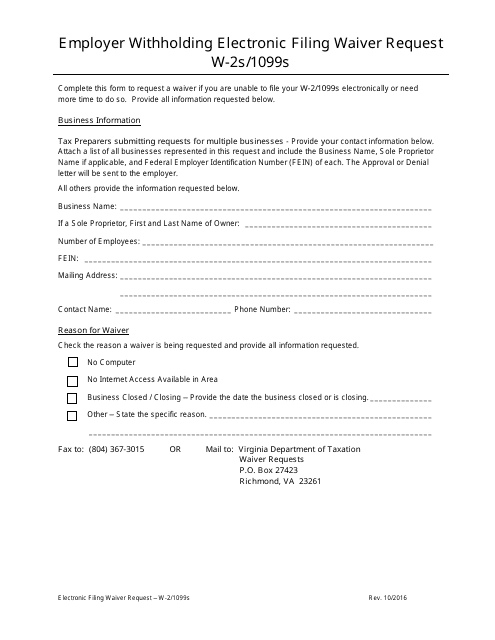

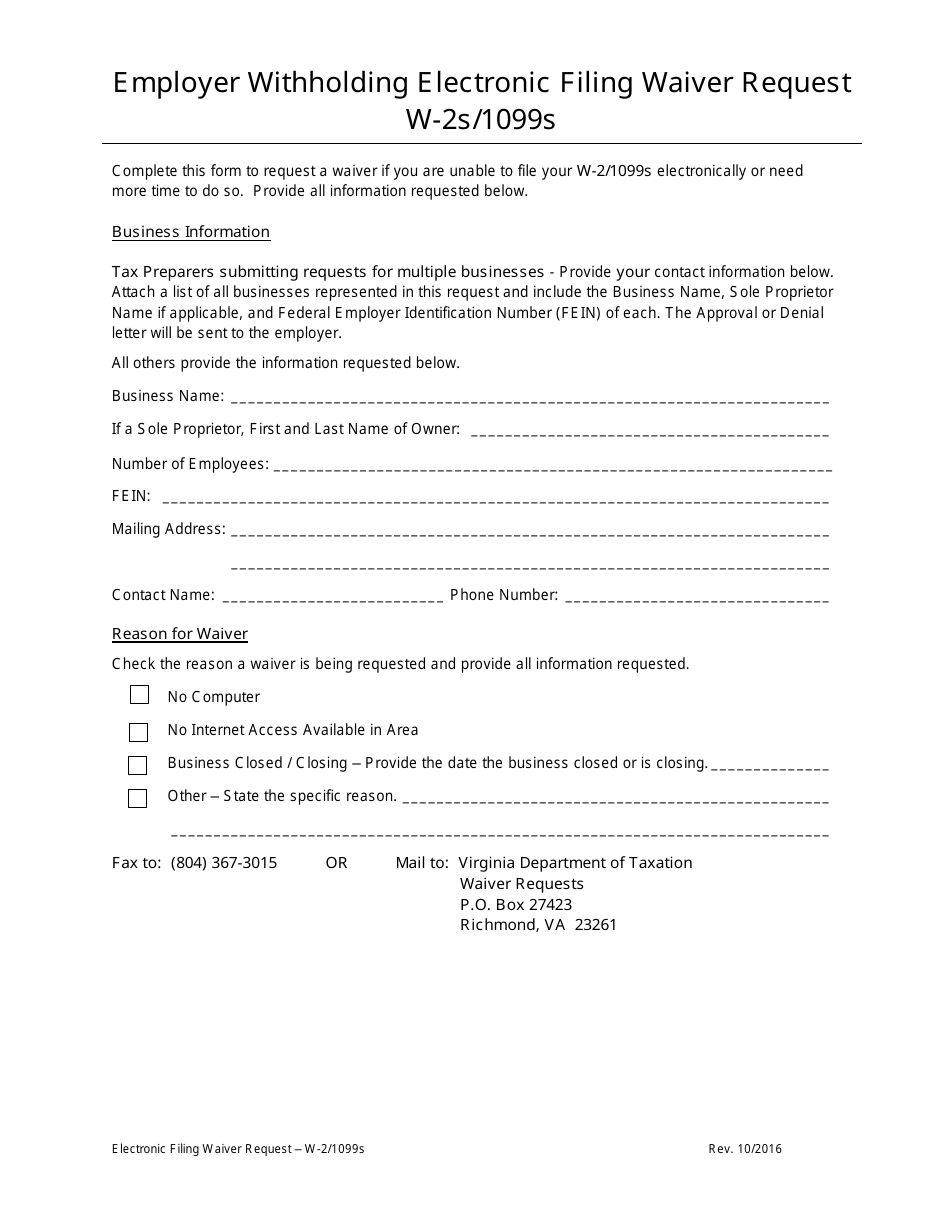

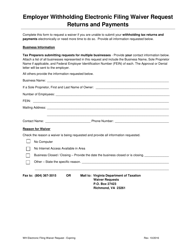

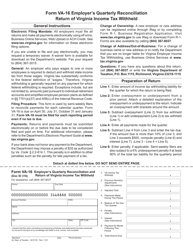

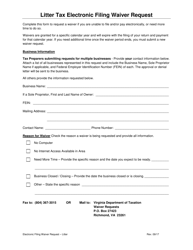

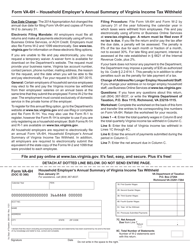

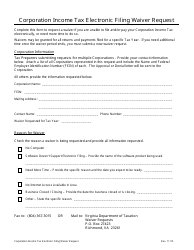

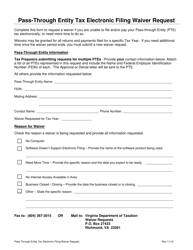

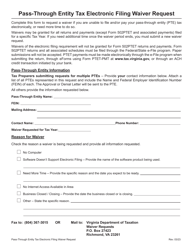

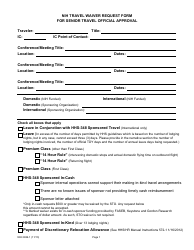

Form W-2S / 1099S Employer Withholding Electronic Filing Waiver Request - Virginia

What Is Form W-2S/1099S?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

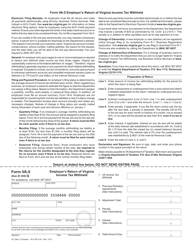

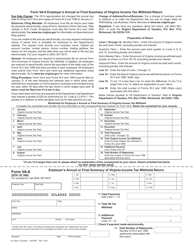

Q: What is Form W-2S?

A: Form W-2S is a form used by employers in Virginia to report state income tax withholding for their employees.

Q: What is Form 1099S?

A: Form 1099S is a form used to report real estate transactions and certain royalties or fixed determinable and annual or periodical income.

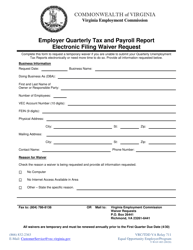

Q: What is the Employer Withholding Electronic Filing Waiver Request?

A: The Employer Withholding Electronic Filing Waiver Request is a form used by employers in Virginia to request a waiver from electronic filing of withholding forms.

Q: Who is eligible to request a waiver from electronic filing?

A: Employers who can demonstrate undue hardship or technical difficulty in electronically filing their withholding forms may be eligible to request a waiver.

Q: How can employers request a waiver?

A: Employers can request a waiver by completing and submitting the Employer Withholding Electronic Filing Waiver Request form to the Virginia Department of Taxation.

Q: Is there a deadline to request a waiver?

A: Yes, employers must submit the waiver request at least 30 days before the due date of the first withholding report covered by the waiver.

Q: Do employers need to provide any supporting documentation for their waiver request?

A: Yes, employers must provide detailed explanations and supporting documentation for their waiver requests, including the nature of the undue hardship or technical difficulty they are experiencing.

Q: What happens after the waiver request is submitted?

A: The Virginia Department of Taxation will review the waiver request and notify the employer of their decision.

Q: Are employers still required to file withholding forms if their waiver request is approved?

A: Yes, employers are still required to file the required withholding forms, but they may be able to file them on paper instead of electronically.

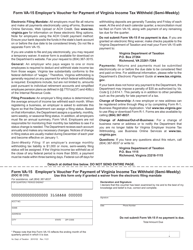

Form Details:

- Released on October 1, 2016;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form W-2S/1099S by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.