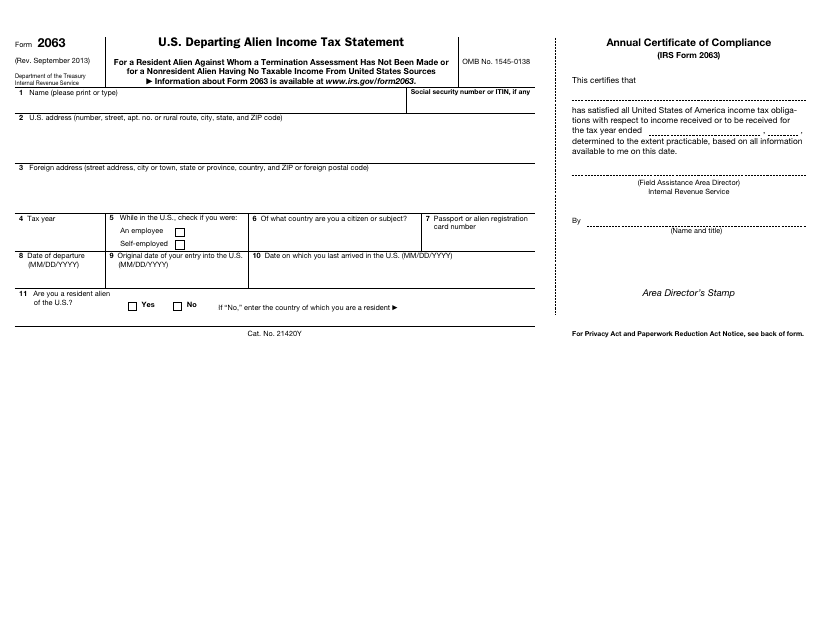

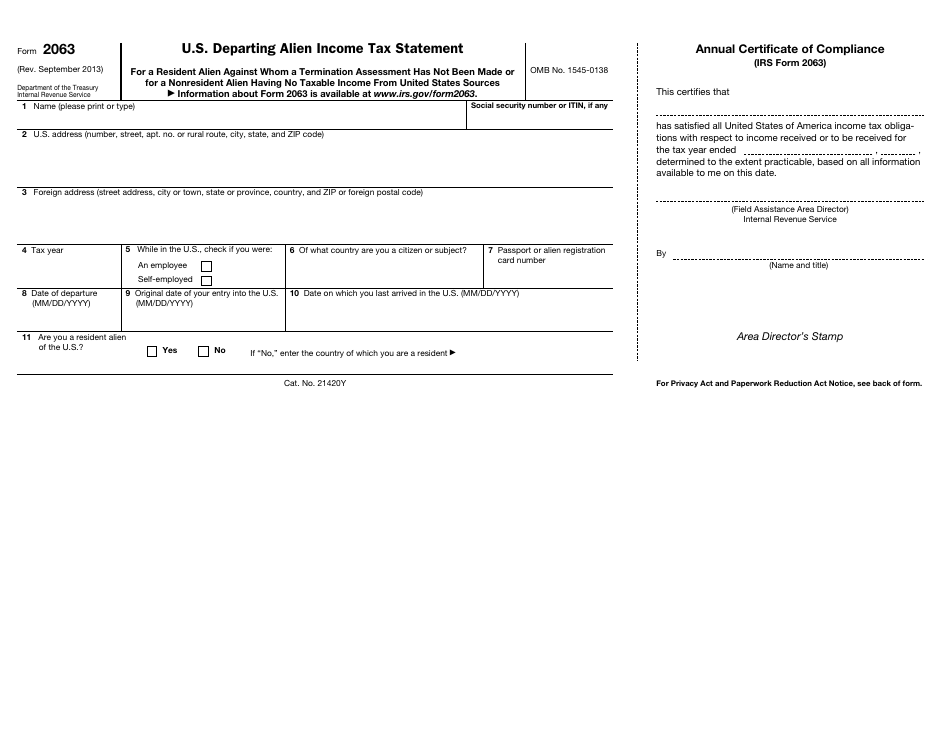

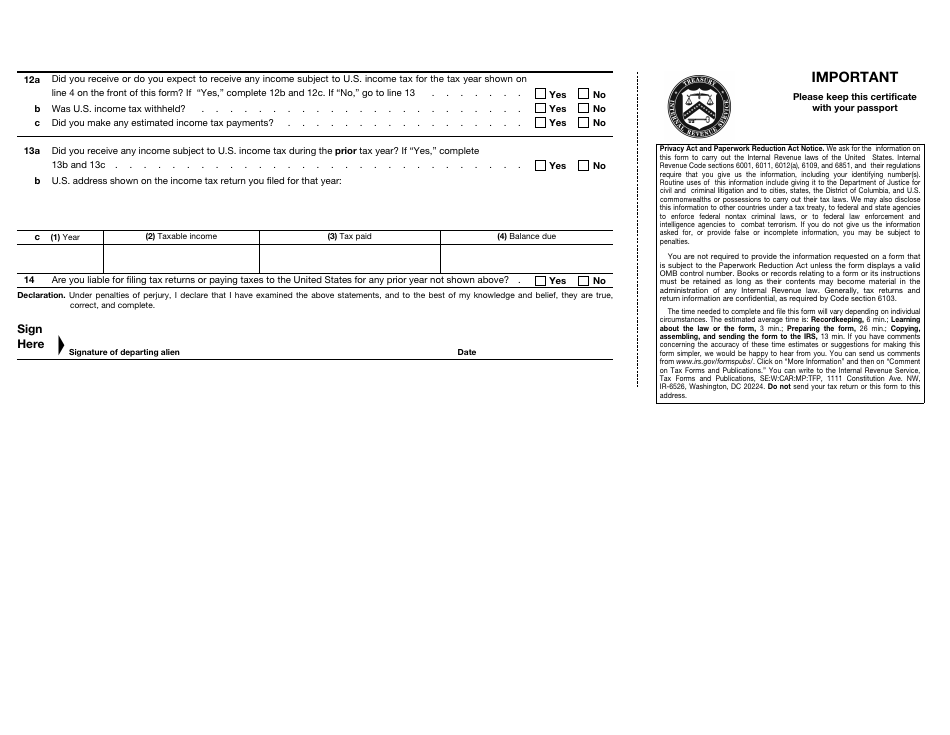

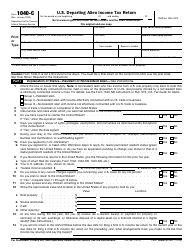

IRS Form 2063 U.S. Departing Alien Income Tax Statement

What Is IRS Form 2063?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on September 1, 2013. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 2063?

A: IRS Form 2063 is the U.S. Departing Alien Income Tax Statement.

Q: Who is required to file IRS Form 2063?

A: Departing aliens who have taxable income in the United States are required to file IRS Form 2063.

Q: When should IRS Form 2063 be filed?

A: IRS Form 2063 should be filed at least 2 weeks before leaving the United States.

Q: What information is required on IRS Form 2063?

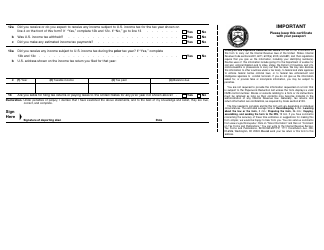

A: IRS Form 2063 requires information about the departing alien's income, deductions, and tax liability.

Q: What happens after filing IRS Form 2063?

A: After filing IRS Form 2063, the departing alien will receive a certificate of compliance or a notice of proposed denial.

Q: Can I e-file IRS Form 2063?

A: No, IRS Form 2063 cannot be e-filed. It must be mailed to the IRS.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 2063 through the link below or browse more documents in our library of IRS Forms.