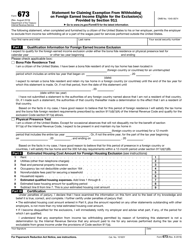

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 2555

for the current year.

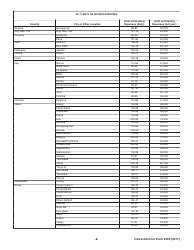

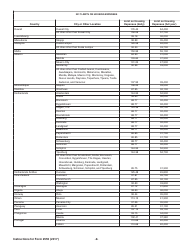

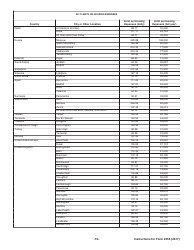

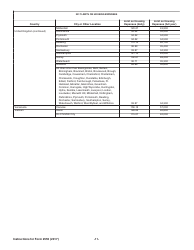

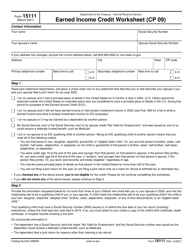

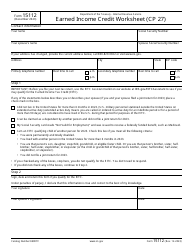

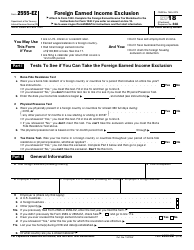

Instructions for IRS Form 2555 Foreign Earned Income

This document contains official instructions for IRS Form 2555 , Foreign Earned Income - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 2555 is available for download through this link.

FAQ

Q: What is IRS Form 2555?

A: IRS Form 2555 is a tax form used to report foreign earned income.

Q: Who needs to file IRS Form 2555?

A: US citizens or resident aliens who have earned income from a foreign country and want to exclude it from their taxable income need to file IRS Form 2555.

Q: What is foreign earned income?

A: Foreign earned income refers to income earned from working in a foreign country.

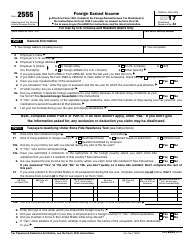

Q: How do I fill out IRS Form 2555?

A: To fill out IRS Form 2555, you need to provide information about your foreign income, foreign housing expenses, and foreign tax paid.

Q: Is there a deadline to file IRS Form 2555?

A: Yes, IRS Form 2555 should be filed along with your annual tax return by the regular tax filing deadline, usually April 15th.

Q: Can I claim a foreign earned income exclusion if I live in the United States?

A: No, the foreign earned income exclusion is only available for US citizens or resident aliens who live and work in a foreign country.

Instruction Details:

- This 11-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.