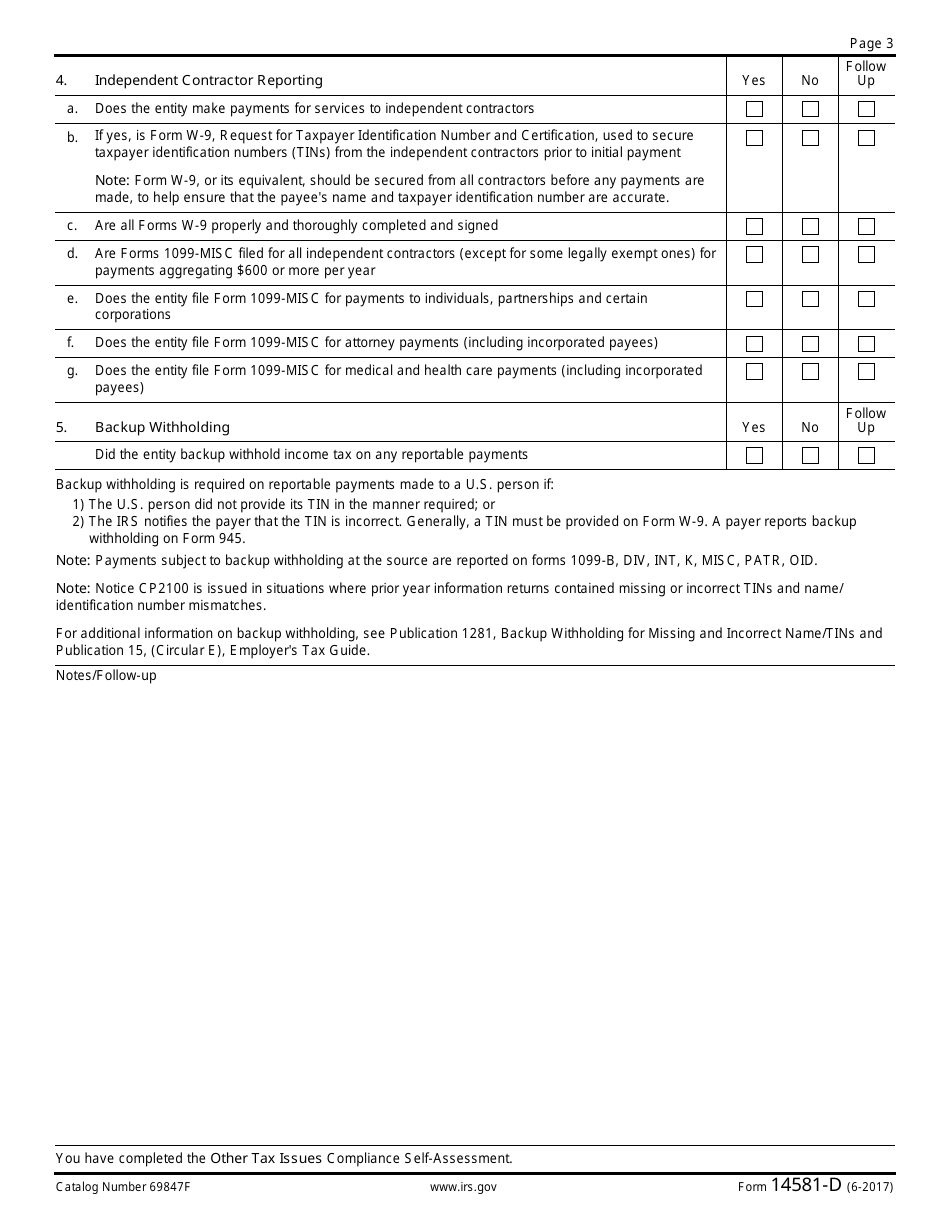

IRS Form 14581-D Other Tax Issues Compliance Self-assessment for Public Employers

What Is IRS Form 14581-D?

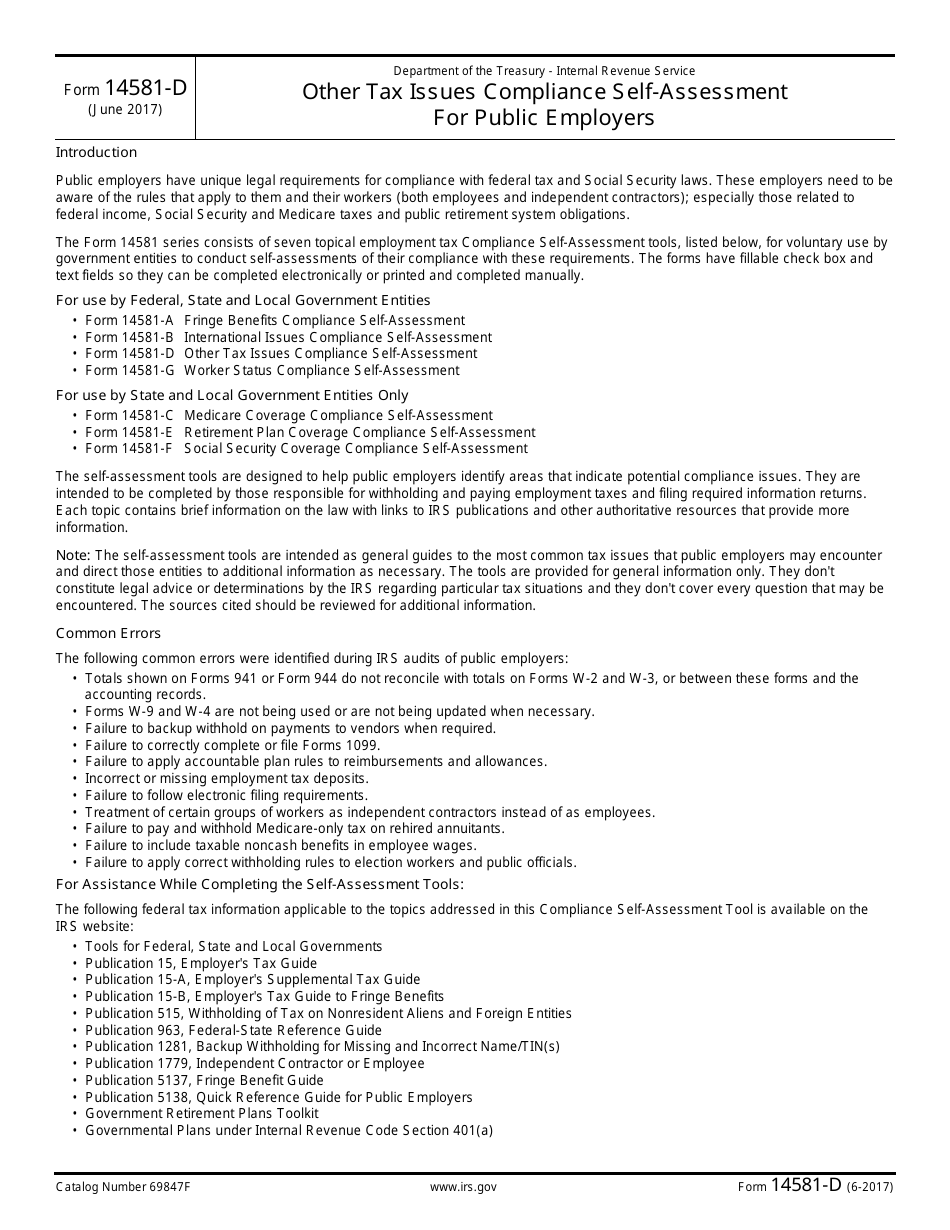

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on June 1, 2017. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is Form 14581-D?

A: Form 14581-D is a compliance self-assessment form for public employers related to other tax issues.

Q: Who needs to fill out Form 14581-D?

A: Public employers who want to assess their compliance with other tax issues need to fill out Form 14581-D.

Q: What is the purpose of Form 14581-D?

A: The purpose of Form 14581-D is to help public employers evaluate their compliance with other tax issues.

Q: Is Form 14581-D mandatory for public employers?

A: Form 14581-D is not mandatory for public employers, but it can help them assess their compliance with other tax issues.

Q: What are other tax issues?

A: Other tax issues include various tax-related matters that public employers may need to comply with, apart from regular tax obligations.

Q: Can individuals and private employers use Form 14581-D?

A: No, Form 14581-D is specifically designed for public employers.

Q: Are there any penalties for not filling out Form 14581-D?

A: No, there are no penalties for public employers who choose not to fill out Form 14581-D.

Q: How often should public employers fill out Form 14581-D?

A: There is no specific frequency mentioned for filling out Form 14581-D. It can be done as needed or desired by public employers.

Form Details:

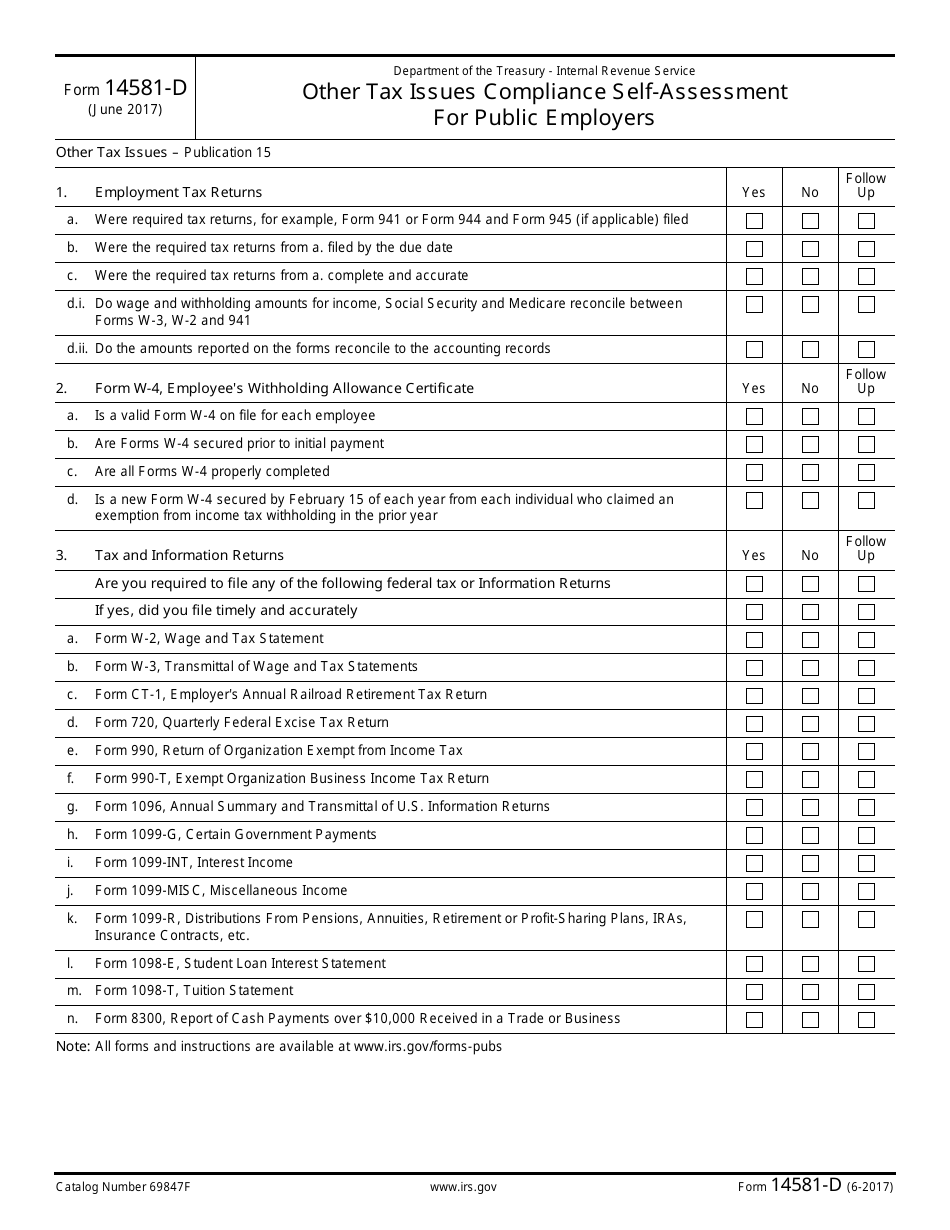

- A 3-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14581-D through the link below or browse more documents in our library of IRS Forms.