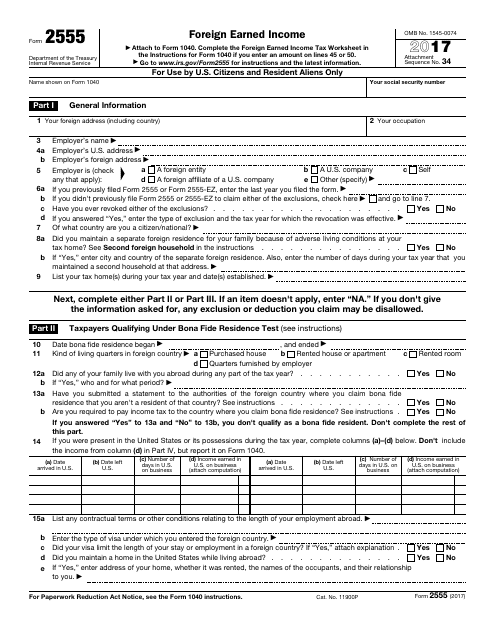

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 2555

for the current year.

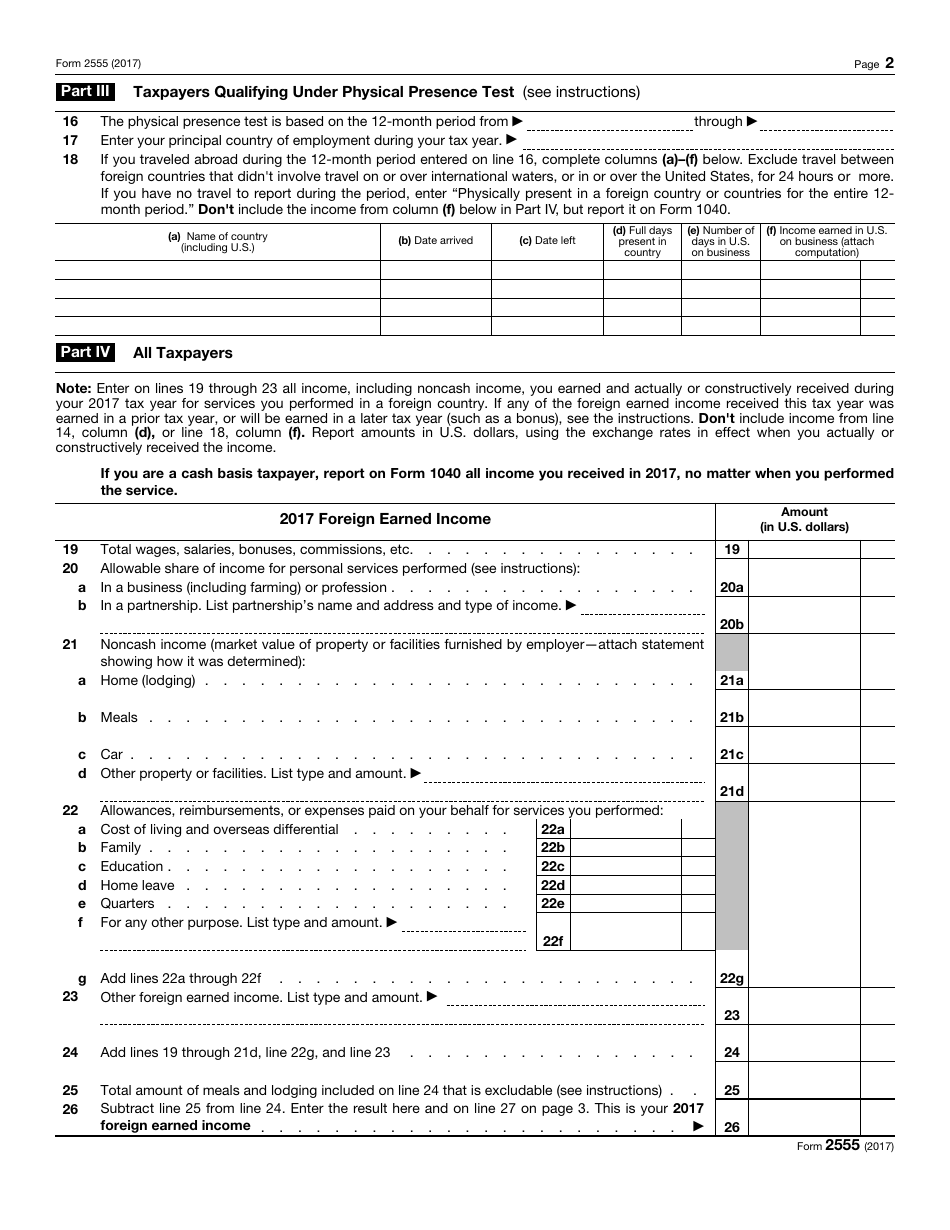

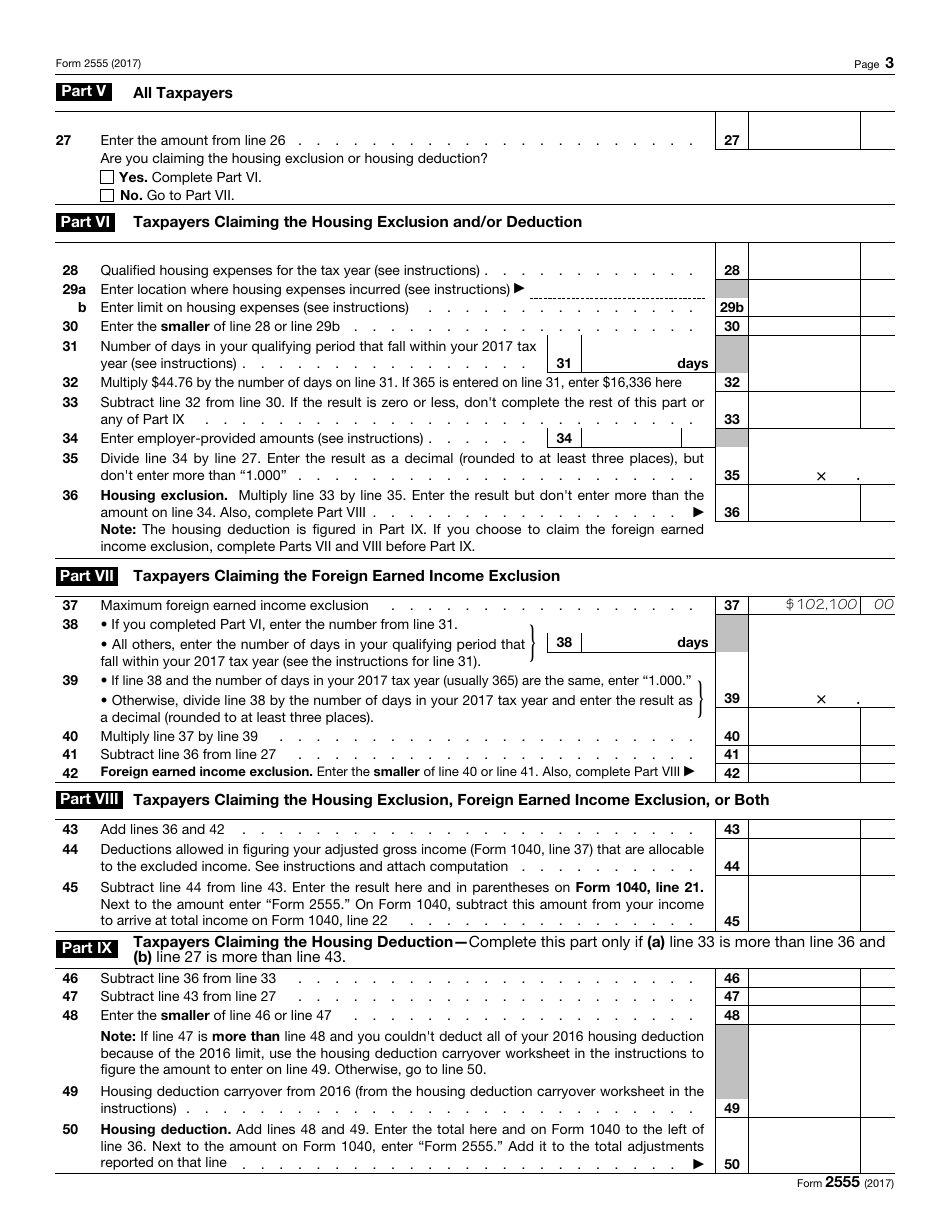

IRS Form 2555 Foreign Earned Income

What Is IRS Form 2555?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on January 1, 2017. Check the official IRS-issued instructions before completing and submitting the form.

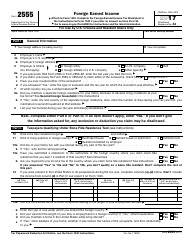

FAQ

Q: What is IRS Form 2555?

A: IRS Form 2555 is a tax form used by U.S. citizens or residents who have foreign earned income to exclude a portion of that income from their taxable income.

Q: Who needs to fill out IRS Form 2555?

A: U.S. citizens or residents who have foreign earned income and want to exclude a portion of that income from their taxable income need to fill out IRS Form 2555.

Q: What is foreign earned income?

A: Foreign earned income is income received for services performed in a foreign country while a person is a U.S. citizen or resident.

Q: Can all foreign earned income be excluded using IRS Form 2555?

A: No, not all foreign earned income can be excluded using IRS Form 2555. There are limits and requirements that need to be met.

Q: What are the requirements to qualify for the foreign earned income exclusion?

A: To qualify for the foreign earned income exclusion, you must meet either the bona fide residence test or the physical presence test, among other requirements.

Q: How do I calculate the amount that can be excluded using IRS Form 2555?

A: The amount that can be excluded using IRS Form 2555 is based on a formula that takes into account your foreign earned income and the maximum exclusion limit set by the IRS.

Q: When do I need to file IRS Form 2555?

A: IRS Form 2555 is filed with your annual income tax return, typically due by April 15th of the following year.

Q: Is there a fee to file IRS Form 2555?

A: No, there is no fee to file IRS Form 2555.

Q: Can I e-file IRS Form 2555?

A: No, IRS Form 2555 cannot be e-filed. It must be filed by mail with your annual income tax return.

Form Details:

- A 3-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 2555 through the link below or browse more documents in our library of IRS Forms.