IRS Form 851 Affiliations Schedule

What Is Form 851?

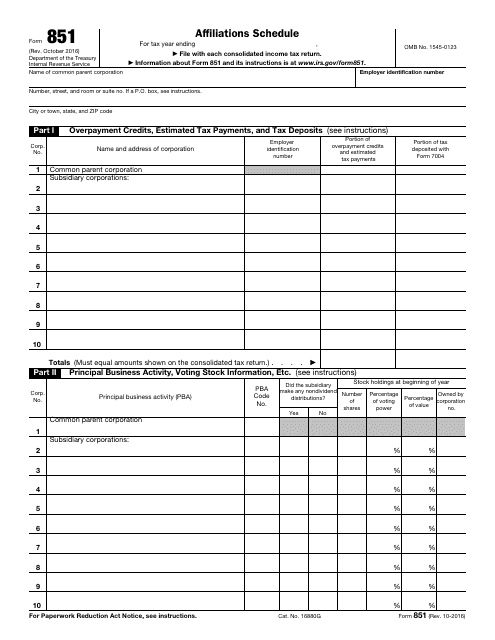

IRS Form 851, Affiliations Schedule , is a form that a parent corporation of an affiliated group should submit in addition to its consolidated income tax return.

Alternate Name:

- Affiliations Schedule Form.

The purpose of submitting Form 851 is to report information about overpayment credits, estimated tax payments, and tax deposits, related to a common parent corporation and their subsidiary corporations. An 851 Form allows the identification of a common parent corporation and each subsidiary corporation and to define that each one of them can be qualified as a member of the affiliated group.

This form was released by the Department of the Treasury Internal Revenue Service and the latest version was issued on October 1, 2016 . A fillable 851 Form is available for download below.

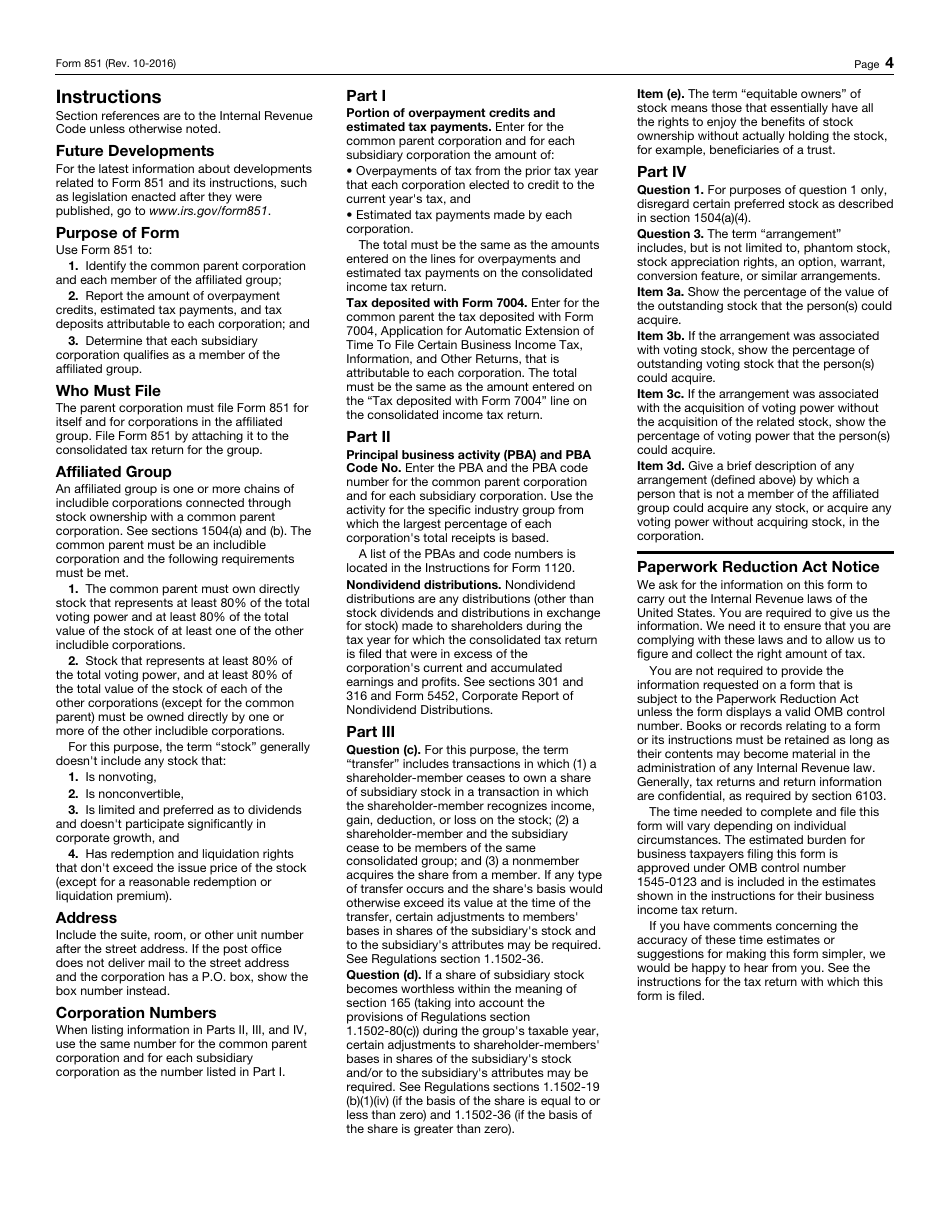

IRS Form 851 Instructions

The instructions for filling in an Affiliations Schedule Form are the following:

An applicant has to indicate the tax year, enter the name of the common parent corporation, its Employer identification number, and address.

-

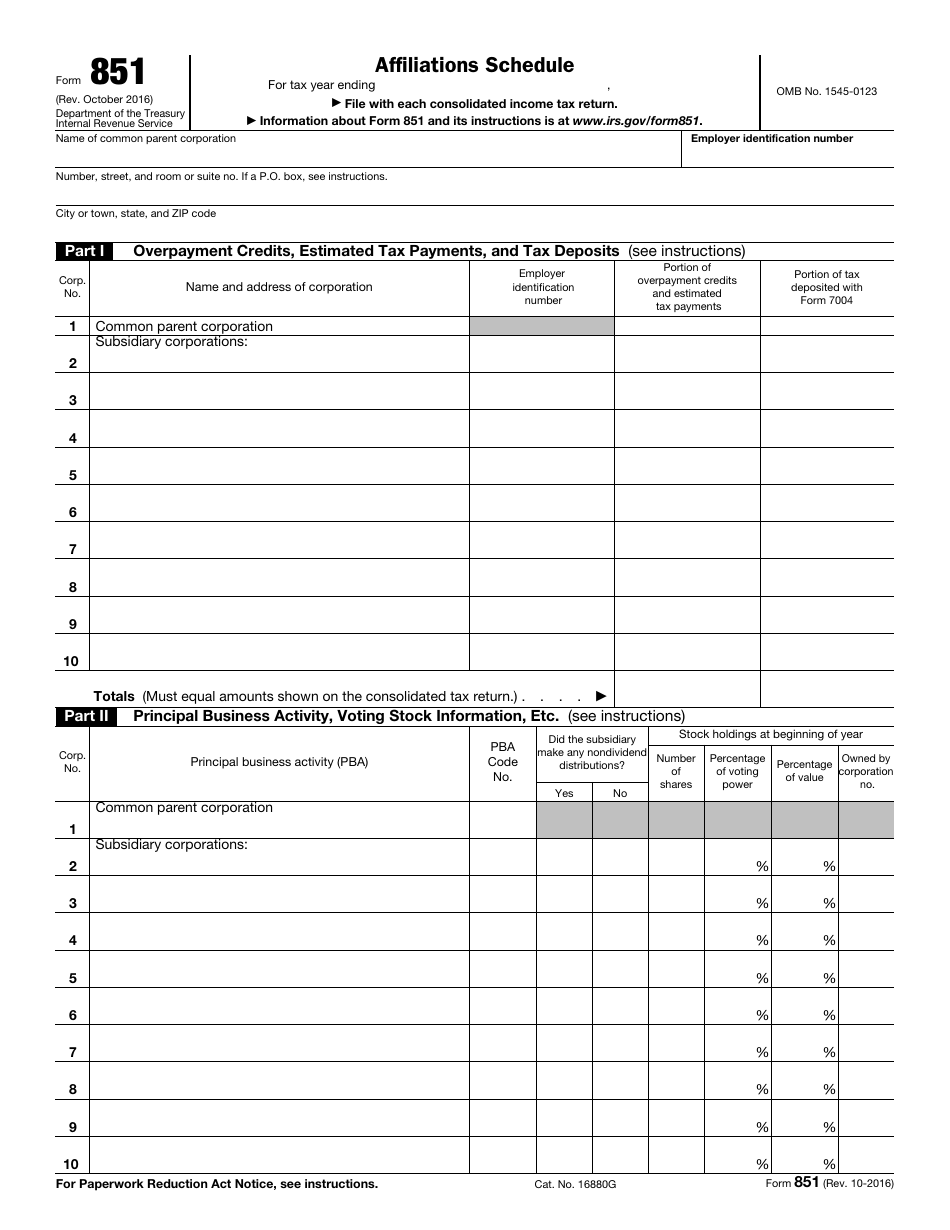

Part I . A filer should enter the Employer Identification Number of each entity. Provide names and addresses of subsidiary corporations. Indicate the amount of overpayment credits and estimated tax payments for every organization separately and its total amount. Provide the amount of the tax deposited with IRS Form 7004, Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns, related to every corporation and its total amount as well. Form 7004 is used by applicants to extend the filing period for a specific business income tax. The total amounts, provided in this part, must fit the corresponding amounts indicated on the consolidated income tax return.

-

Part II . A filer should indicate the Principal Business Activity (PBA) and its code number for each corporation. Provide information regarding making any non-dividend distributions and stock holdings of these corporations at the beginning of the year.

-

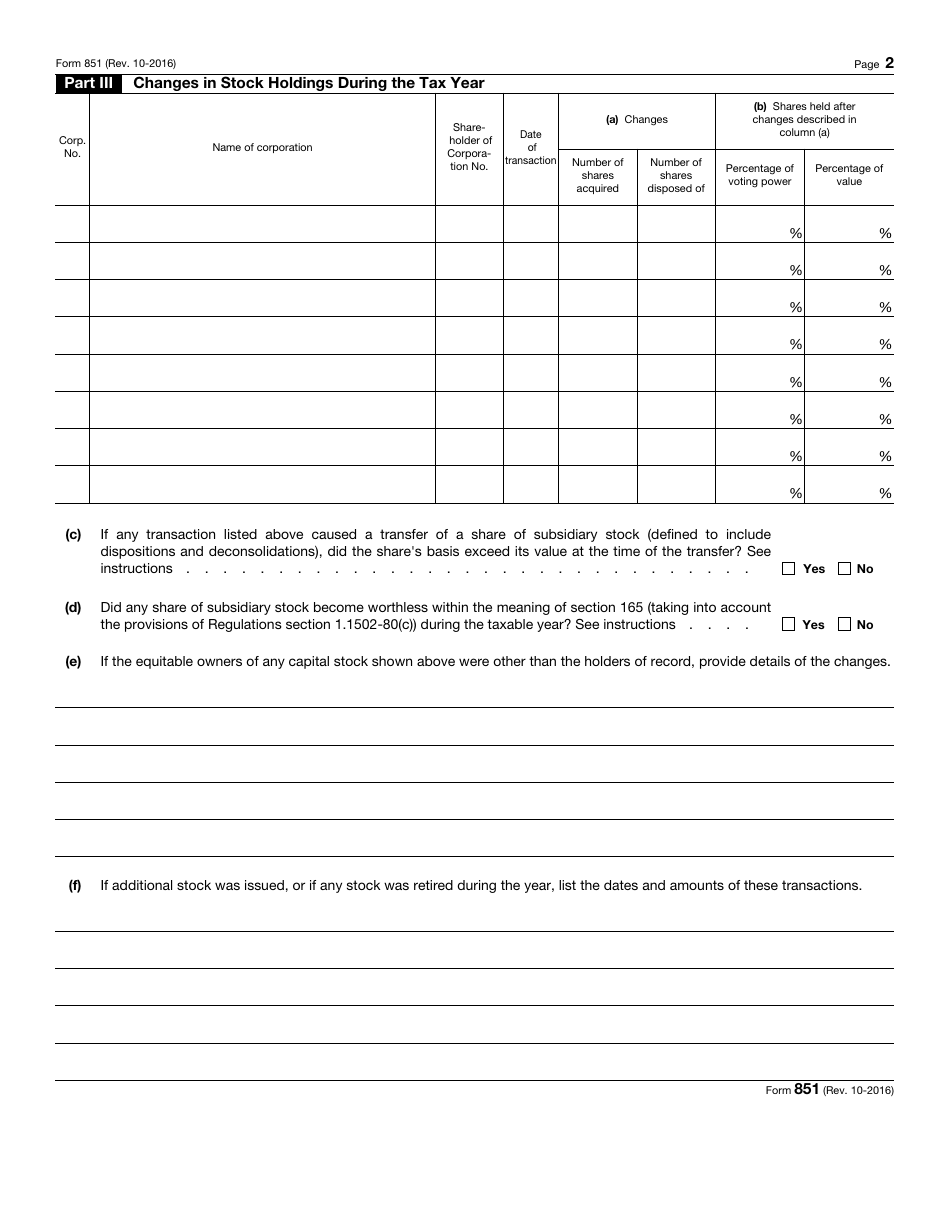

Part III . An applicant should provide information about the changes in stock holdings that occurred during the tax year.

- Questions A-B. Indicate the number of shares purchased and disposed of, percentages of voting power and value;

- Questions C-D. Answer "Yes" or "No" to the additional questions regarding a share of subsidiary stock;

- Questions E-F. Indicate the details about the presence of the equitable owners and issuing the additional stock;

-

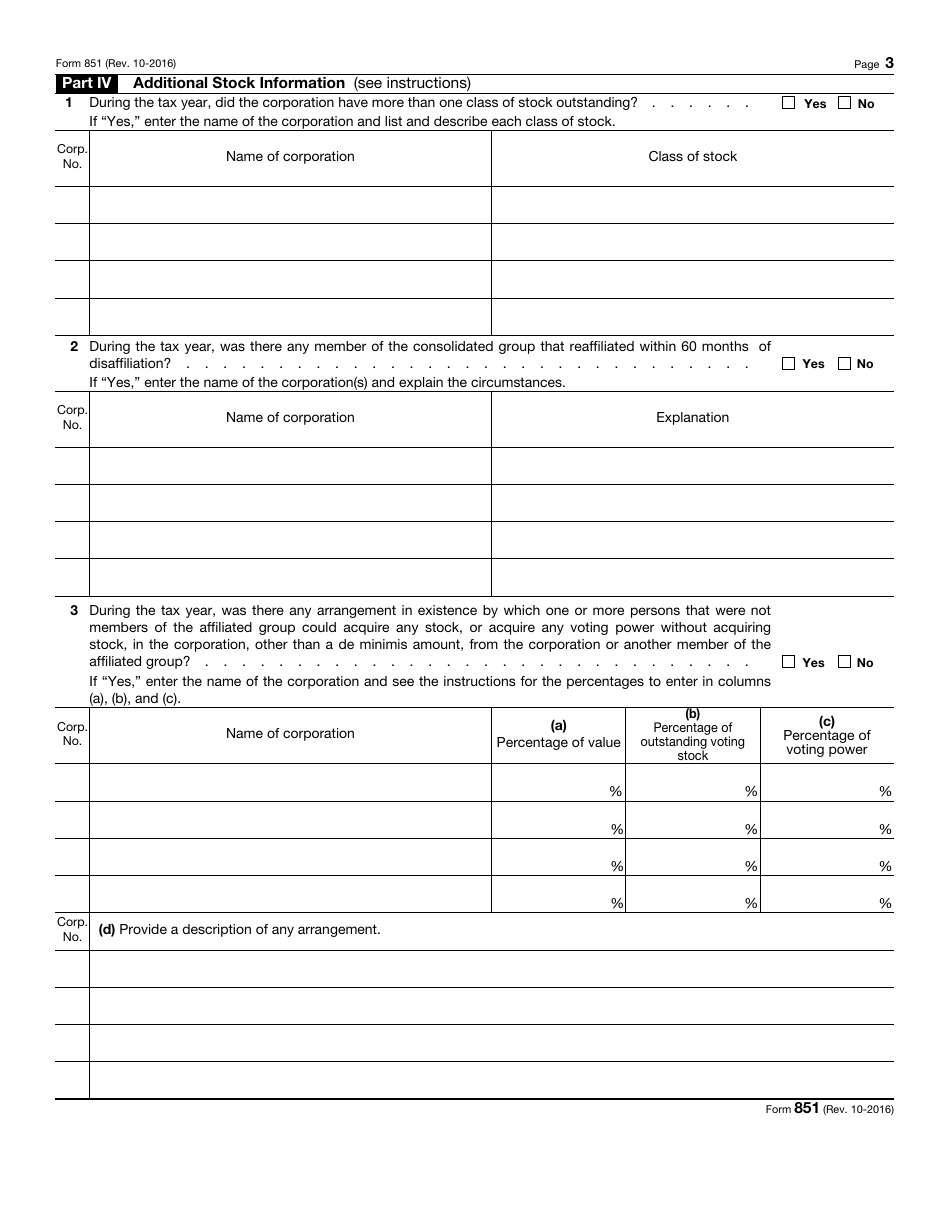

Part IV . An applicant should provide additional stock information for the tax year.

- Question 1. In the case of presence of the several classes of stock outstanding in the corporation, an applicant should describe each one;

- Question 2. If there was any corporation that reaffiliated within 60 months of disaffiliation, provide an explanation;

- Question 3. In the case of availability of the arrangement, such as stock appreciation rights, warrant, or an option, provide information about it. On Items A, B, C, an applicant has to indicate percentages of the value, the outstanding voting stock, and voting power that a person that is not a member of the affiliated group could acquire. On Item d, provide a description of any arrangement described.