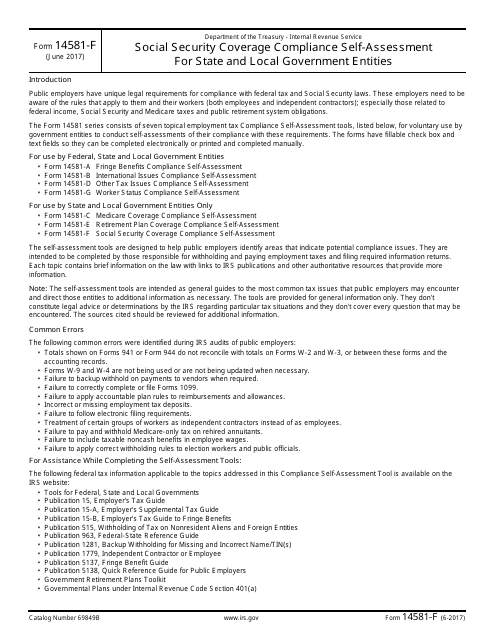

IRS Form 14581-F Social Security Coverage Compliance Self-assessment for State and Local Government Entities

What Is IRS Form 14581-F?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on June 1, 2017. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 14581-F?

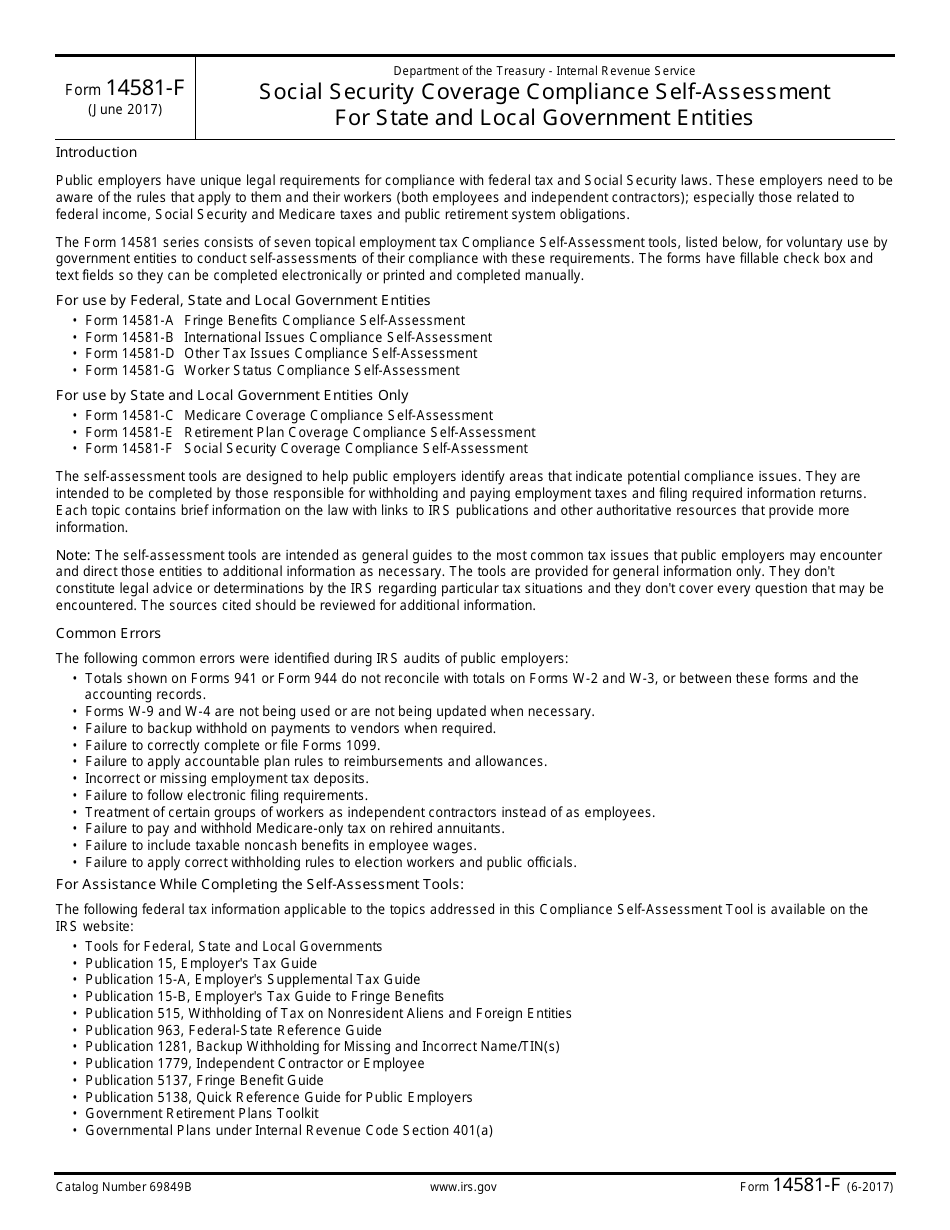

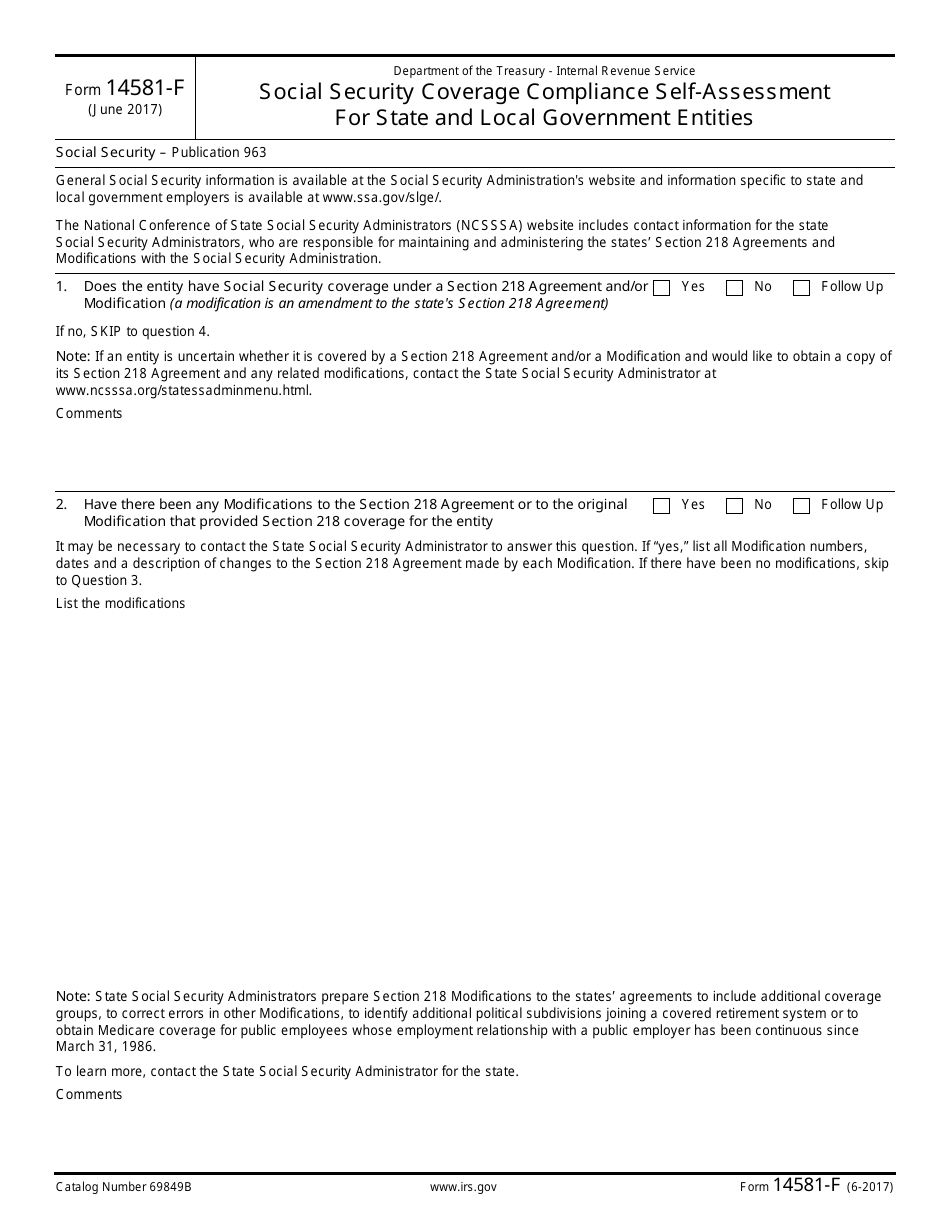

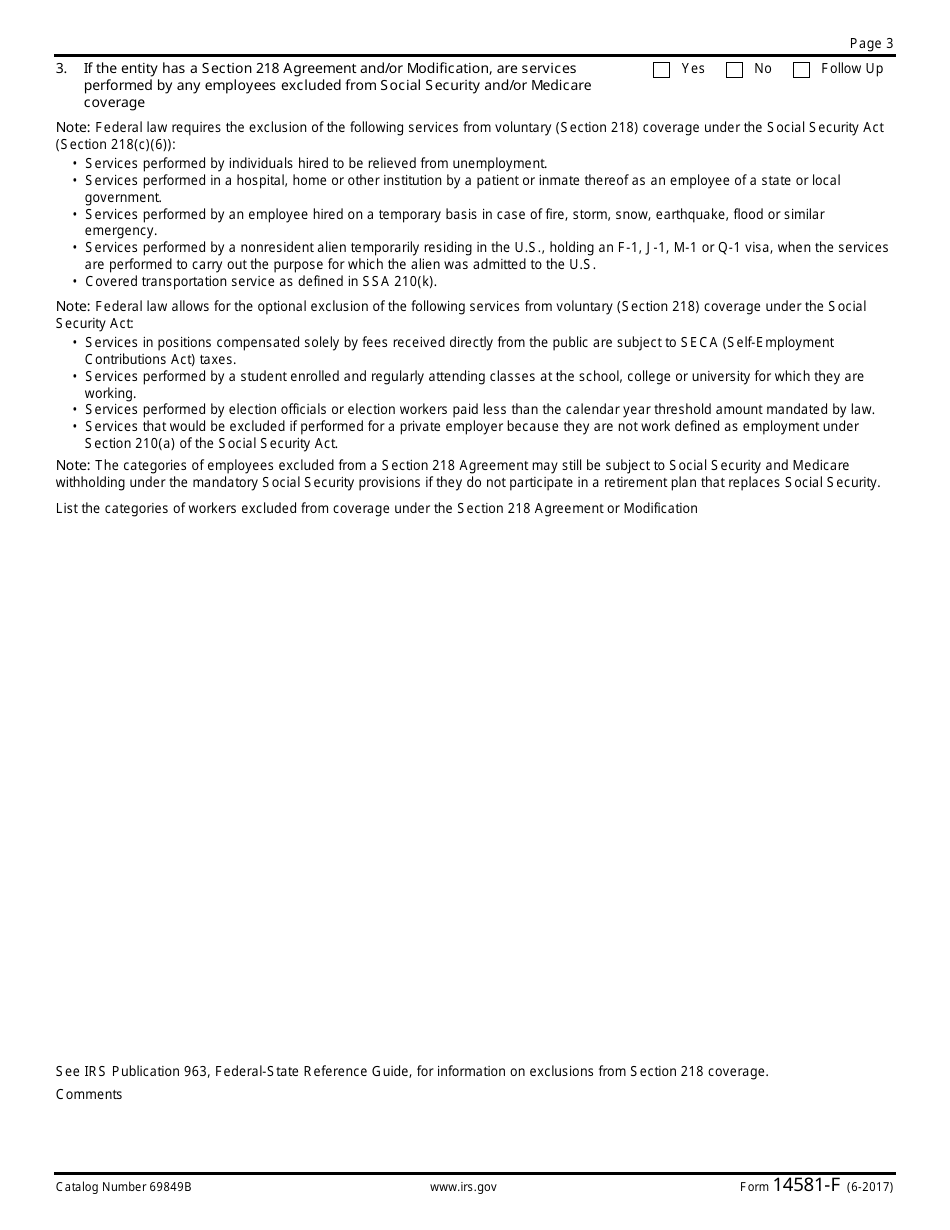

A: IRS Form 14581-F is a self-assessment form for state and local government entities to ensure compliance with social security coverage.

Q: Who uses IRS Form 14581-F?

A: State and local government entities use IRS Form 14581-F.

Q: What is the purpose of IRS Form 14581-F?

A: The purpose of IRS Form 14581-F is to assess compliance with social security coverage requirements for state and local government entities.

Q: How often should IRS Form 14581-F be completed?

A: IRS Form 14581-F should be completed annually.

Form Details:

- A 4-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14581-F through the link below or browse more documents in our library of IRS Forms.