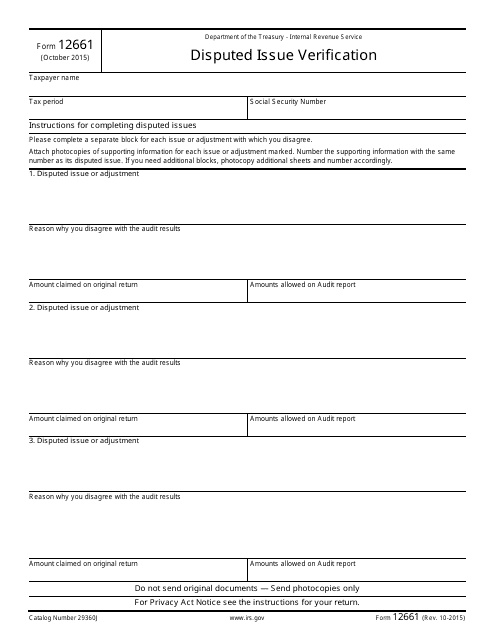

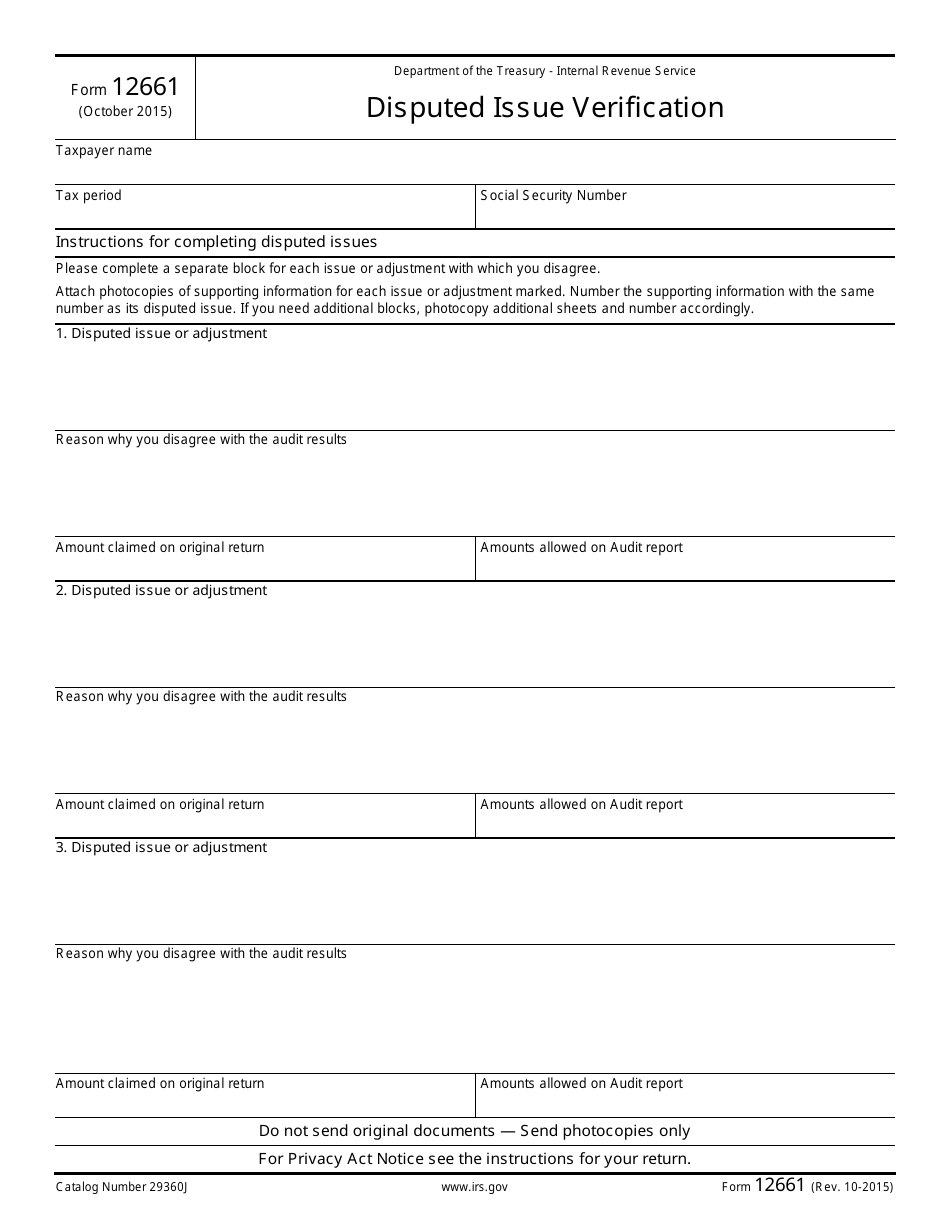

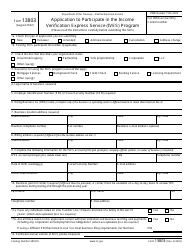

IRS Form 12661 Disputed Issue Verification

What Is IRS Form 12661?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on October 1, 2015. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 12661?

A: IRS Form 12661 is the Disputed Issue Verification form.

Q: When should I use IRS Form 12661?

A: You should use IRS Form 12661 when you want to request a conference with the IRS to resolve a disputed issue on your tax return.

Q: How do I fill out IRS Form 12661?

A: You need to provide your contact information, explain the issues in dispute, and state the facts, law, or other supporting evidence.

Q: Is there a deadline to submit IRS Form 12661?

A: There is no specific deadline to submit IRS Form 12661, but it is recommended to do so as soon as possible to resolve the dispute.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 12661 through the link below or browse more documents in our library of IRS Forms.