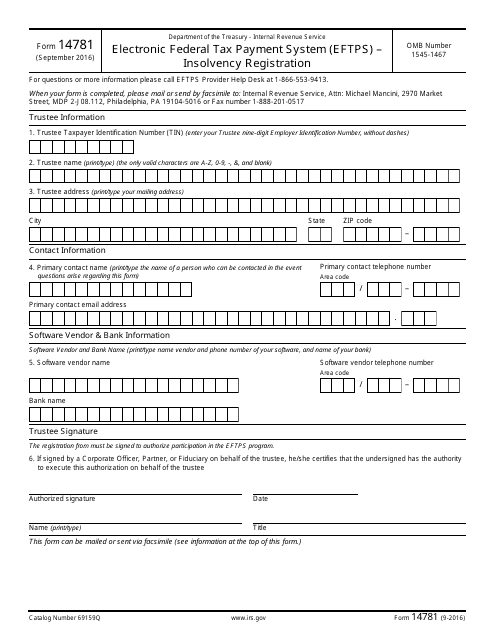

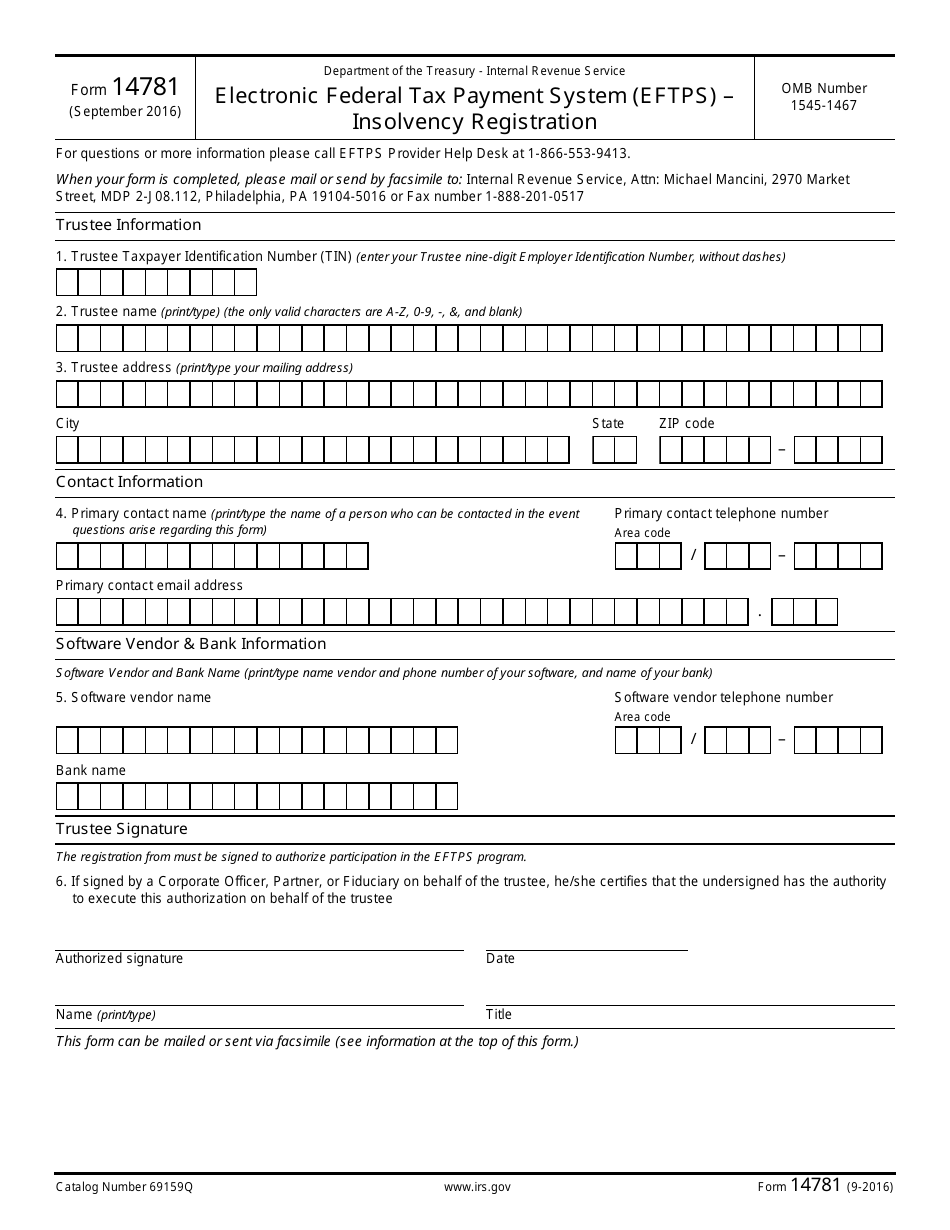

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 14781

for the current year.

IRS Form 14781 Electronic Federal Tax Payment System (Eftps) Insolvency Registration

What Is IRS Form 14781?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on September 1, 2016. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 14781?

A: IRS Form 14781 is the Electronic Federal Tax Payment System (EFTPS) Insolvency Registration form.

Q: What is the purpose of IRS Form 14781?

A: The purpose of IRS Form 14781 is to register for the Electronic Federal Tax Payment System (EFTPS) Insolvency program.

Q: What is the Electronic Federal Tax Payment System (EFTPS)?

A: The Electronic Federal Tax Payment System (EFTPS) is a system provided by the IRS for businesses and individuals to make federal tax payments electronically.

Q: Who should use IRS Form 14781?

A: IRS Form 14781 should be used by businesses or individuals who are insolvent, meaning that their liabilities exceed their assets, and want to register for the EFTPS Insolvency program.

Q: What are the benefits of the EFTPS Insolvency program?

A: The EFTPS Insolvency program allows qualified taxpayers to temporarily defer federal tax liabilities until their financial situation improves.

Q: Are there any fees associated with the EFTPS Insolvency program?

A: No, there are no fees associated with the EFTPS Insolvency program.

Q: Can I use the EFTPS Insolvency program to avoid paying my federal taxes?

A: No, the EFTPS Insolvency program is designed to provide temporary relief for taxpayers who are insolvent but still requires eventual payment of federal tax liabilities.

Q: What is the deadline for submitting IRS Form 14781?

A: The deadline for submitting IRS Form 14781 is determined by the IRS and may vary.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14781 through the link below or browse more documents in our library of IRS Forms.