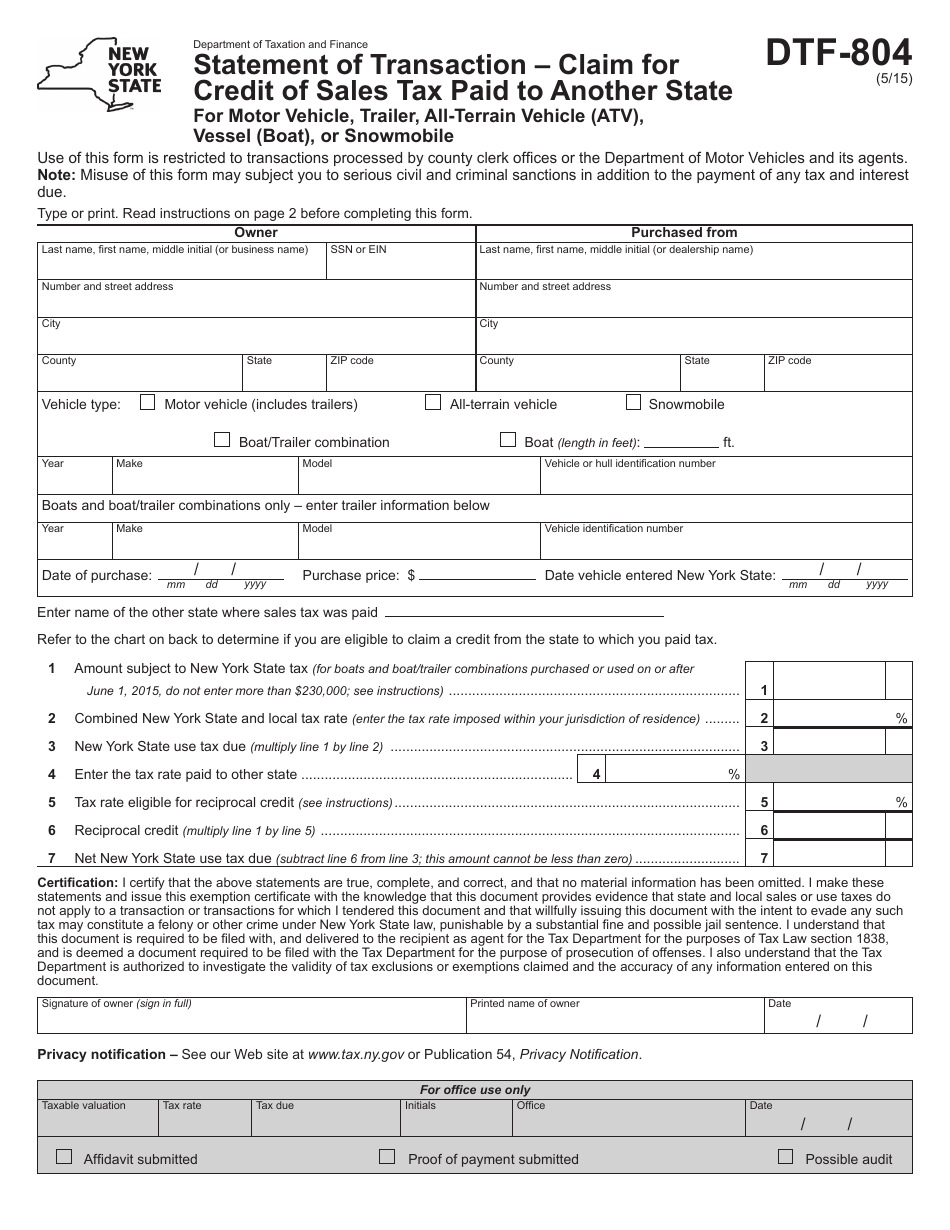

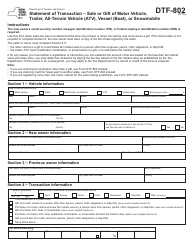

Form DTF-804 Statement of Transaction - Calim for Credit of Sales Tapaid to Another State for Motor Vehicle, Trailer, All'terrain Vehicle (Atv), Vessel (Boat), or Snowmobile - New York

What Is Form DTF-804?

This is a legal form that was released by the New York State Department of Motor Vehicles - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form DTF-804?

A: Form DTF-804 is the Statement of Transaction - Claim for Credit of Sales Tax Paid to Another State for Motor Vehicle, Trailer, All-Terrain Vehicle (ATV), Vessel (Boat), or Snowmobile in New York.

Q: What is the purpose of form DTF-804?

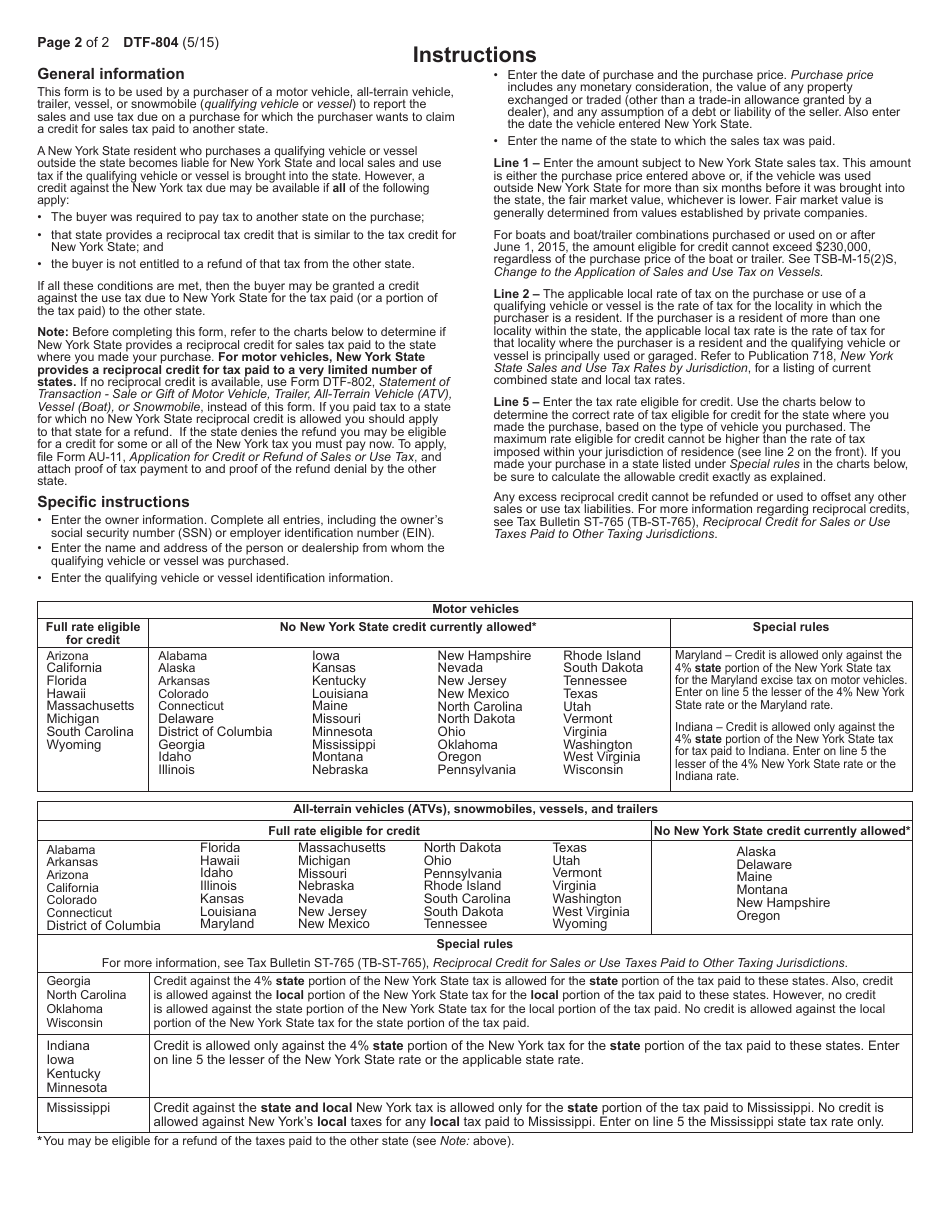

A: The purpose of form DTF-804 is to claim a credit for sales tax paid to another state when purchasing a motor vehicle, trailer, ATV, boat, or snowmobile in New York.

Q: Who can use form DTF-804?

A: Individuals who have purchased a motor vehicle, trailer, ATV, boat, or snowmobile in New York and have paid sales tax to another state can use form DTF-804.

Q: What type of transactions does form DTF-804 cover?

A: Form DTF-804 covers transactions involving motor vehicles, trailers, ATVs, boats, or snowmobiles.

Q: What information is required on form DTF-804?

A: Form DTF-804 requires information about the purchaser, the seller, the vehicle or vessel being purchased, and details of the sales tax paid to another state.

Q: Is there a deadline for filing form DTF-804?

A: Yes, form DTF-804 must be filed within three years from the date of the purchase.

Q: Can I claim a credit for sales tax paid to another country on form DTF-804?

A: No, form DTF-804 is specifically for claiming a credit for sales tax paid to another state, not another country.

Form Details:

- Released on May 1, 2015;

- The latest edition provided by the New York State Department of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DTF-804 by clicking the link below or browse more documents and templates provided by the New York State Department of Motor Vehicles.