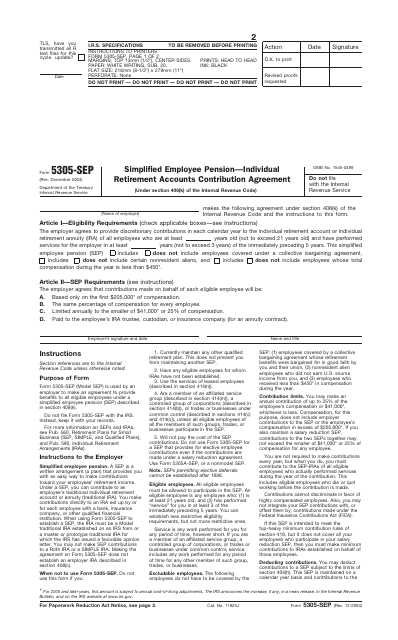

IRS Form 5305-SEP Simplified Employee Pension - Individual Retirement Accounts Contribution Agreement

What Is IRS Form 5305-SEP?

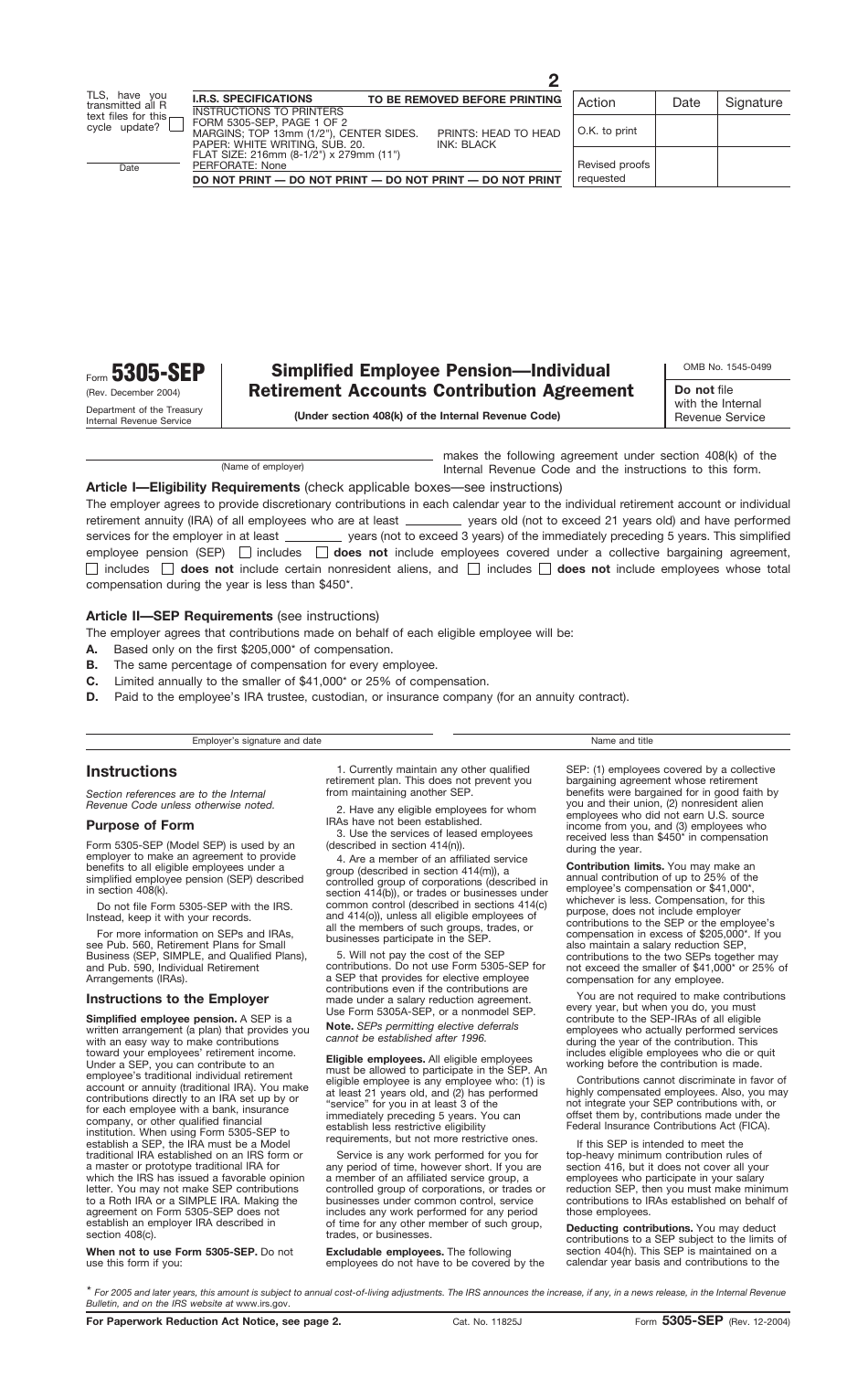

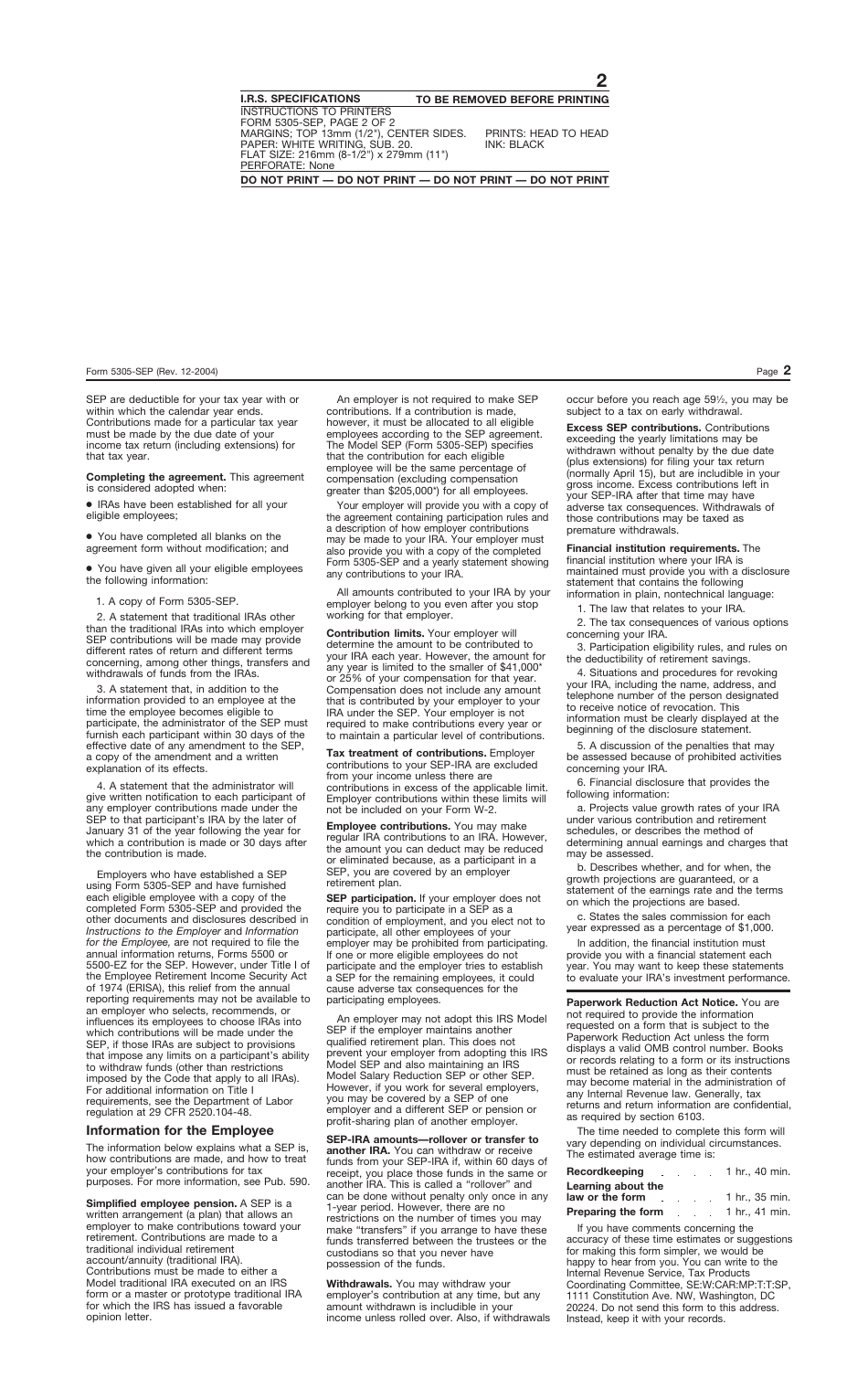

IRS Form 5305-SEP, Simplified Employee Pension - Individual Retirement Accounts Contribution Agreement , is a formal agreement signed by an employer to arrange a simplified employee pension.

Alternate Name:

- Tax Form 5305-SEP.

If you have employees who are eligible to participate in this program, offer them to contribute towards their retirement in this manner - this is a great choice for small companies that can take advantage of the simplified employee pension as a means to increase retirement savings of people that work for them for at least for three years.

This document was issued by the Internal Revenue Service (IRS) on December 1, 2004 , with all previous editions obsolete. An IRS Form 5305-SEP fillable version is available for download below.

Fill out a few empty lines the employer must complete - write down the employer's name, confirm you agree to take part in an alternative method to contribute to retirement accounts, list eligibility criteria the employees of your business meet (you need to specify the minimum age of employees that qualify for the pension as well as the duration of their employment), and elaborate whether the proposed arrangement applies to employees that signed the collective bargaining agreement, nonresident aliens, and individuals that earn less than $450 per year.

Certify your preparedness to make contributions on behalf of employees within the limits indicated in the form, include your name, title, and date, and sign the papers. Keep a copy of the document in your records - there is no obligation to file it with the IRS.