This version of the form is not currently in use and is provided for reference only. Download this version of

Form SSA-4-BK

for the current year.

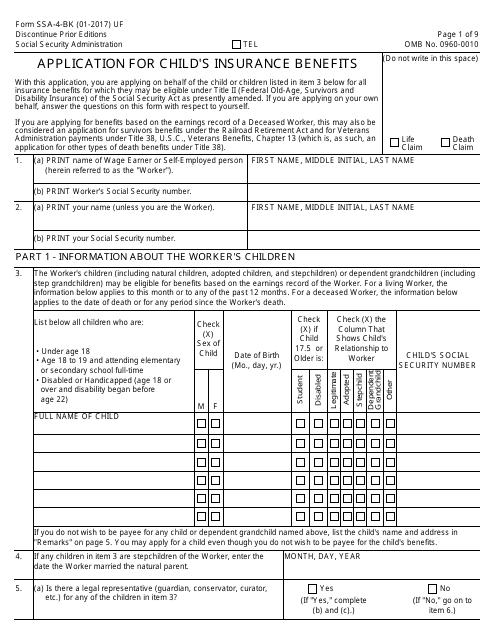

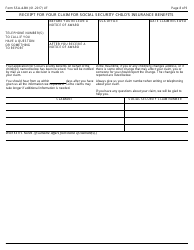

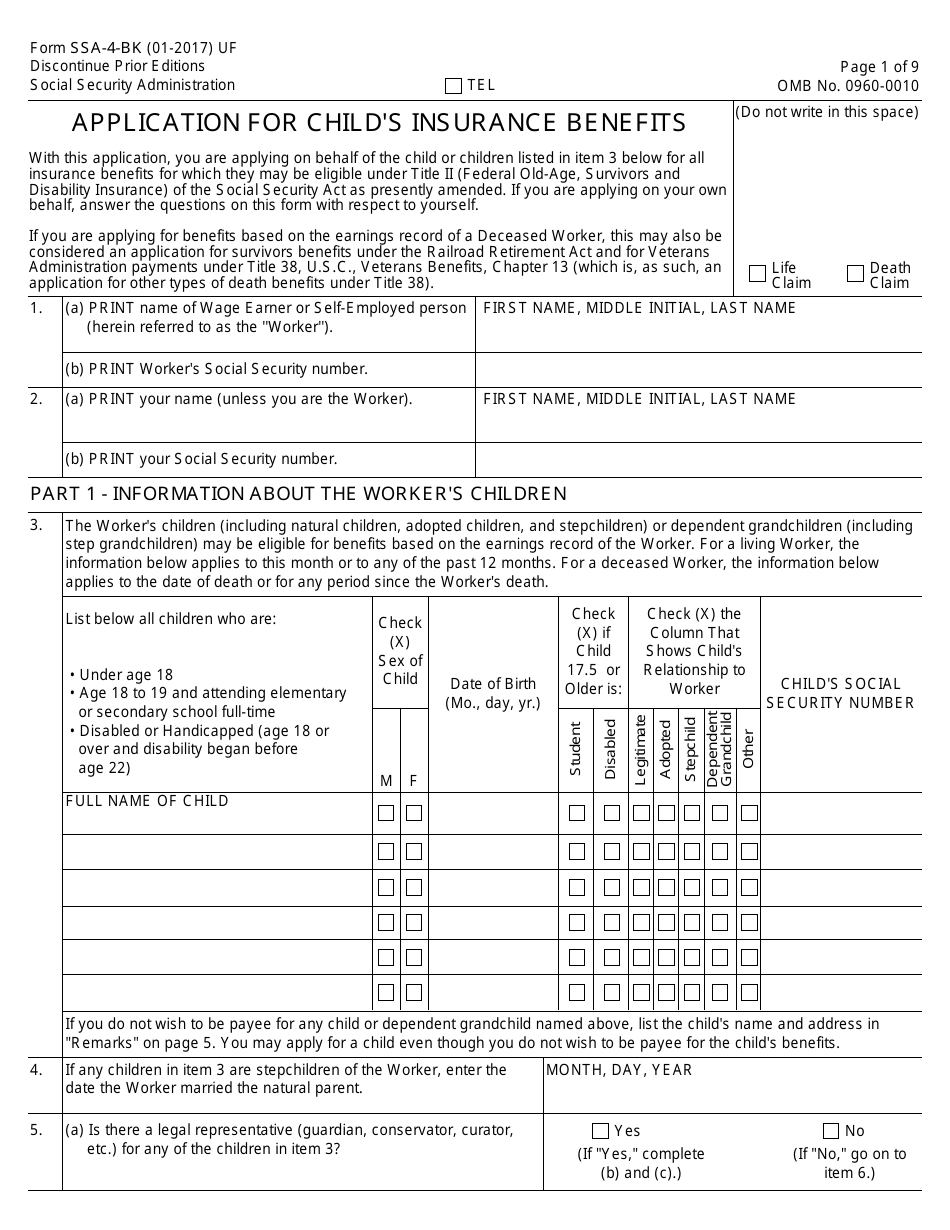

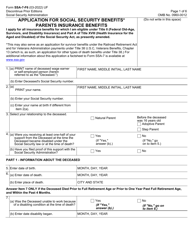

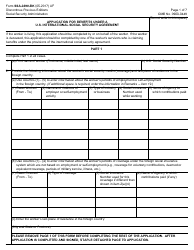

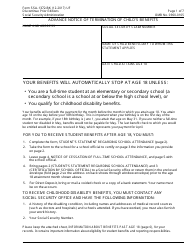

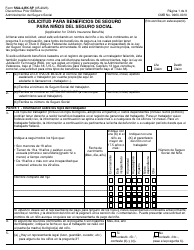

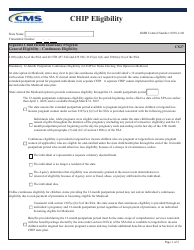

Form SSA-4-BK Application for Child's Insurance Benefits

What Is Form SSA-4-BK?

Form SSA-4-BK, Application for Child's Insurance Benefits , is a form that is used to apply for Child's Insurance Benefits on behalf of children.

Alternate Name:

- Child Insurance Benefits Application.

This form was released by the Social Security Administration (SSA) and the latest version was issued on January 1, 2017 . A fillable Child Insurance Benefits Application is available for download below.

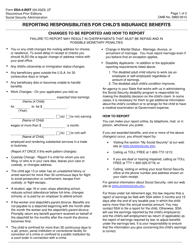

A child is eligible to get these benefits if they have:

- A disabled or retired parent, entitled to Social Security benefits; or

- A deceased parent who has died after paying enough Social Security taxes.

Child Insurance Benefits can be applied for on behalf of the applicant's natural children, their stepchild, grandchild, step-grandchild, and adopted child. The SSA-4-BK Form can be completed by a parent of a child or on behalf of a deceased parent.

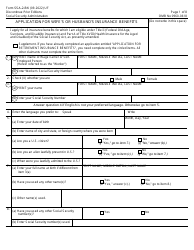

Form SSA-4-BK Instructions

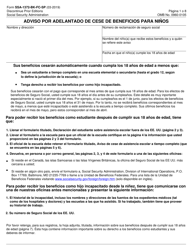

To qualify for Child's Insurance Benefits a child should be unmarried and meet the following conditions:

- Be younger than 18;

- Be 18-19 years old and a full-time student (no higher than grade 12); or

- Be 18 or older and disabled. Their disability, in this case, must have begun before age 22.

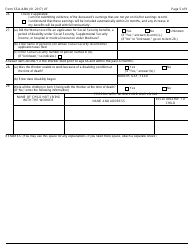

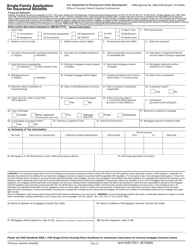

Form SSA-4-BK instructions are as follows:

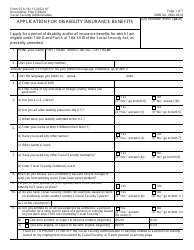

-

1 - 2. Enter full names and Social Security numbers of the SSA worker and the eligible applicant.

-

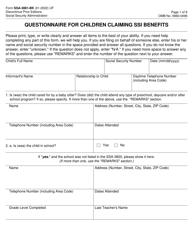

Part 1 - Information about the worker's children:

- 3 - 5. Provide information about the children who are eligible for Benefits;

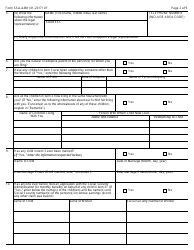

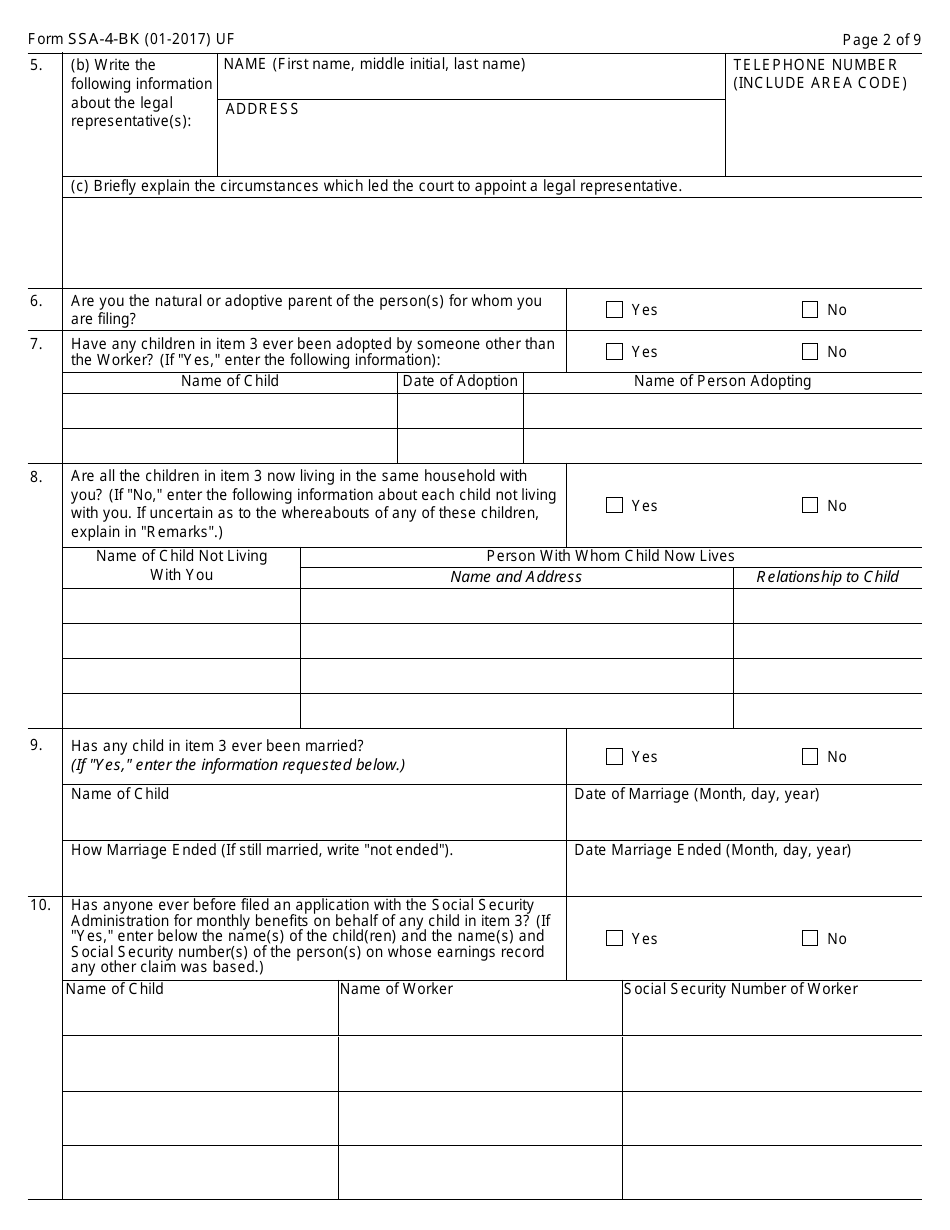

- 6 - 7. Indicate if you are the natural or adoptive parent of the indicated children, provide information about the presence of any other adoptive parents;

- 8. Indicate the children are not living with them now;

- 9. Indicate if any child in Item 3 has ever been married;

- 10. Provide information about anyone who has ever filed for Benefits on behalf of these children;

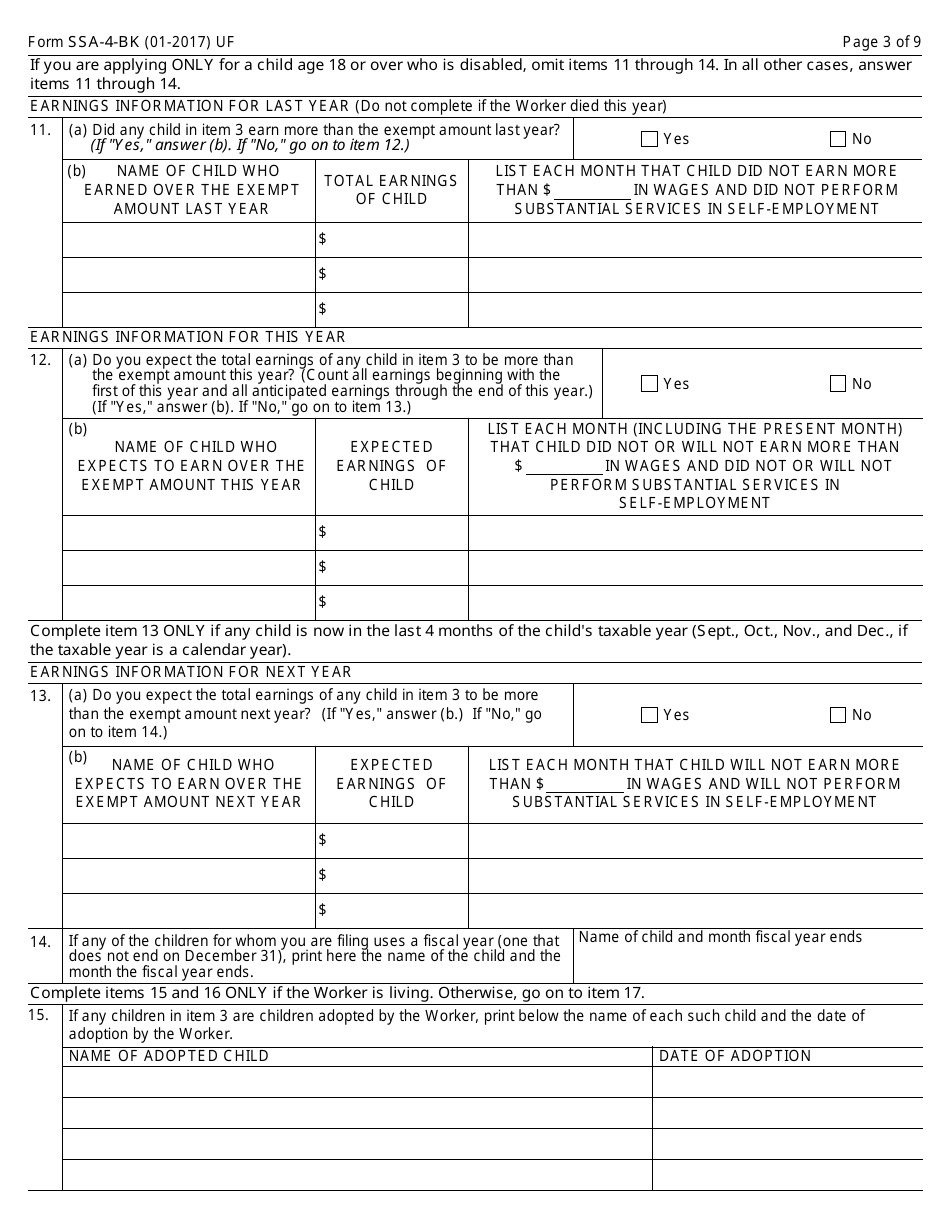

- 11 - 13. Enter the amount of each child's current and expected earnings over the exempt amount for this year, last year and next year;

- 14. Indicate the name of a child who uses a fiscal year (one that does not end on December 31);

- 15. Provide information about any children in Item 3 adopted by the worker;

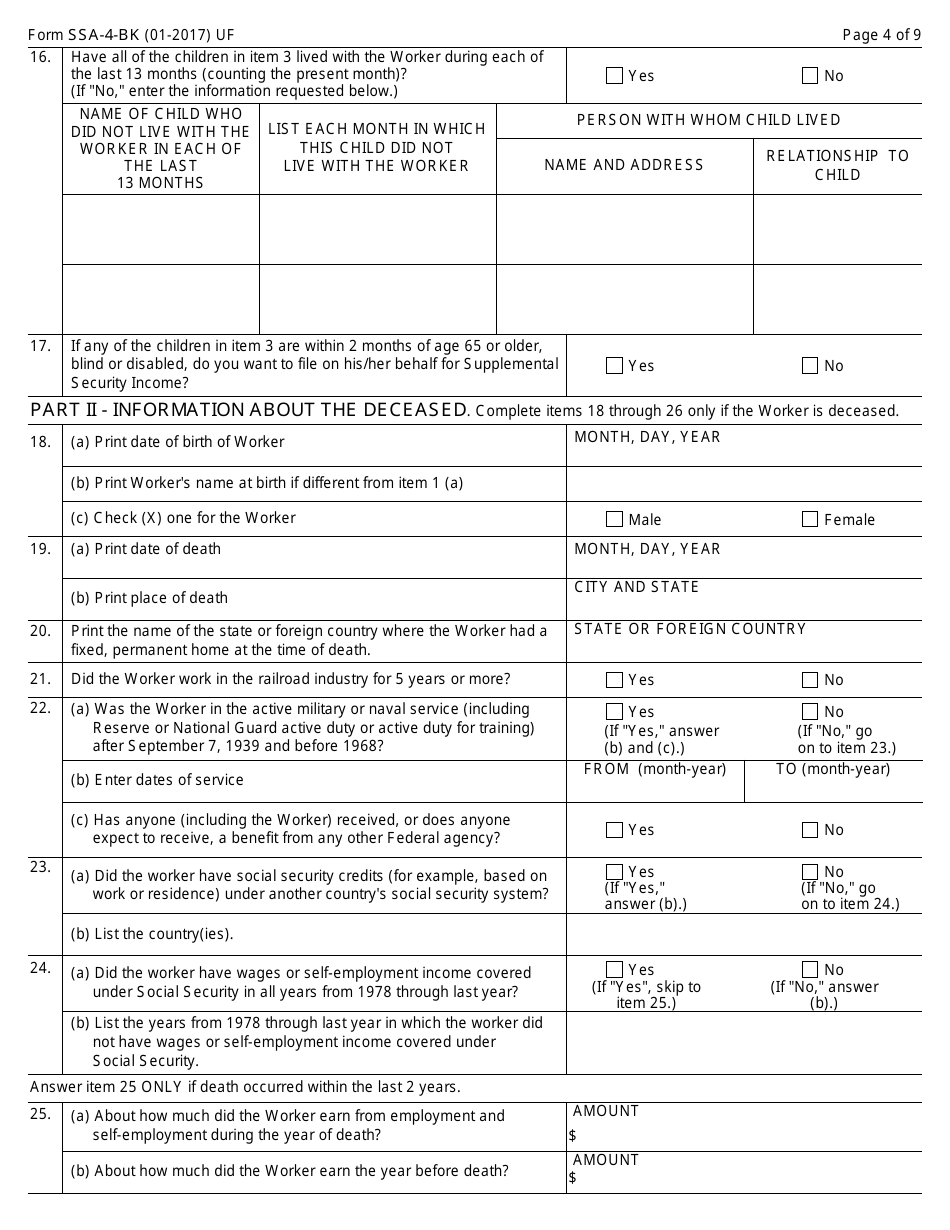

- 16. Indicate any child who did not live with them during the last 13 months;

- 17. Respond regarding filing for Supplemental Security Income.

-

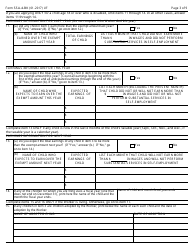

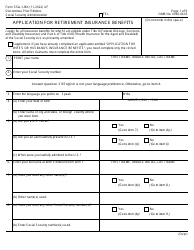

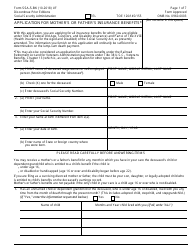

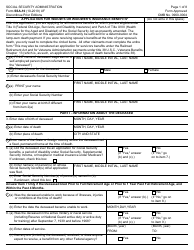

Part 2 - Information about the deceased. Complete items 18 through 26 regarding the deceased worker only.

- 18 - 24. Provide information about this person;

-

- Indicate the earnings of the deceased in the year of death and the year before death;

-

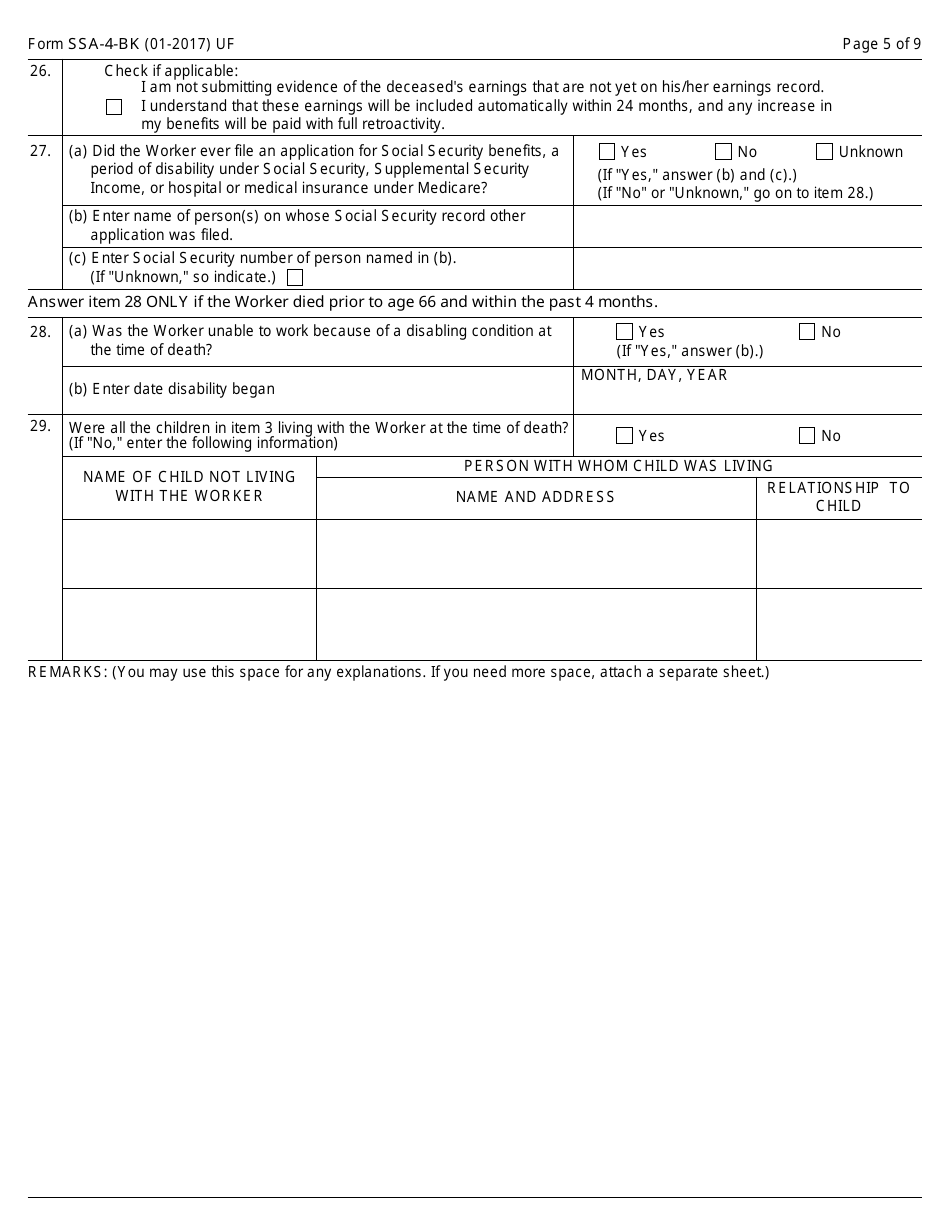

- If there are any earnings of the deceased worker that are not yet on their earning records, indicate it in this Item;

-

- Indicate if the worker has ever filed for Social Security benefits;

-

- Note if the person was unable to work because of a disabling condition;

-

- Provide information about any children of the deceased not living with them at the time of death.

-

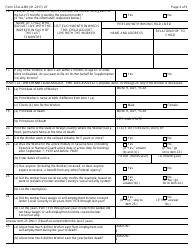

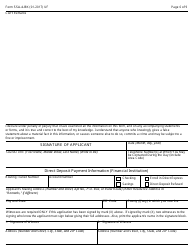

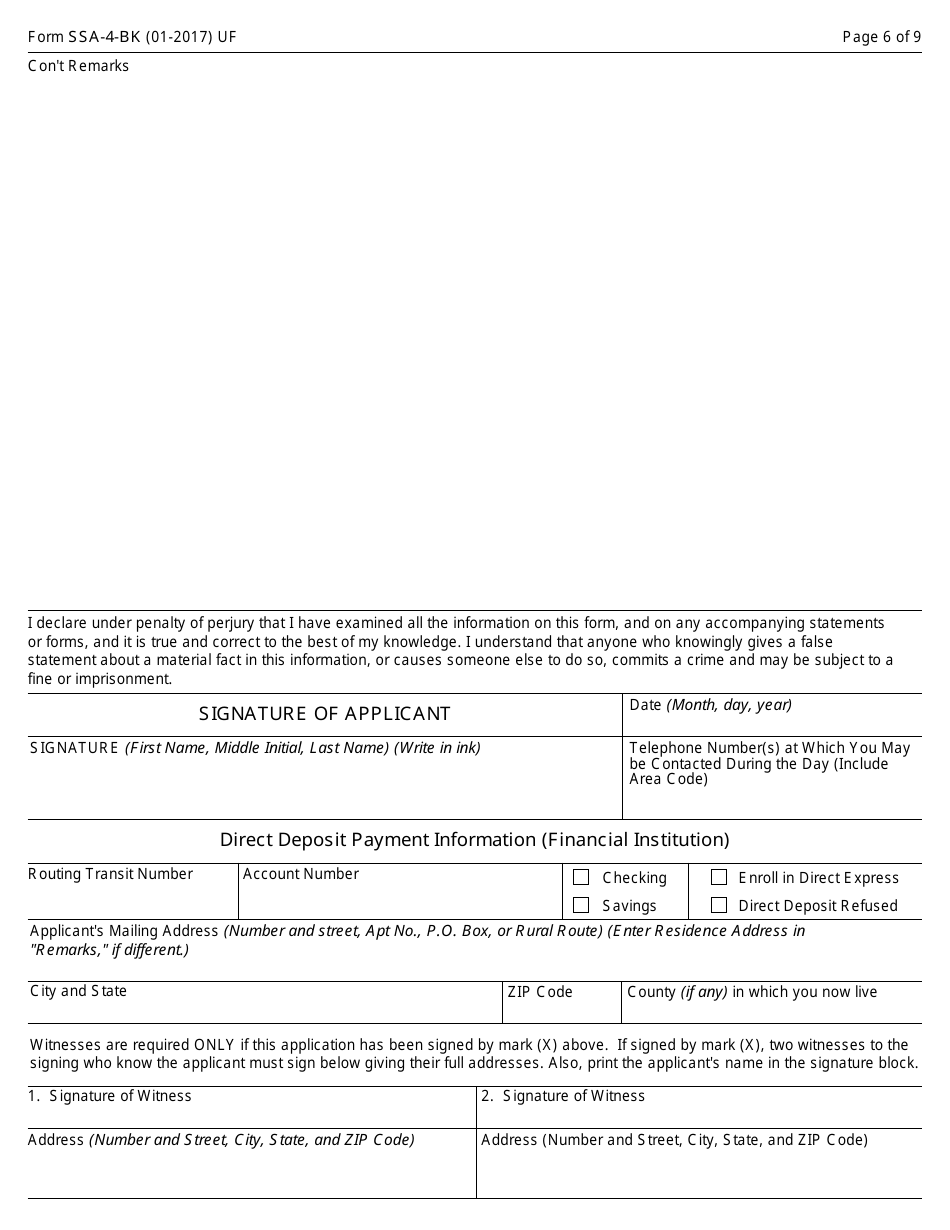

Sign the form, enter your full name and phone number.

-

Provide Direct Deposit Payment information.

Looking to learn more? Check out these related forms and templates: