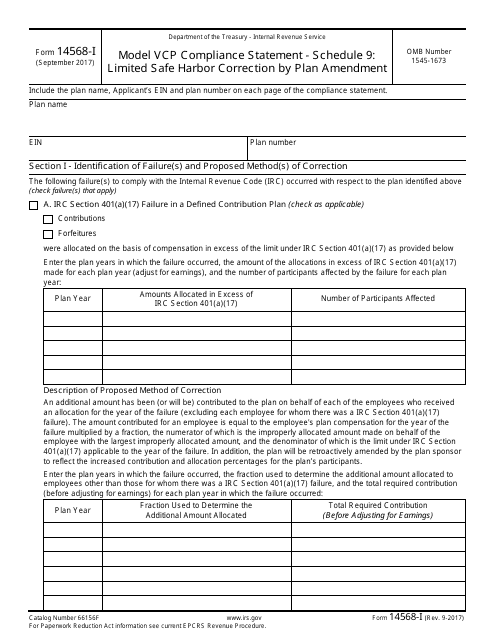

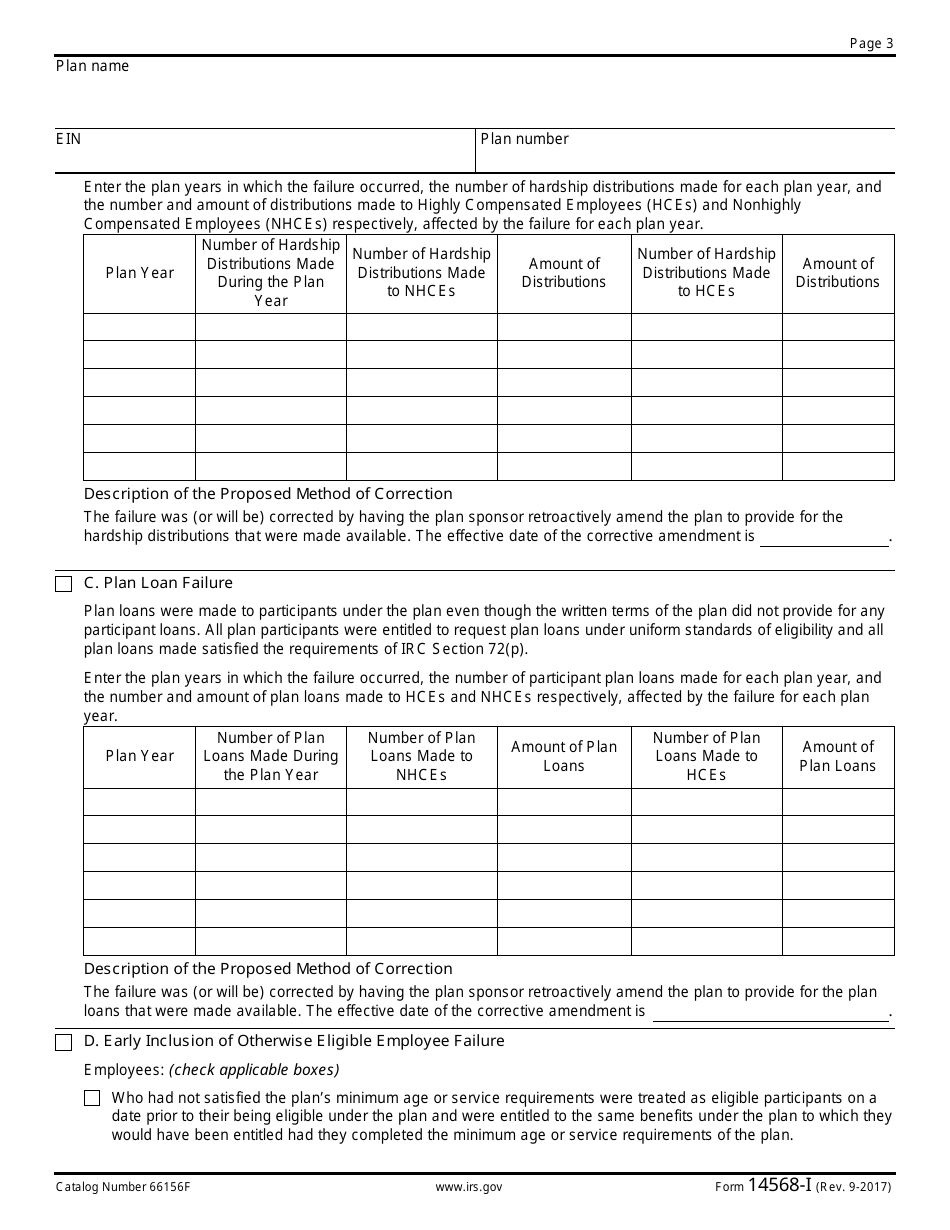

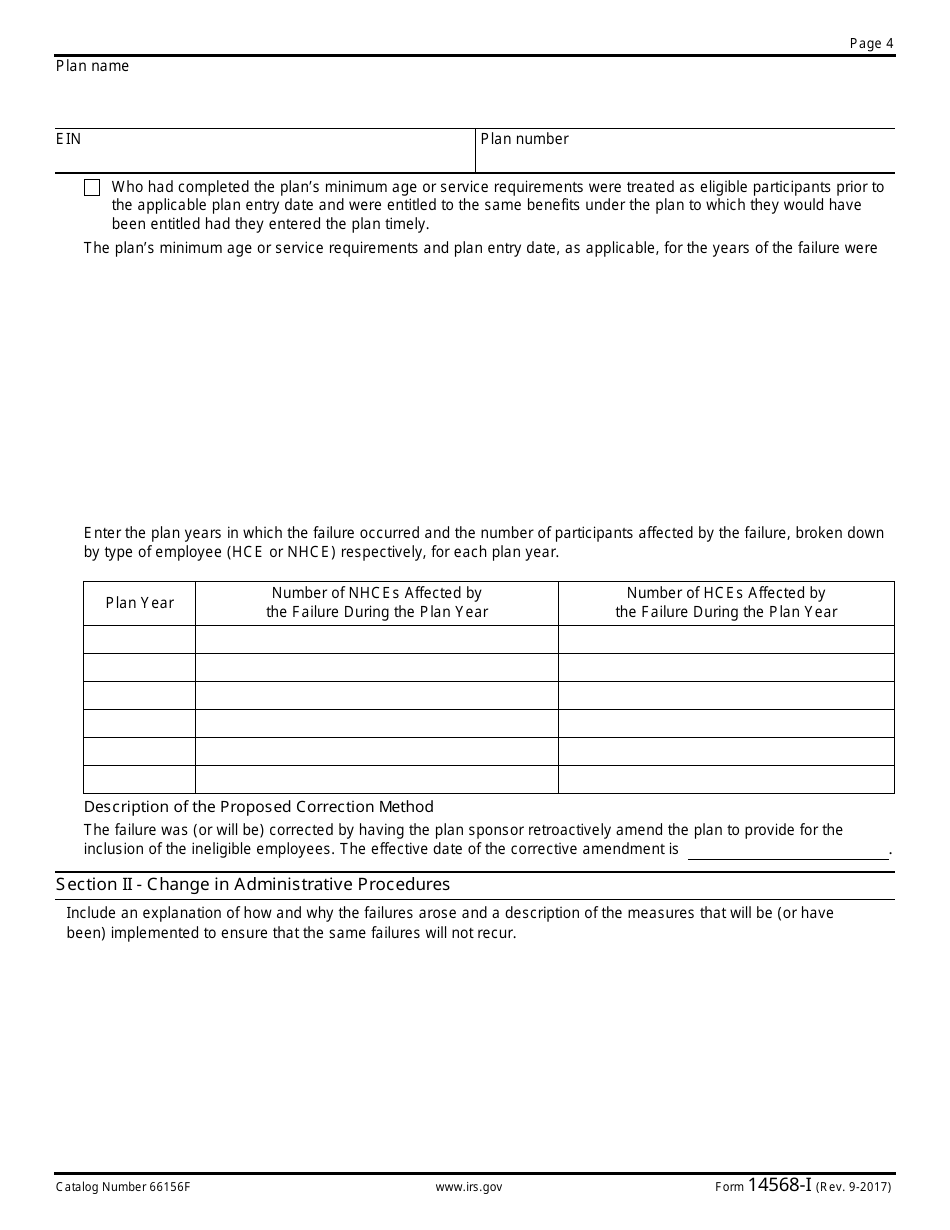

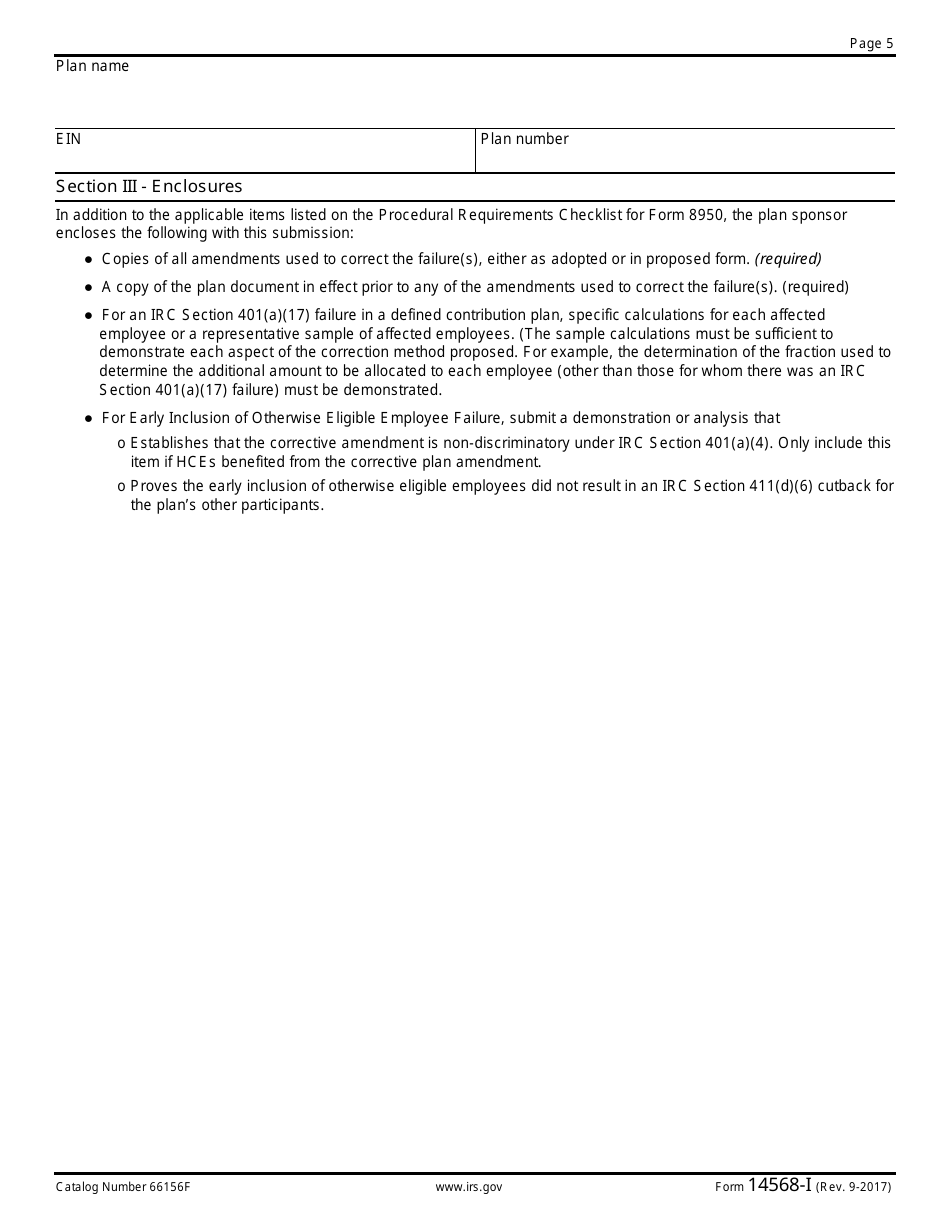

IRS Form 14568-I Schedule 9 Limited Safe Harbor Correction by Plan Amendment

What Is IRS Form 14568-I Schedule 9?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on September 1, 2017. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 14568-I?

A: IRS Form 14568-I is a form used for limited safe harbor corrections by plan amendment.

Q: What is Schedule 9 of IRS Form 14568-I?

A: Schedule 9 is used to document limited safe harbor corrections by plan amendment.

Q: What are limited safe harbor corrections by plan amendment?

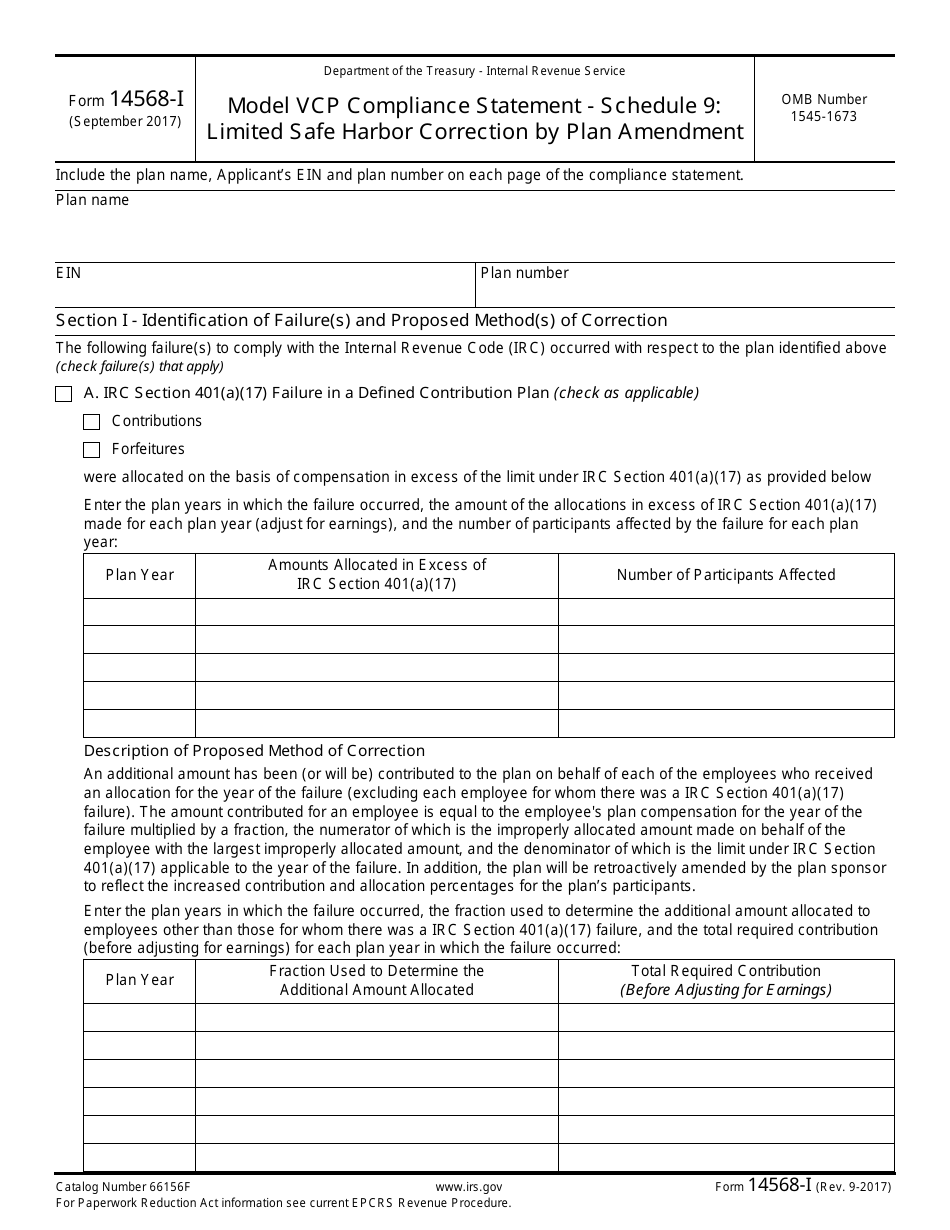

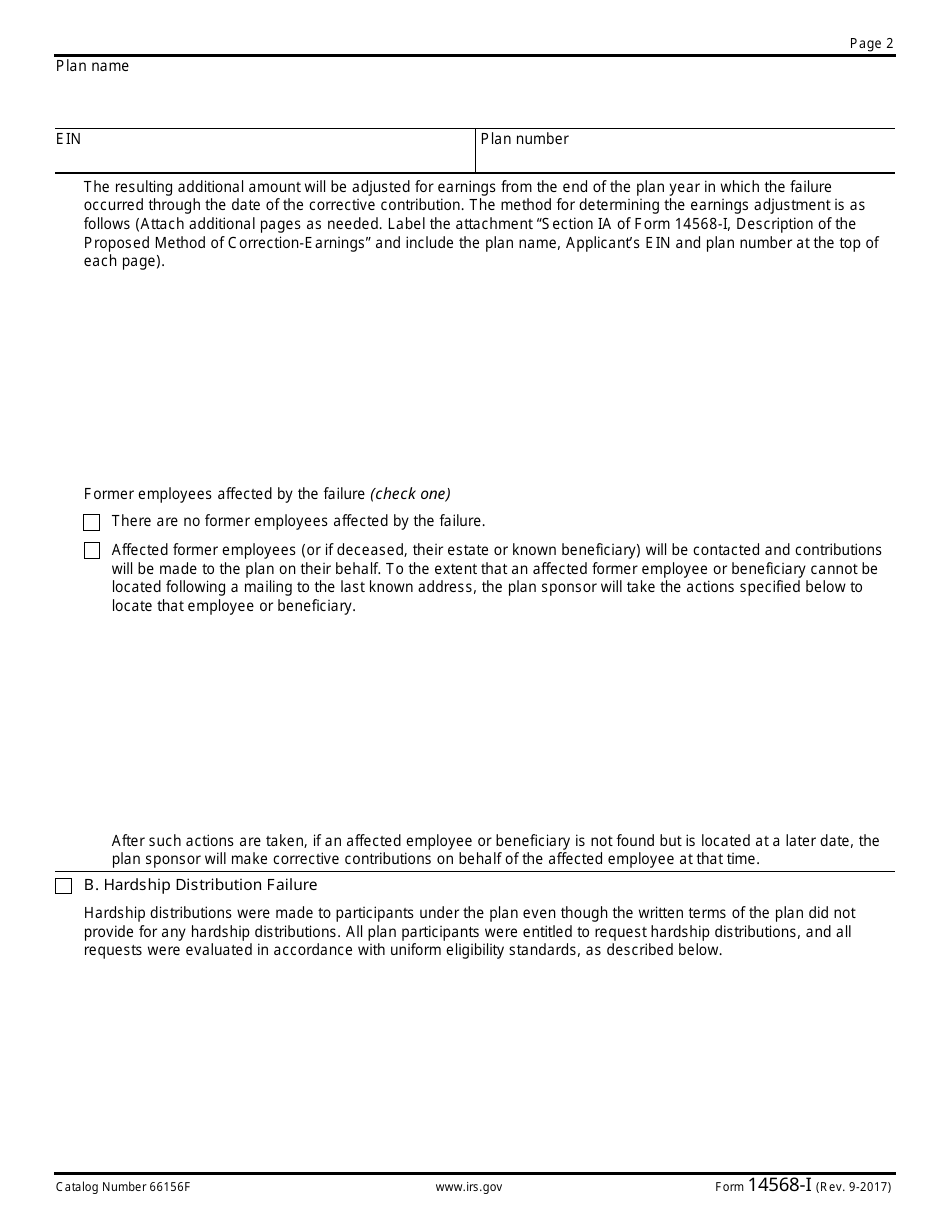

A: Limited safe harbor corrections by plan amendment are corrections that can be made to retirement plans to maintain compliance with IRS rules.

Q: Why would I need to use Schedule 9?

A: You would use Schedule 9 if you need to make limited safe harbor corrections to your retirement plan by amending the plan.

Q: What information do I need to complete Schedule 9?

A: To complete Schedule 9, you will need to provide details about the limited safe harbor corrections made to your retirement plan.

Form Details:

- A 5-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14568-I Schedule 9 through the link below or browse more documents in our library of IRS Forms.