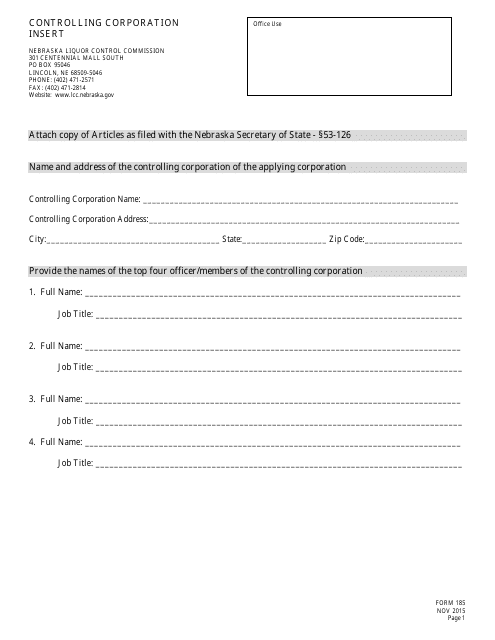

Form 185 Controlling Corporation Insert - Nebraska

What Is Form 185?

This is a legal form that was released by the Nebraska Liquor Control Commission - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 185 Controlling Corporation Insert?

A: Form 185 Controlling Corporation Insert is a document used in Nebraska.

Q: Who uses Form 185 Controlling Corporation Insert?

A: This form is used by controlling corporations in Nebraska.

Q: What is the purpose of Form 185 Controlling Corporation Insert?

A: The purpose of this form is to provide information about the controlling corporation.

Q: Is Form 185 Controlling Corporation Insert required in Nebraska?

A: Yes, controlling corporations in Nebraska are required to file this form.

Q: What information is required in Form 185 Controlling Corporation Insert?

A: This form requires details such as the name and address of the controlling corporation, information about the controlled corporations, and the name and contact information of the person completing the form.

Q: When should Form 185 Controlling Corporation Insert be filed?

A: This form should be filed annually by controlling corporations no later than the last day of the month in which the corporation was initially formed in Nebraska or the month in which the filing fee is received, whichever is later.

Q: What happens if Form 185 Controlling Corporation Insert is not filed?

A: Failure to file this form can result in penalties, such as the imposition of late fees or even the loss of the controlling corporation's ability to transact business in Nebraska.

Form Details:

- Released on November 1, 2015;

- The latest edition provided by the Nebraska Liquor Control Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 185 by clicking the link below or browse more documents and templates provided by the Nebraska Liquor Control Commission.