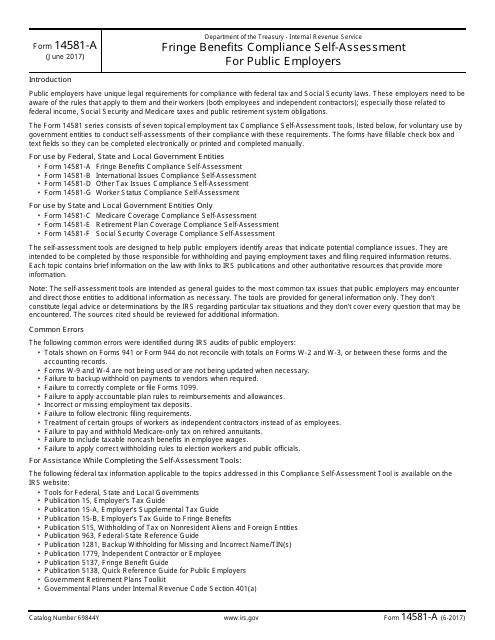

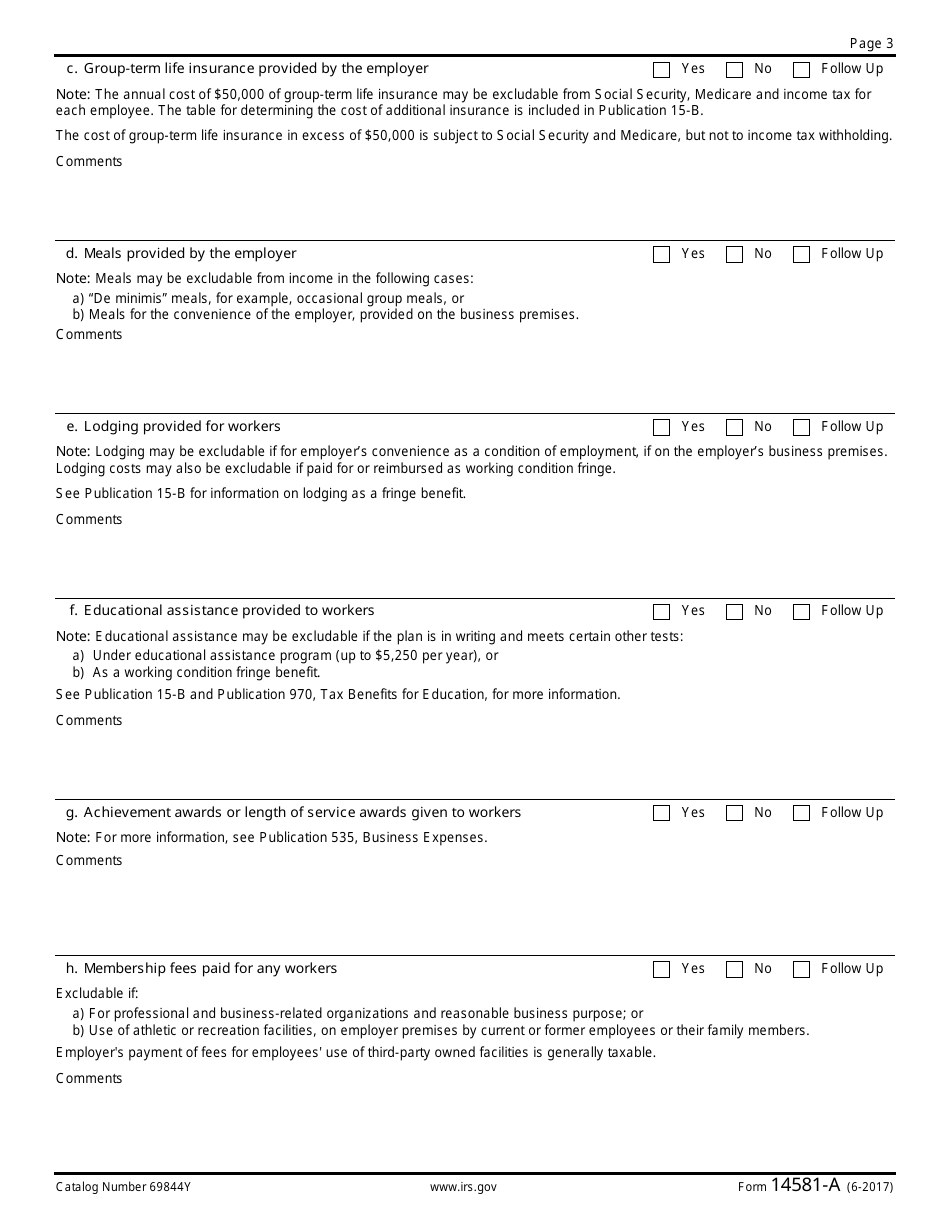

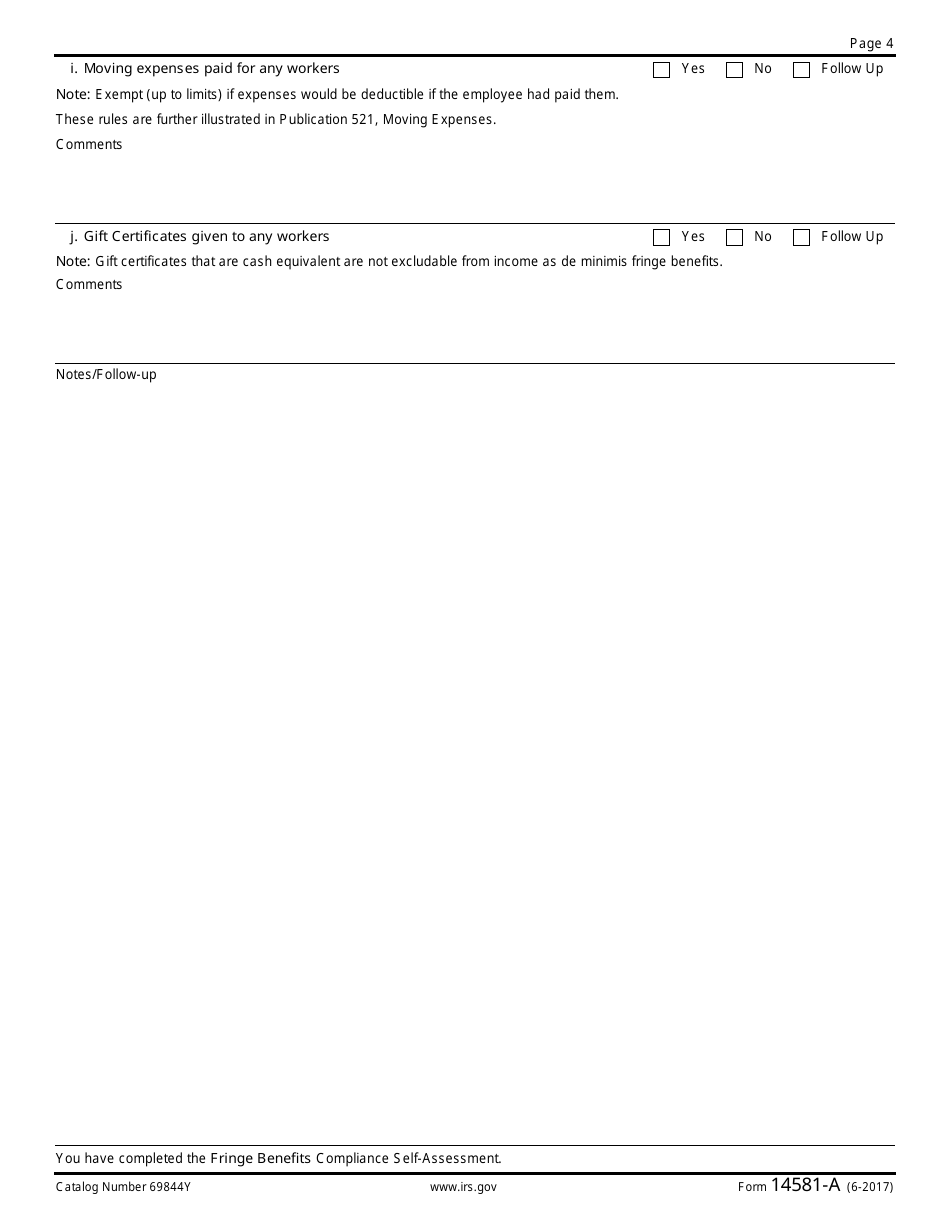

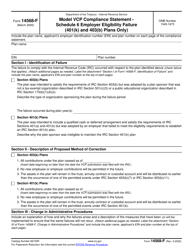

IRS Form 14581-A Fringe Benefits Compliance Self-assessment for Public Employers

What Is IRS Form 14581-A?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on June 1, 2017. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 14581-A?

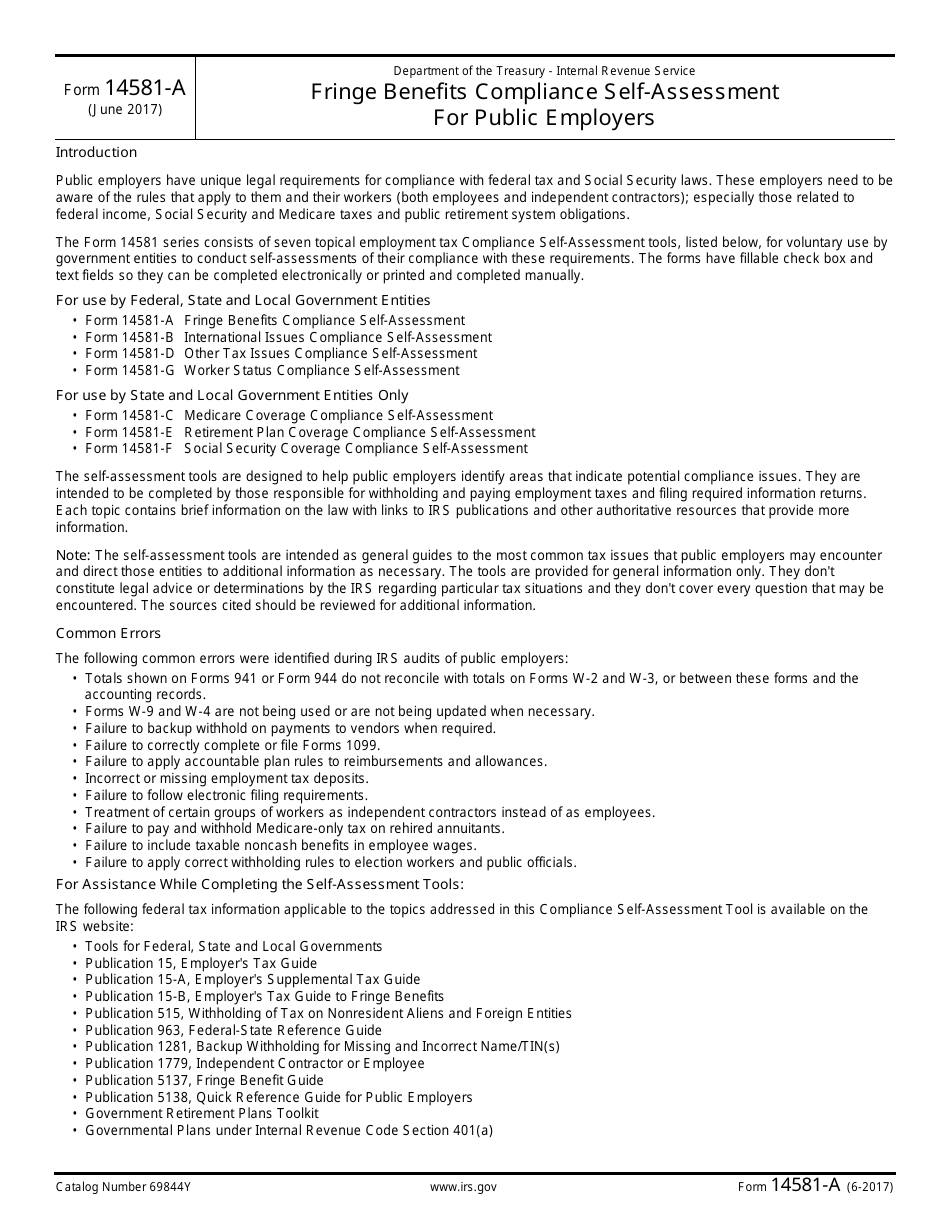

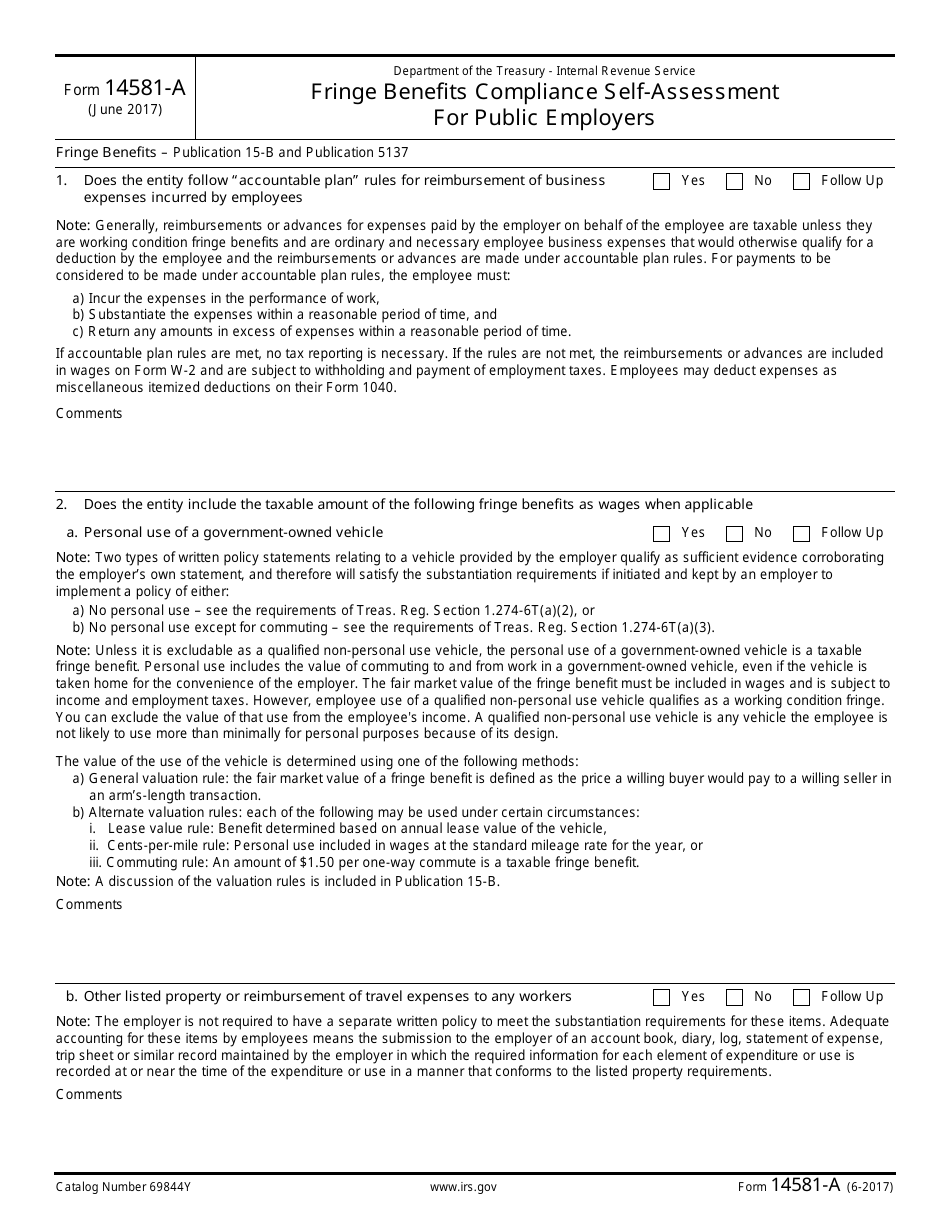

A: IRS Form 14581-A is a self-assessment form for public employers to assess their compliance with fringe benefits regulations.

Q: Who should use IRS Form 14581-A?

A: IRS Form 14581-A is specifically designed for public employers to evaluate their compliance with fringe benefits regulations.

Q: What is the purpose of IRS Form 14581-A?

A: The purpose of IRS Form 14581-A is to help public employers assess their compliance with fringe benefits regulations.

Q: Can private employers use IRS Form 14581-A?

A: No, IRS Form 14581-A is only intended for use by public employers.

Q: What kind of information is required on IRS Form 14581-A?

A: IRS Form 14581-A requires information related to fringe benefits provided by public employers.

Q: Is there a deadline for submitting IRS Form 14581-A?

A: The deadline for submitting IRS Form 14581-A may vary, so it's important to check the instructions or consult with the IRS.

Q: What happens if a public employer does not submit IRS Form 14581-A?

A: Failure to submit IRS Form 14581-A can result in penalties or further scrutiny by the IRS.

Q: Can IRS Form 14581-A be filed electronically?

A: Yes, IRS Form 14581-A can be filed electronically.

Q: Are there any fees associated with IRS Form 14581-A?

A: There are no fees associated with filing IRS Form 14581-A.

Form Details:

- A 4-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14581-A through the link below or browse more documents in our library of IRS Forms.