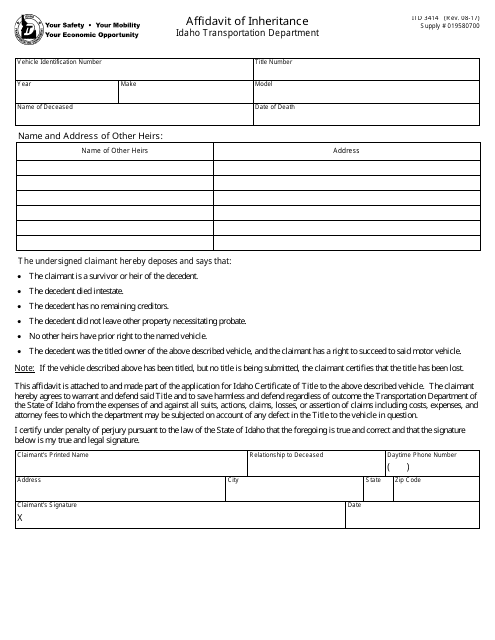

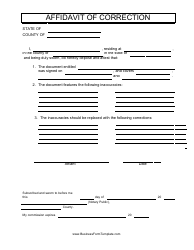

This version of the form is not currently in use and is provided for reference only. Download this version of

Form ITD3414

for the current year.

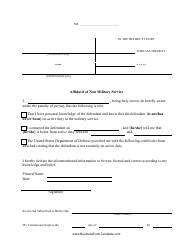

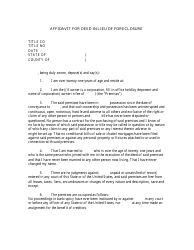

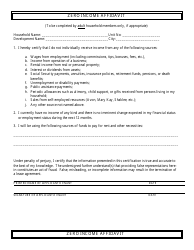

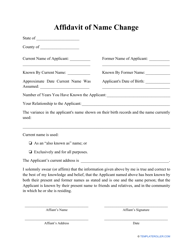

Form ITD3414 Affidavit of Inheritance - Idaho

What Is Form ITD3414?

This is a legal form that was released by the Idaho Department of Transportation - a government authority operating within Idaho. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the ITD3414 Affidavit of Inheritance?

A: The ITD3414 Affidavit of Inheritance is a legal document used in Idaho to establish a person's entitlement to inherit property.

Q: Who needs to file the ITD3414 Affidavit of Inheritance?

A: The ITD3414 Affidavit of Inheritance needs to be filed by the person who is claiming inheritance rights to a deceased person's property in Idaho.

Q: What information is required in the ITD3414 Affidavit of Inheritance?

A: The ITD3414 Affidavit of Inheritance requires information about the deceased person, the relationship between the person claiming inheritance and the deceased, and details of any existing will or estate proceedings.

Q: Are there any filing fees for the ITD3414 Affidavit of Inheritance?

A: No, there are no filing fees for the ITD3414 Affidavit of Inheritance in Idaho.

Q: What should I do after completing the ITD3414 Affidavit of Inheritance?

A: After completing the ITD3414 Affidavit of Inheritance, you should sign it in the presence of a notary public and submit it to the Idaho State Tax Commission or the appropriate county clerk's office.

Q: What if I have more questions about the ITD3414 Affidavit of Inheritance?

A: If you have more questions about the ITD3414 Affidavit of Inheritance, you should consult with an attorney or seek guidance from the Idaho State Tax Commission or a local county clerk's office.

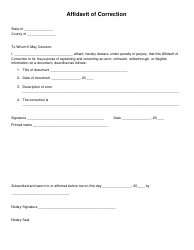

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the Idaho Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ITD3414 by clicking the link below or browse more documents and templates provided by the Idaho Department of Transportation.