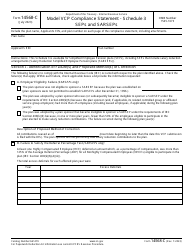

This version of the form is not currently in use and is provided for reference only. Download this version of

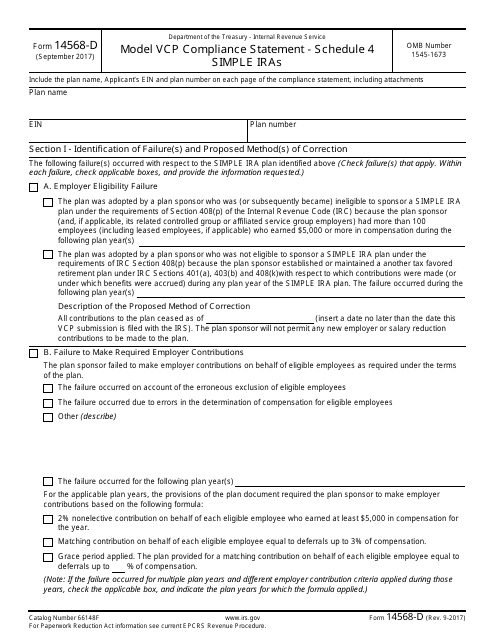

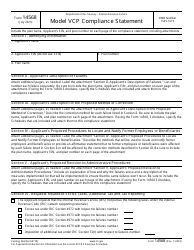

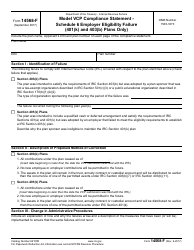

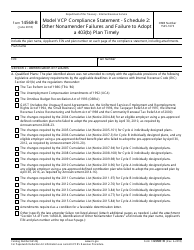

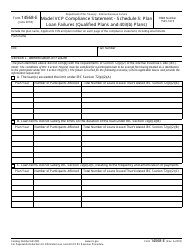

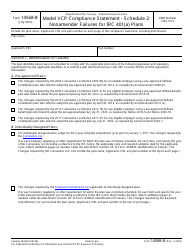

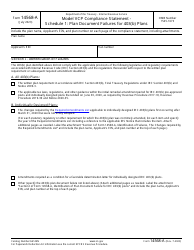

IRS Form 14568-D Schedule 4

for the current year.

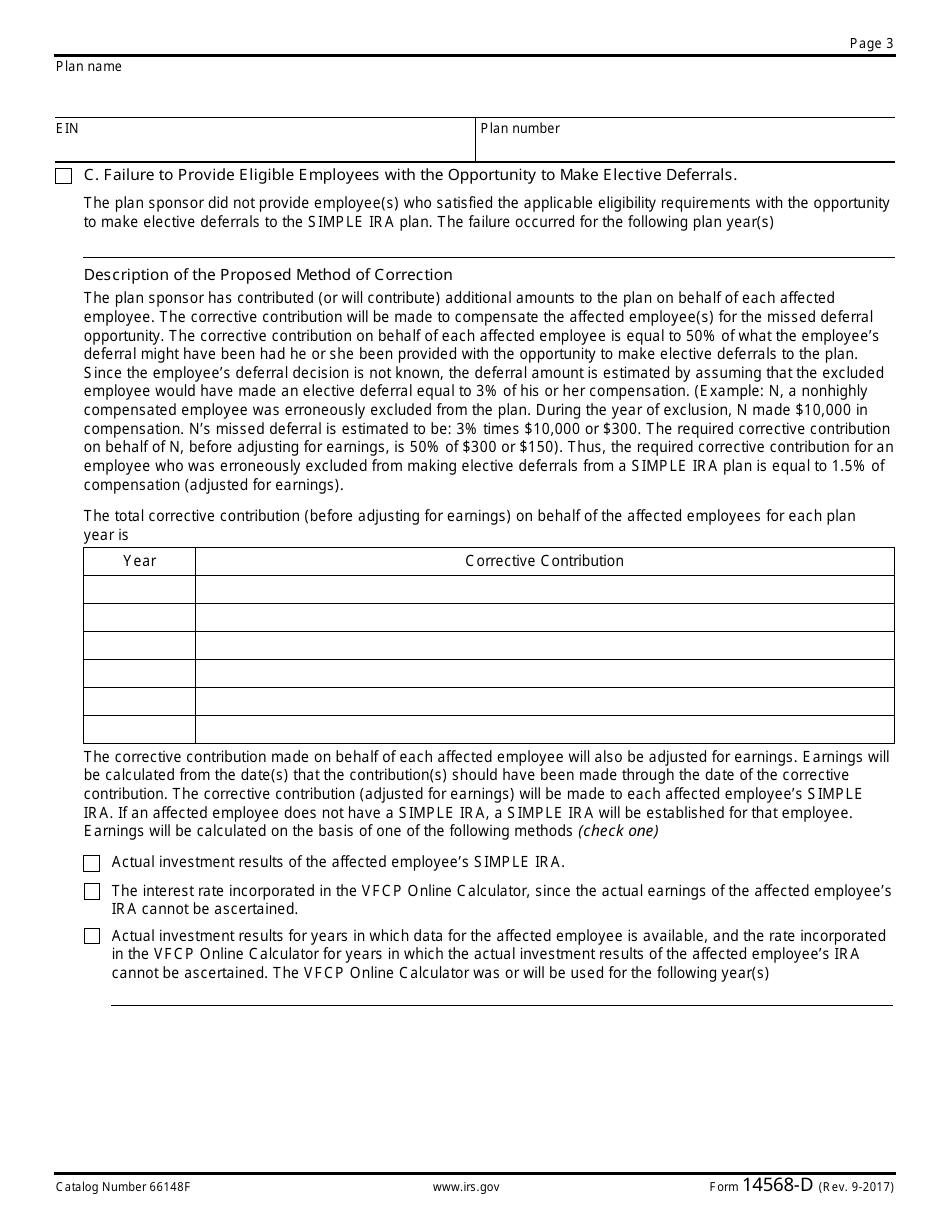

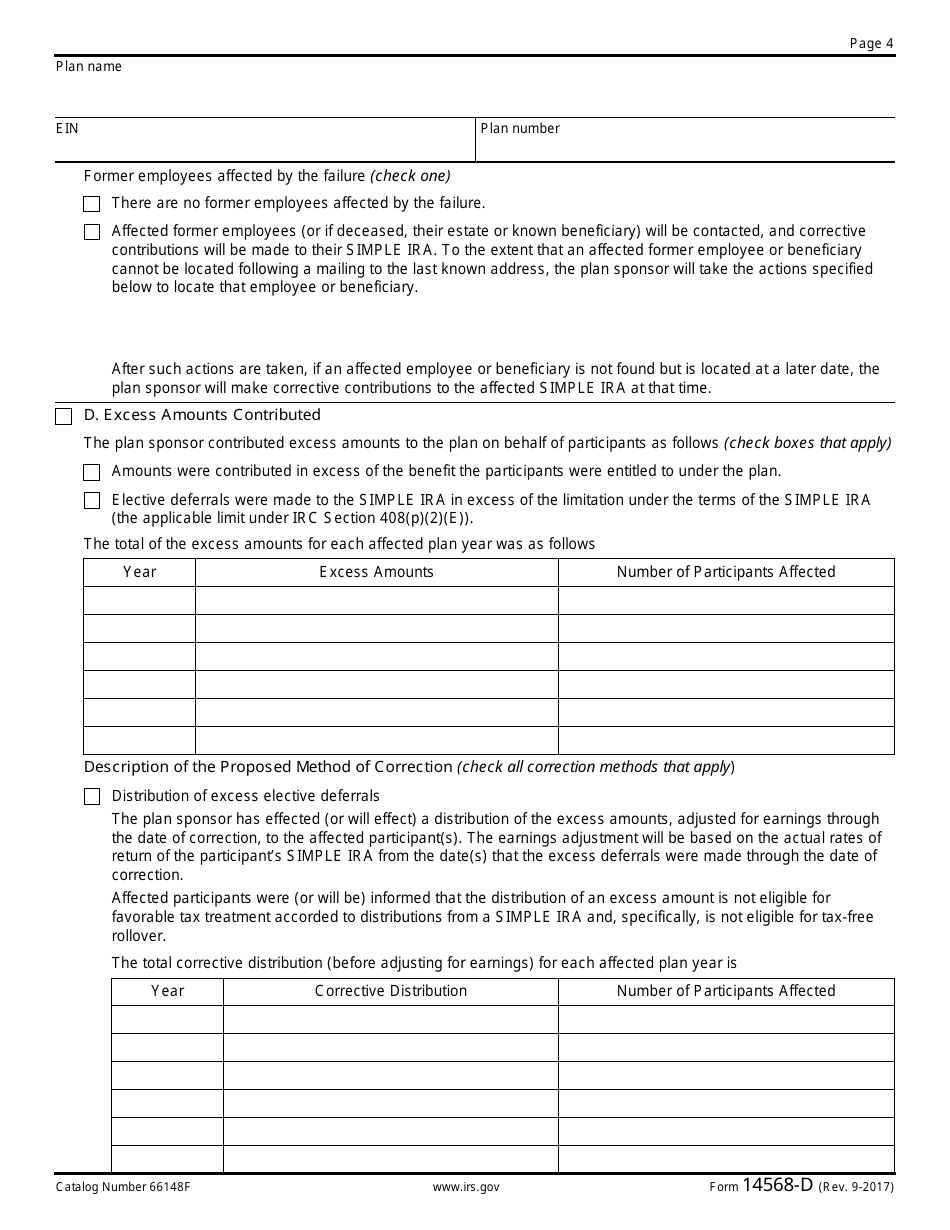

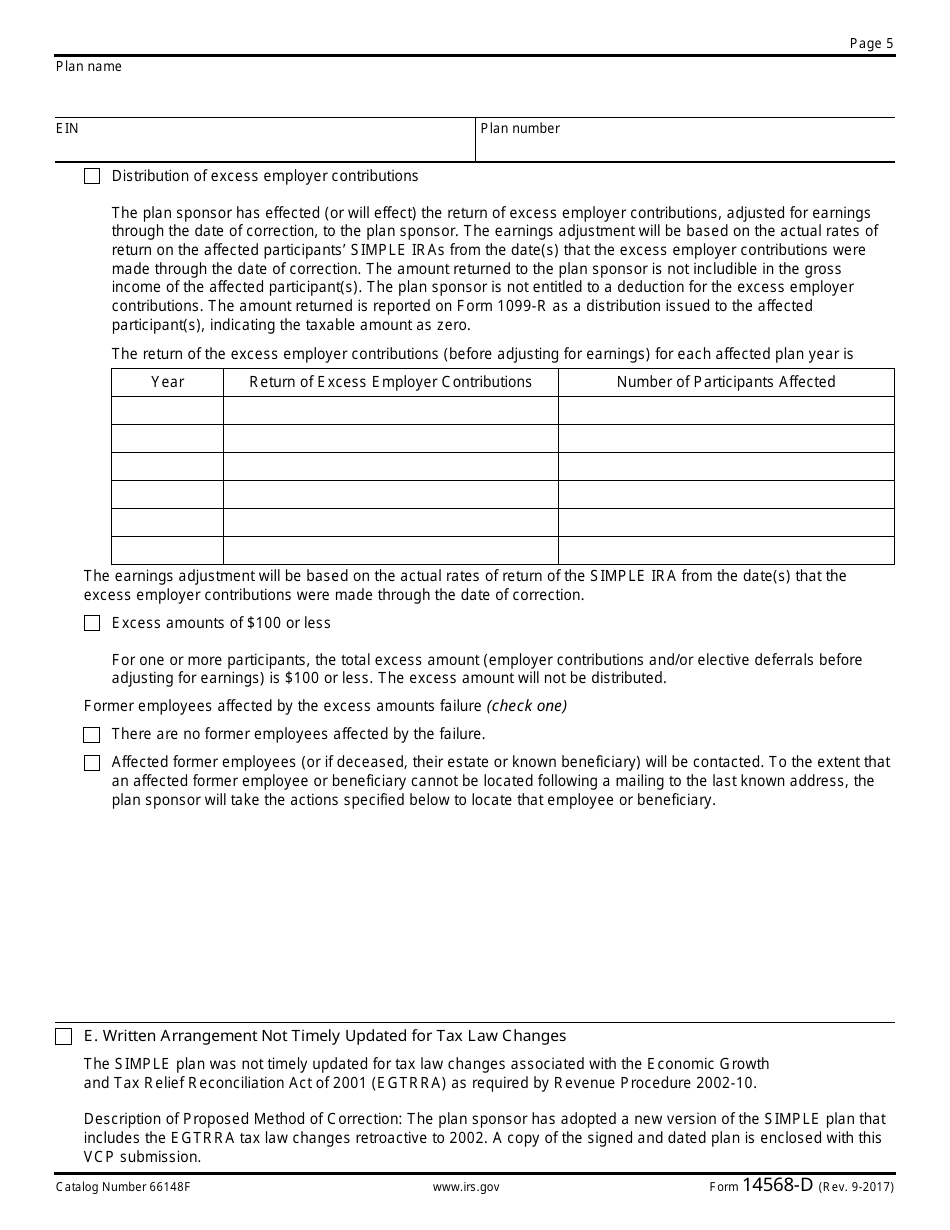

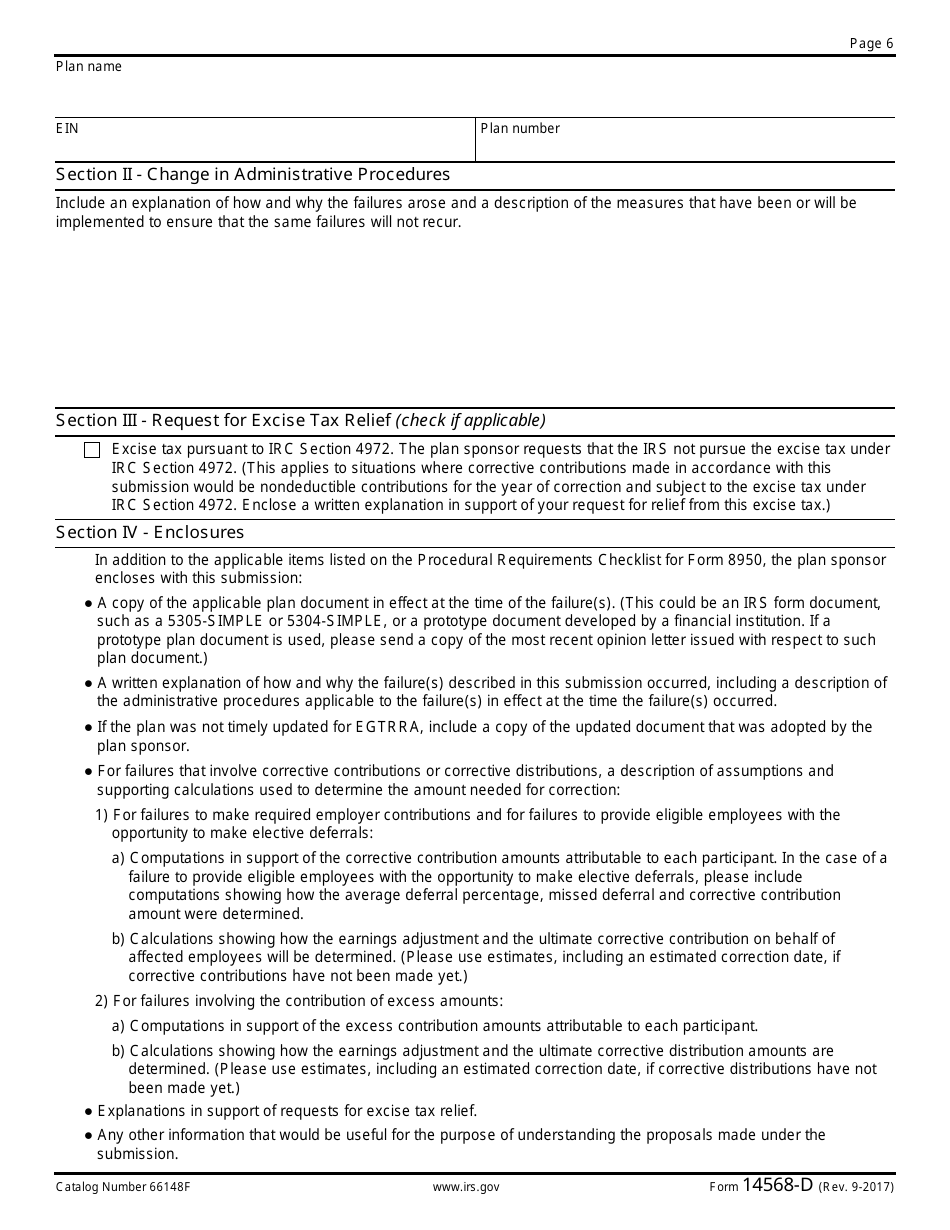

IRS Form 14568-D Schedule 4 Model Vcp Compliance Statement - Simple Iras

What Is IRS Form 14568-D Schedule 4?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on September 1, 2017. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

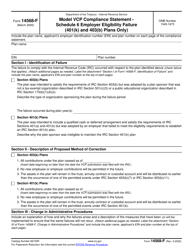

Q: What is IRS Form 14568-D?

A: IRS Form 14568-D is a form used for submitting a VCP compliance statement.

Q: What is Schedule 4?

A: Schedule 4 is a section within Form 14568-D used specifically for Simple IRAs.

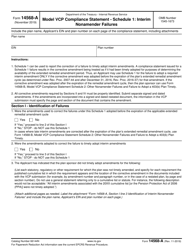

Q: What is a VCP compliance statement?

A: A VCP compliance statement is a document that outlines any corrections made to a retirement plan to bring it into compliance with IRS rules.

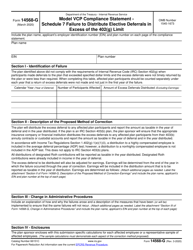

Q: What are Simple IRAs?

A: Simple IRAs are retirement plans for small businesses or self-employed individuals.

Q: Who needs to file IRS Form 14568-D Schedule 4?

A: Those who have a Simple IRA retirement plan and are submitting a VCP compliance statement need to file Schedule 4.

Q: Are there any filing fees associated with IRS Form 14568-D Schedule 4?

A: Yes, there are typically fees associated with filing IRS Form 14568-D and Schedule 4. The exact fees may vary.

Q: What should be included in a VCP compliance statement for Simple IRAs?

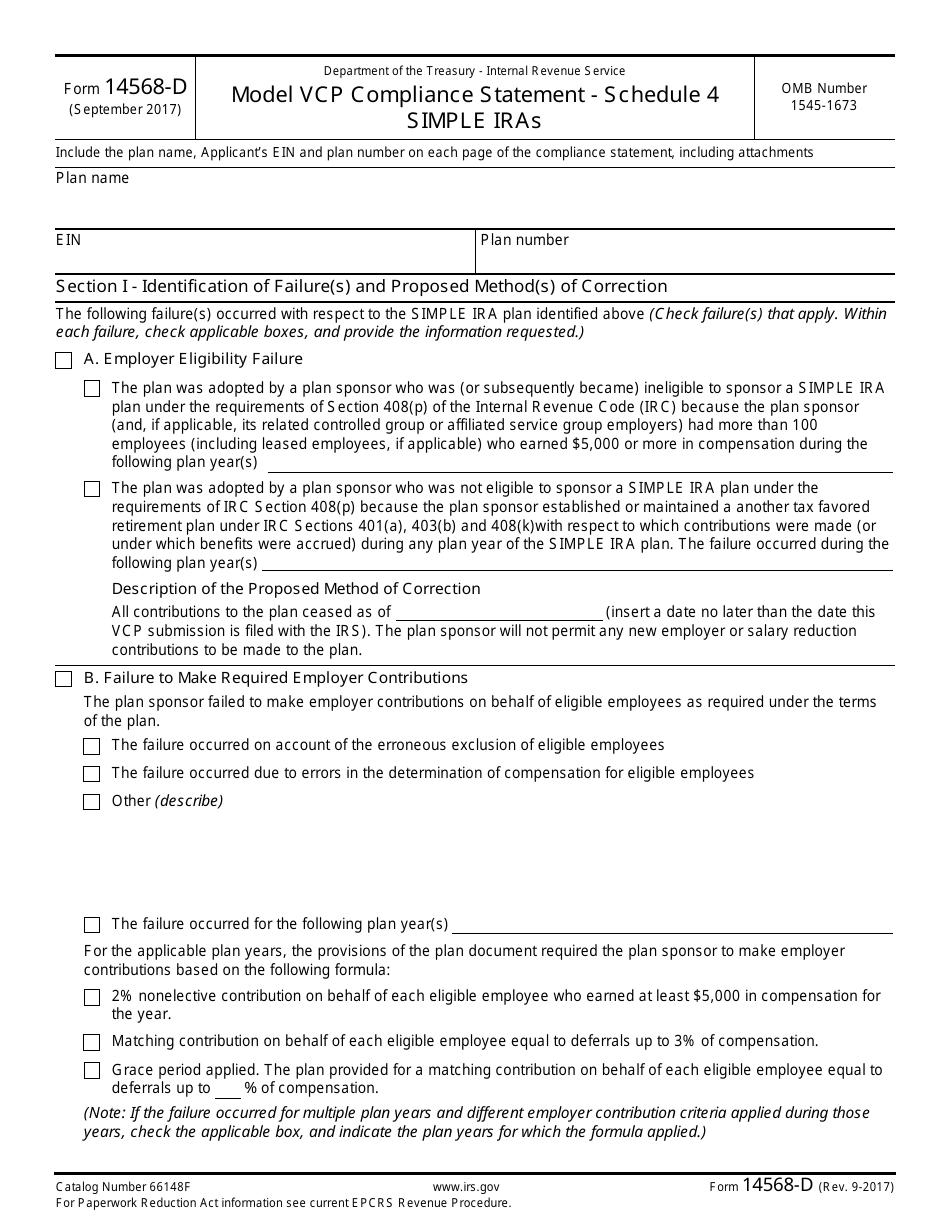

A: A VCP compliance statement for Simple IRAs should include a description of any errors or failures in the plan, the actions taken to correct them, and any additional information required by the IRS.

Q: What happens after filing IRS Form 14568-D Schedule 4?

A: After filing IRS Form 14568-D Schedule 4, the IRS will review the VCP compliance statement and determine if the corrections are acceptable. They may contact you for further information or clarification.

Q: Can I file IRS Form 14568-D Schedule 4 electronically?

A: No, IRS Form 14568-D and Schedule 4 must be filed by mail or fax.

Form Details:

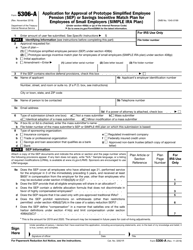

- A 6-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14568-D Schedule 4 through the link below or browse more documents in our library of IRS Forms.