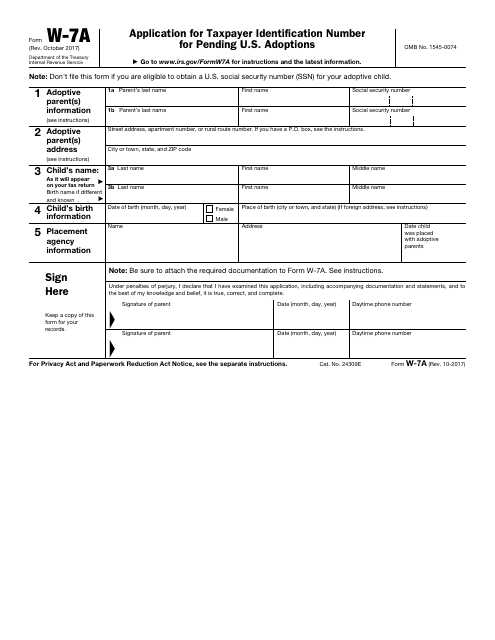

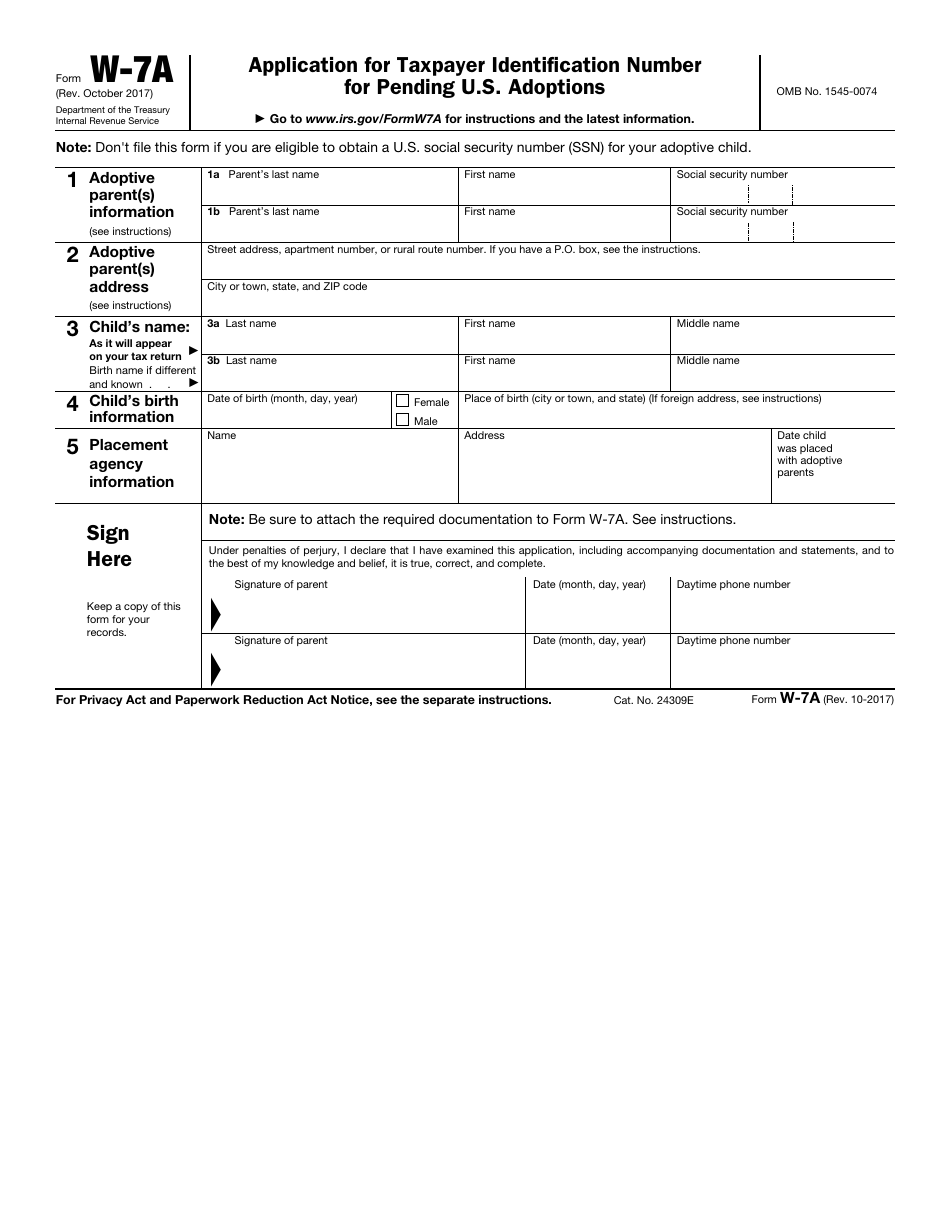

IRS Form W-7A Application for Taxpayer Identification Number for Pending U.S. Adoptions

What Is IRS Form W-7A?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on October 1, 2017. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form W-7A?

A: IRS Form W-7A is the application for a Taxpayer Identification Number (TIN) for pending U.S. adoptions.

Q: Who needs to fill out Form W-7A?

A: Anyone who is involved in a pending U.S. adoption and needs a Taxpayer Identification Number (TIN) needs to fill out Form W-7A.

Q: What is a Taxpayer Identification Number (TIN)?

A: A Taxpayer Identification Number (TIN) is a unique identifying number assigned by the IRS for tax purposes.

Q: What is the purpose of Form W-7A?

A: The purpose of Form W-7A is to apply for a Taxpayer Identification Number (TIN) for pending U.S. adoptions.

Q: Are there any fees associated with filing Form W-7A?

A: No, there are no fees associated with filing Form W-7A.

Q: Are there any supporting documents required to be submitted with Form W-7A?

A: Yes, there are supporting documents required to be submitted with Form W-7A. The specific documents needed depend on the individual's circumstances. The instructions for Form W-7A provide details on the required documents.

Q: How long does it take to process Form W-7A?

A: The processing time for Form W-7A varies. It may take several weeks for the IRS to process the application.

Q: Can Form W-7A be filed electronically?

A: No, Form W-7A cannot be filed electronically. It must be mailed to the IRS.

Q: What should I do if I have questions or need assistance with Form W-7A?

A: If you have questions or need assistance with Form W-7A, you can contact the IRS directly or seek the help of a tax professional.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form W-7A through the link below or browse more documents in our library of IRS Forms.