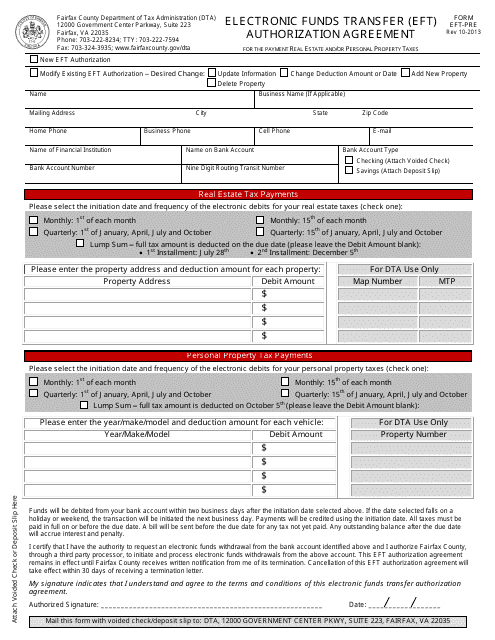

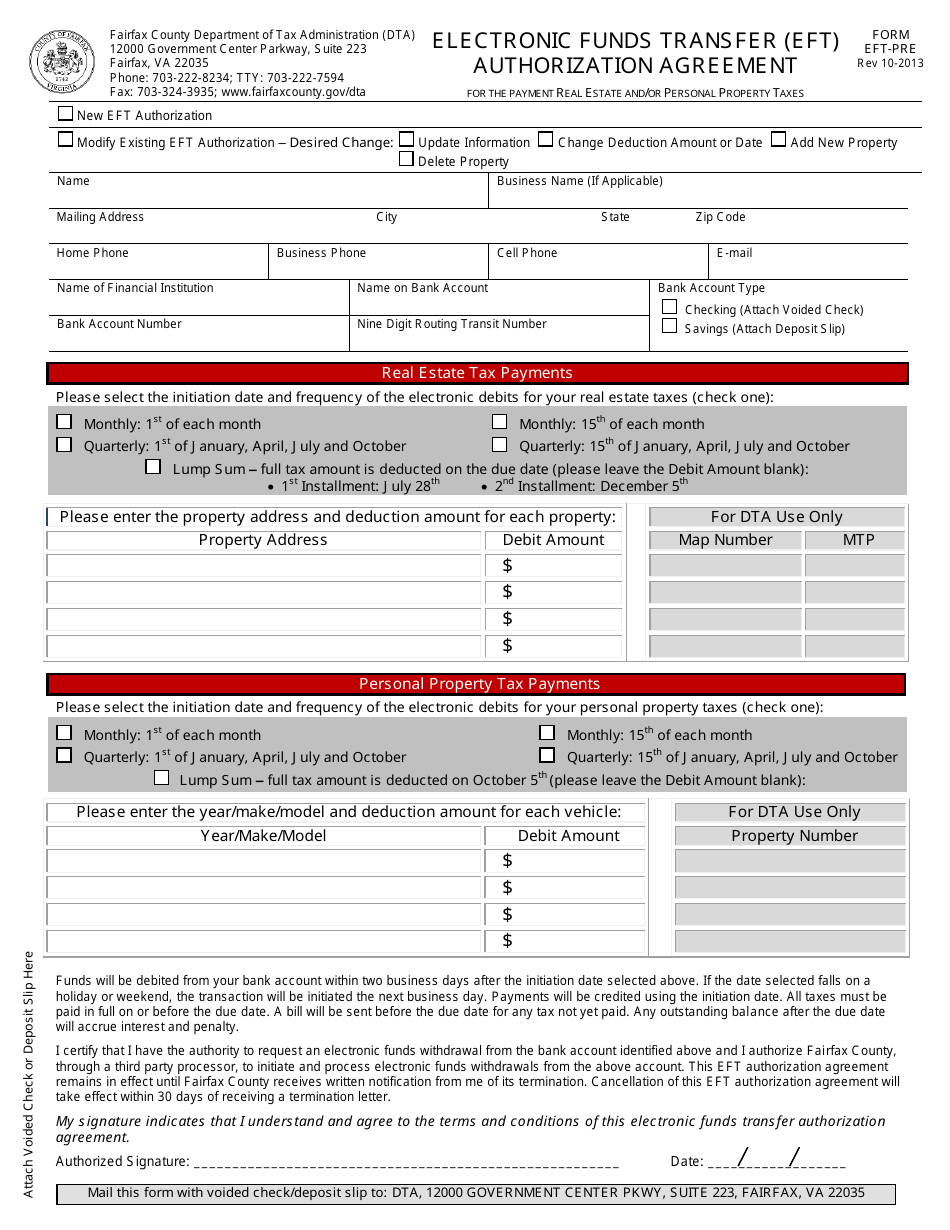

Form EFT-PRE Electronic Funds Transfer (Eft) Authorization Agreement - Fairfax County, Virginia

What Is Form EFT-PRE?

This is a legal form that was released by the Department of Tax Administration - Fairfax County, Virginia - a government authority operating within Virginia. The form may be used strictly within Fairfax County. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is EFT-PRE?

A: EFT-PRE stands for Electronic Funds Transfer - PRE which is a method of making electronic payments.

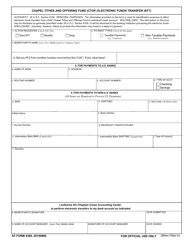

Q: What is the purpose of the EFT-PRE Authorization Agreement?

A: The purpose of this agreement is to authorize Fairfax County, Virginia to make electronic transfers of funds from your account.

Q: How do I authorize EFT-PRE?

A: You can authorize EFT-PRE by completing and signing the EFT-PRE Authorization Agreement form.

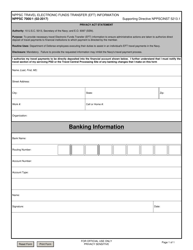

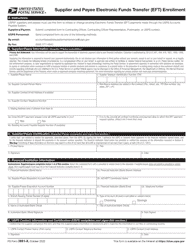

Q: What information is required on the EFT-PRE Authorization Agreement form?

A: The form will require your name, address, banking information, and signature.

Q: What type of payments can be made using EFT-PRE?

A: EFT-PRE can be used for various types of payments, such as taxes, fees, and other government charges.

Q: Can I cancel my EFT-PRE authorization?

A: Yes, you can cancel your EFT-PRE authorization by providing written notice to Fairfax County, Virginia.

Q: How long does it take for EFT-PRE payments to be processed?

A: EFT-PRE payments typically take one to two business days to be processed.

Q: Is there a fee for using EFT-PRE?

A: There may be fees associated with using EFT-PRE, depending on your banking institution. It is recommended to check with your bank for more information.

Q: Is my personal information secure with EFT-PRE?

A: Yes, EFT-PRE uses industry-standard security measures to protect your personal information.

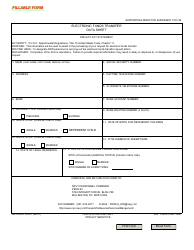

Form Details:

- Released on October 1, 2013;

- The latest edition provided by the Department of Tax Administration - Fairfax County, Virginia;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form EFT-PRE by clicking the link below or browse more documents and templates provided by the Department of Tax Administration - Fairfax County, Virginia.