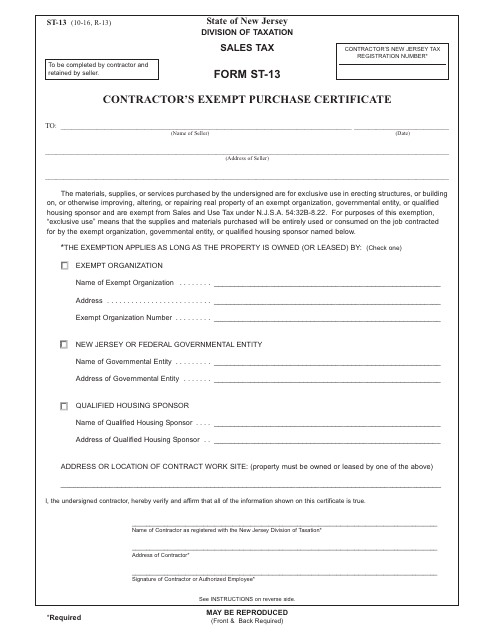

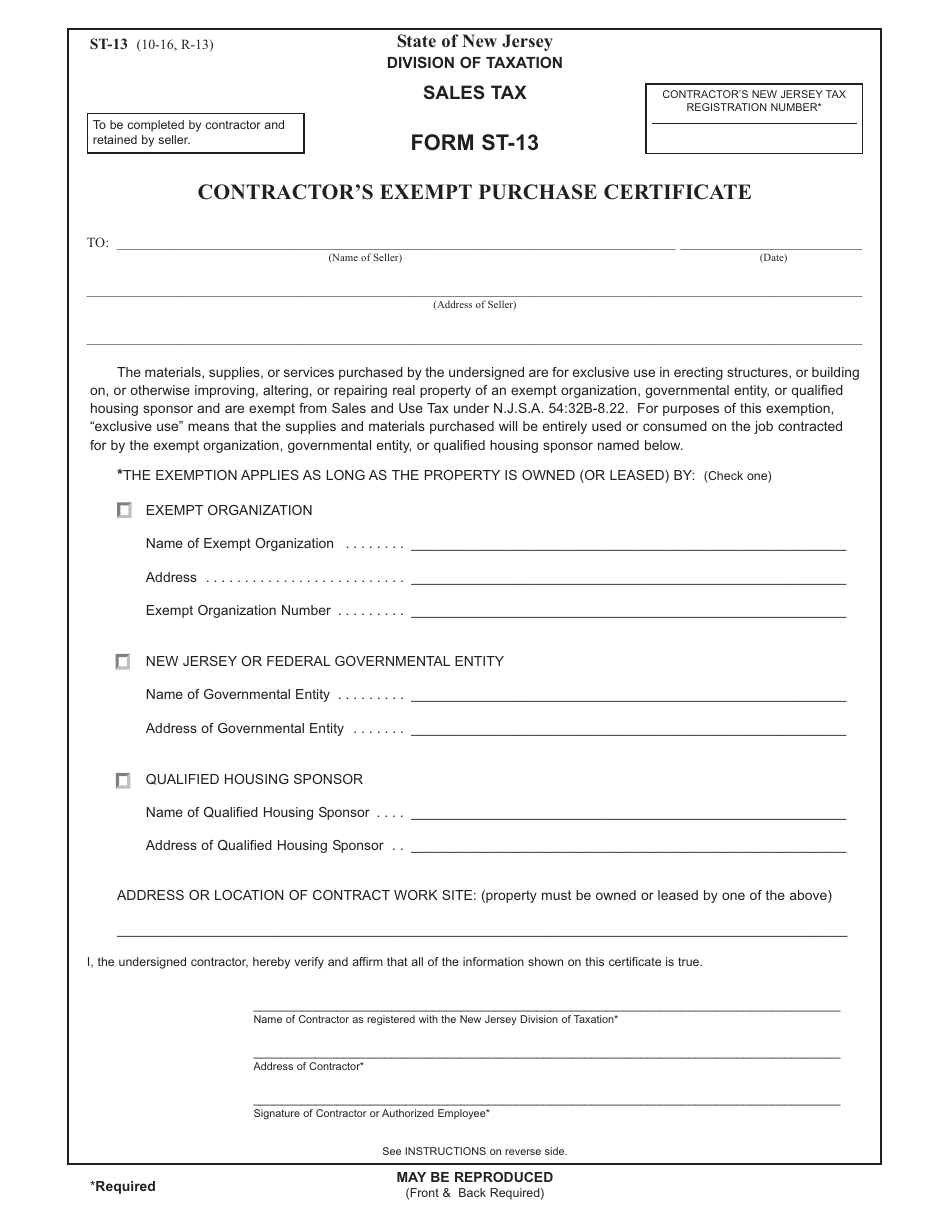

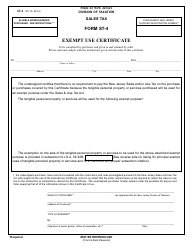

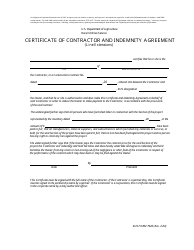

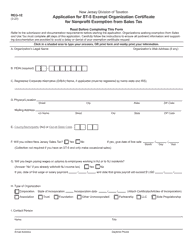

Form ST-13 Contractor's Exempt Purchase Certificate - New Jersey

What Is Form ST-13?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-13?

A: Form ST-13 is the Contractor's Exempt Purchase Certificate for New Jersey.

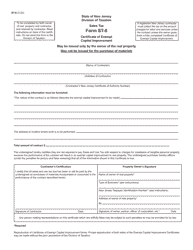

Q: Who needs to fill out Form ST-13?

A: Contractors in New Jersey who are exempt from paying sales tax on their purchases.

Q: What is the purpose of Form ST-13?

A: The purpose of Form ST-13 is to provide a certificate of exemption to suppliers when purchasing materials, supplies, or equipment for use in a contracting job.

Q: When should I use Form ST-13?

A: Use Form ST-13 when making purchases for a contracting job where you are exempt from paying sales tax.

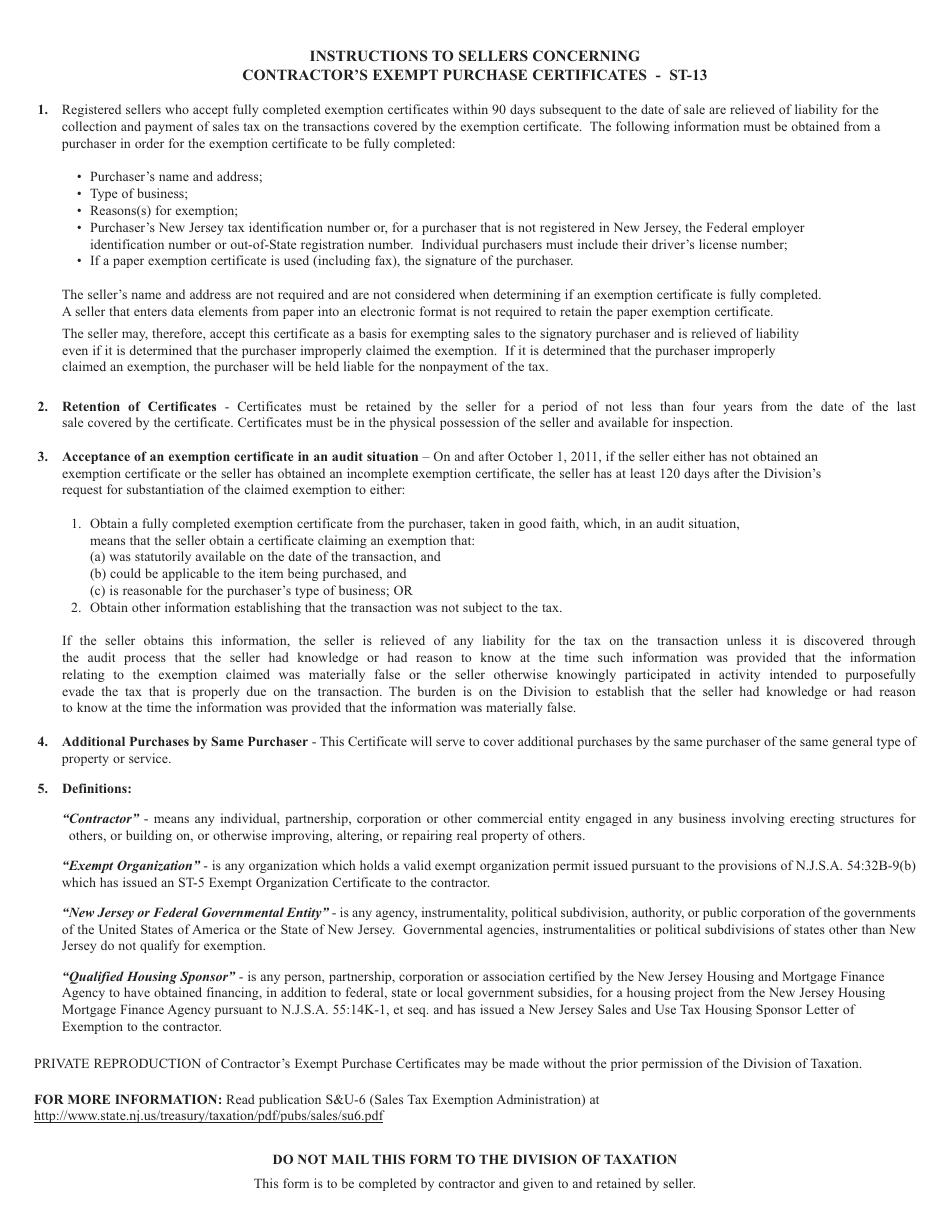

Q: Are there any conditions for using Form ST-13?

A: Yes, you must meet certain criteria to be eligible for exemption, such as being a registered contractor and using the materials, supplies, or equipment solely in a contracting job.

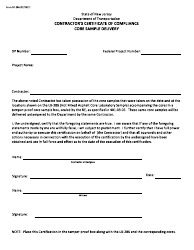

Q: Do I need to renew Form ST-13?

A: No, Form ST-13 does not need to be renewed. However, you should update your information if there are any changes to your business.

Q: What should I do with Form ST-13 once it's completed?

A: Provide a copy of Form ST-13 to your supplier when making purchases, and keep a copy for your records.

Q: What happens if I misuse Form ST-13?

A: Misusing Form ST-13 can result in penalties, including fines and loss of exemption privileges.

Q: Is there a deadline for submitting Form ST-13?

A: There is no specific deadline for submitting Form ST-13, but it should be provided to your supplier before making exempt purchases.

Form Details:

- Released on October 1, 2016;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-13 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.