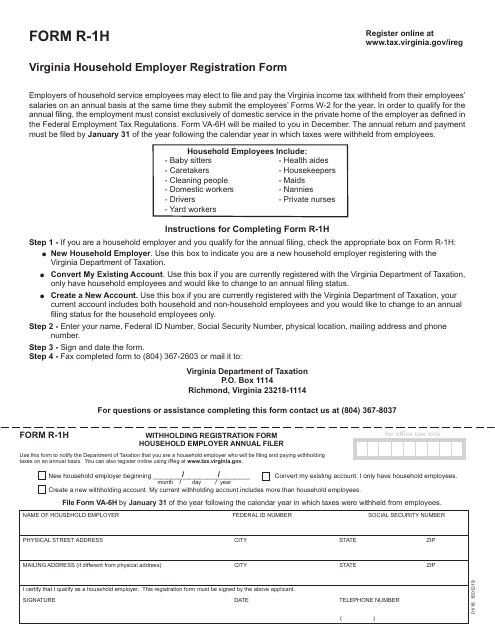

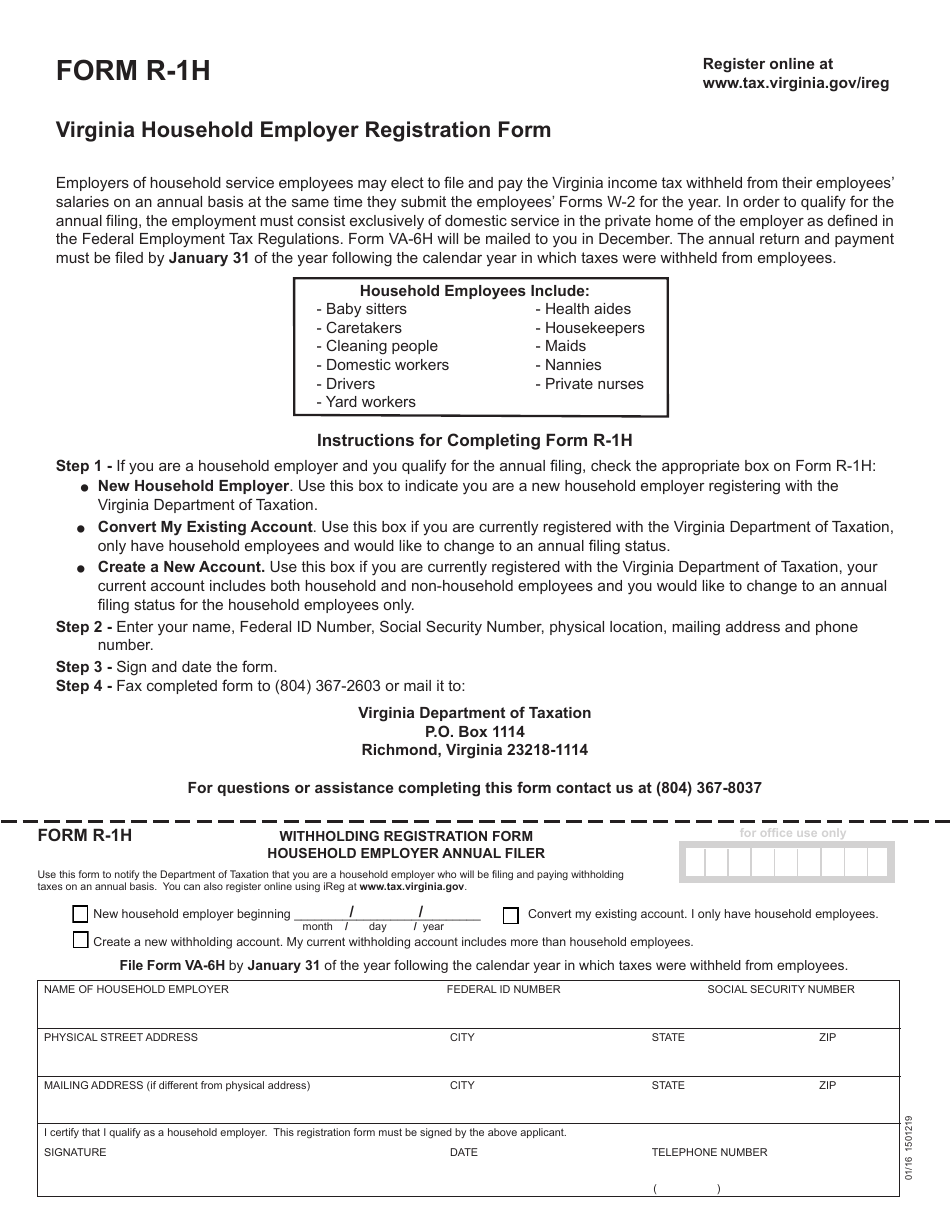

Form R-1H Virginia Household Employer Registration Form - Virginia

What Is Form R-1H?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-1H?

A: Form R-1H is the Virginia Household Employer Registration Form.

Q: Who should use Form R-1H?

A: This form should be used by household employers in Virginia.

Q: What is a household employer?

A: A household employer is an individual who employs someone to work in their private residence.

Q: Why do household employers need to register?

A: Household employers in Virginia need to register to comply with state tax laws.

Q: What information is required on Form R-1H?

A: The form requires information such as the employer's name, address, and federal employer identification number (FEIN).

Q: Is there a deadline for submitting Form R-1H?

A: There is no specific deadline mentioned for submitting Form R-1H, but it should be filed as soon as the individual becomes a household employer.

Q: Is there a fee for registering as a household employer?

A: No, there is no fee for registering as a household employer in Virginia.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-1H by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.