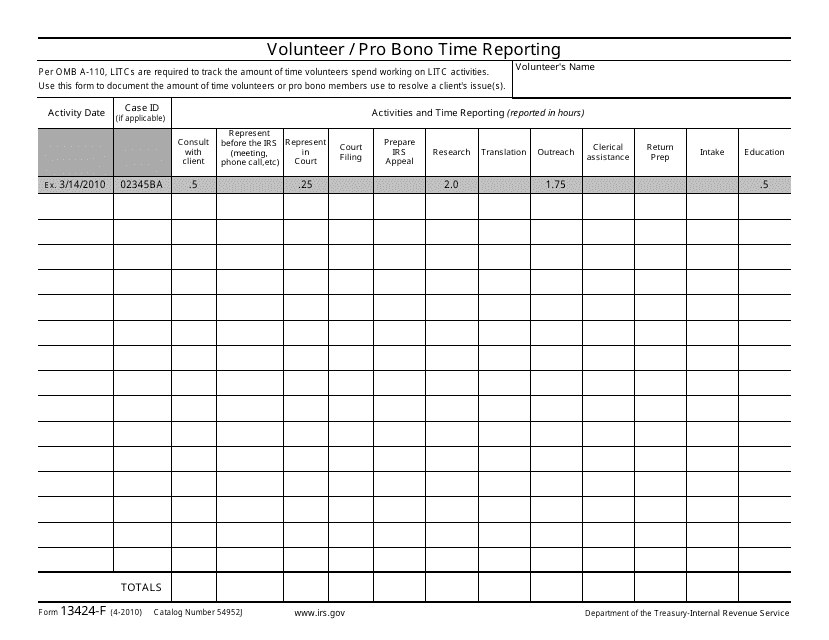

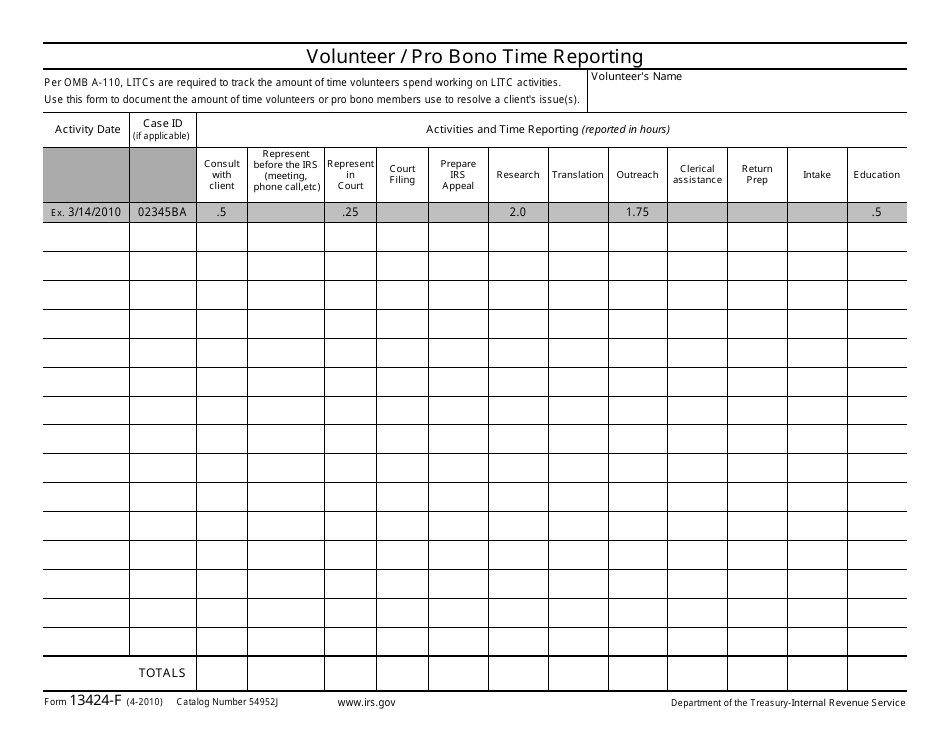

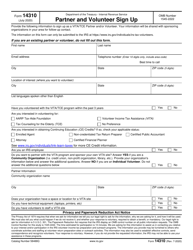

IRS Form 13424-F Volunteer / Pro Bono Time Reporting

What Is IRS Form 13424-F?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on April 1, 2010. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is Form 13424-F?

A: Form 13424-F is a Volunteer/Pro Bono Time Reporting form used by volunteers to report their volunteer or pro bono service time.

Q: Who needs to fill out Form 13424-F?

A: Volunteers or individuals who have provided volunteer or pro bono services and want to report their time need to fill out Form 13424-F.

Q: Why is it important to report volunteer or pro bono time?

A: Reporting volunteer or pro bono time is important to track and document the valuable service provided by volunteers for tax purposes and other official records.

Q: What information is required on Form 13424-F?

A: Form 13424-F requires information such as the volunteer's name, contact information, the organization or program served, the type of service provided, and the number of hours volunteered.

Q: When is the deadline for submitting Form 13424-F?

A: The deadline for submitting Form 13424-F may vary depending on the IRS guidelines or the specific program or organization the volunteer is associated with. It is important to check the applicable deadlines.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 13424-F through the link below or browse more documents in our library of IRS Forms.