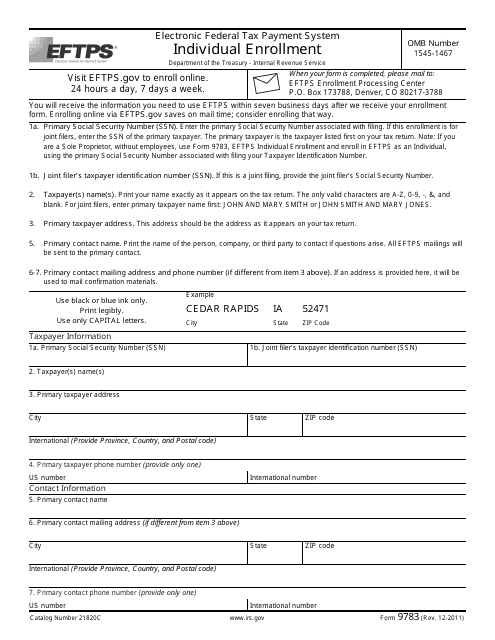

IRS Form 9783 Electronic Federal Tax Payment System Individual Enrollment

What Is IRS Form 9783?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2011. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is Form 9783?

A: Form 9783 is the IRS form used for enrollment in the Electronic Federal Tax Payment System (EFTPS) as an individual.

Q: What is the Electronic Federal Tax Payment System (EFTPS)?

A: The Electronic Federal Tax Payment System (EFTPS) is a free service provided by the U.S. Department of Treasury that allows individuals to make electronic tax payments.

Q: Who should use Form 9783?

A: Individuals who want to enroll in the Electronic Federal Tax Payment System (EFTPS) should use Form 9783.

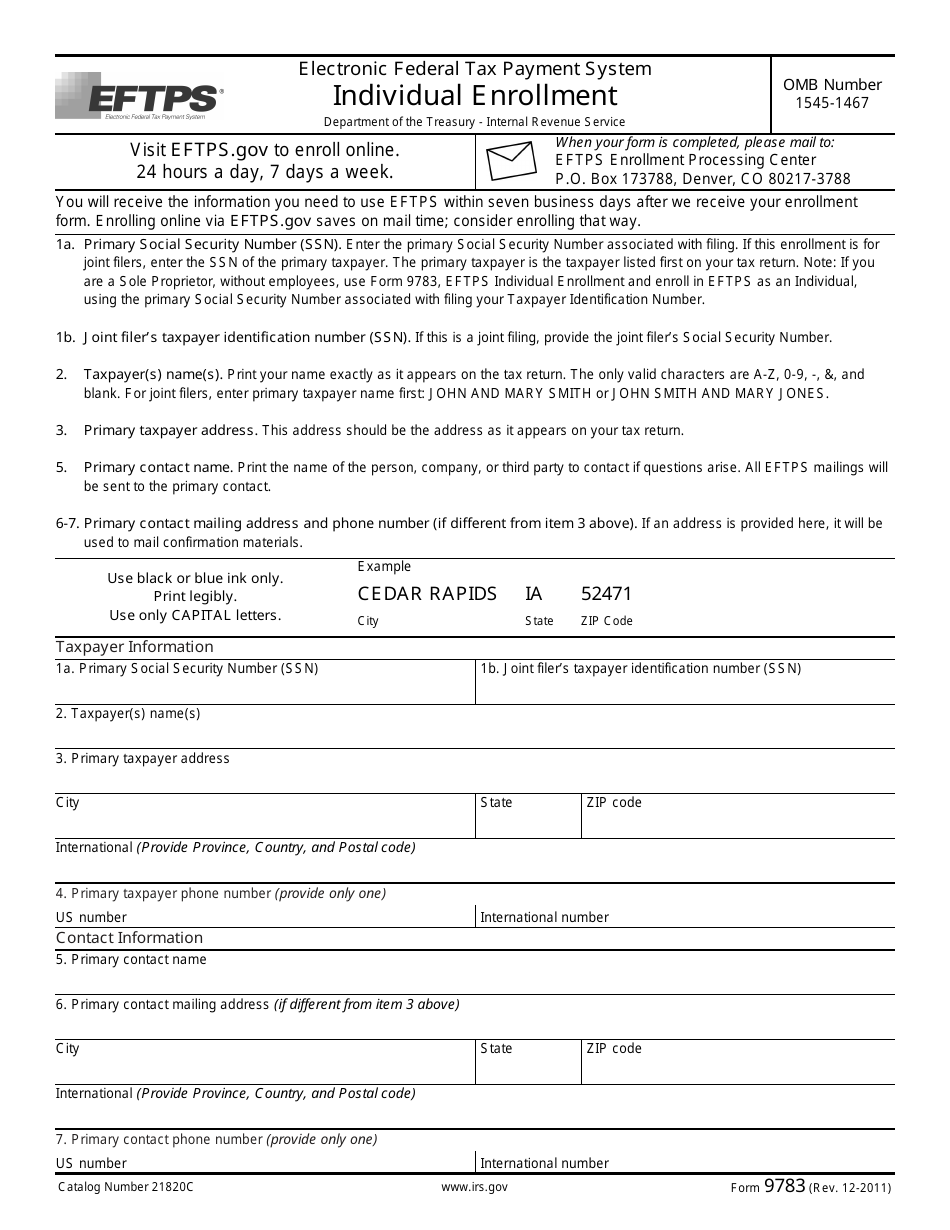

Q: What information is required on Form 9783?

A: Form 9783 requires your personal information, including your name, social security number, and contact details. You will also need to provide your bank account information for making electronic tax payments.

Q: Can I enroll in EFTPS without using Form 9783?

A: No, Form 9783 is the official IRS form for enrolling in the Electronic Federal Tax Payment System (EFTPS) as an individual. You must complete and submit this form to enroll in EFTPS.

Q: Is there a deadline for submitting Form 9783?

A: There is no specific deadline for submitting Form 9783. You can enroll in the Electronic Federal Tax Payment System (EFTPS) at any time.

Q: Are there any fees associated with EFTPS?

A: No, the Electronic Federal Tax Payment System (EFTPS) is a free service provided by the U.S. Department of Treasury.

Q: What are the benefits of using EFTPS?

A: Using the Electronic Federal Tax Payment System (EFTPS) allows you to make secure and convenient electronic tax payments, schedule payments in advance, and receive immediate confirmation of your payment.

Q: Can I still use EFTPS if I don't have a computer?

A: Yes, you can make electronic tax payments through EFTPS even if you don't have a computer. You can use the telephone voice response system or work with your financial institution to make payments.

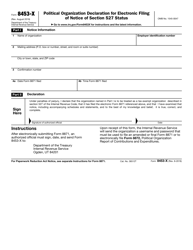

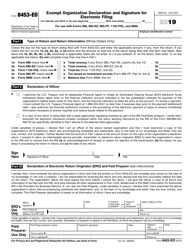

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 9783 through the link below or browse more documents in our library of IRS Forms.