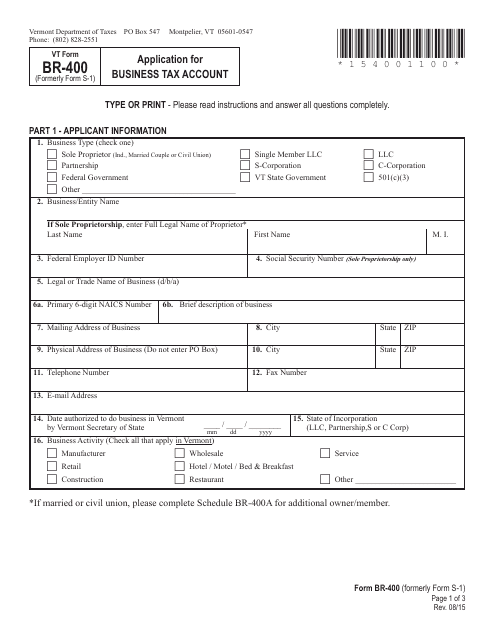

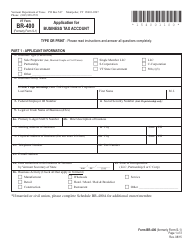

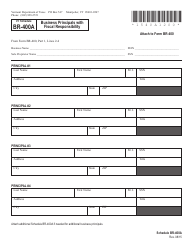

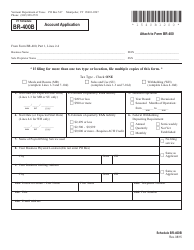

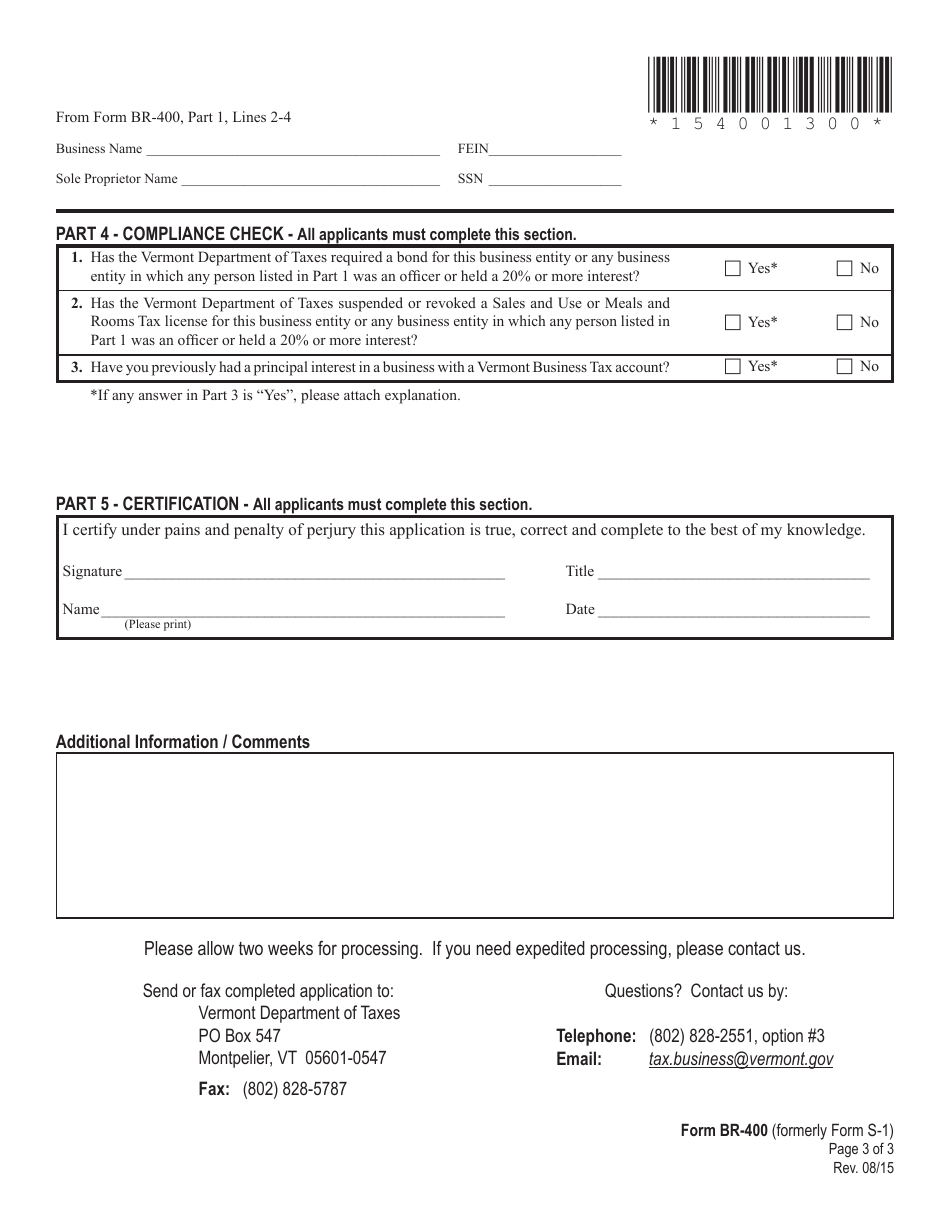

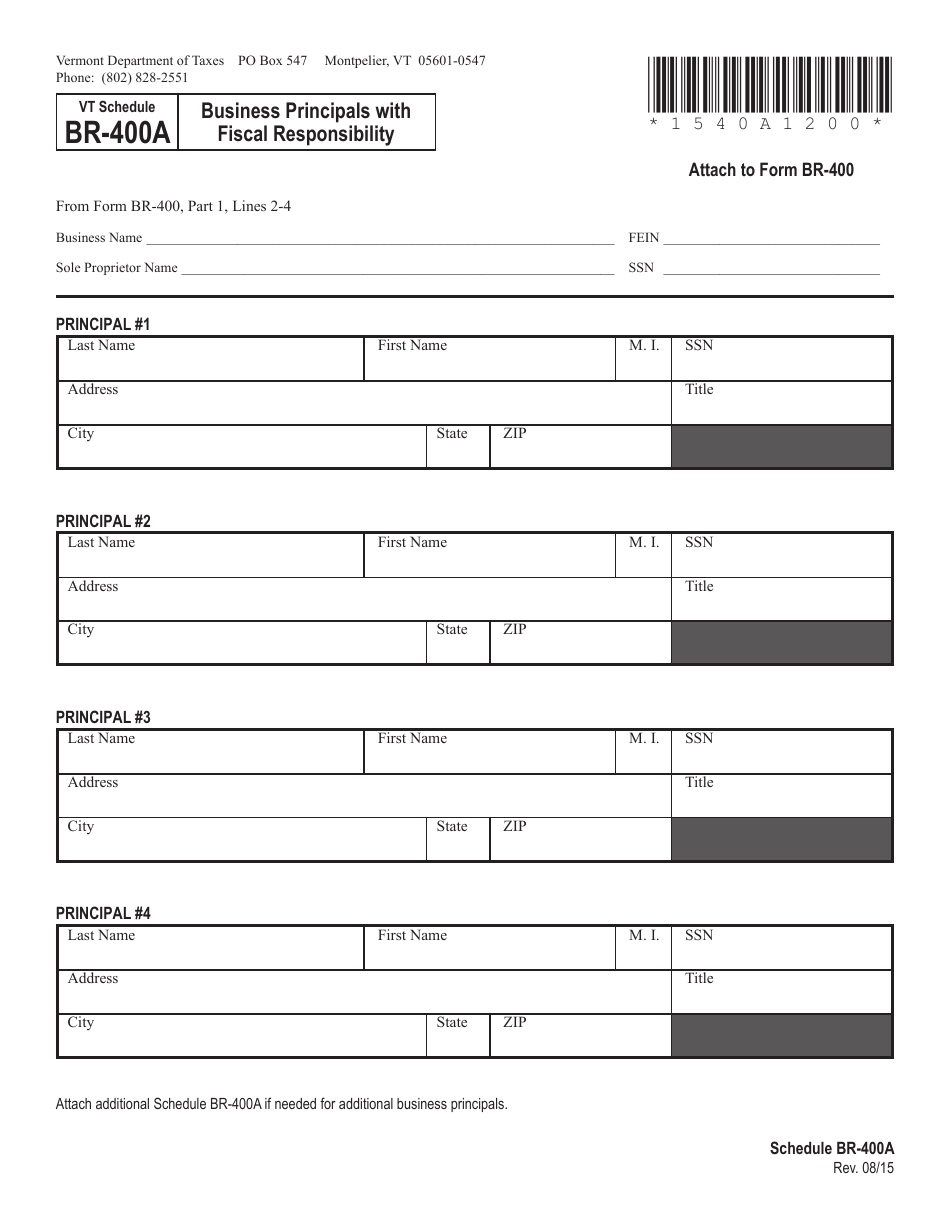

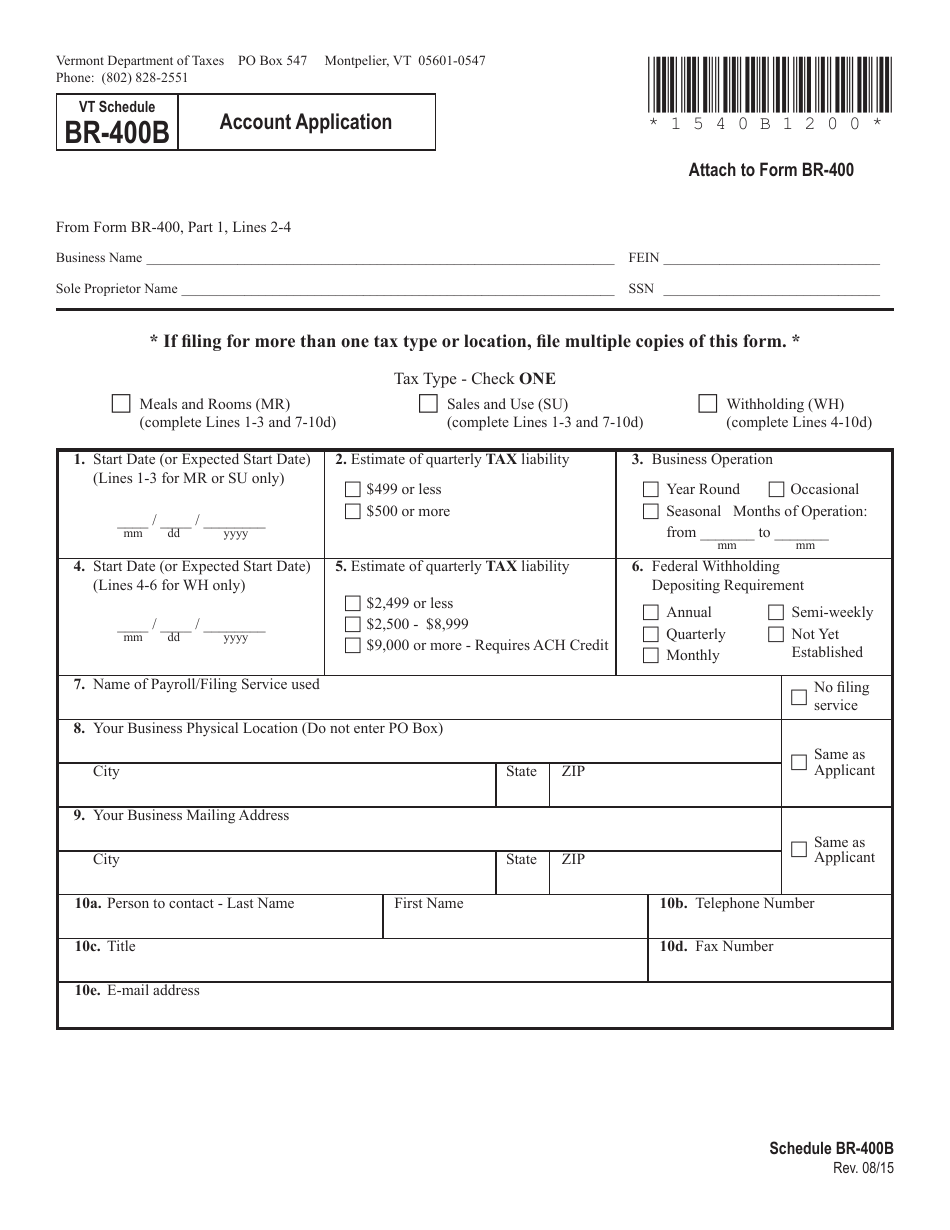

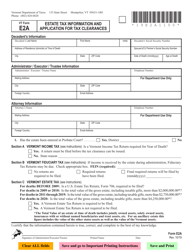

VT Form BR-400 Application for Business Tax Account - Vermont

What Is VT Form BR-400?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. Check the official instructions before completing and submitting the form.

FAQ

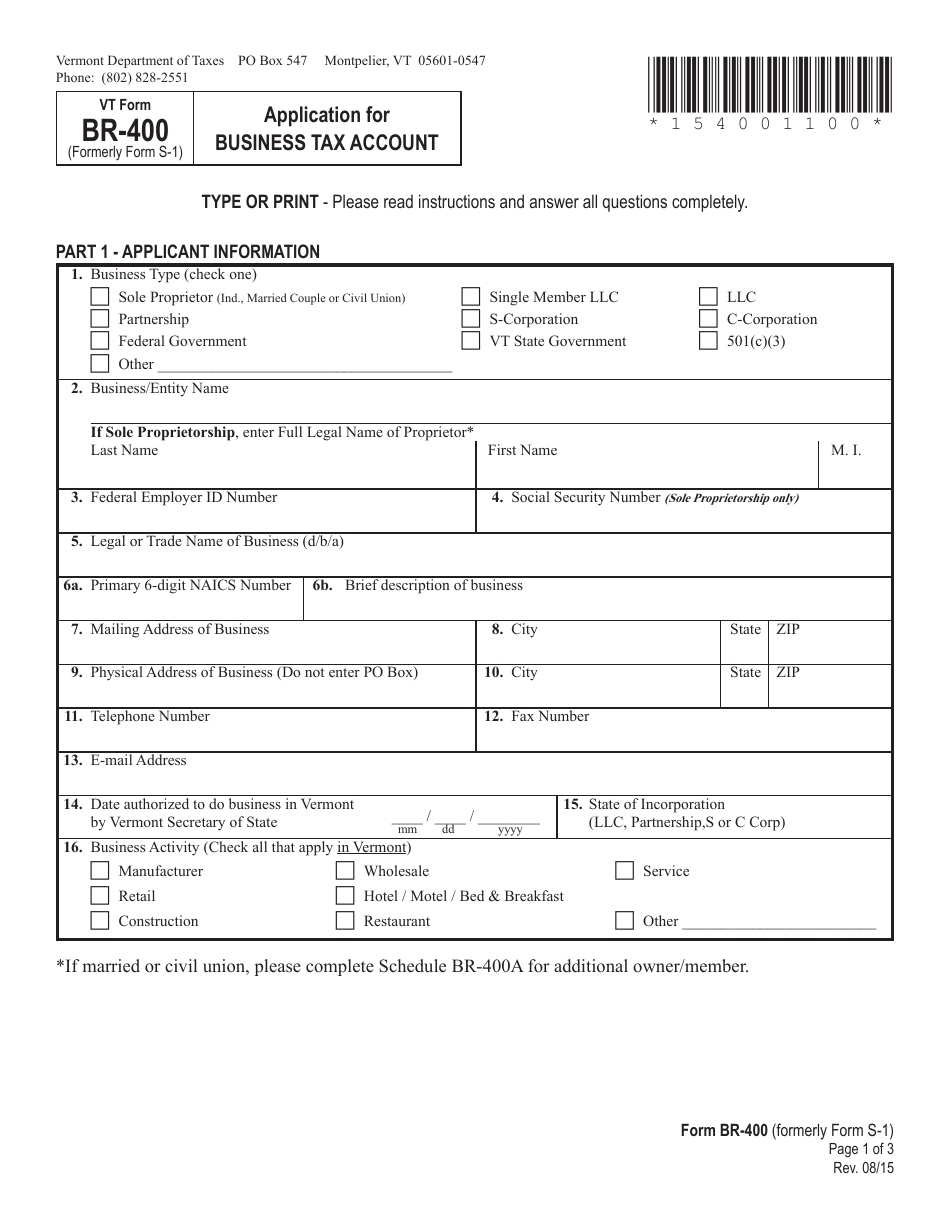

Q: What is Form BR-400?

A: Form BR-400 is an application for a Business Tax Account in Vermont.

Q: Who needs to fill out Form BR-400?

A: Any business that needs to establish a tax account in Vermont must fill out Form BR-400.

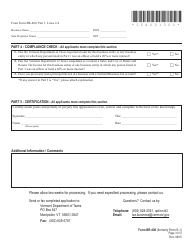

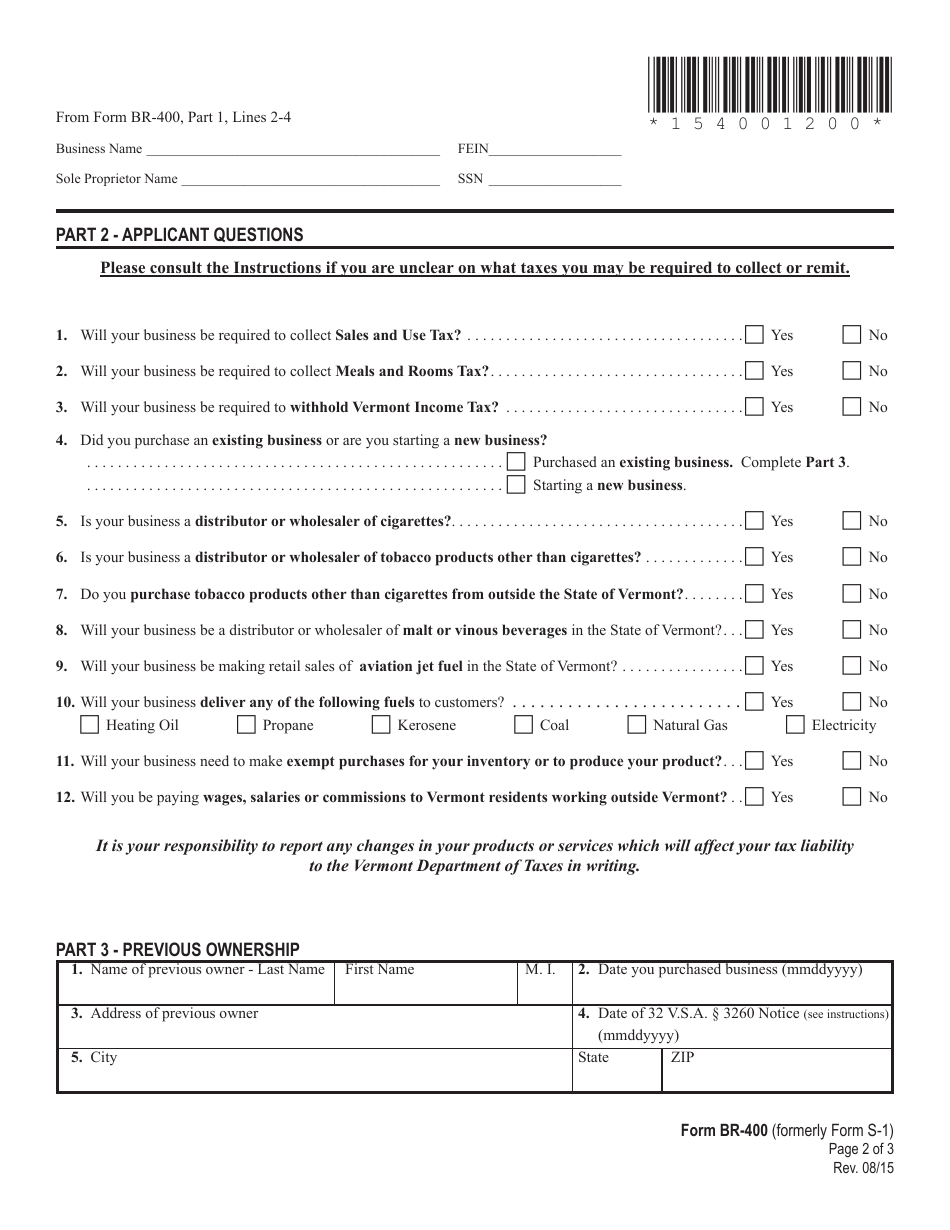

Q: What information is required on Form BR-400?

A: Form BR-400 requires information such as business name, address, business type, federal employer identification number, and other details.

Q: Is there a fee to file Form BR-400?

A: No, there is no fee to file Form BR-400 in Vermont.

Q: Are there any deadlines for filing Form BR-400?

A: Yes, Form BR-400 must be filed within 45 days after your business begins operations in Vermont.

Q: What should I do if there are changes to the information provided on Form BR-400?

A: If there are any changes to the information provided on Form BR-400, you need to update the Vermont Department of Taxes as soon as possible.

Form Details:

- Released on August 1, 2015;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of VT Form BR-400 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.