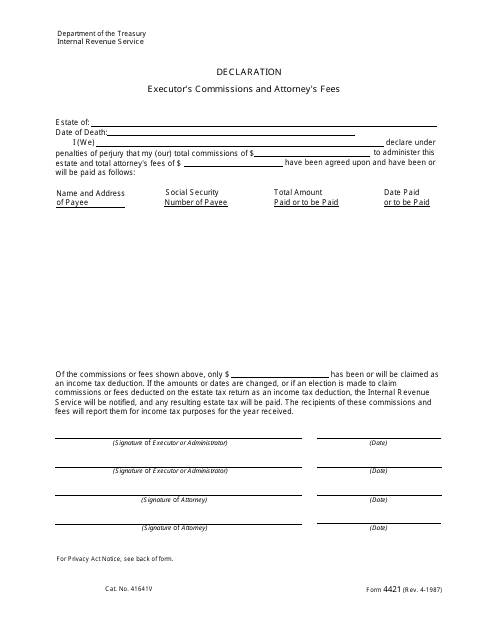

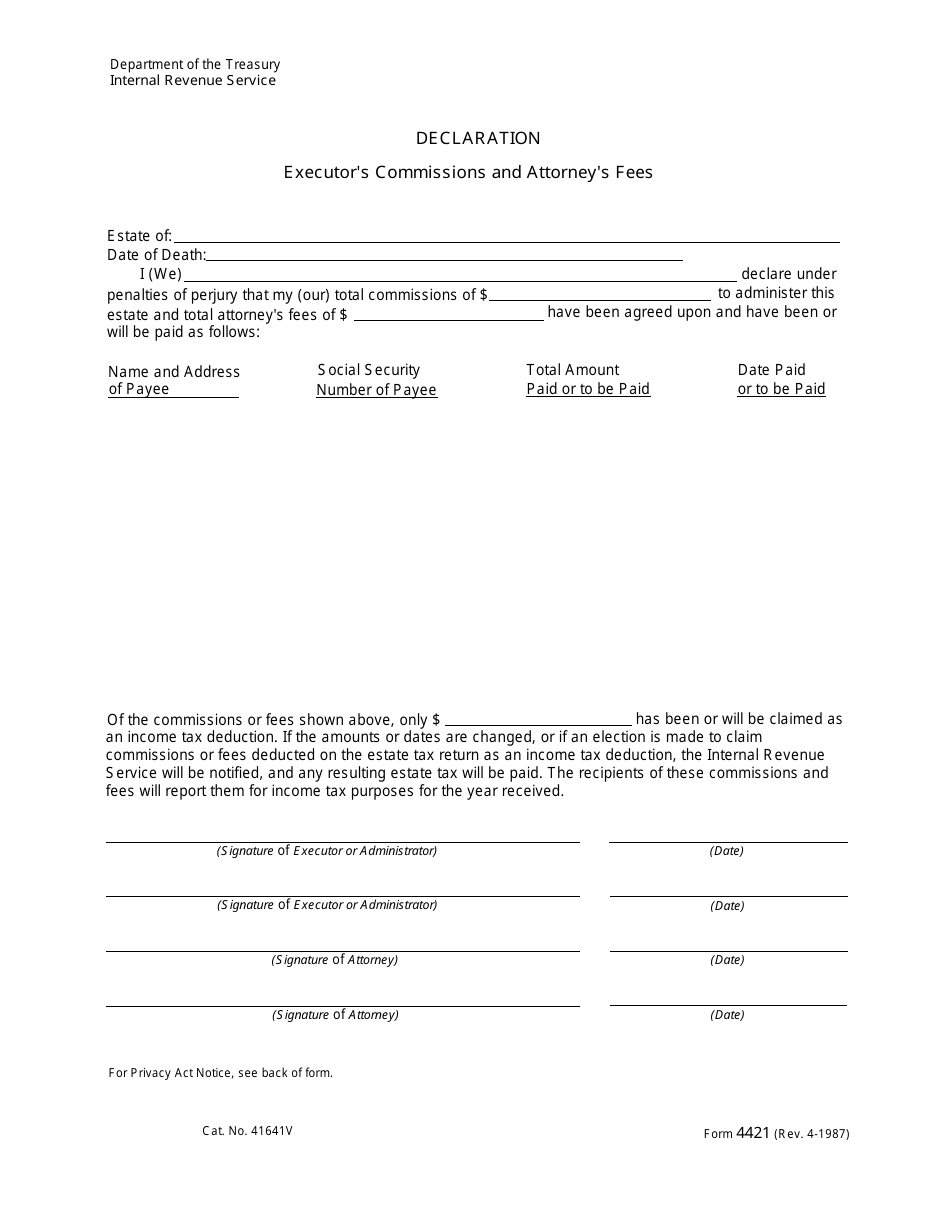

IRS Form 4421 Declaration - Executor's Commissioner's and Attorney's Fees

What Is Form 4421?

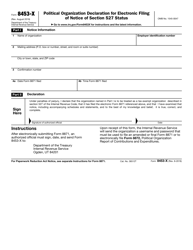

IRS Form 4421, Declaration - Executor's Commissions and Attorney's Fees , is a form that should be filled in by an executor and an attorney, hired to manage the probate estate of a deceased person. This service includes the identification of assets of the deceased, paying their debts from estate funds, filing an estate income tax return, and supporting the process of transferring ownership to legal beneficiaries. When completing Form 4421, an executor and an attorney should indicate their total commissions and fees for these services and confirm that they are obliged to report the indicated payment for the income tax purposes.

This form was released by the Department of the Treasury Internal Revenue Service and the latest version was issued in April 1987 . A Form 4421 fillable version is available for download below.

The instructions for filling in Form 4421 are the following:

- An applicant must indicate the deceased owner of the estate and provide the date of death of this person;

- A filer should enter their name. If an executor and an attorney are different persons, both their names must be specified. The total commissions of an executor and the total fees of the attorney should be indicated;

- Provide the name, address, and Social Security Number of a payee. Indicate the details of payment, such as its total amount and the date of the transaction. If these commissions and fees are due to payment, an applicant should provide the expected amount and estimated payment date;

- An applicant must enter the amount of income tax deduction of this payment;

- An executor and an attorney must sign the form and indicate the date of completion.

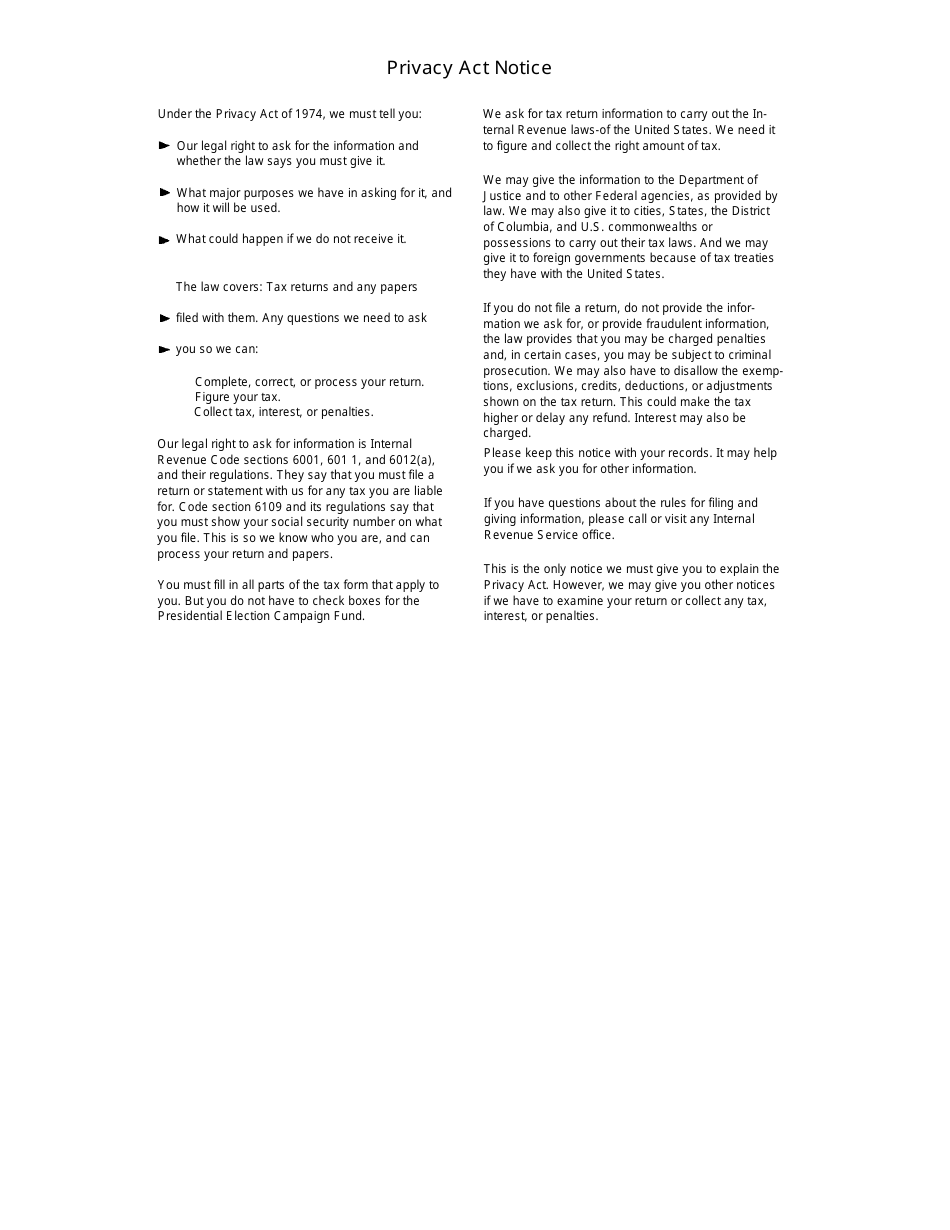

Section "Privacy Act Notice" that may be found under the form is informative and contains an explanation of the reasons for requesting this information, its usage, and the consequences of failure to provide it.