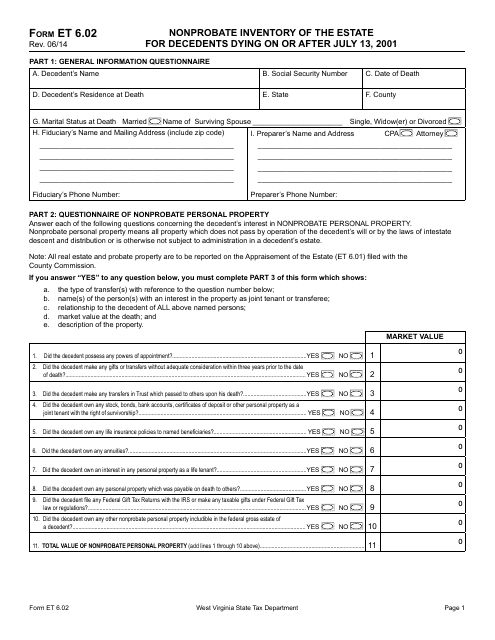

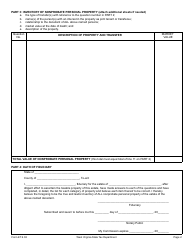

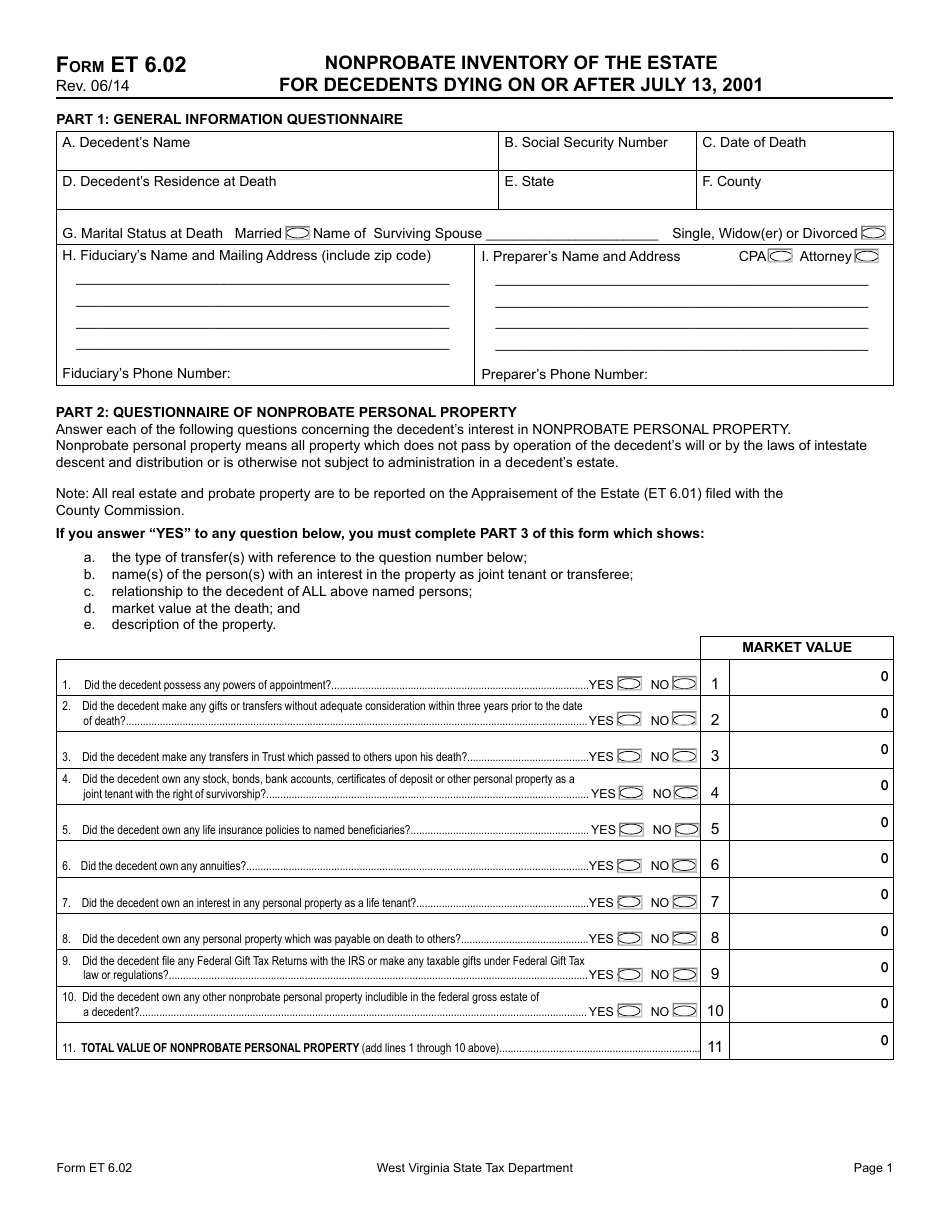

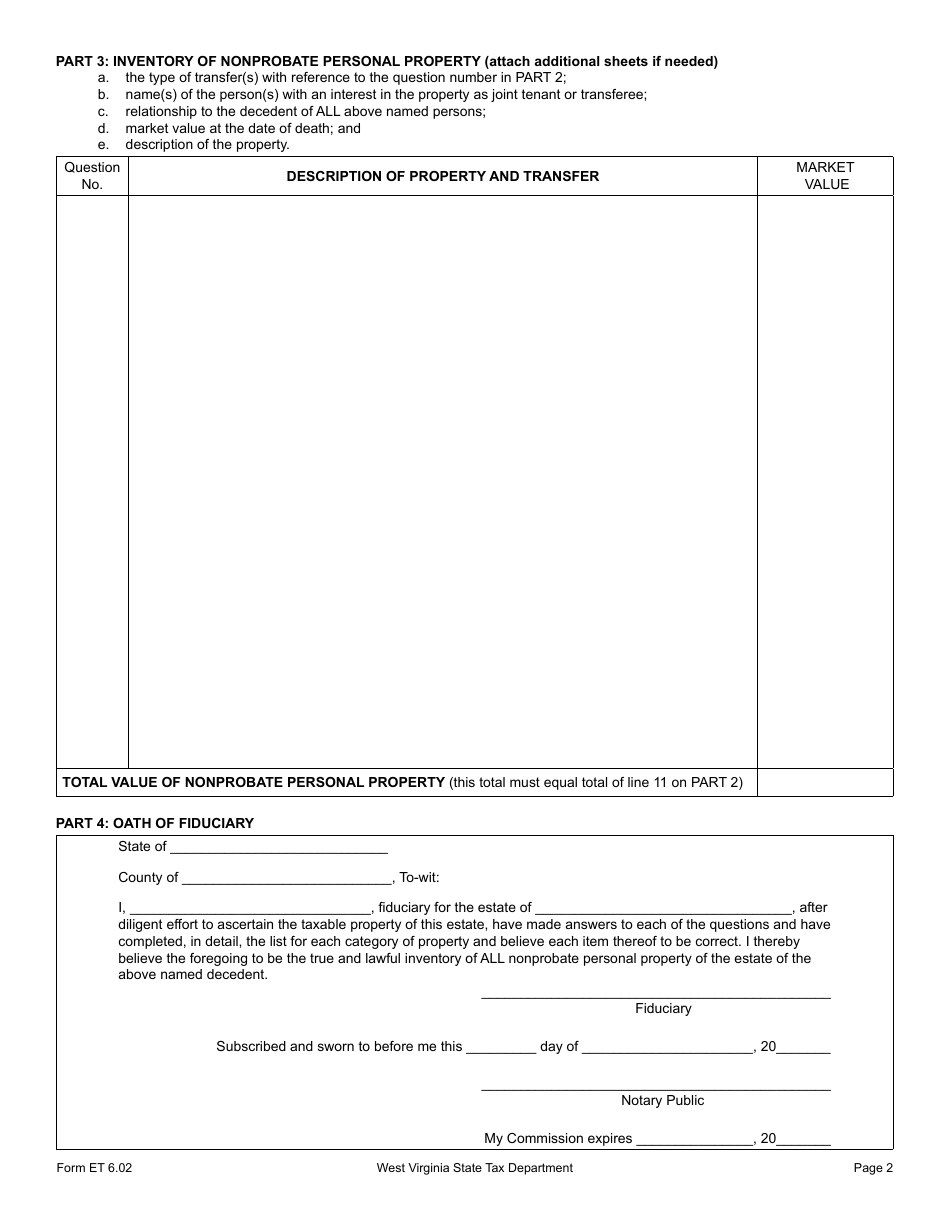

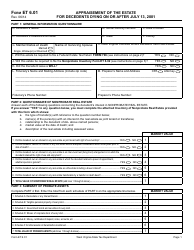

Form ET6.02 Nonprobate Inventory of the Estate for Decedents Dying on or After July 13, 2001 - West Virginia

What Is Form ET6.02?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ET6.02?

A: Form ET6.02 is the Nonprobate Inventory of the Estate for Decedents Dying on or After July 13, 2001 for the state of West Virginia.

Q: Who needs to fill out Form ET6.02?

A: This form needs to be filled out by the executor or personal representative of a decedent's estate in West Virginia.

Q: What is the purpose of Form ET6.02?

A: Form ET6.02 is used to provide an inventory of nonprobate assets of a decedent's estate in West Virginia.

Q: When is Form ET6.02 required?

A: This form is required when a decedent died on or after July 13, 2001 in West Virginia and has nonprobate assets.

Q: Is there a deadline to submit Form ET6.02?

A: Yes, in West Virginia, Form ET6.02 must be filed within 60 days after the appointment of the executor or personal representative.

Q: Are there any filing fees for Form ET6.02?

A: There may be filing fees associated with filing Form ET6.02 in West Virginia. Please check with the probate court for the current fee schedule.

Q: What should I do with Form ET6.02 once it's completed?

A: Once completed, Form ET6.02 should be filed with the probate court and a copy should be provided to all interested parties.

Q: Is Form ET6.02 confidential?

A: Form ET6.02 is a public document and can generally be accessed by anyone seeking information about the decedent's estate in West Virginia.

Q: What happens if I don't file Form ET6.02?

A: Failure to file Form ET6.02 in West Virginia may result in penalties and delays in the administration of the estate.

Form Details:

- Released on June 1, 2014;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ET6.02 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.