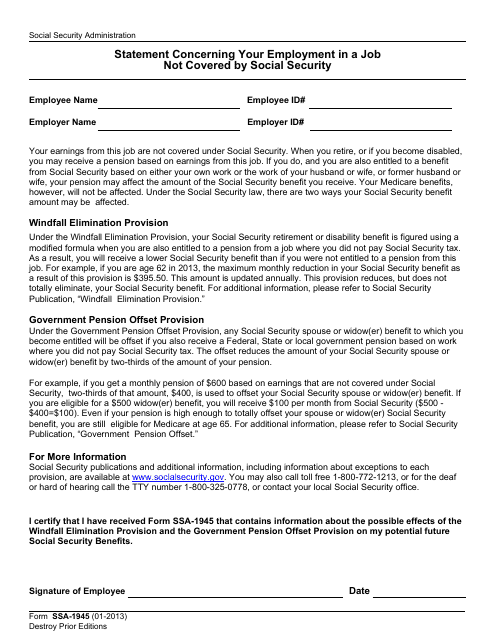

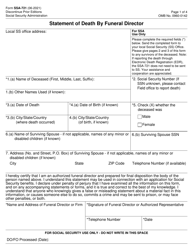

Form SSA-1945 Statement Concerning Your Employment in a Job Not Covered by Social Security

What Is Form SSA-1945?

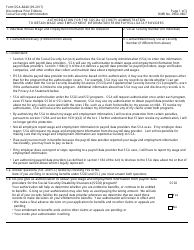

Form SSA-1945, Statement Concerning Your Employment in a Job Not Covered by Social Security , is a form used for providing an explanation of how the present employment can affect future Social Security benefits of the employee. It is required to fill out and submit this form when you take any job for which you do not pay Social Security tax.

Alternate Name:

- SSA Form 1945.

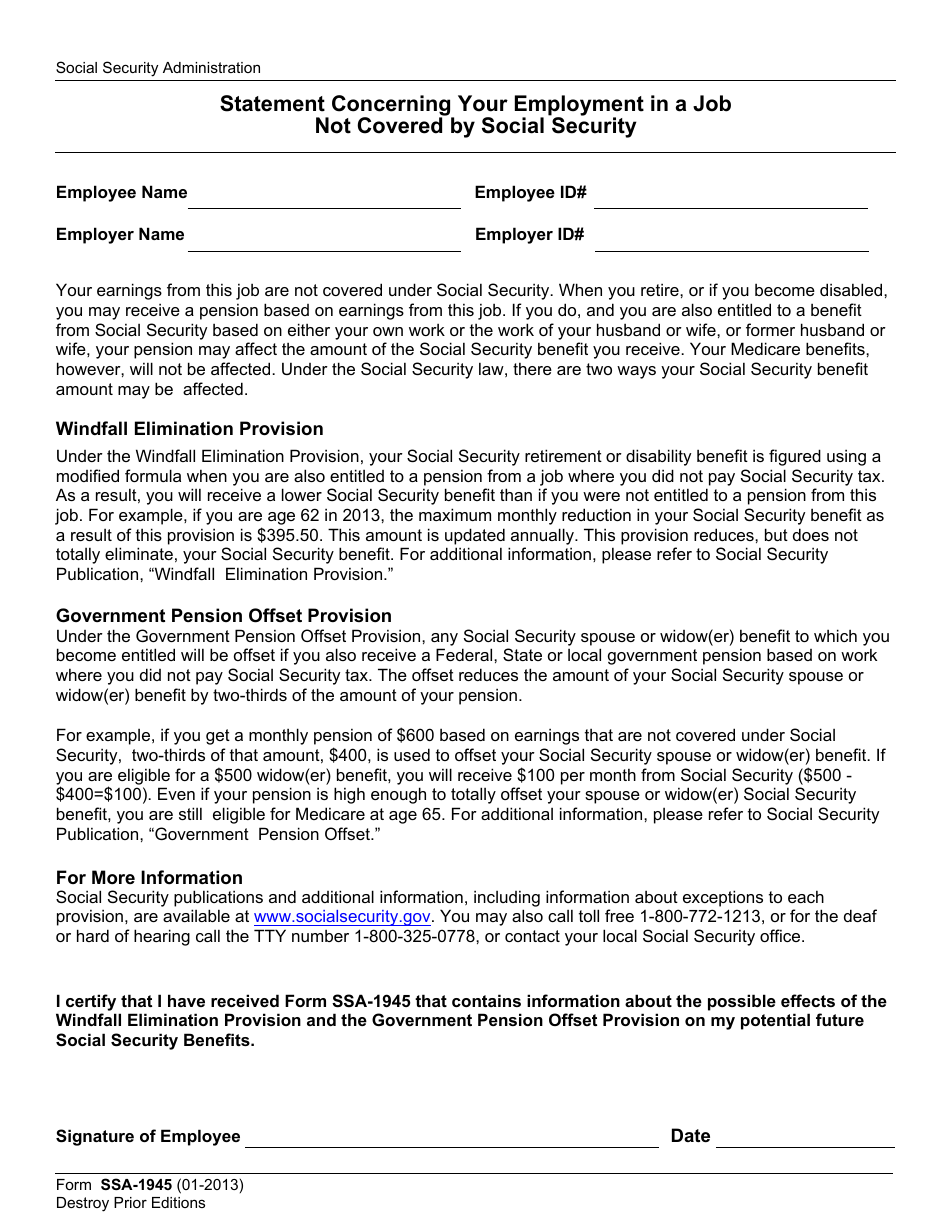

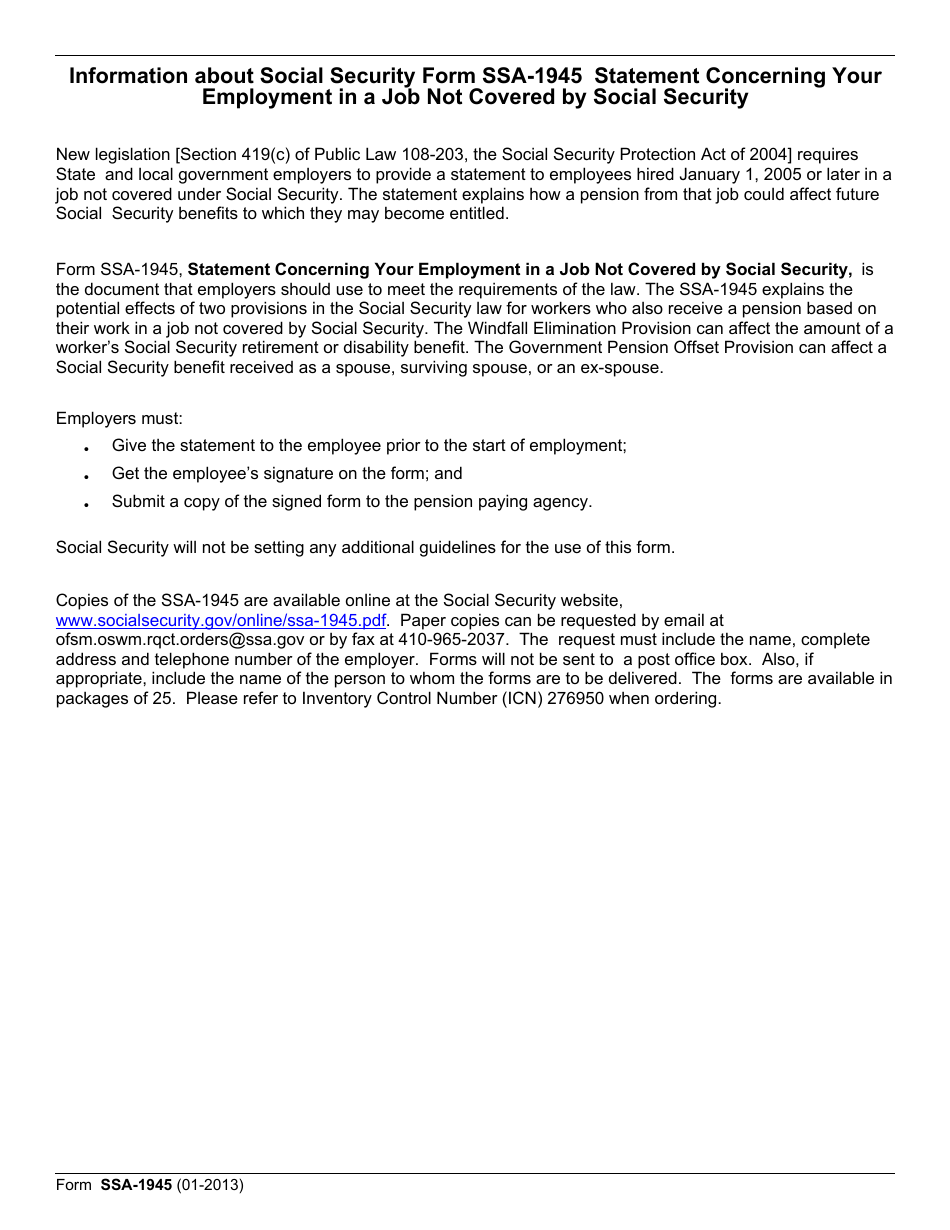

The form was issued by the U.S. Social Security Administration (SSA) on January 1, 2013 , with all previous editions obsolete. An SSA-1945 fillable form is available for download and digital filing below.

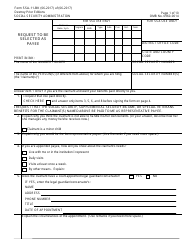

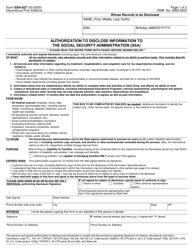

If you are an employer and need paper copies of the document, you can request them from the SSA by email or fax. Indicate your full name, address, and telephone number. You may also provide the name of the person these documents will be delivered to. The forms are sent in packages of 25. The documents will not be delivered to a post office box.

How to Use Form SSA-1945?

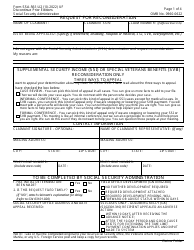

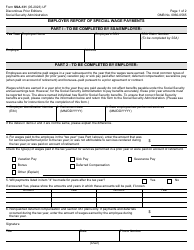

Employers are obliged to use the Social Security Form SSA-1945 to fulfill the requirements of U.S. law. The document states that the employee's earnings from this job are not covered under Social Security. Besides, it contains an explanation of provisions in the Social Security law for the employees who receive a pension based on a job not covered under Social Security. There are two such provisions:

- The "Windfall Elimination Provision."

- The "Government Pension Offset Provision."

The first one affects the calculations of your retirement or disability benefits. If your employer does not withhold from your salary Social Security taxes, any retirement or disability pension based on this job can reduce the amount of Social Security benefits you may be entitled to.

According to the second, if you are entitled to receive a federal, state, or local government pension based on the job you did not pay Social Security taxes for, any Social Security spouse or widow(er) benefits you become entitled will be offset. Thus, the amount of your Social Security payments will be reduced by two-thirds of the amount of your pension.

An SS employer has to provide you with an SSA-1945 for reading and signing, to make sure you are fully aware of the potential effect of these provisions on your future Social Security benefits. The document also contains examples of possible monthly reductions of the Social Security benefits, formulas, according to which you can calculate the potential reductions, and toll-free phone numbers you can call for any additional information.

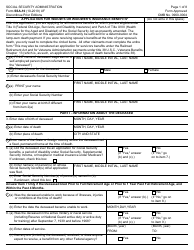

Form SSA-1945 Instructions

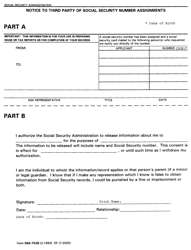

- The employer is obliged to provide you with Form SSA-1945 before your employment starts.

- You must read the form carefully. If something is unclear or you have further questions, contact the nearest SSA office or call the number provided on the form. The SSA officials can also inform you about exceptions to each provision.

- Print your name and ID at the top of the form.

- You may be required to print the name and ID of your employer too in some cases.

- Sign the form and provide the date in the applicable fields at the bottom of the page.

- Make a copy of the document for future references.

- Return the completed form to your employer.

The employer will submit a copy of the signed form to the pension paying agency.