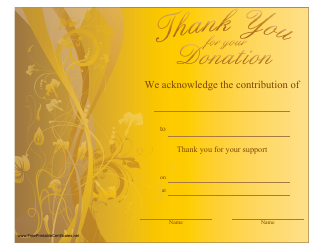

Donation Certificate Template - Azure

The Donation Certificate Template - Azure is a document used to acknowledge and provide evidence of a charitable donation made by an individual or organization. It can be used to recognize and thank donors for their contributions.

FAQ

Q: What is a donation certificate?

A: A donation certificate is a document given to individuals or organizations as proof of their charitable contribution.

Q: Why would someone need a donation certificate?

A: People may need a donation certificate for tax purposes, to claim deductions on their income tax returns.

Q: What is the purpose of a donation certificate?

A: The purpose of a donation certificate is to acknowledge and validate a donation made to a nonprofit or charitable organization.

Q: How can I obtain a donation certificate?

A: You can obtain a donation certificate from the nonprofit or charitable organization to which you made the donation.

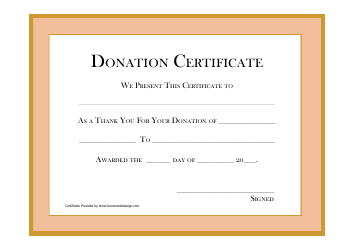

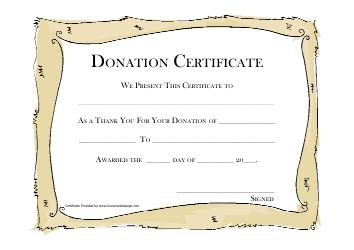

Q: What information is typically included in a donation certificate?

A: A donation certificate usually includes the donor's name, the recipient organization's name, the donation amount, and the date of the donation.

Q: Is a donation certificate legally binding?

A: No, a donation certificate is not legally binding. It is simply a document that acknowledges a donation.

Q: Is a donation certificate the same as a tax receipt?

A: In some cases, a donation certificate may be used as a tax receipt to claim tax deductions. However, not all donation certificates may serve this purpose.

Q: How long should I keep a donation certificate?

A: It is advisable to keep donation certificates and any related tax documents for at least three years in case of an audit by the IRS.