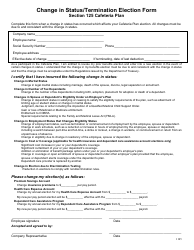

This version of the form is not currently in use and is provided for reference only. Download this version of

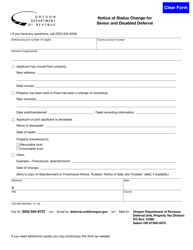

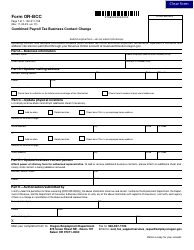

Form 150-211-156

for the current year.

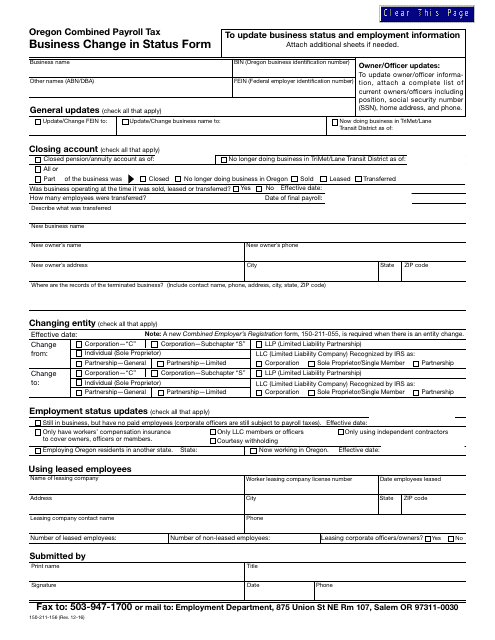

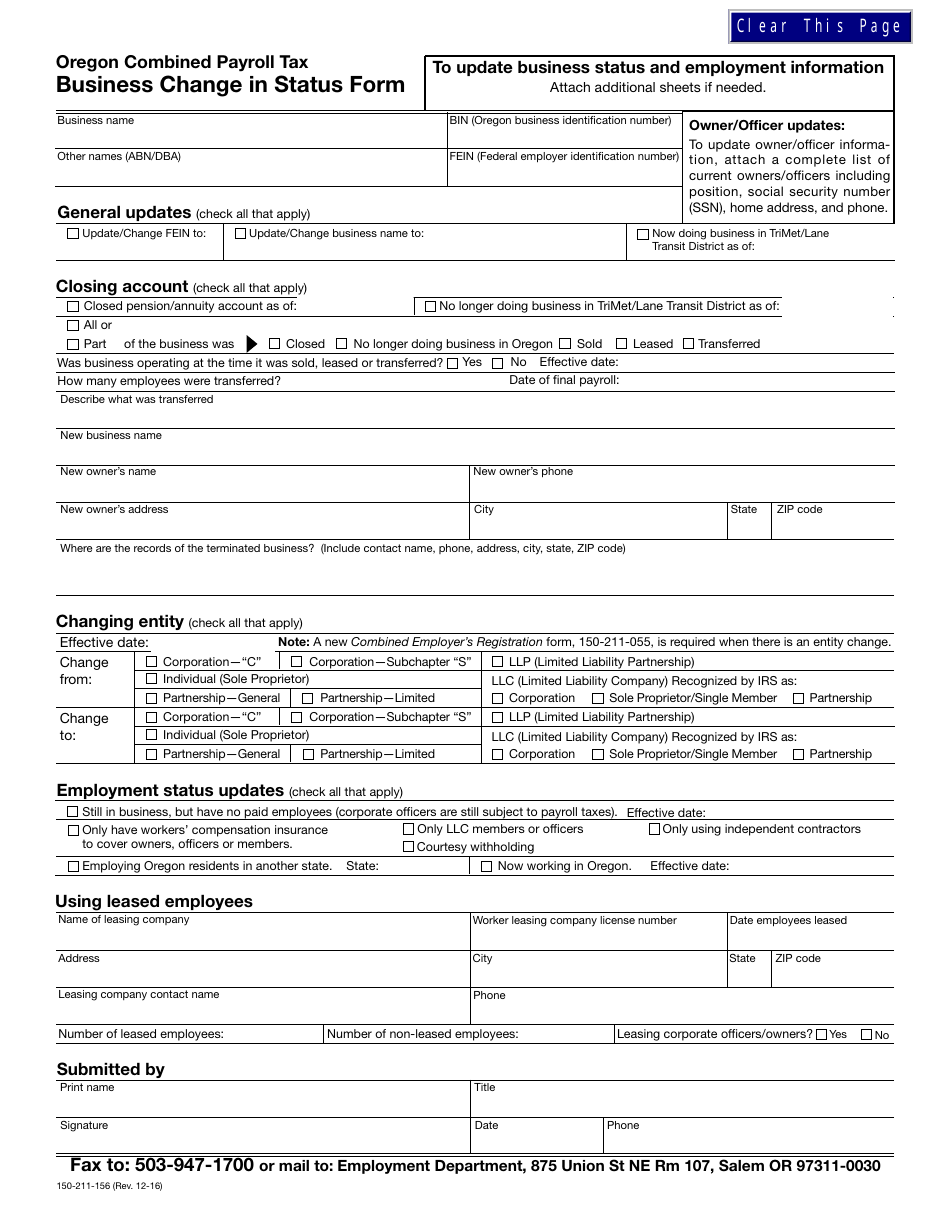

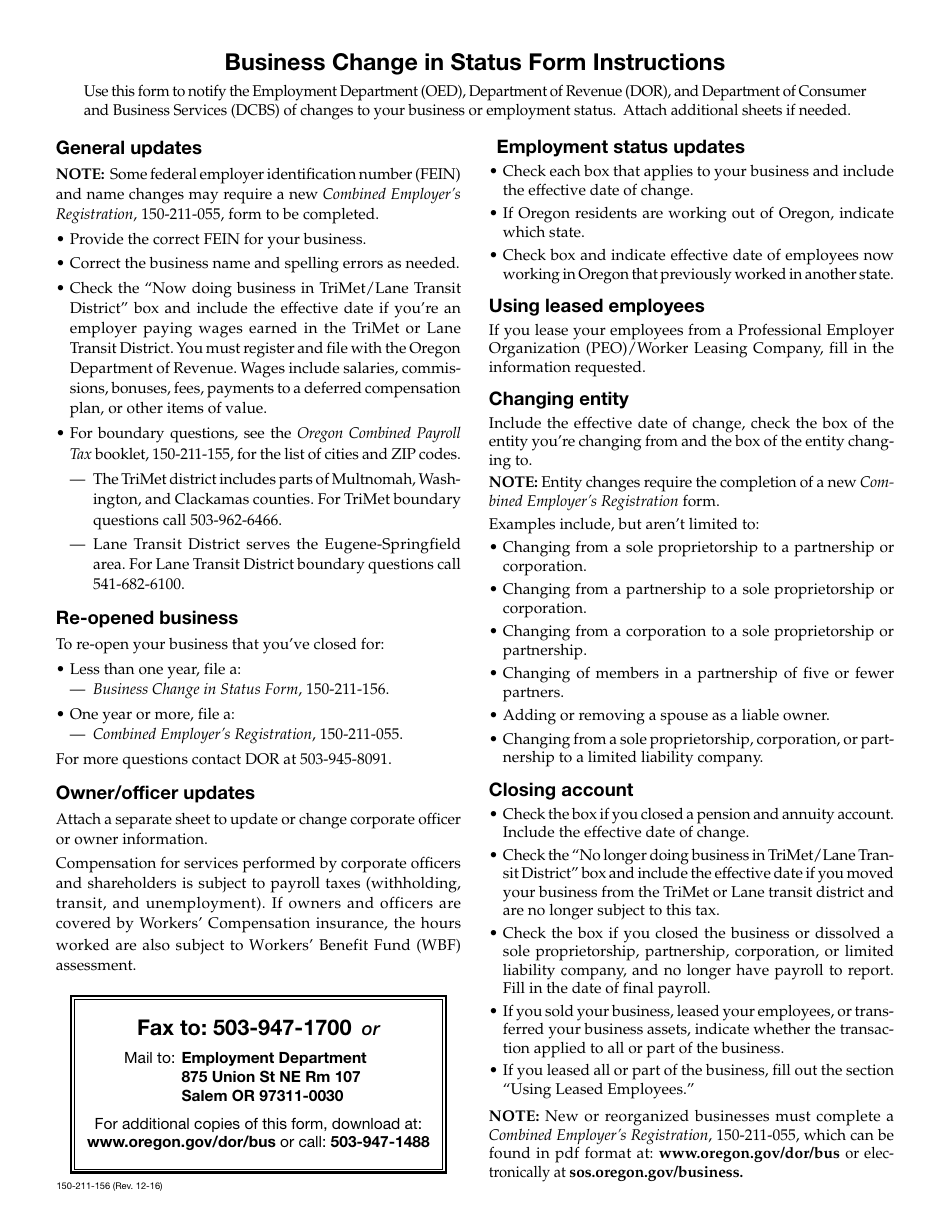

Form 150-211-156 Business Change in Status Form - Oregon

What Is Form 150-211-156?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-211-156?

A: Form 150-211-156 is the Business Change in Status Form for the state of Oregon.

Q: What is the purpose of Form 150-211-156?

A: The purpose of Form 150-211-156 is to report any changes in the status of a business in Oregon.

Q: Who needs to fill out Form 150-211-156?

A: Any business operating in Oregon that undergoes a change in status should fill out Form 150-211-156.

Q: What types of changes in status should be reported using Form 150-211-156?

A: Form 150-211-156 should be used to report changes such as ownership changes, business name changes, or changes in tax status.

Q: Is there a deadline for submitting Form 150-211-156?

A: Yes, Form 150-211-156 should be submitted within 30 days of the change in status of the business.

Form Details:

- Released on December 1, 2016;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-211-156 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.