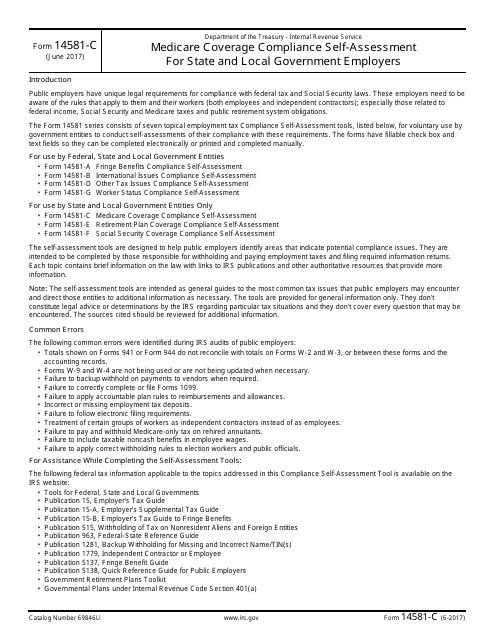

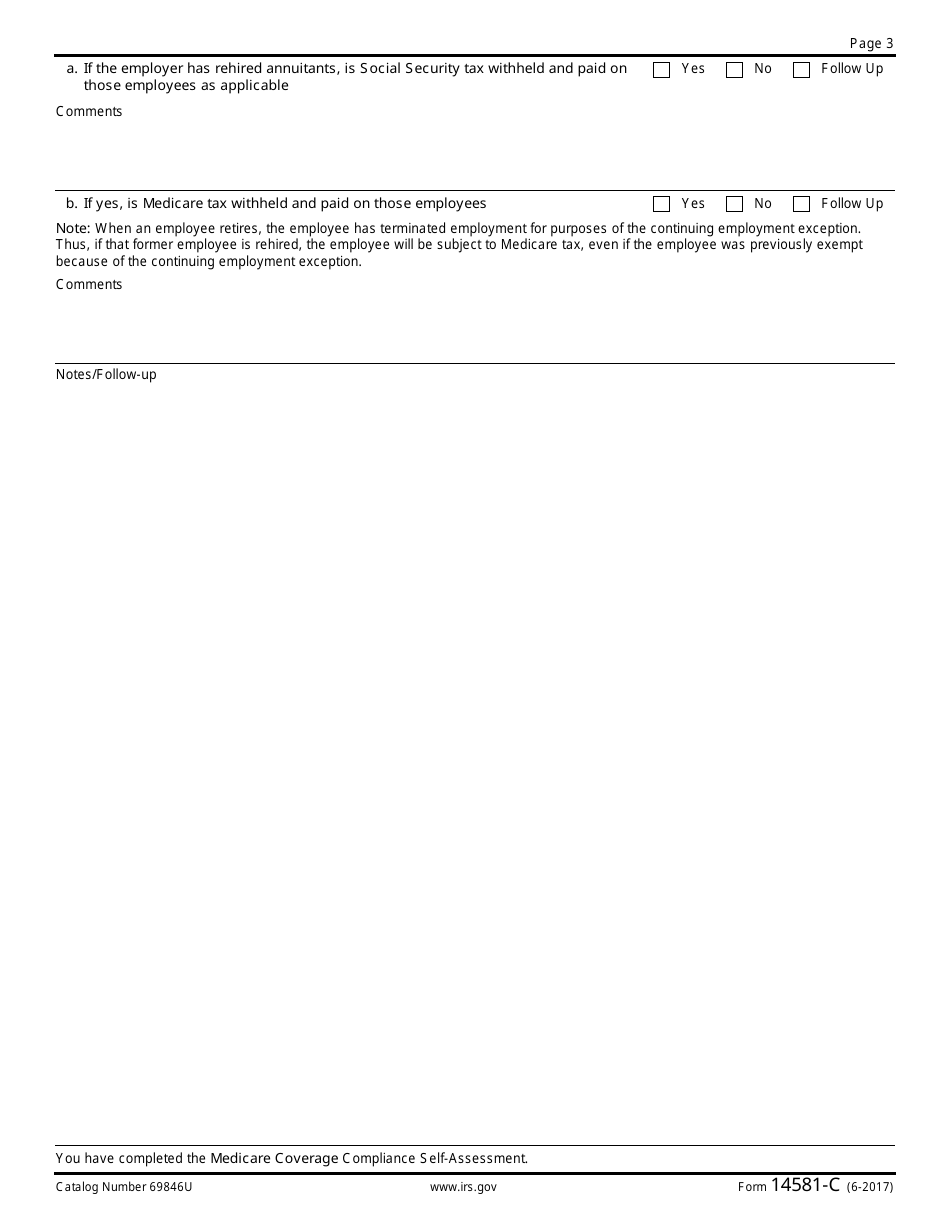

IRS Form 14581-C Medicare Coverage Compliance Self-assessment for State and Local Government Employers

What Is IRS Form 14581-C?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on June 1, 2017. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 14581-C?

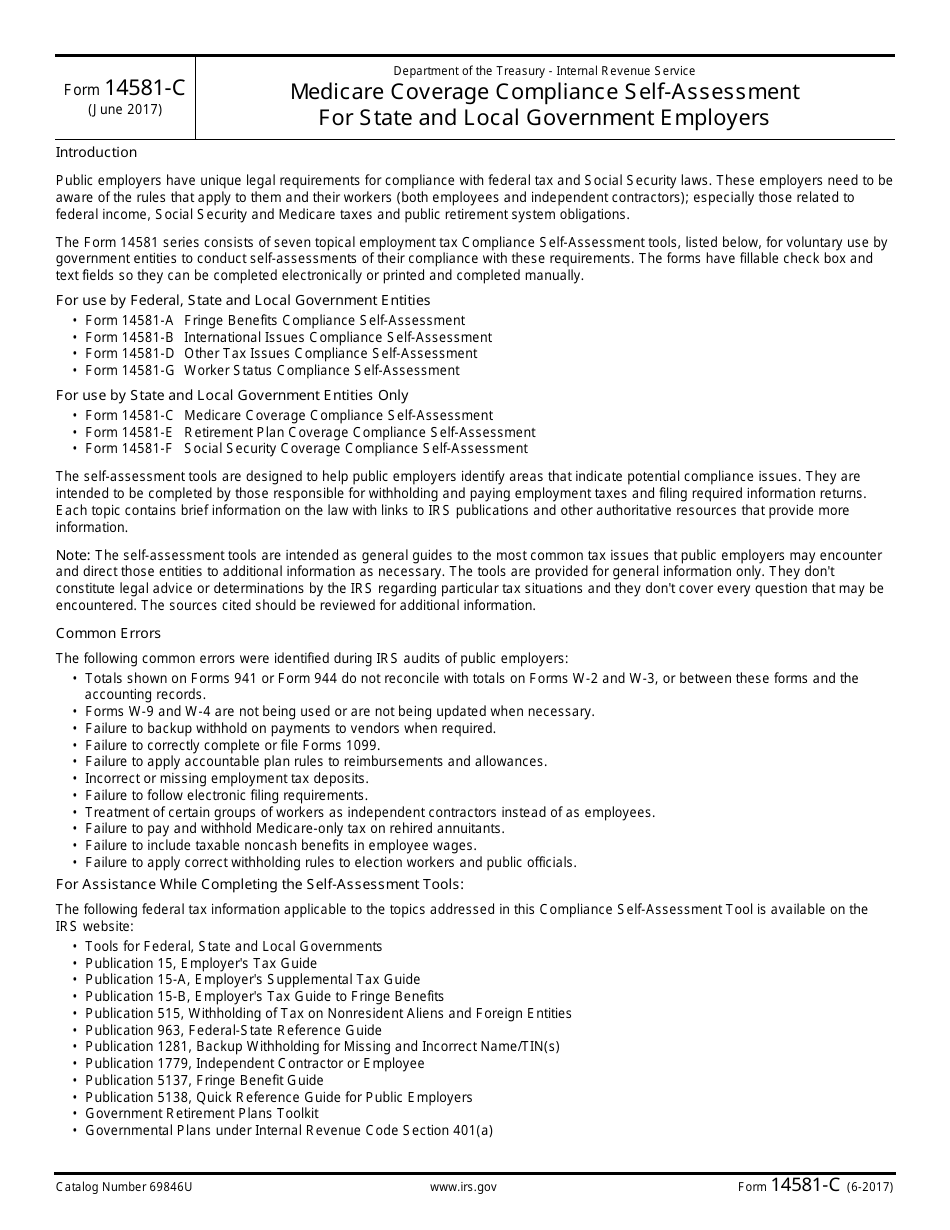

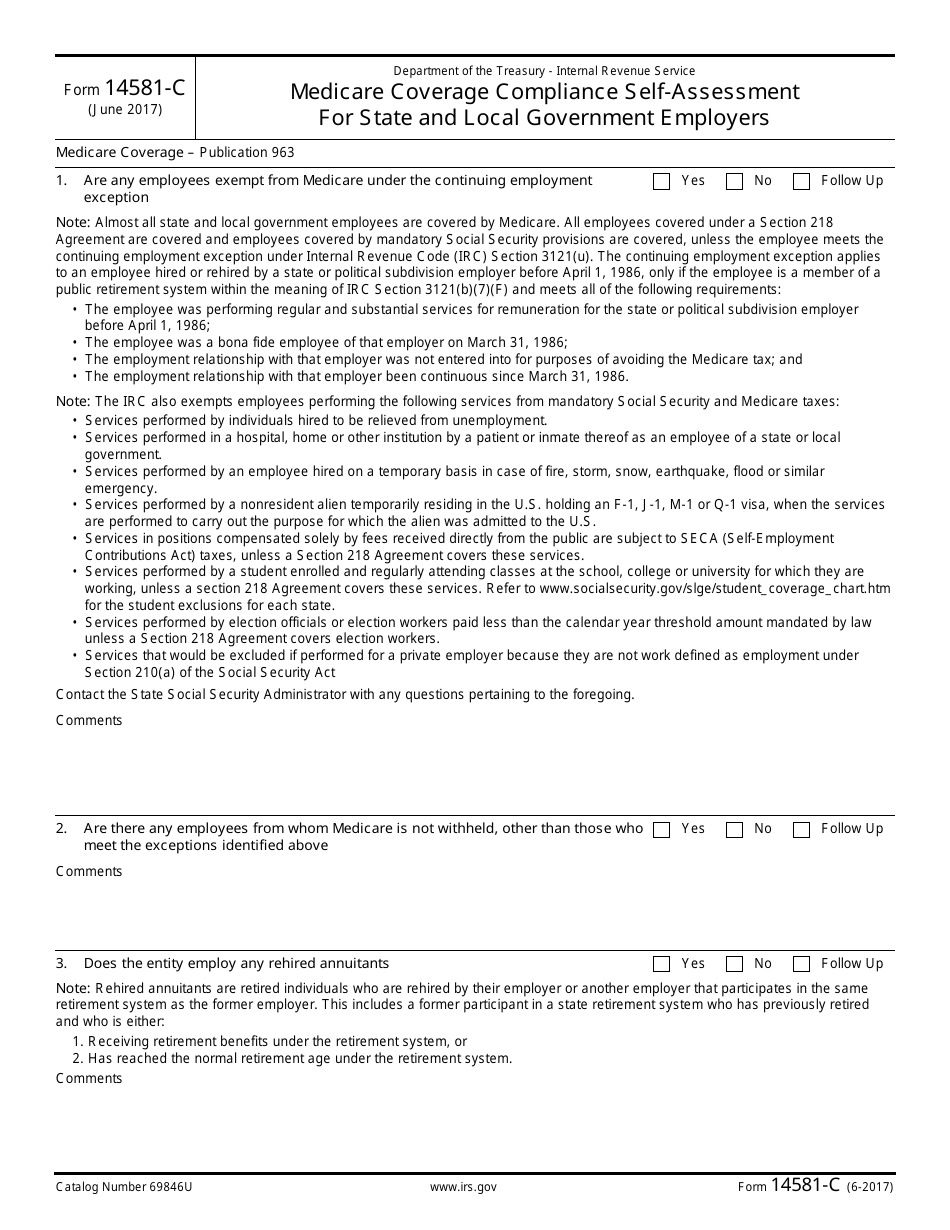

A: IRS Form 14581-C is a form used for Medicare Coverage Compliance Self-assessment for state and local government employers.

Q: Who uses IRS Form 14581-C?

A: State and local government employers use IRS Form 14581-C.

Q: What is the purpose of IRS Form 14581-C?

A: The purpose of IRS Form 14581-C is to help state and local government employers determine if they meet the requirements for Medicare coverage.

Q: Is IRS Form 14581-C mandatory?

A: Yes, IRS Form 14581-C is mandatory for state and local government employers.

Q: Are there any penalties for not filing IRS Form 14581-C?

A: Yes, there may be penalties for not filing IRS Form 14581-C, so it is important to comply with the requirements.

Form Details:

- A 3-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14581-C through the link below or browse more documents in our library of IRS Forms.