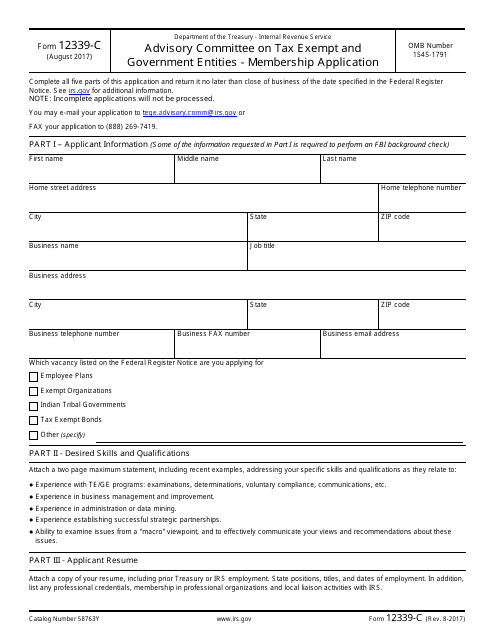

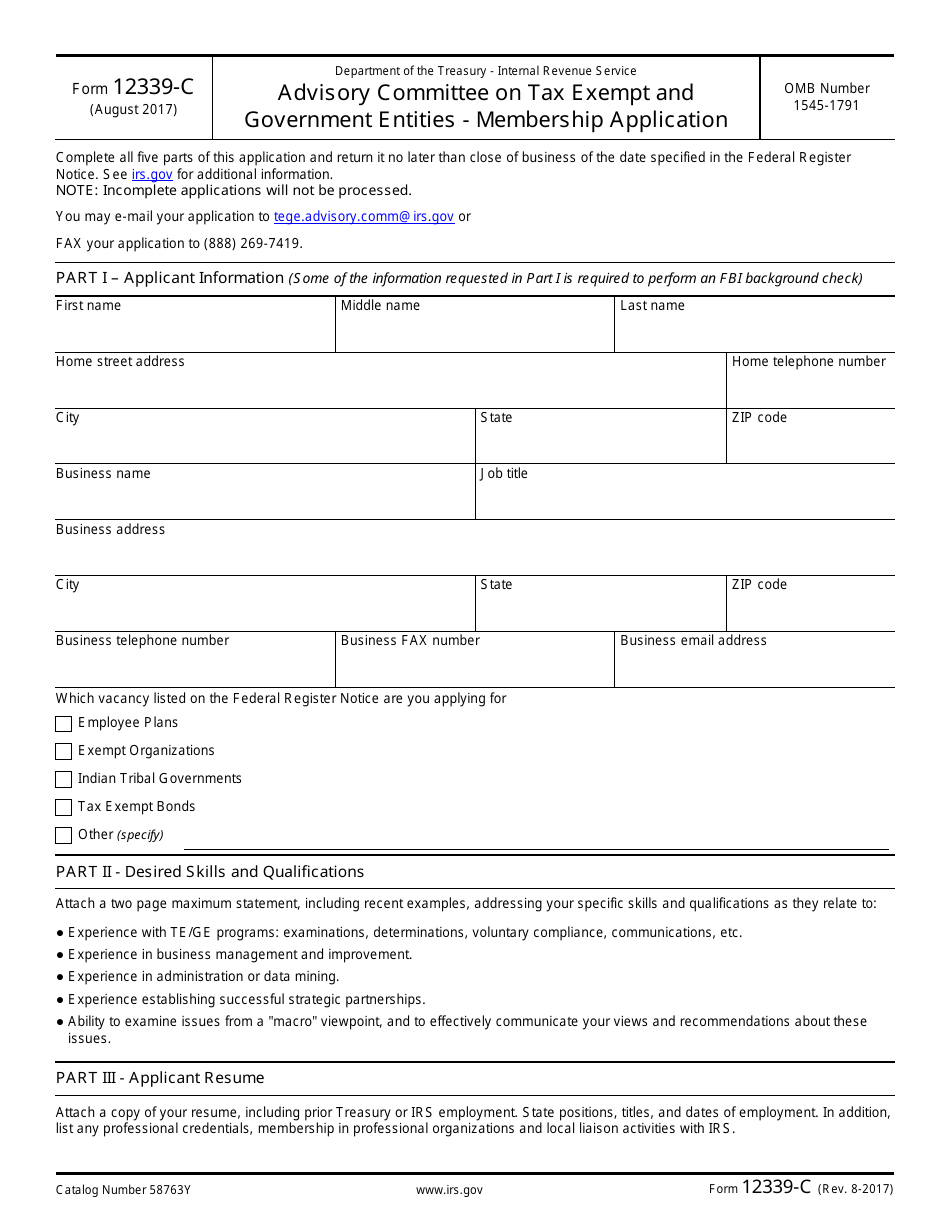

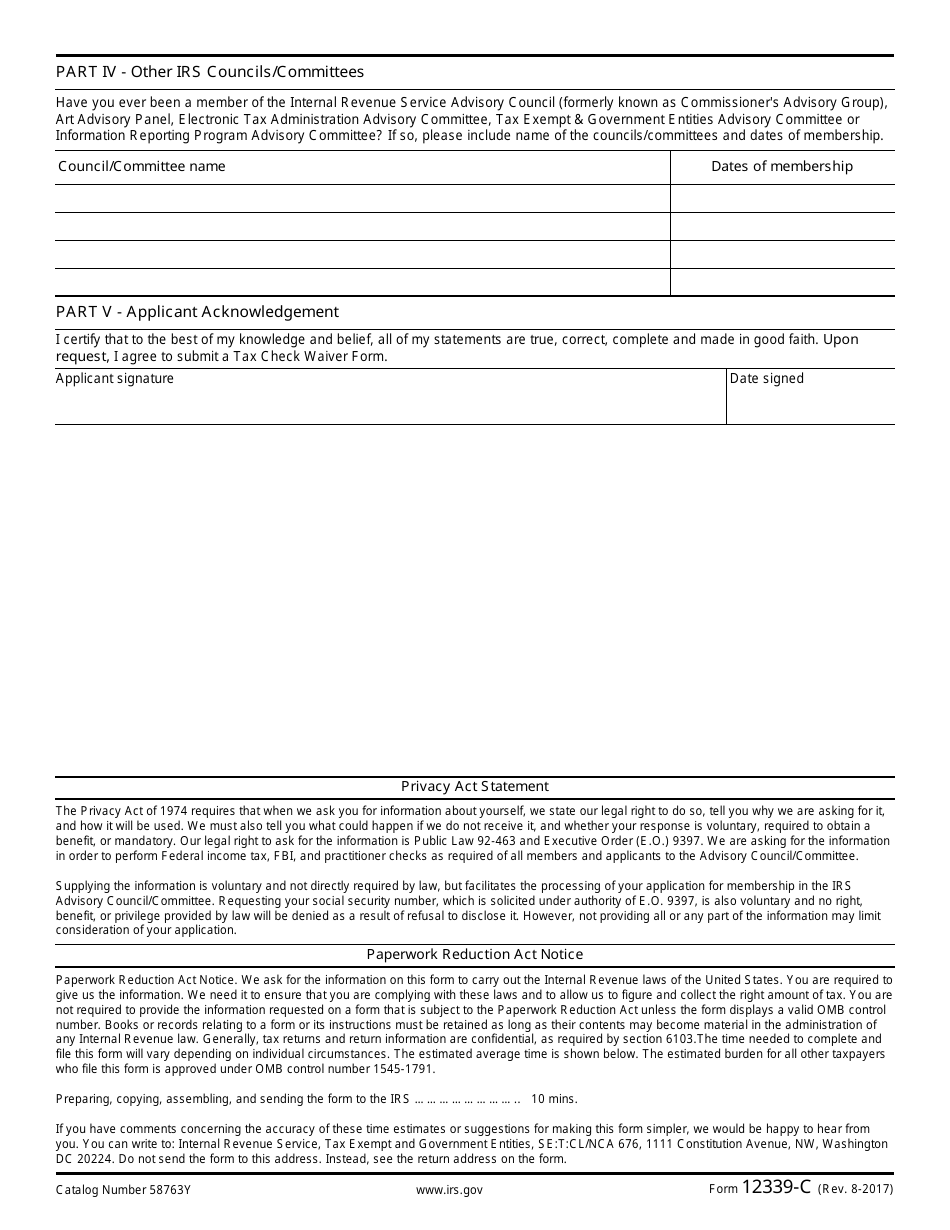

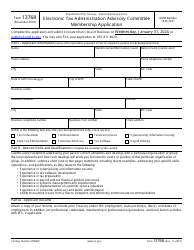

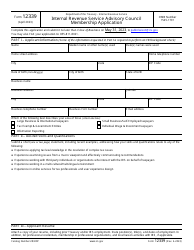

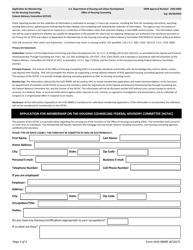

IRS Form 12339-C Advisory Committee on Tax Exempt and Government Entities - Membership Application

What Is IRS Form 12339-C?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on August 1, 2017. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 12339-C?

A: IRS Form 12339-C is the Membership Application for the Advisory Committee on Tax Exempt and Government Entities.

Q: What is the Advisory Committee on Tax Exempt and Government Entities?

A: The Advisory Committee on Tax Exempt and Government Entities is a committee that advises the IRS on issues related to tax-exempt organizations and government entities.

Q: Who can use IRS Form 12339-C?

A: Individuals who are interested in becoming members of the Advisory Committee on Tax Exempt and Government Entities can use IRS Form 12339-C to apply.

Q: Is there a fee to submit IRS Form 12339-C?

A: No, there is no fee to submit IRS Form 12339-C.

Q: What information is required on IRS Form 12339-C?

A: IRS Form 12339-C requires information such as personal details, professional qualifications, and a statement of interest.

Q: How long does it take to process IRS Form 12339-C?

A: The processing time for IRS Form 12339-C may vary, but you can contact the IRS for more information on the timeline.

Q: What happens after I submit IRS Form 12339-C?

A: After submitting IRS Form 12339-C, the IRS will review your application and contact you if further information is needed or if you are selected as a member of the committee.

Q: Can I reapply if my application for the Advisory Committee on Tax Exempt and Government Entities is not accepted?

A: Yes, you can reapply for the Advisory Committee on Tax Exempt and Government Entities in the future if your initial application is not accepted.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 12339-C through the link below or browse more documents in our library of IRS Forms.