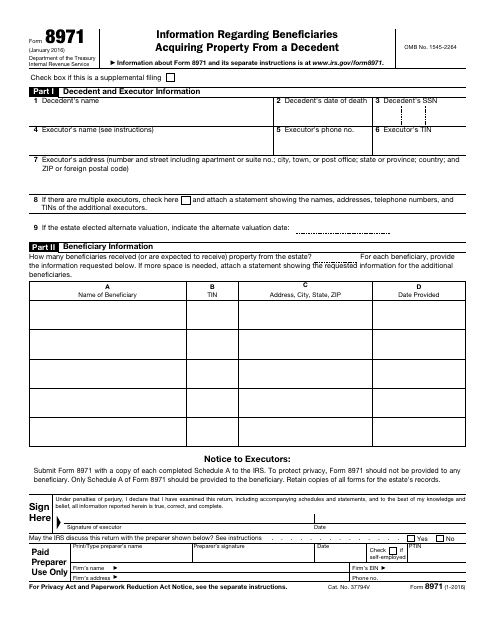

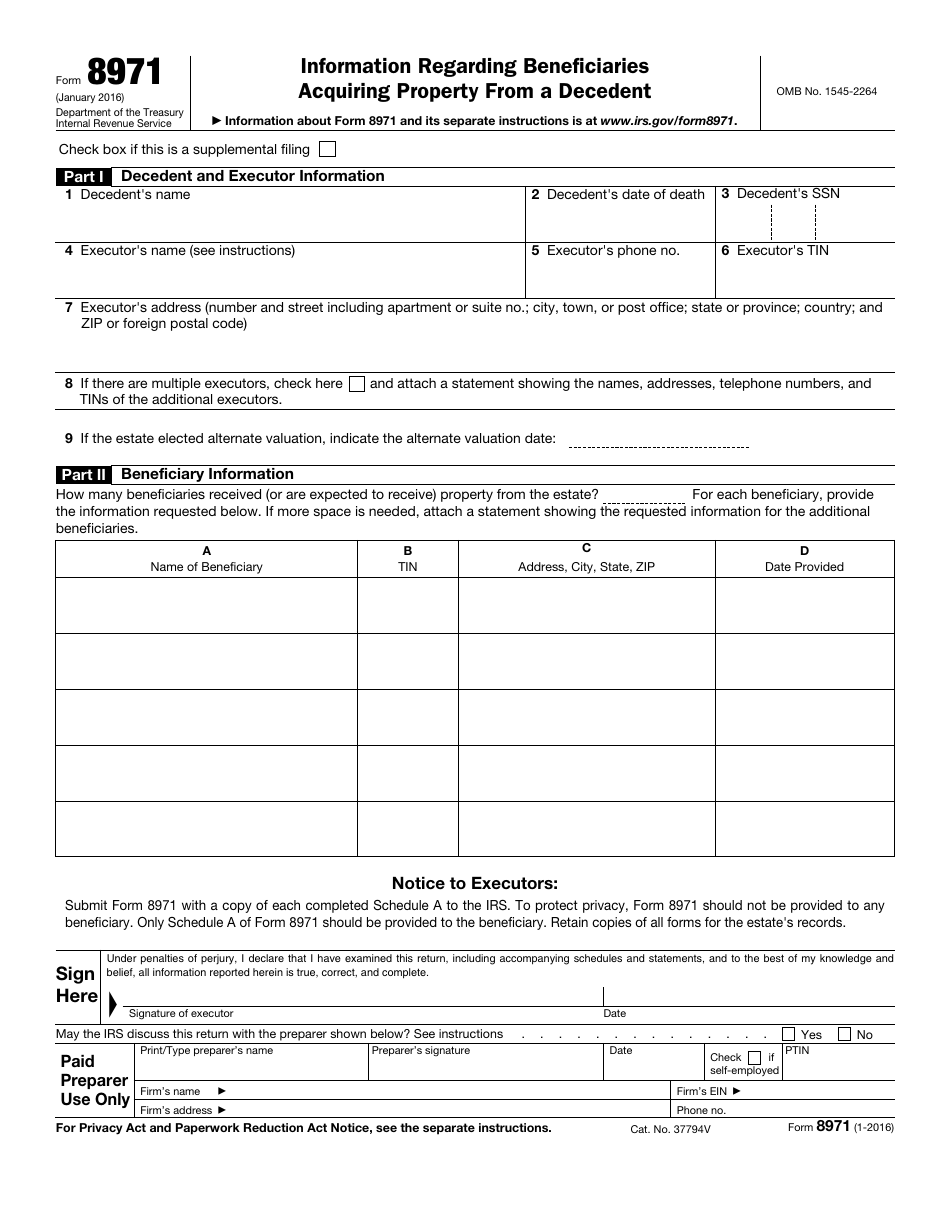

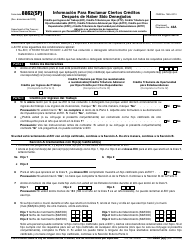

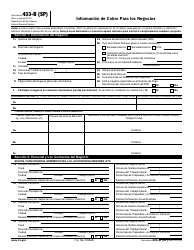

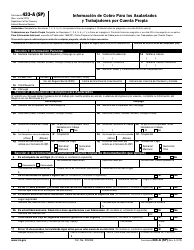

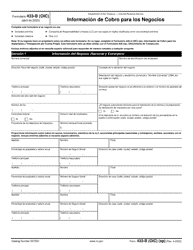

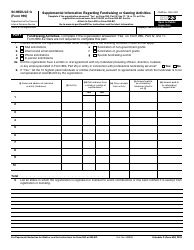

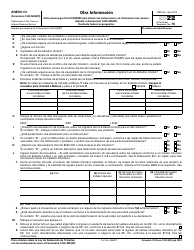

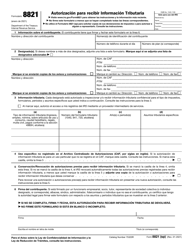

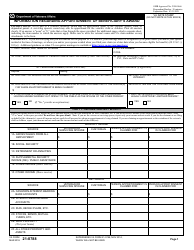

IRS Form 8971 Information Regarding Beneficiaries Acquiring Property From a Decedent

What Is IRS Form 8971?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on January 1, 2016. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8971?

A: IRS Form 8971 is a form used to report information about property acquired by beneficiaries from a deceased person's estate.

Q: Who needs to file IRS Form 8971?

A: The executor or administrator of the estate is responsible for filing IRS Form 8971.

Q: When is IRS Form 8971 due?

A: IRS Form 8971 is generally due within 30 days after the date of final distribution of the estate's assets.

Q: What information is reported on IRS Form 8971?

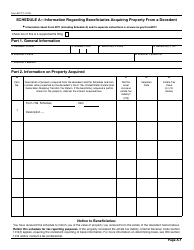

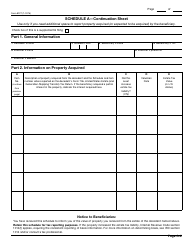

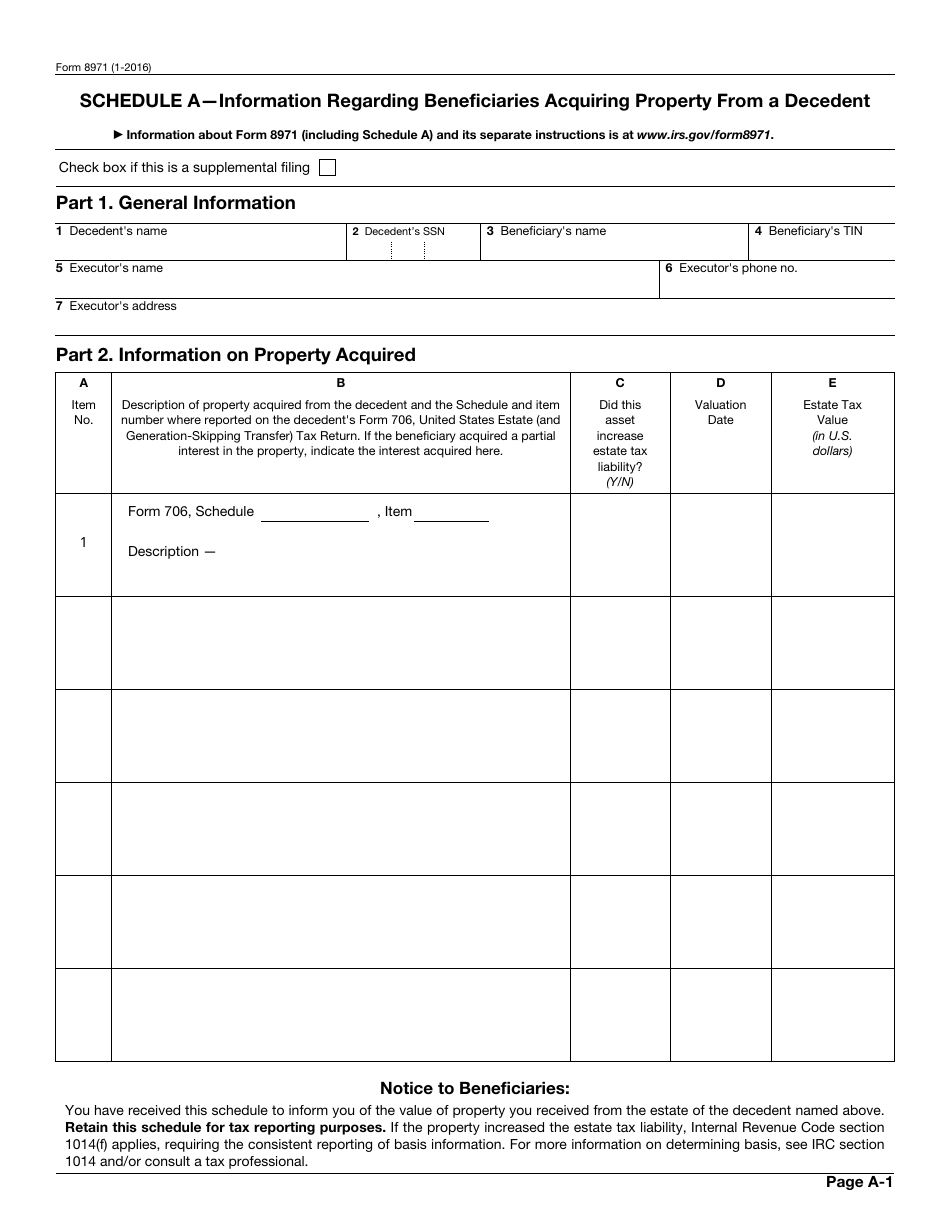

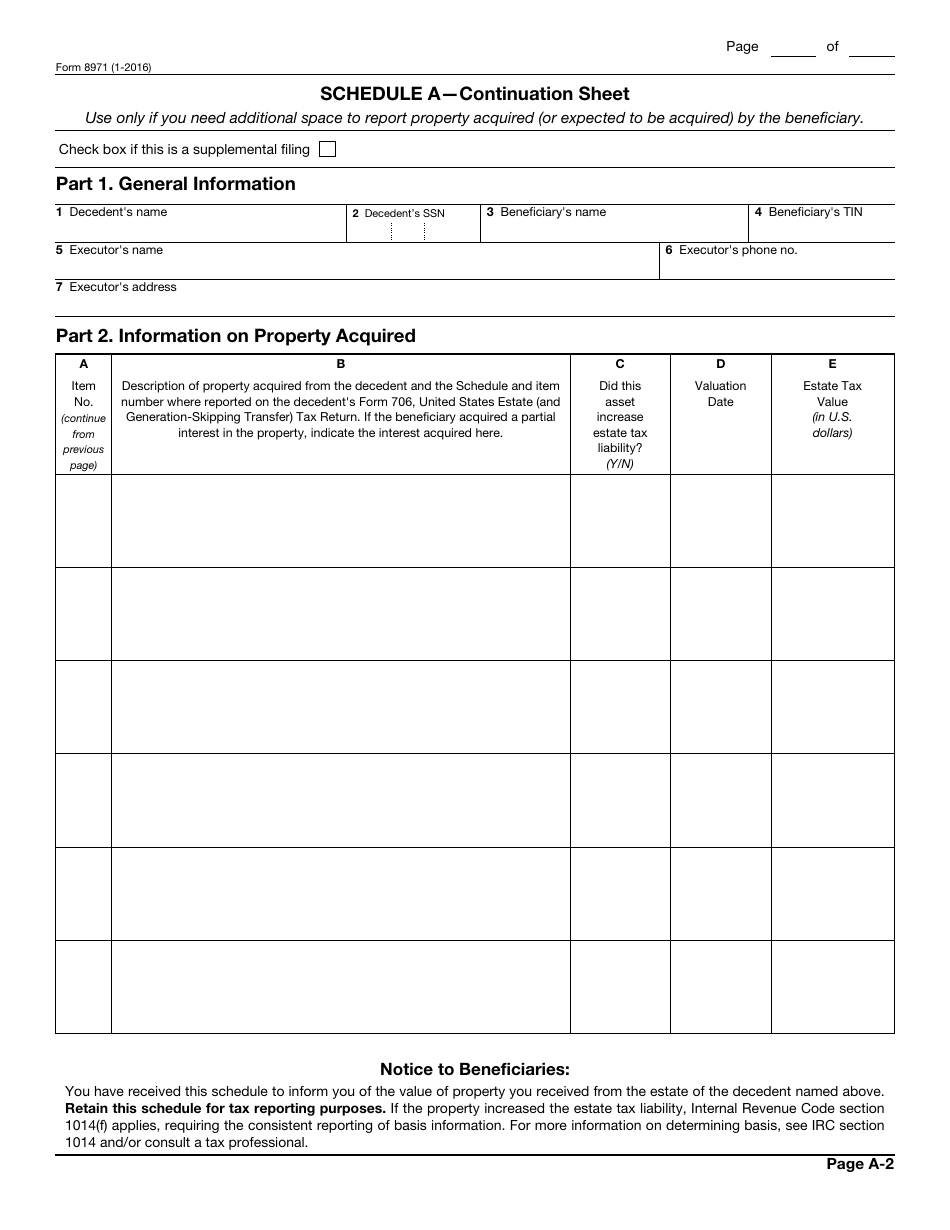

A: IRS Form 8971 reports information such as the identity of the beneficiaries, the value of property acquired, and the basis of the property.

Q: Why is IRS Form 8971 important?

A: IRS Form 8971 helps the IRS track the basis of property acquired by beneficiaries and ensures accurate reporting of capital gains or losses when the property is later sold.

Q: Are there any penalties for not filing IRS Form 8971?

A: Yes, failure to file IRS Form 8971 or filing an incomplete or incorrect form may result in penalties imposed by the IRS.

Form Details:

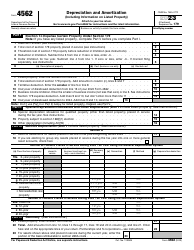

- A 4-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8971 through the link below or browse more documents in our library of IRS Forms.