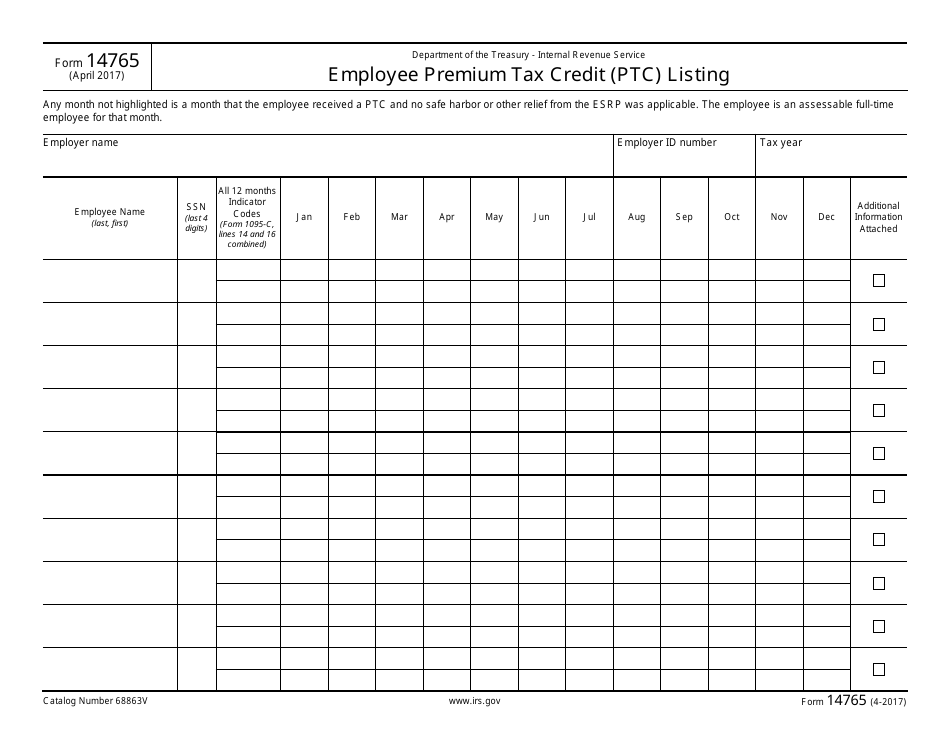

IRS Form 14765 Employee Premium Tax Credit (Ptc) Listing

What Is IRS Form 14765?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on April 1, 2017. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is Form 14765 Employee Premium Tax Credit (PTC) Listing?

A: Form 14765 Employee Premium Tax Credit (PTC) Listing is a form used by employers to report the employees who received a premium tax credit (PTC) for health insurance coverage through the Health Insurance Marketplace.

Q: Why is Form 14765 Employee Premium Tax Credit (PTC) Listing important?

A: Form 14765 is important for employers because it helps them verify that the employees who received a premium tax credit are eligible for it based on their coverage through the Health Insurance Marketplace.

Q: Who is required to file Form 14765?

A: Employers who offer health insurance coverage to their employees and have received a notice from the IRS regarding an employee's premium tax credit (PTC) are required to file Form 14765.

Q: What information is required on Form 14765?

A: Form 14765 requires the employer to provide the employee's name, Social Security number, and the coverage start and end dates for the health insurance through the Health Insurance Marketplace.

Q: When is the deadline for filing Form 14765?

A: The deadline for filing Form 14765 is specified in the notice received from the IRS. It is important to comply with the deadline to avoid penalties or fines.

Q: Are there any penalties for not filing Form 14765?

A: Failure to file Form 14765 or providing inaccurate information may result in penalties imposed by the IRS.

Q: Can employees access their own Form 14765?

A: No, Form 14765 is submitted by the employer to the IRS and is not accessible to employees.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14765 through the link below or browse more documents in our library of IRS Forms.