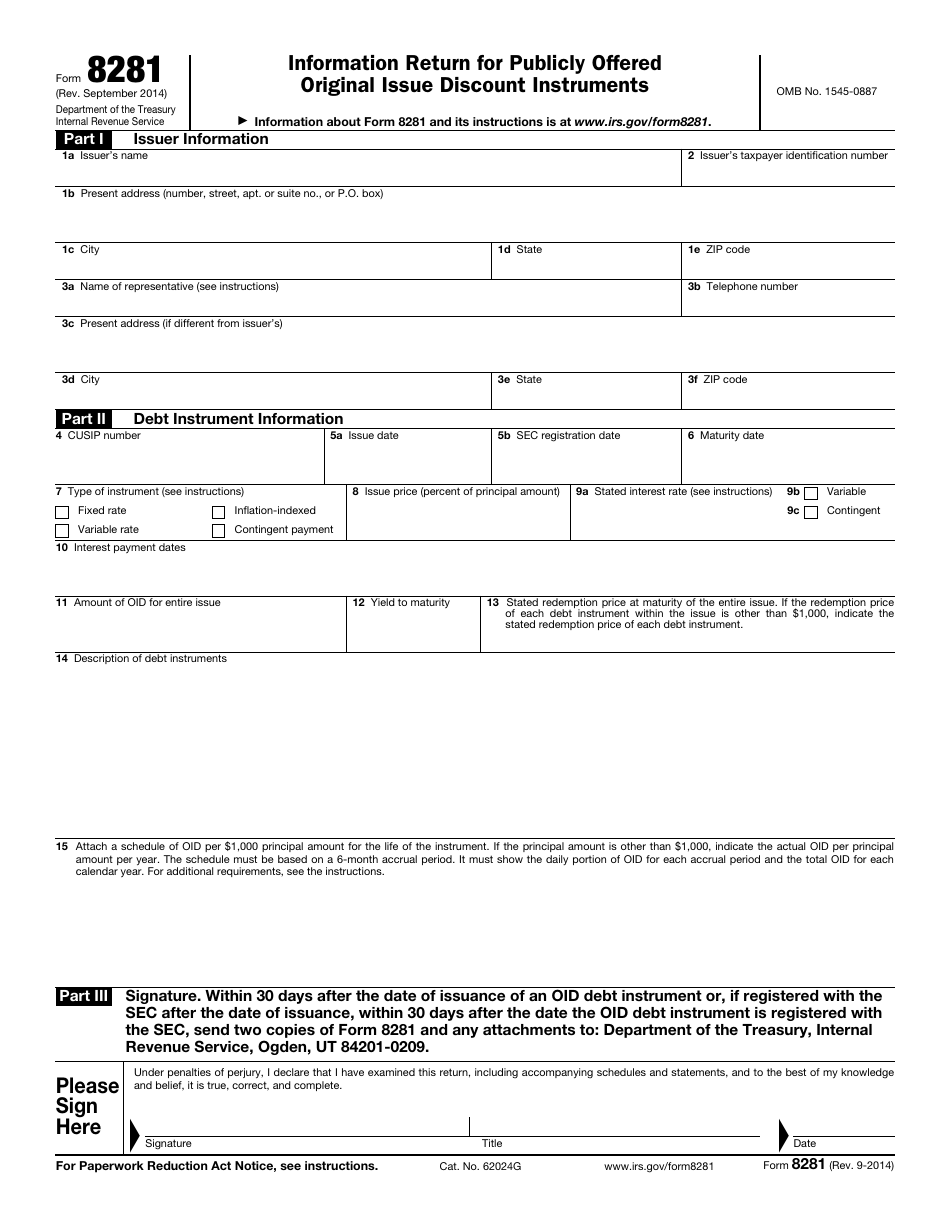

IRS Form 8281 Information Return for Publicly Offered Original Issue Discount Instruments

What Is IRS Form 8281?

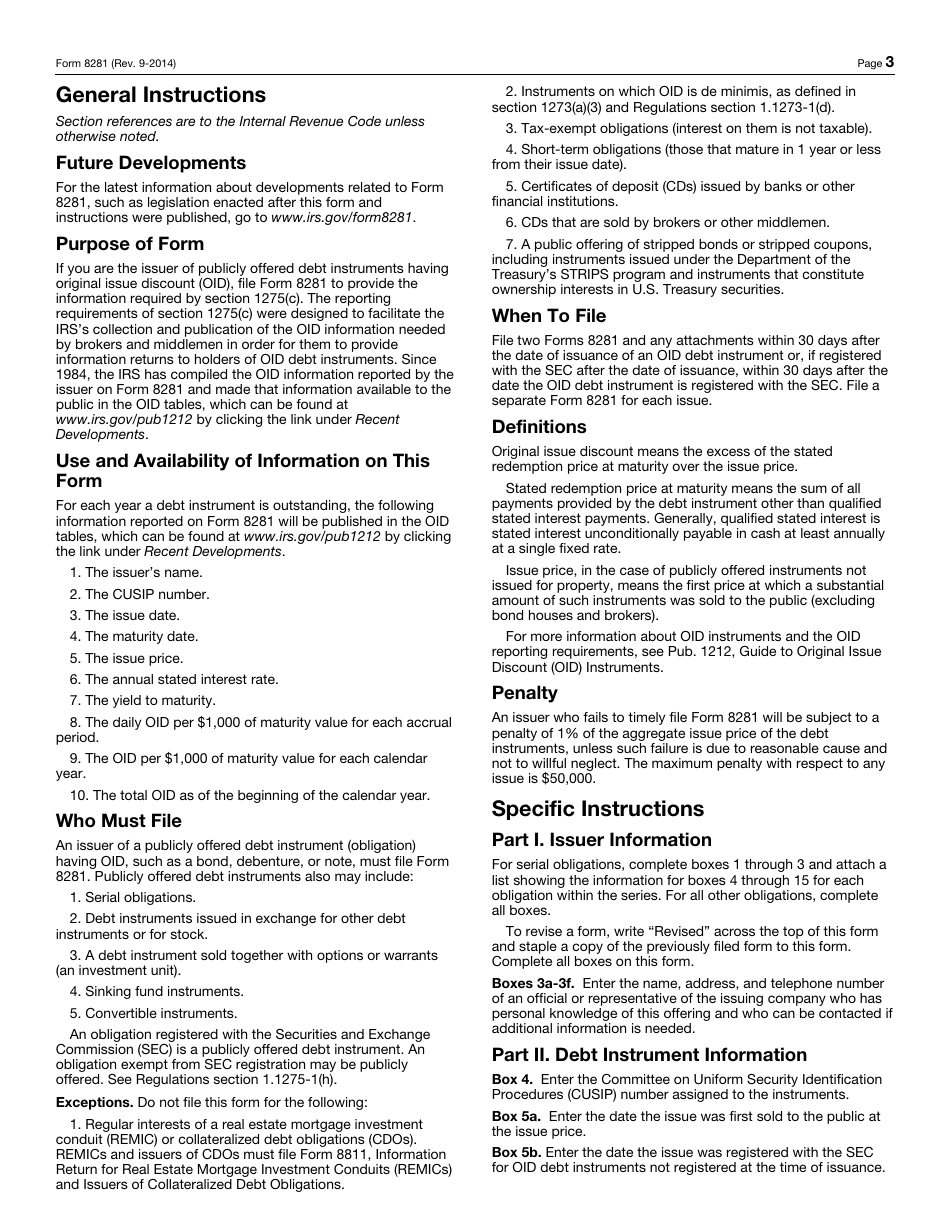

IRS Form 8281, Information Return for Publicly Offered Original Issue Discount Instruments , is a written instrument filled out and filed by the taxpayers that issued publicly offered debt instruments with an original issue discount. The tax authorities need to receive this form within a month after every debt instrument is issued or registered with the Securities and Exchange Commission - the return covers bonds, debentures, notes, and instruments that were created to be exchanged with other instruments or stock.

This document was released by the Internal Revenue Service (IRS) on September 1, 2014 - older versions of the form are now obsolete. You may download an IRS Form 8281 fillable version via the link below.

To complete the paperwork correctly, you need to add your personal details and contact information and describe every debt instrument separately. It is necessary to indicate the number assigned to the debt instrument in question by the Committee on Uniform Security Identification Procedures, specify when it was issued and registered as well as enter the maturity date of the instrument.

Make sure the statement clarifies the type of the instrument, the price of the issue, the interest rate, the dates when the interest payment is supposed to be made, and the description of the debt instrument. Attach a schedule of the original issue discount for every $1.000 of the principal amount. Certify Form 8281 by confirming the details you put in writing are true and accurate to the best of your knowledge, record your title, sign and date the instrument.