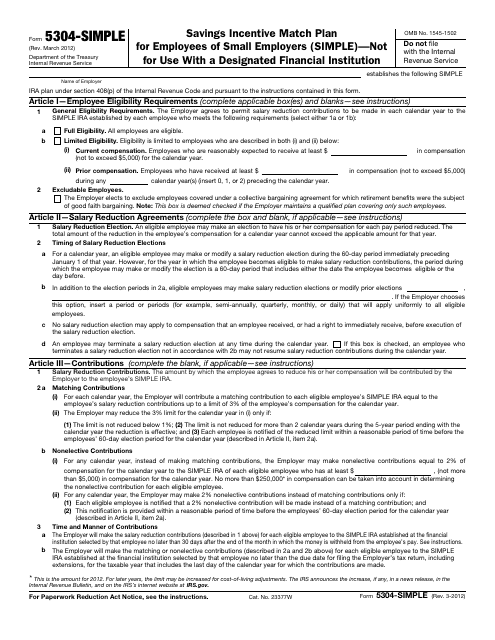

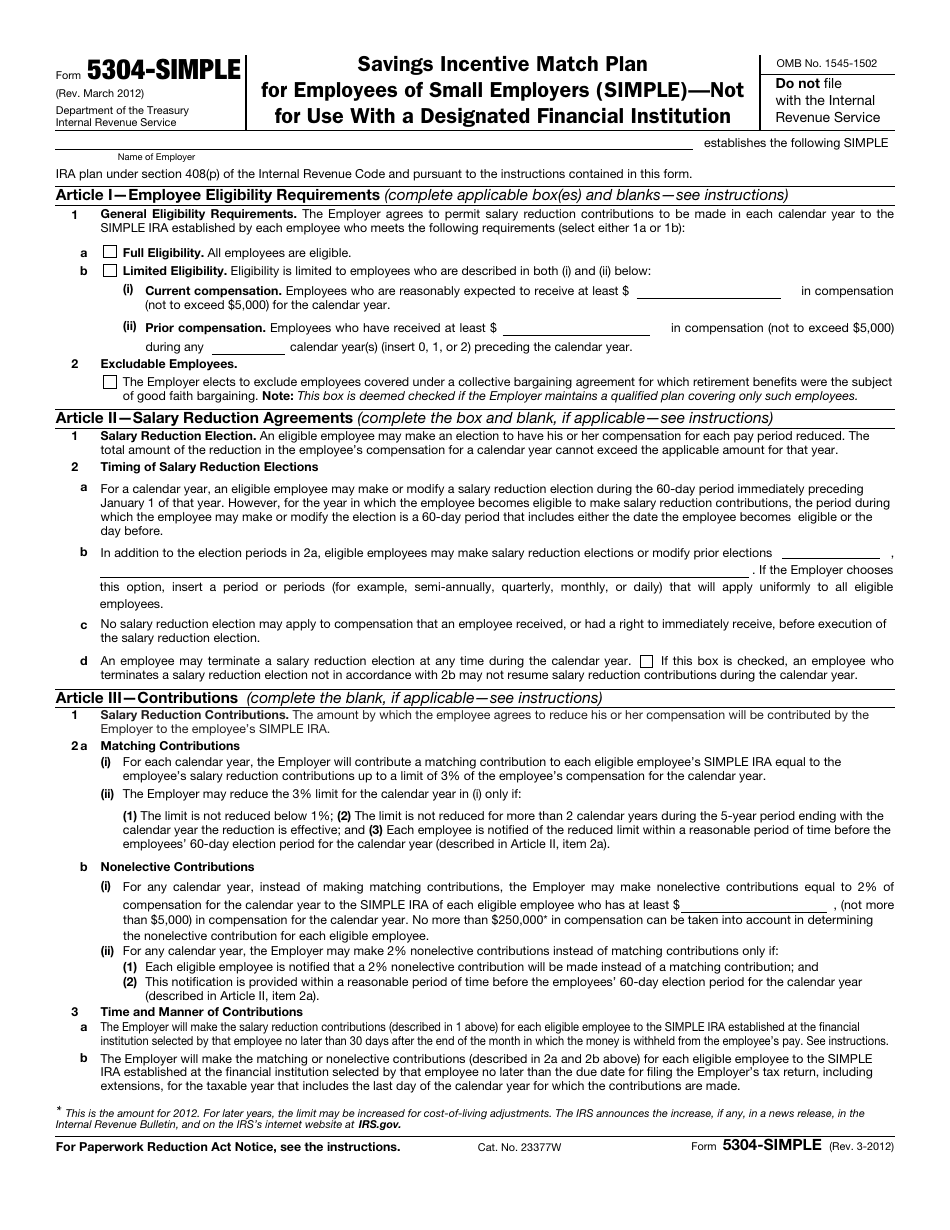

IRS Form 5304-SIMPLE Savings Incentive Match Plan for Employees of Small Employers (Simple) - Not for Use With a Designated Financial Institution

What Is IRS Form 5304-SIMPLE?

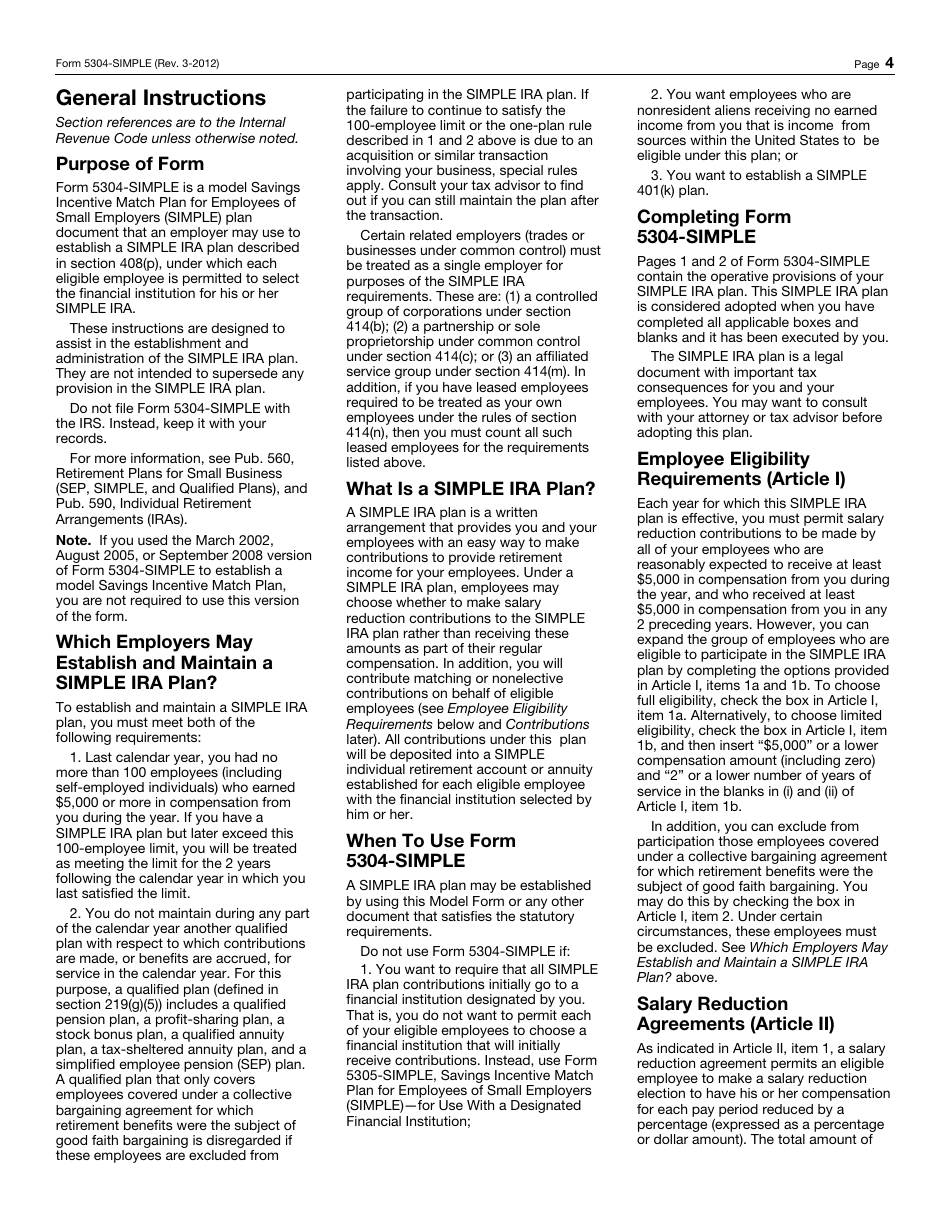

IRS Form 5304-SIMPLE, Savings Incentive Match Plan for Employees of Small Employers (Simple) - Not for Use With a Designated Financial Institution , is a fiscal document that outlines the details of a retirement plan established with the agreement of the company and its employees. SIMPLE individual retirement arrangements will become an important income source upon retirement if employees and employers agree to save money in retirement accounts.

Small businesses with a hundred employees and fewer may fill out this instrument that will provide benefits to all employees that are eligible - moreover, this tool will permit every participant to choose a financial institution that will let them receive their retirement plan contributions.

This document was issued by the Internal Revenue Service (IRS) on March 1, 2012 , making older editions of the form obsolete. Download an IRS Form 5304-SIMPLE fillable version through the link below.

How to Fill Out Form 5304-SIMPLE?

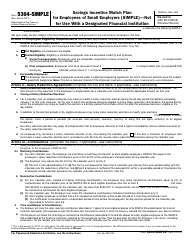

Follow these Form 5304-SIMPLE instructions to agree upon salary reductions and contributions to a more advantageous retirement plan:

-

Indicate the name of the employer and specify how many employees are eligible to participate in the retirement planning in question - check the box to state whether all employees are eligible or only some of them are . The eligibility can be defined by the current or prior compensation; you are also obliged to exclude certain employees if they are covered by a collective bargaining agreement.

-

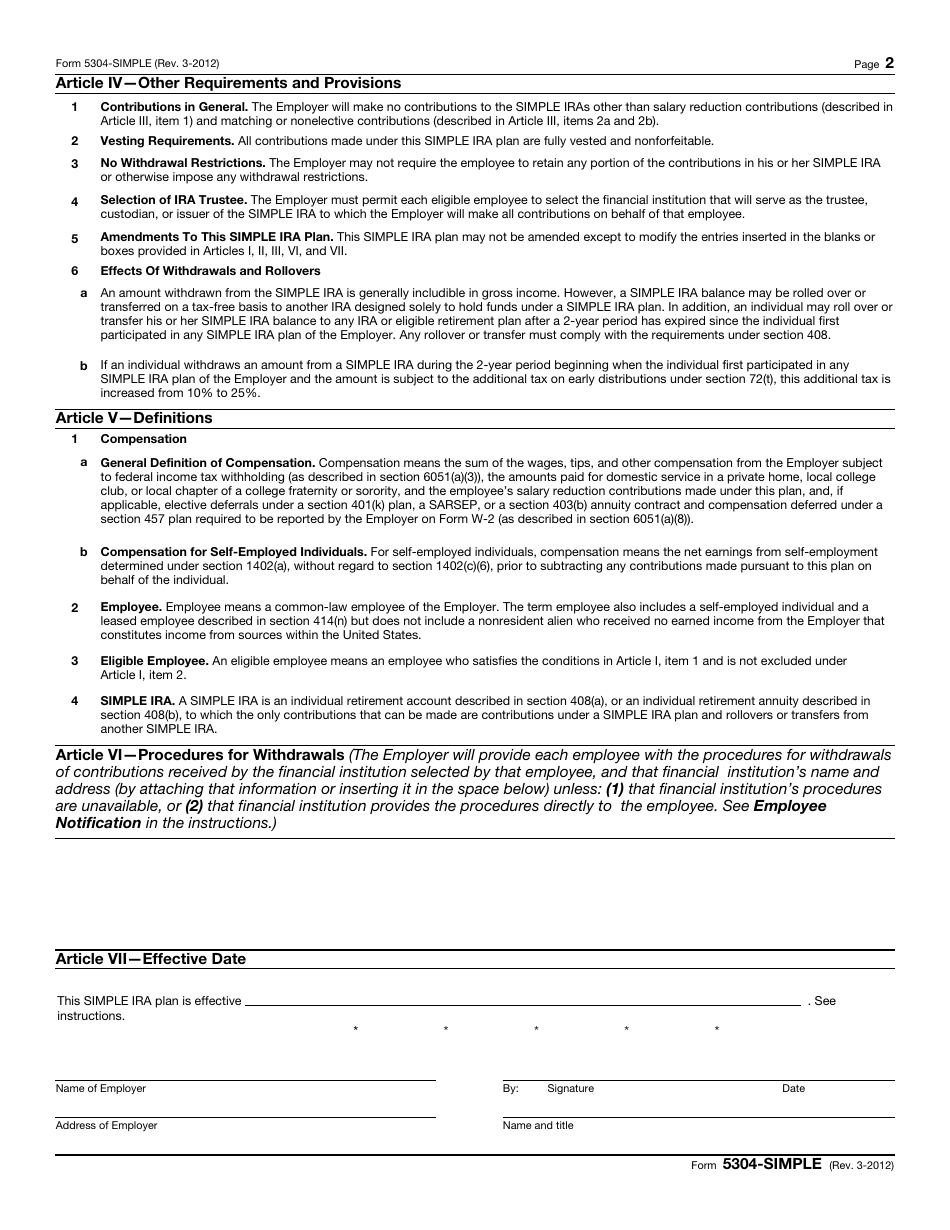

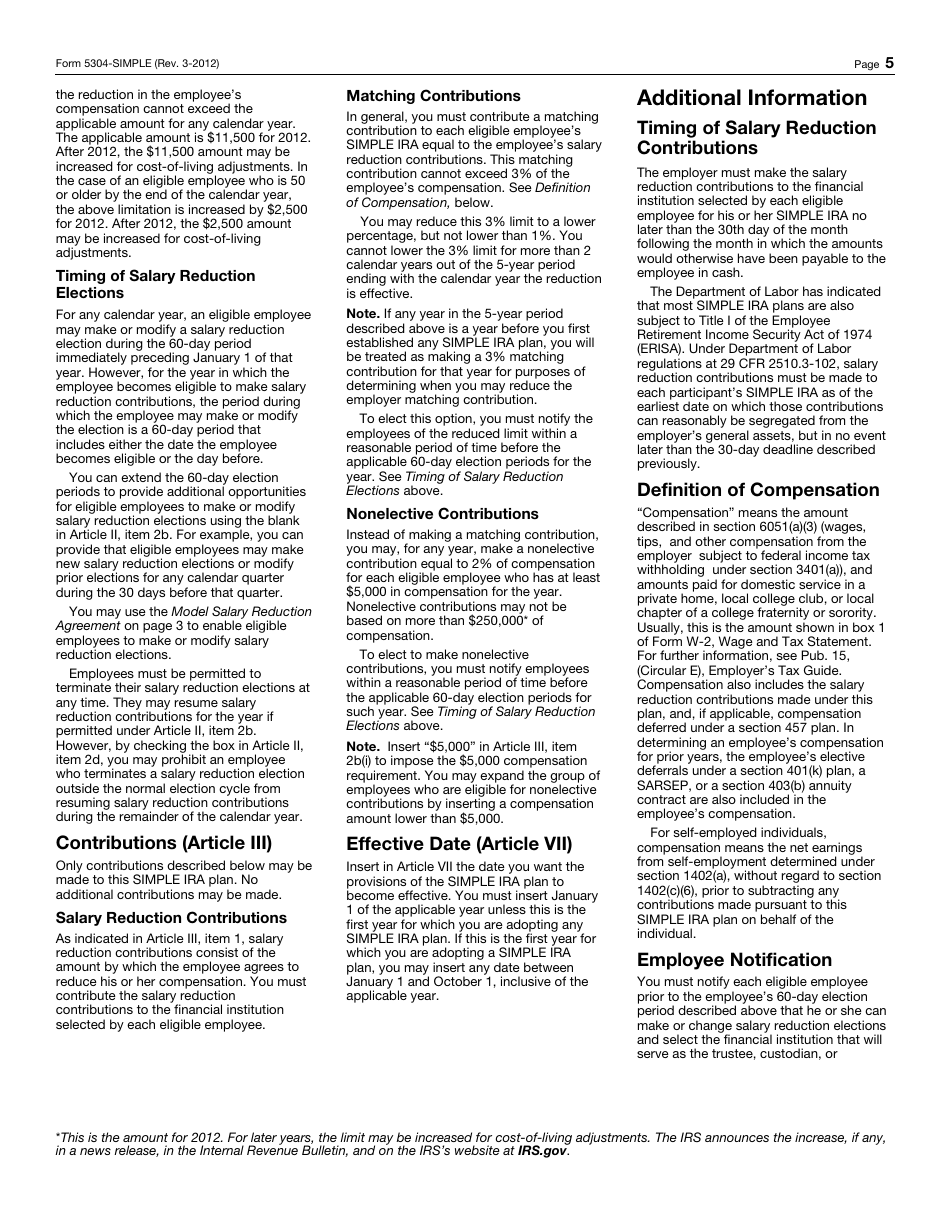

Review the terms of the salary reduction agreement that will apply to eligible employees . It is possible to opt for a reduction or make modifications to a prior election. Check the box in case any employee is given an opportunity to terminate the election in question at any time they like. Learn more about contributions to the plan and set a threshold for the compensation received by eligible employees.

-

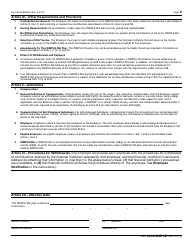

Read the provisions of the plan that list the requirements all participants need to be aware of - it is essential to figure out how you can withdraw from the plan, what kind of compensation self-employed people can count on, and what contributions will be allowed under the current regulations . Once these guidelines are understood, the employer needs to certify the document - state the date the plan become effective, write down your name and correspondence address, specify the title, and sign and date Form 5304-SIMPLE.

-

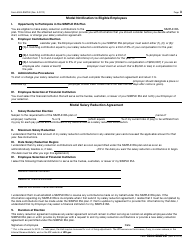

Prepare a formal notice for your employees - summarize the specifics of the retirement plan and ask every person working for you to sign the paperwork in order to confirm their participation in the agreement . All individuals get to choose when salary reduction contributions will start to apply as well as the percentage of their salary that will be contributed to the plan. Additionally, all employees get to select a financial institution that will be the issuer, custodian, or trustee of their savings plan - record the name and number of the account opened in a bank or similar financial entity.