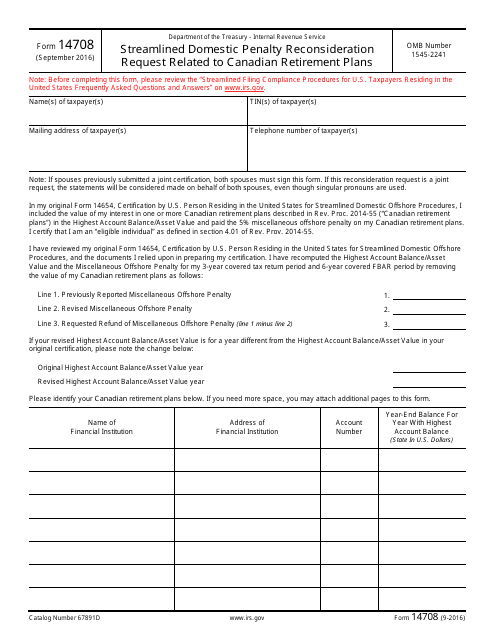

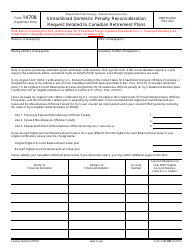

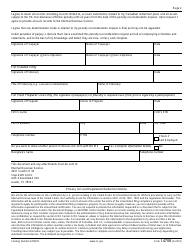

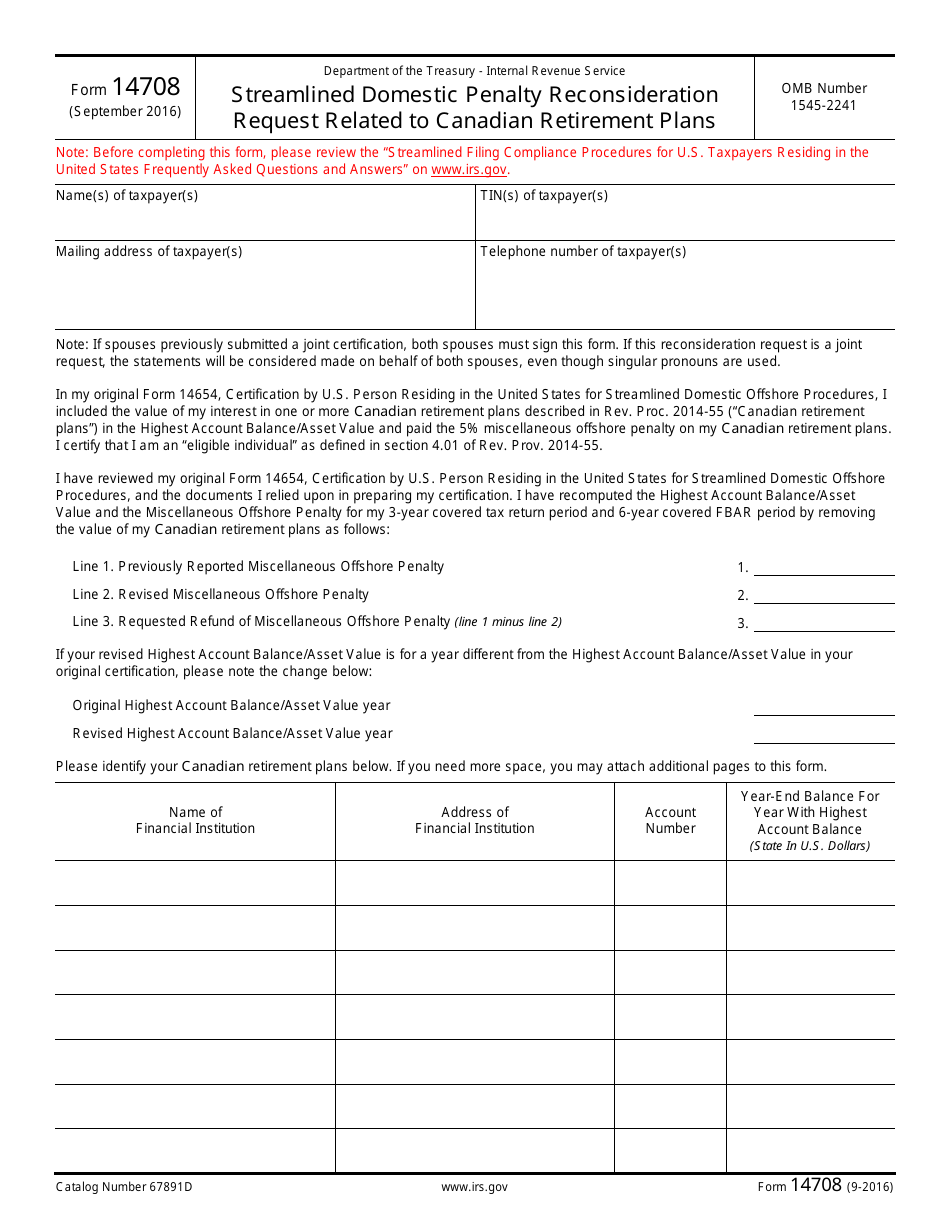

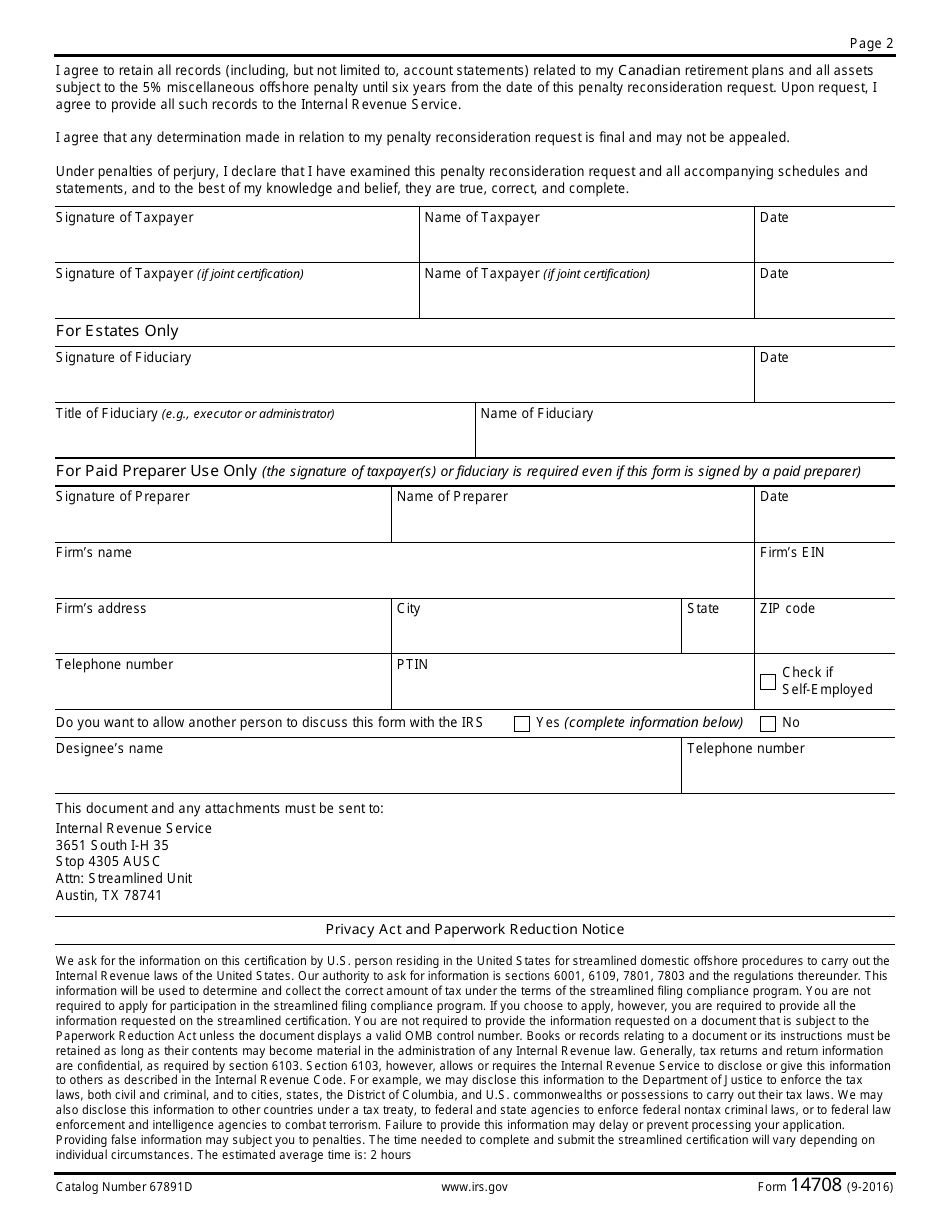

IRS Form 14708 Streamlined Domestic Penalty Reconsideration Request Related to Canadian Retirement Plans

What Is IRS Form 14708?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on September 1, 2016. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 14708?

A: IRS Form 14708 is a form used for Streamlined Domestic Penalty Reconsideration Request related to Canadian Retirement Plans.

Q: What is the purpose of IRS Form 14708?

A: The purpose of Form 14708 is to request a reconsideration of penalties related to Canadian retirement plans under the Streamlined Domestic Offshore Procedures.

Q: Who should use IRS Form 14708?

A: Individuals who are seeking a reconsideration of penalties related to Canadian retirement plans under the Streamlined Domestic Offshore Procedures should use Form 14708.

Q: What are the Streamlined Domestic Offshore Procedures?

A: The Streamlined Domestic Offshore Procedures are a program designed by the IRS to help taxpayers with undisclosed foreign financial assets come into compliance with their tax obligations.

Q: What are Canadian retirement plans?

A: Canadian retirement plans refer to retirement accounts or pensions that individuals hold in Canada, such as Registered Retirement Savings Plans (RRSPs) or Registered Pension Plans (RPPs).

Q: Are there any specific requirements for using IRS Form 14708?

A: Yes, there are specific requirements and eligibility criteria that taxpayers must meet in order to use Form 14708. These requirements are outlined in the instructions accompanying the form.

Q: What should I do if I have questions about IRS Form 14708?

A: If you have questions about Form 14708 or need assistance with completing the form, it is recommended to consult with a tax professional or contact the IRS for guidance.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14708 through the link below or browse more documents in our library of IRS Forms.