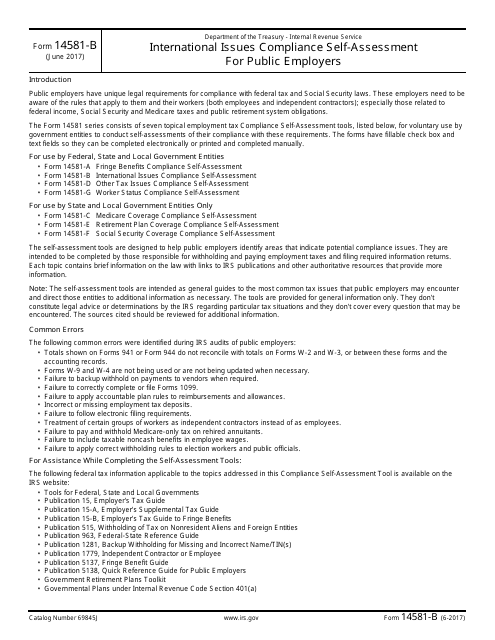

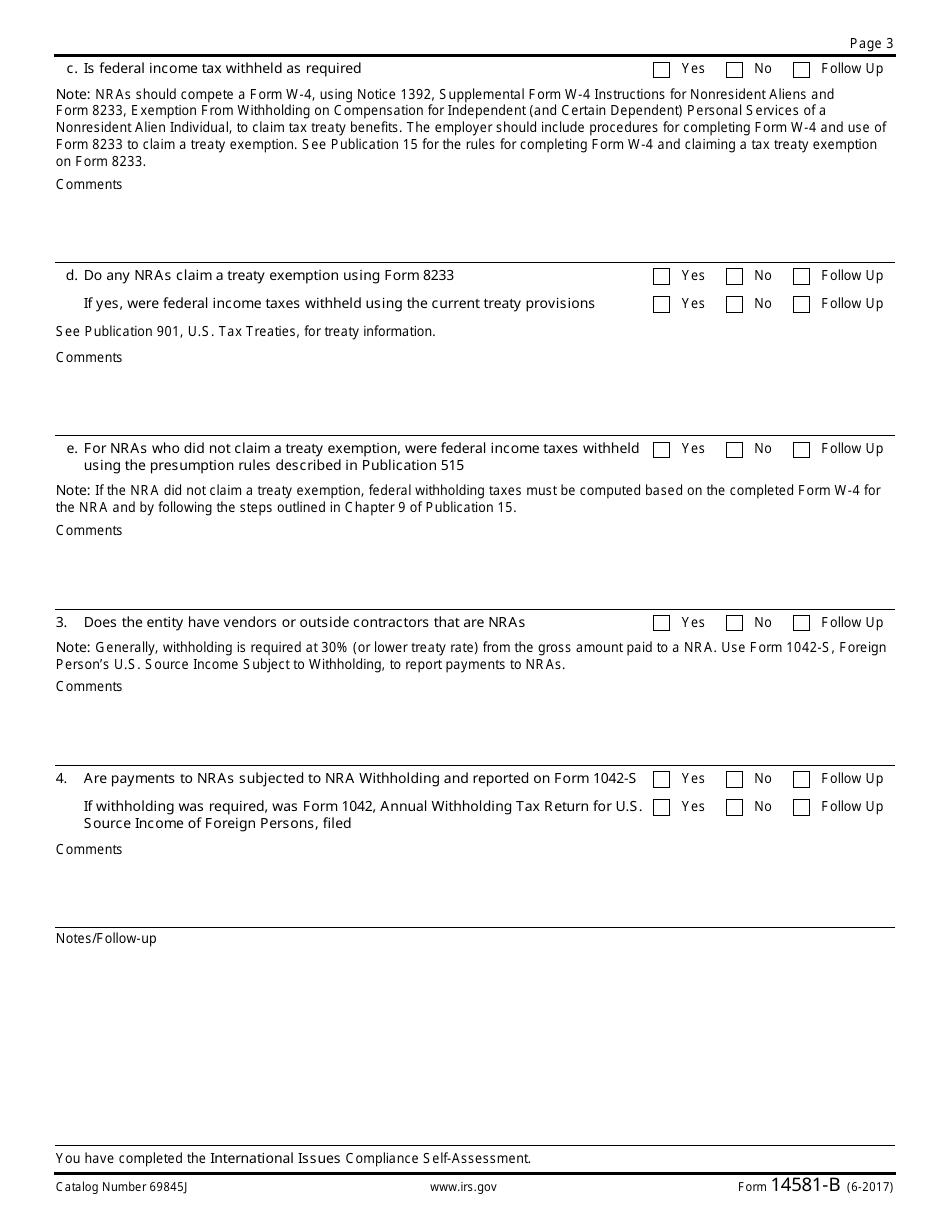

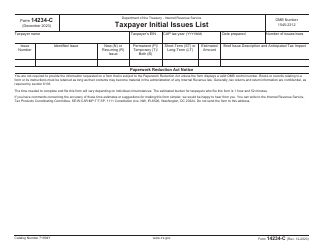

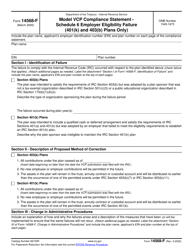

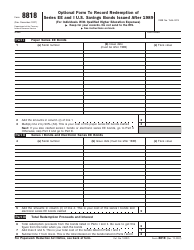

IRS Form 14581-B International Issues Compliance Self-assessment for Public Employers

What Is IRS Form 14581-B?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on June 1, 2017. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 14581-B?

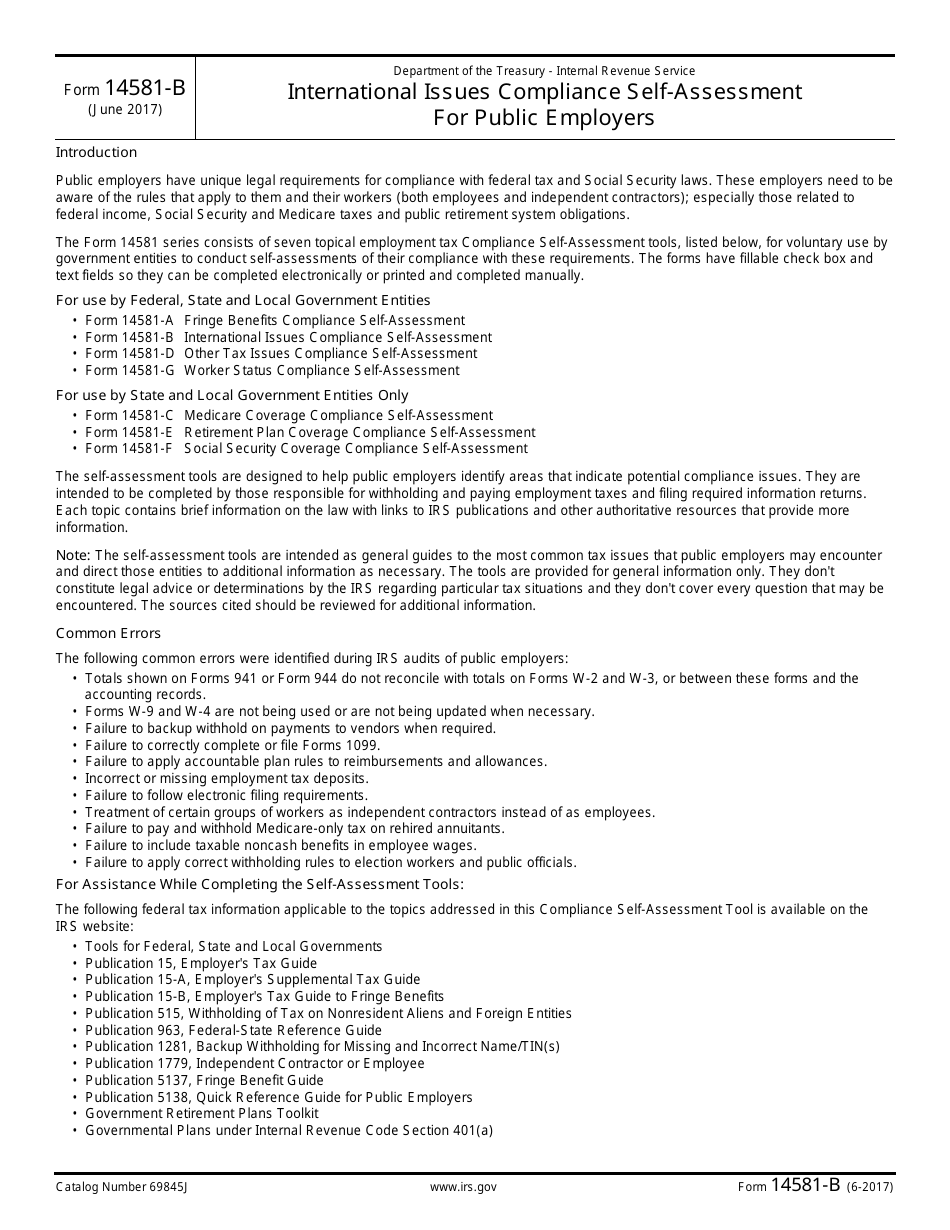

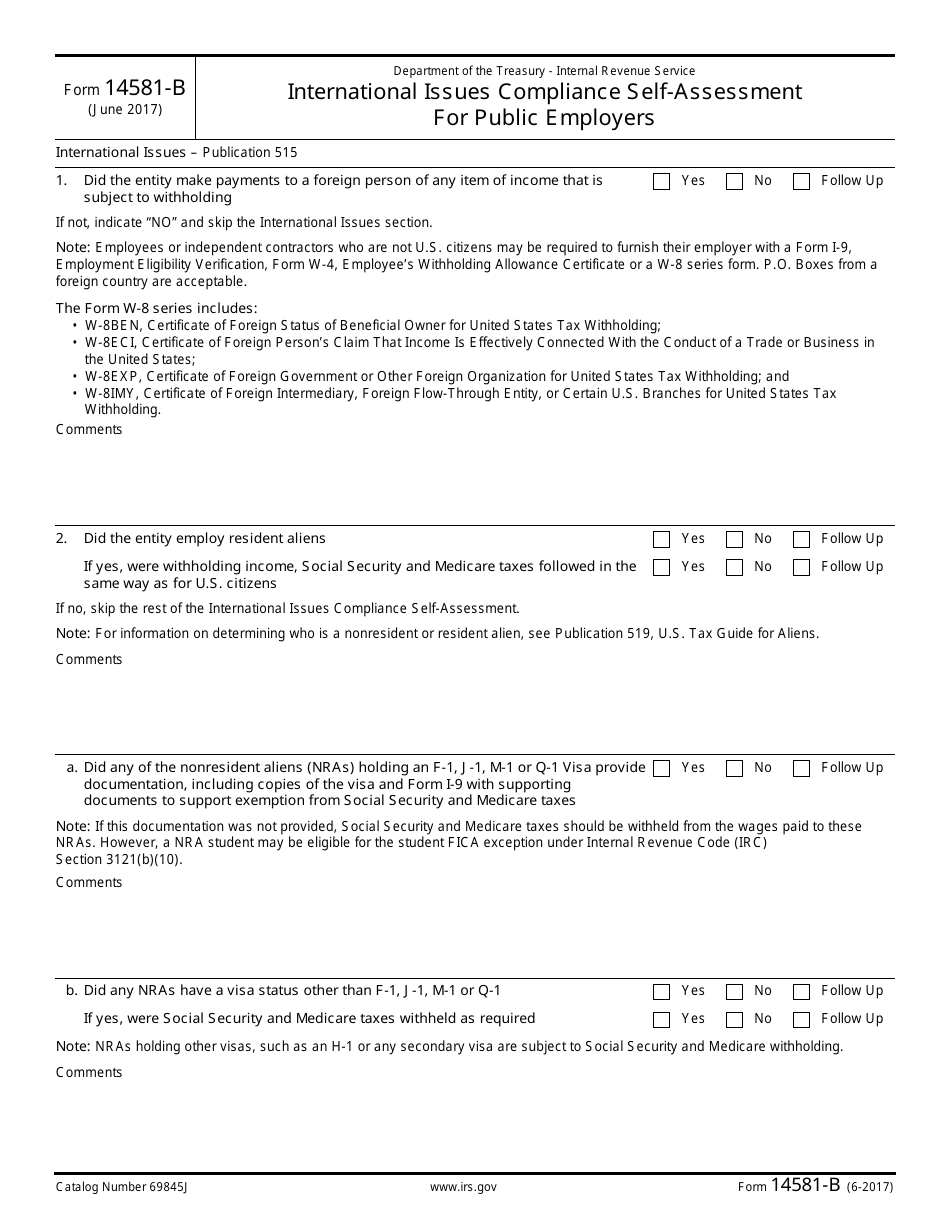

A: IRS Form 14581-B is a Compliance Self-assessment specifically for Public Employers regarding international issues.

Q: Who is required to complete IRS Form 14581-B?

A: Public Employers are required to complete IRS Form 14581-B.

Q: What is the purpose of IRS Form 14581-B?

A: The purpose of IRS Form 14581-B is to assess compliance with international tax obligations for Public Employers.

Q: Is IRS Form 14581-B mandatory for Public Employers?

A: Yes, IRS Form 14581-B is mandatory for Public Employers.

Q: When is the deadline for filing IRS Form 14581-B?

A: The deadline for filing IRS Form 14581-B varies and a specific due date will be provided by the IRS.

Form Details:

- A 3-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14581-B through the link below or browse more documents in our library of IRS Forms.