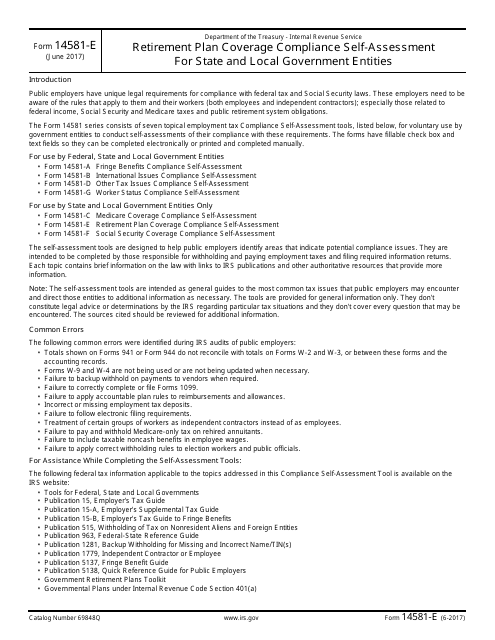

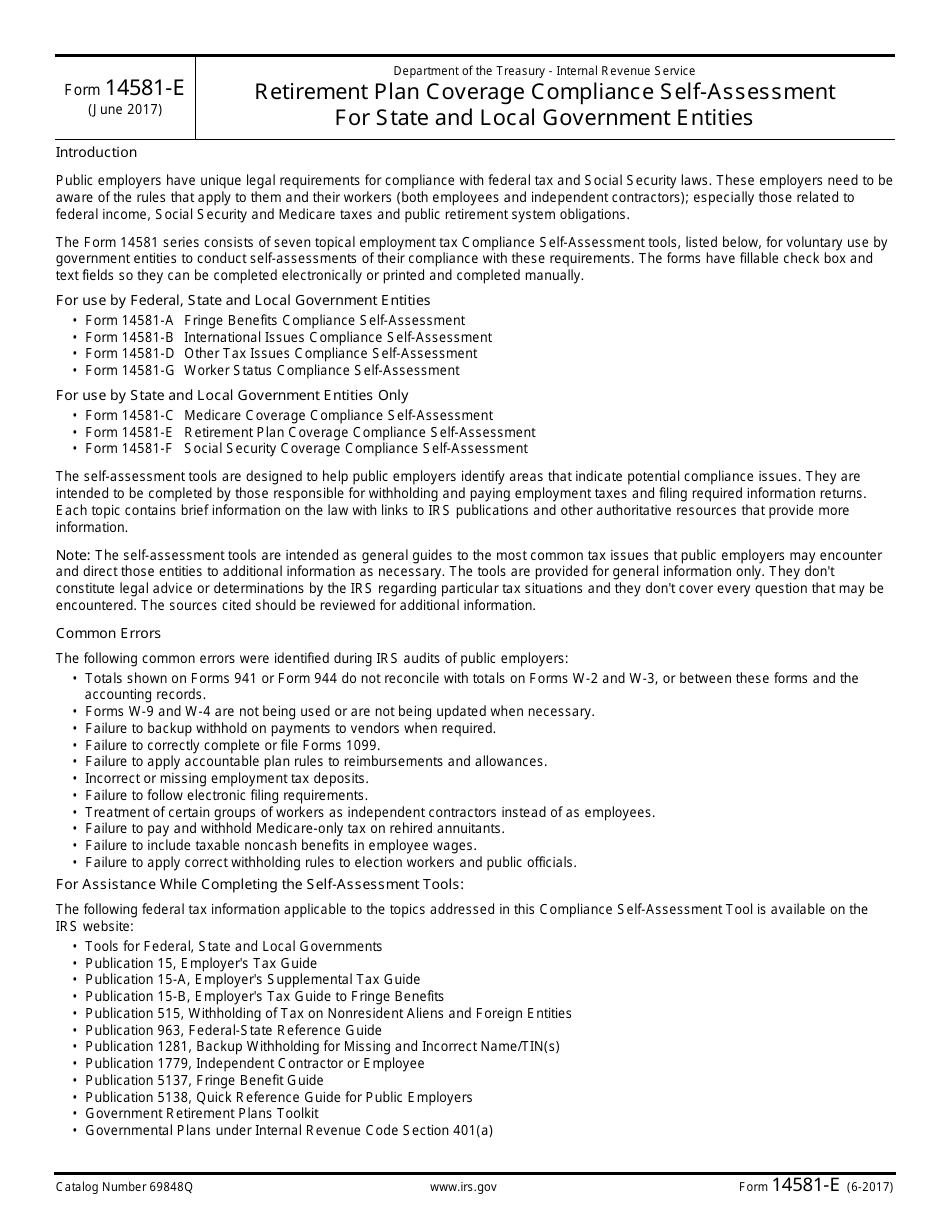

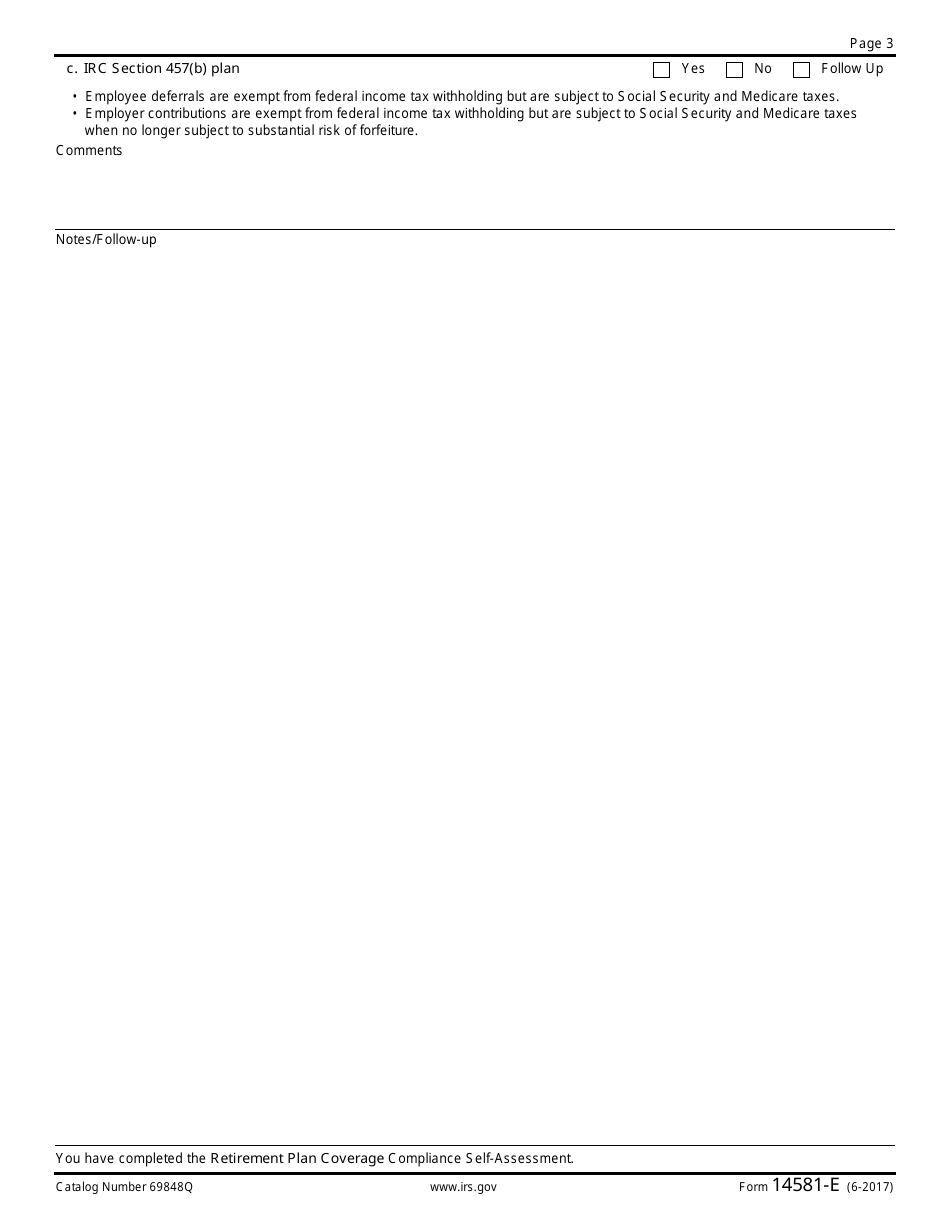

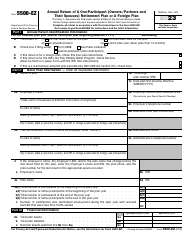

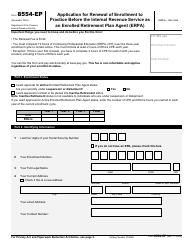

IRS Form 14581-E Retirement Plan Coverage Compliance Self-assessment for State and Local Government Entities

What Is IRS Form 14581-E?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on June 1, 2017. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 14581-E?

A: IRS Form 14581-E is a retirement plan coverage compliance self-assessment specifically designed for state and local government entities.

Q: Who should complete IRS Form 14581-E?

A: State and local government entities should complete IRS Form 14581-E.

Q: What is the purpose of IRS Form 14581-E?

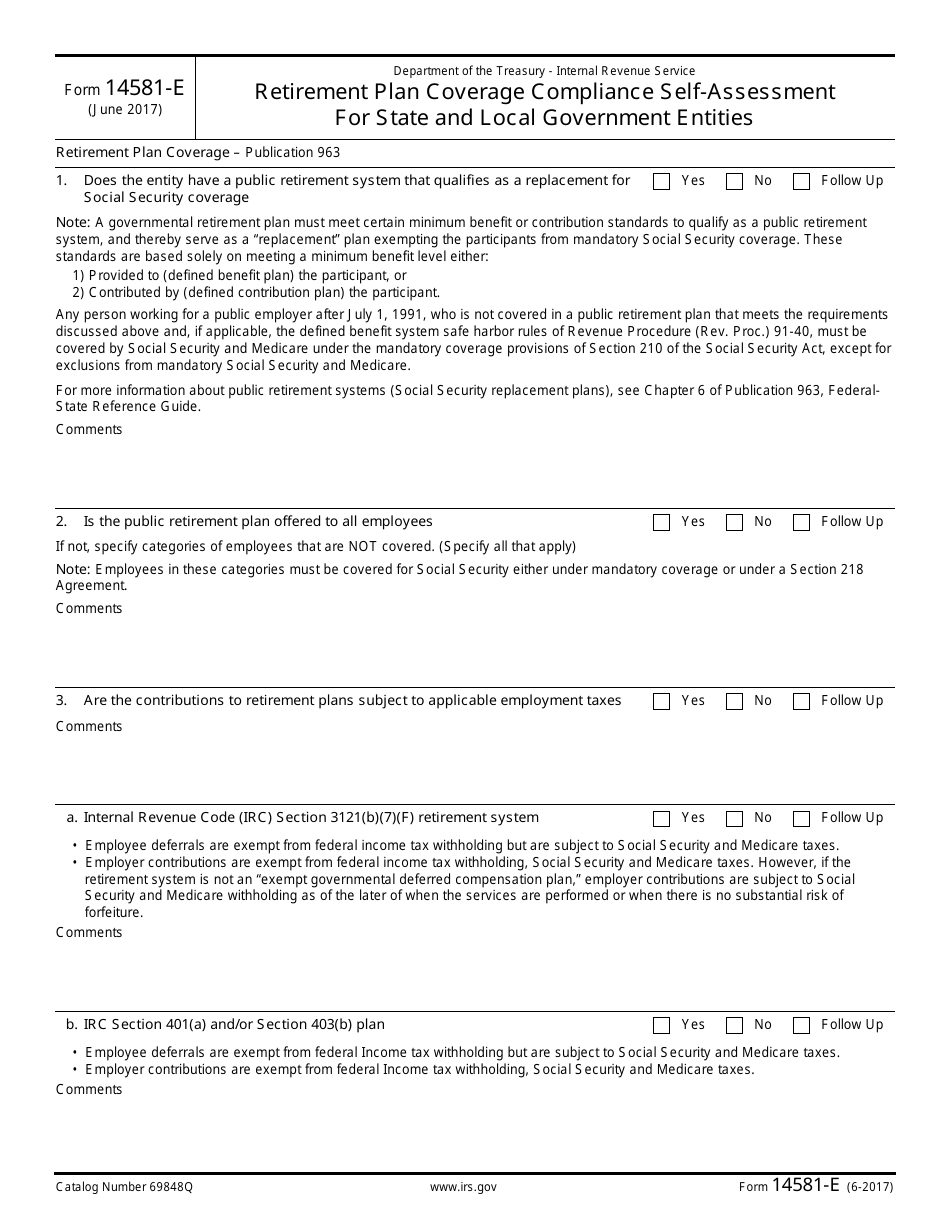

A: The purpose of IRS Form 14581-E is to self-assess the retirement plan coverage compliance of state and local government entities.

Q: What does the self-assessment cover in IRS Form 14581-E?

A: The self-assessment in IRS Form 14581-E covers retirement plan coverage compliance for state and local government entities.

Q: Is IRS Form 14581-E mandatory?

A: IRS Form 14581-E is not mandatory, but it is recommended for state and local government entities to self-assess their retirement plan coverage compliance.

Q: Are there any filing deadlines for IRS Form 14581-E?

A: There are no specific filing deadlines for IRS Form 14581-E. However, it is recommended to complete the self-assessment on an annual basis.

Q: Are there any penalties for not completing IRS Form 14581-E?

A: There are no specific penalties for not completing IRS Form 14581-E, as it is not mandatory. However, it is recommended to self-assess retirement plan coverage compliance.

Q: Can I get assistance in completing IRS Form 14581-E?

A: Yes, you can seek assistance from tax professionals or consult the official IRS instructions provided with the form.

Q: Is IRS Form 14581-E applicable to all types of retirement plans?

A: IRS Form 14581-E is specifically designed for state and local government entities and their retirement plans.

Form Details:

- A 3-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14581-E through the link below or browse more documents in our library of IRS Forms.