Form CF-ES2620 Verification of Employment / Loss of Income - Florida

What Is Form CF-ES2620?

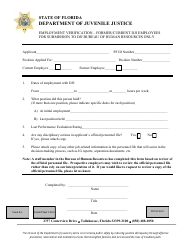

Form CF-ES2620, Verification of Employment/Loss of Income , is a document that can be used to verify the eligibility for public assistance of an individual based on information about their income or employment. The purpose of the document is to prove whether the individual has lost their income or has employment.

Alternate Name:

- Verification of Employment/Loss of Income Form.

The latest Form CF-ES2620 was issued on May 1, 2010 by the Florida Department of Children and Families and is only applicable in the state of Florida. A fillable Verification of Employment/Loss of Income Form is available for download below.

Verification of Employment/Loss of Income Instructions

A CF-ES2620 Form consists of several parts which include the following:

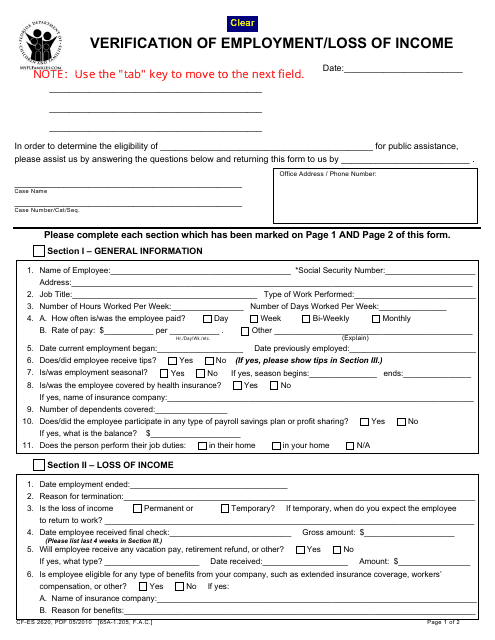

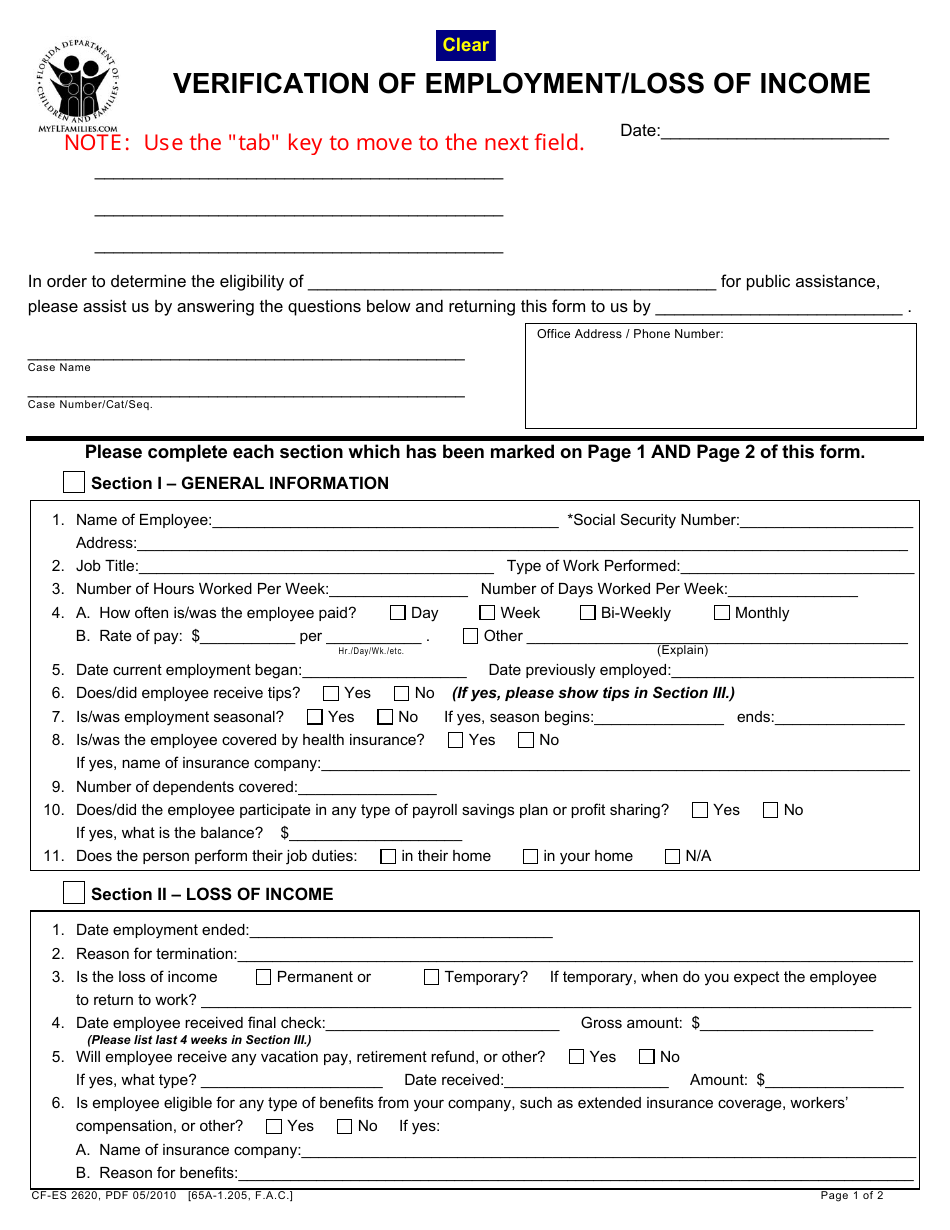

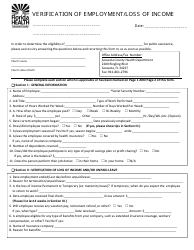

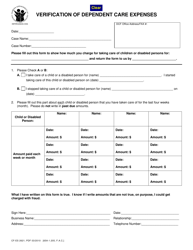

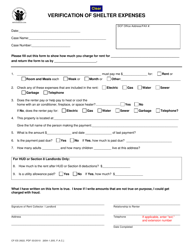

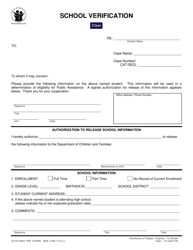

- Information About The Verification . The first part of the document is supposed to be filled in by an eligibility specialist. Here, they can state whose eligibility is being determined, the date until which the individual is supposed to submit it, and the address of the health department where the document is supposed to be filed. The specialist should also state information about the case to which this document is attached, such as the case name, case number, case category, etc.;

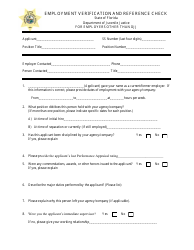

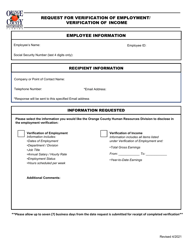

- General Information . Starting from this part, the document should be filled out by the employer (or former employer) of the individual. Employers can use this section of the document to designate the identifying information of the individual, their job, working hours, health insurance, and employment. To describe the individual's employment, the employer should indicate the date when the employment started, whether the employment was seasonal, if the employee participated in any payroll savings plans, etc.;

- Loss of Income . The employer can use this part of the document to describe the employment termination and its consequences for the individual. They can state the reasons for employment termination and the date when it ended, whether the loss of income is permanent or temporary (if it is temporary, then when the employee is expected to return to work), whether the employee is eligible for any company benefits, etc.;

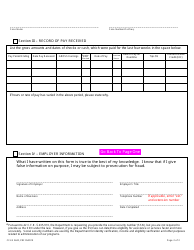

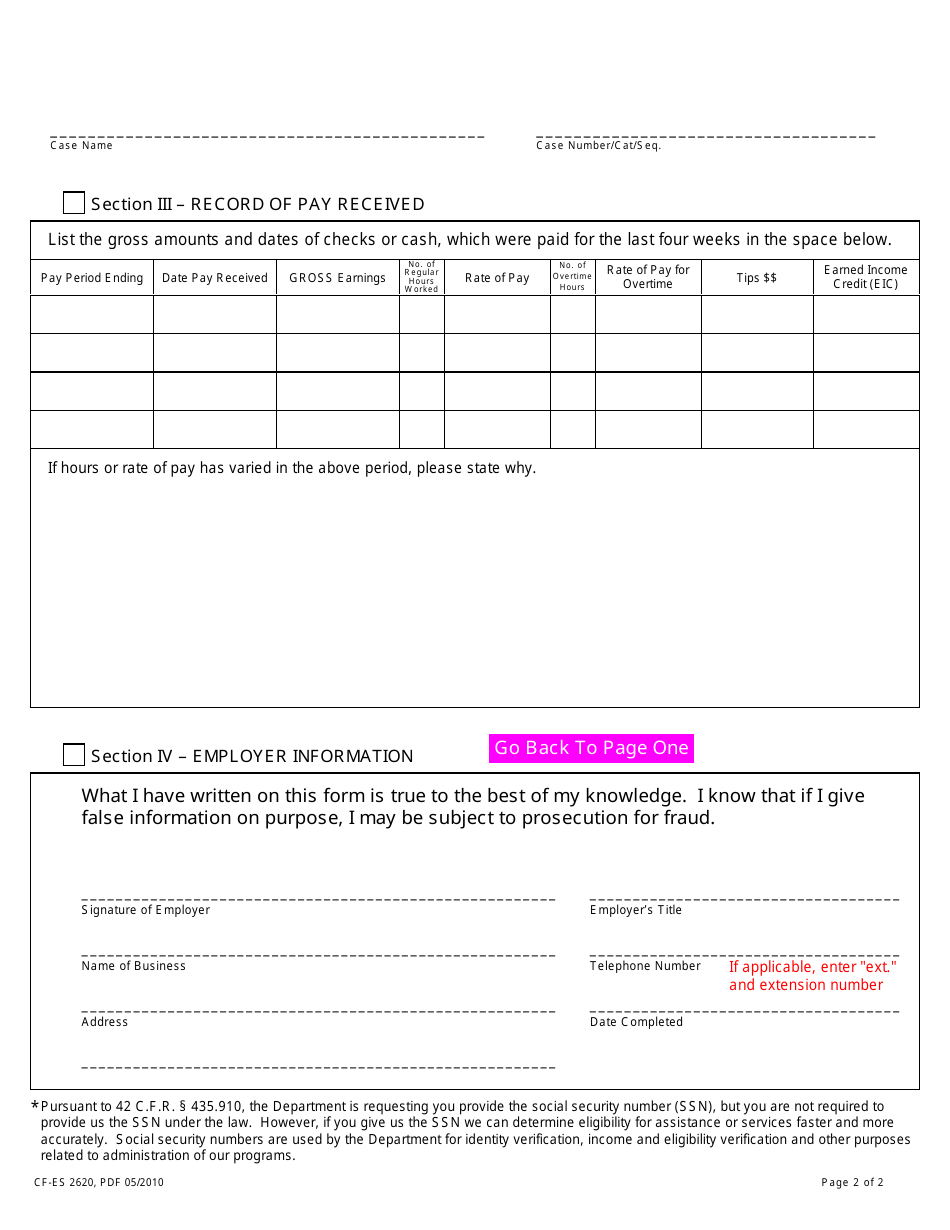

- Record of Pay Received . The document is presented in the form of a timetable, where the employer can list the amounts and checks that were paid to the individual within the last four weeks. To do so, they need to indicate the ending of the pay period, the date when the payment has been received, the rate of pay, tips, etc. If the pay rate or the amount of working hours has changed through the periods described in the timetable, the employer must explain why;

- Employer Information . In the last part of the document, the employer can designate the name of the business, the employer's title, address, and telephone number. To state that everything written in the document is true and correct, the employer can sign the document.

In addition to everything mentioned above, at the end of the document, the employer must certify that they are completing it with valid information. If the information presented in the form is false and the employer put it there intentionally, they can be subject to prosecution for fraud.