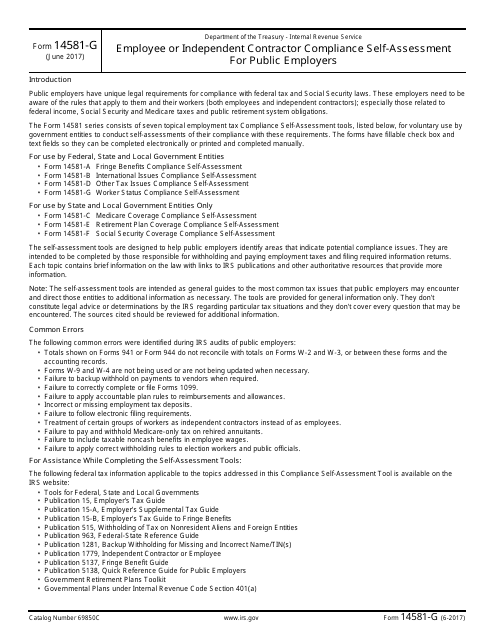

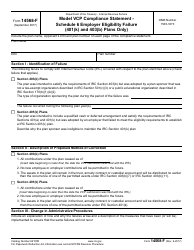

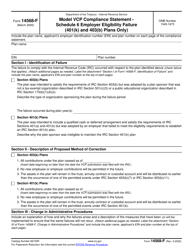

IRS Form 14581-G Employee or Independent Contractor Compliance Self-assessment for Public Employers

What Is IRS Form 14581-G?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on June 1, 2017. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 14581-G?

A: IRS Form 14581-G is the Employee or Independent Contractor Compliance Self-assessment for Public Employers.

Q: Who needs to file IRS Form 14581-G?

A: Public Employers need to file IRS Form 14581-G.

Q: What is the purpose of IRS Form 14581-G?

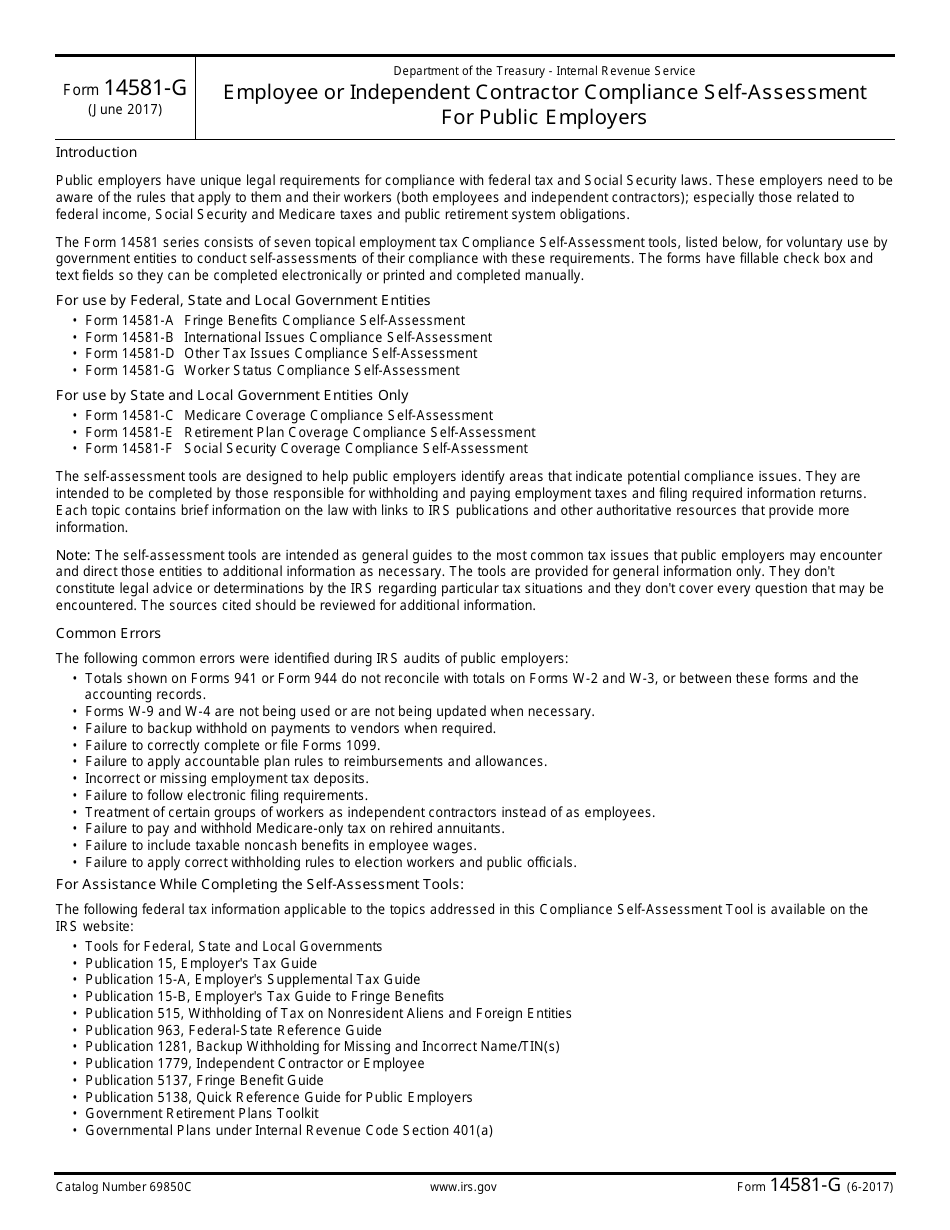

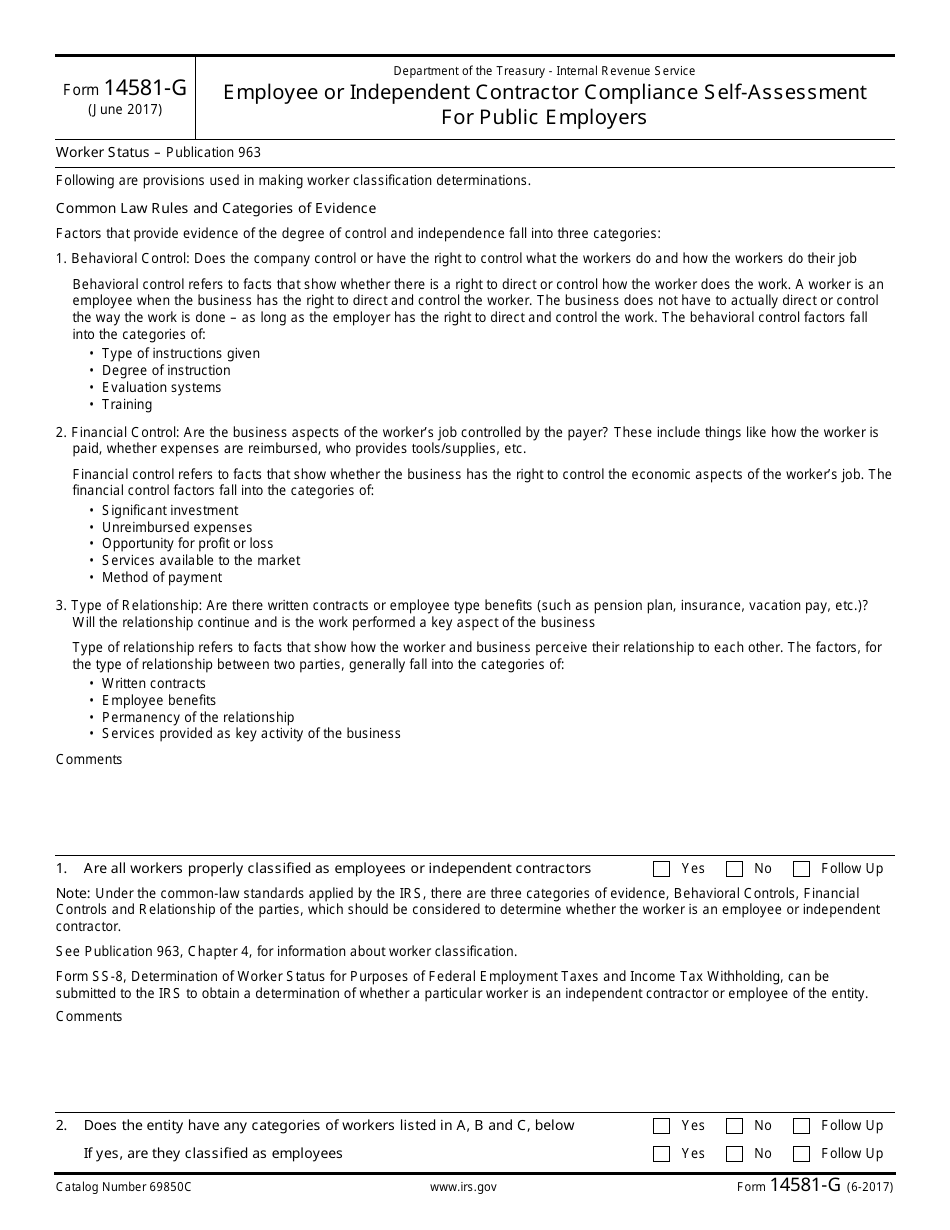

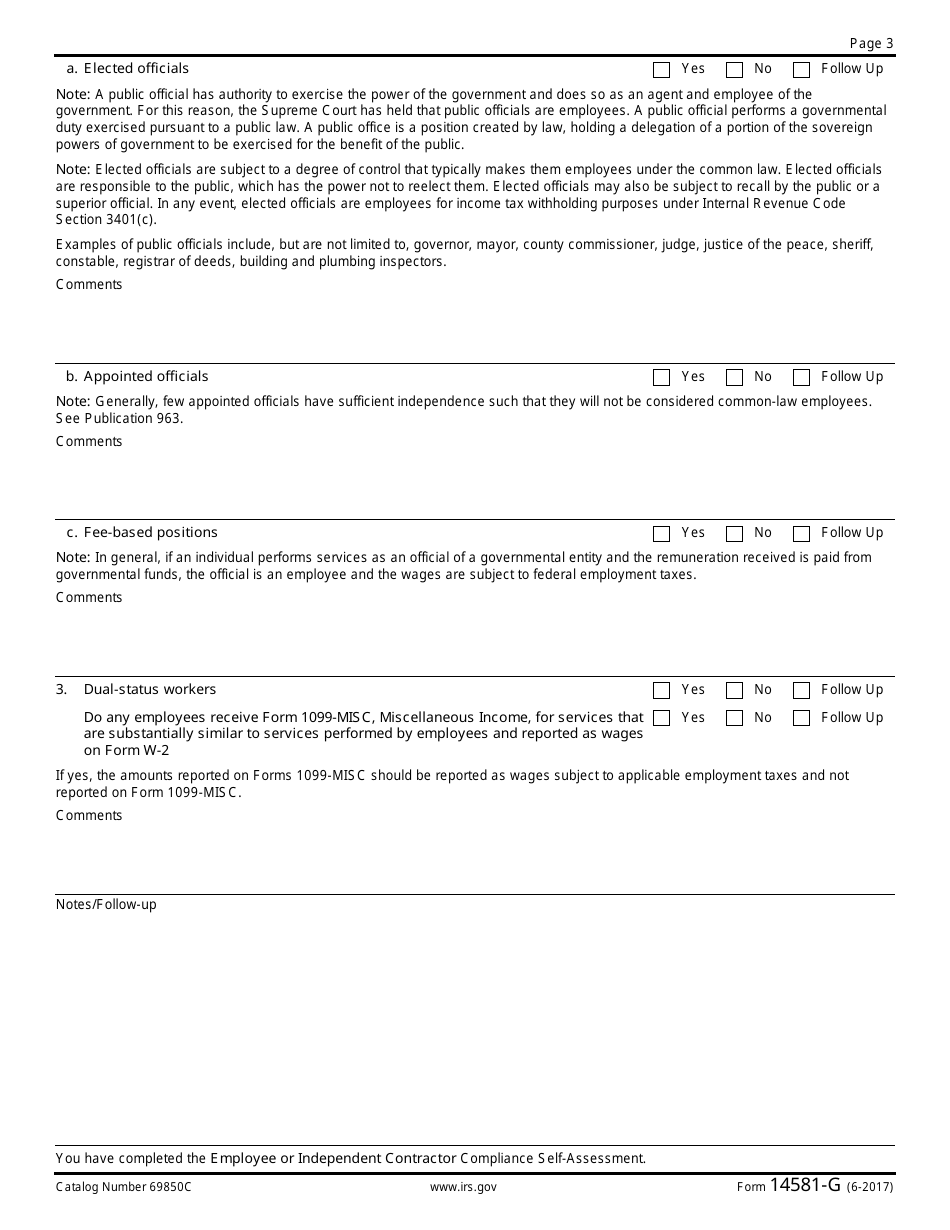

A: The purpose of IRS Form 14581-G is to assess whether a worker is an employee or an independent contractor for tax purposes.

Q: Is IRS Form 14581-G mandatory for public employers?

A: No, IRS Form 14581-G is not mandatory, but it is recommended for public employers to help determine the employment status of their workers.

Form Details:

- A 3-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14581-G through the link below or browse more documents in our library of IRS Forms.