This version of the form is not currently in use and is provided for reference only. Download this version of

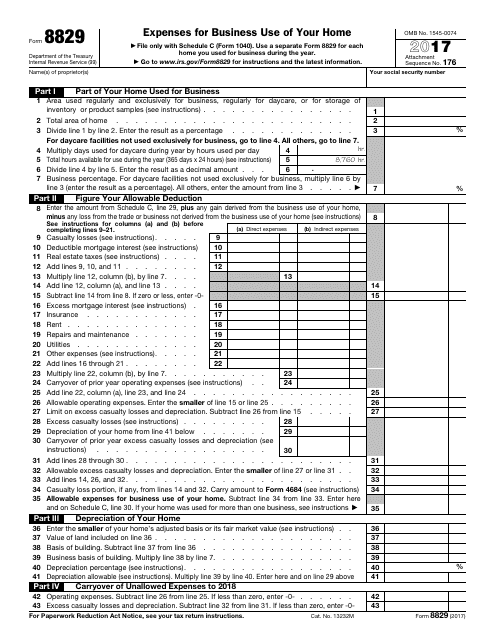

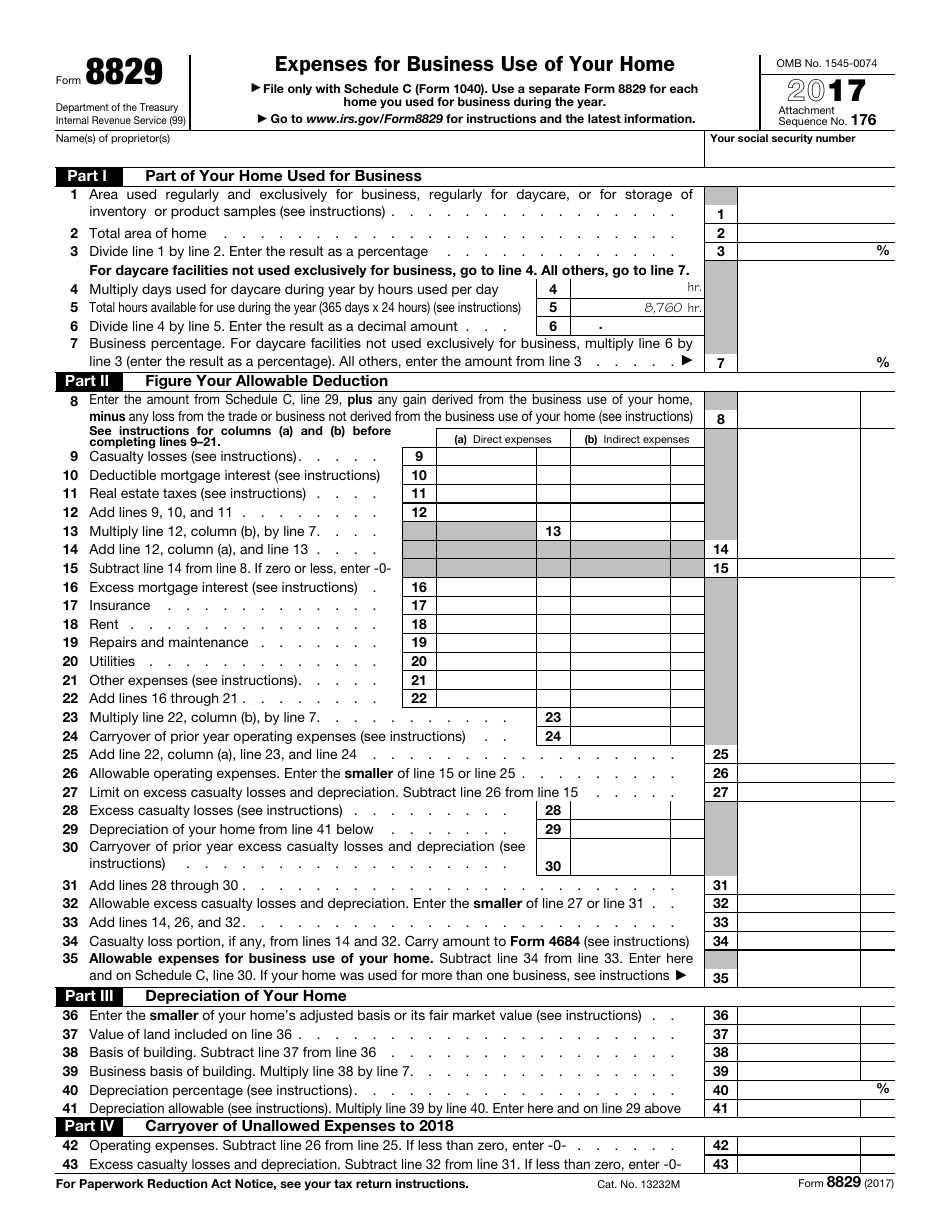

IRS Form 8829

for the current year.

IRS Form 8829 Expenses for Business Use of Your Home

What Is IRS Form 8829?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on January 1, 2017. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8829?

A: IRS Form 8829 is a form used to deduct expenses for the business use of your home.

Q: What are considered business expenses for the use of your home?

A: Business expenses for the use of your home include a portion of your rent or mortgage, utilities, insurance, and repairs.

Q: Can anyone deduct home office expenses?

A: No, home office expenses can only be deducted if you use part of your home regularly and exclusively as your principal place of business.

Q: Do I qualify for the home office deduction?

A: You may qualify for the home office deduction if you use part of your home regularly and exclusively as your principal place of business, or if you use a separate structure on your property for business purposes.

Q: What documents do I need to support my home office expenses?

A: You should keep records of your home office expenses, such as receipts, bills, and a record of the total square footage of your home and the portion used for business purposes.

Q: How do I calculate the deduction for my home office expenses?

A: To calculate the deduction for your home office expenses, you can either use the regular method, which involves tracking and allocating actual expenses, or the simplified method, which allows for a standard deduction based on square footage.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8829 through the link below or browse more documents in our library of IRS Forms.