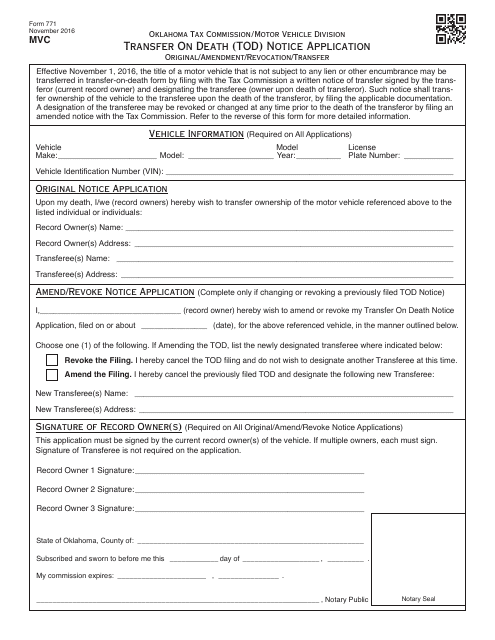

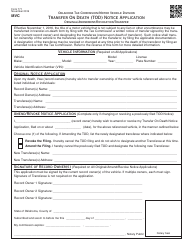

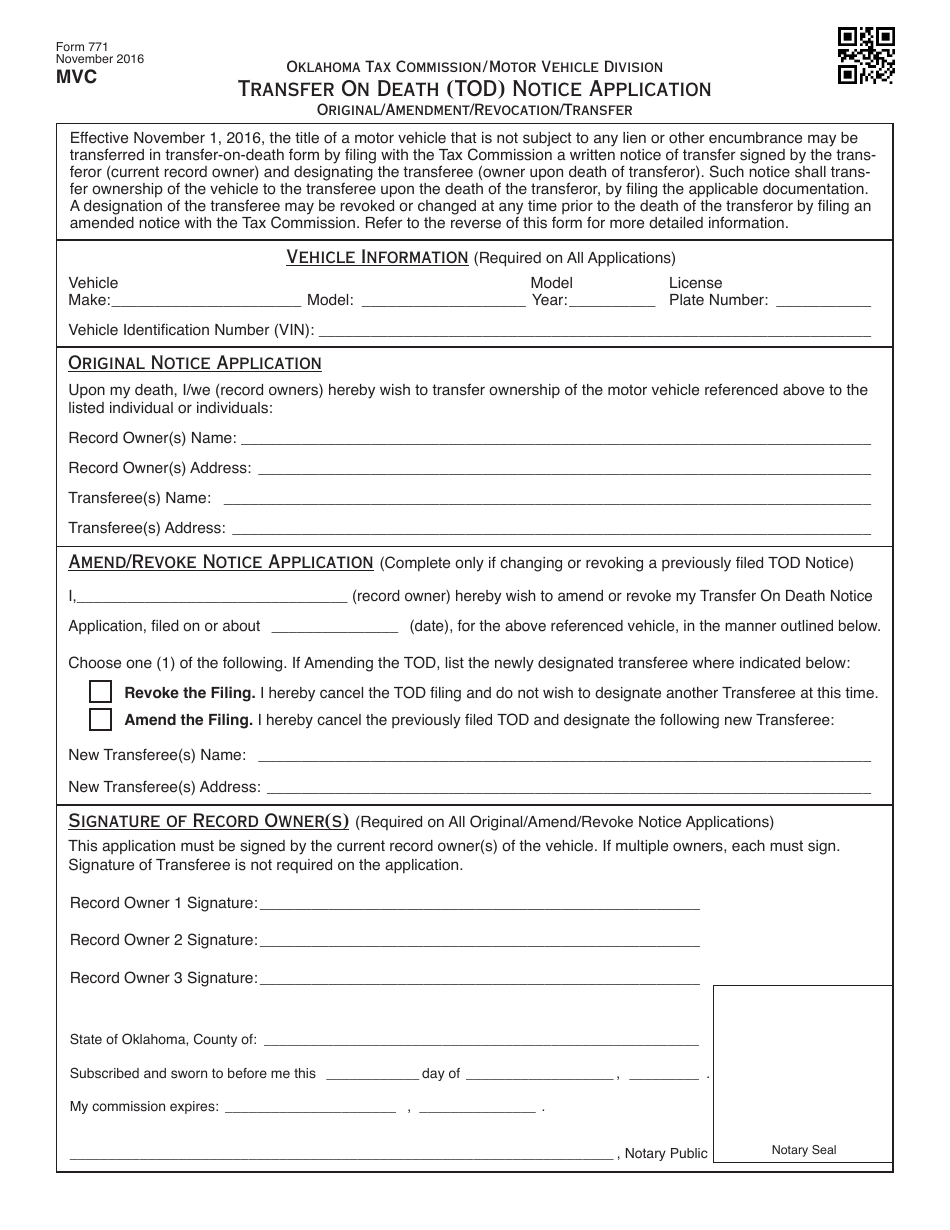

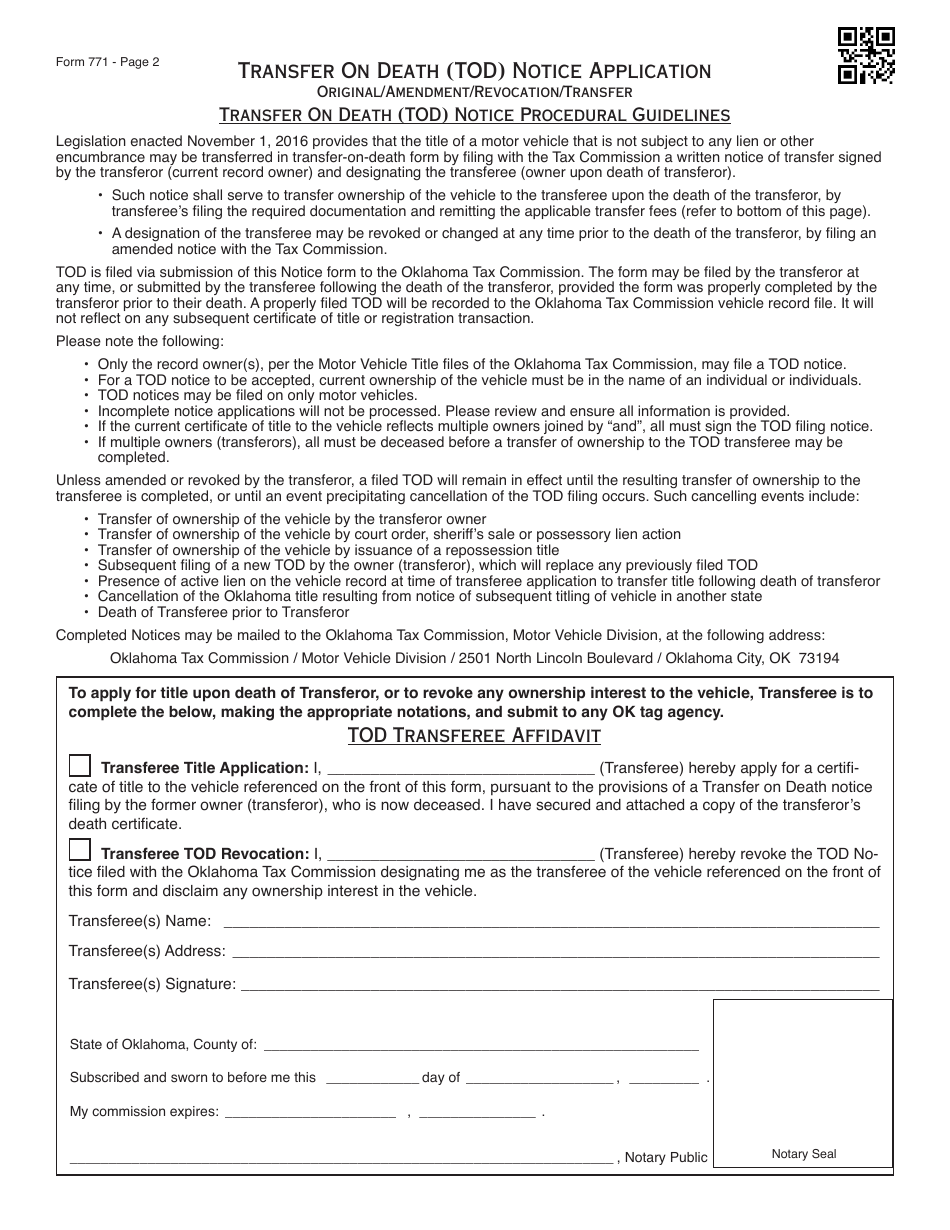

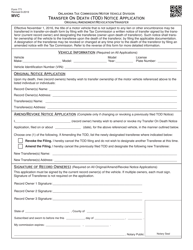

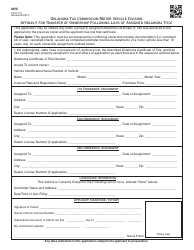

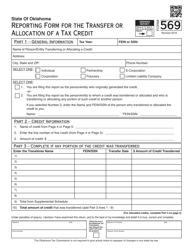

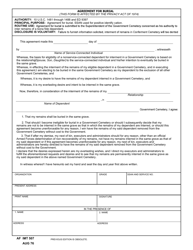

OTC Form 771 Transfer on Death (Tod) Notice Application - Oklahoma

What Is OTC Form 771?

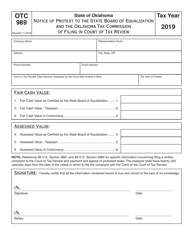

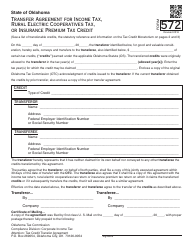

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 771?

A: OTC Form 771 is the Transfer on Death (Tod) Notice Application used in Oklahoma.

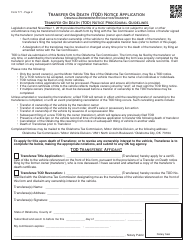

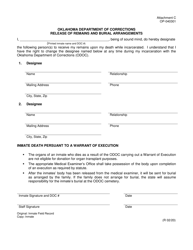

Q: What is a Transfer on Death (Tod) Notice?

A: A Transfer on Death (Tod) Notice is a document that allows the transfer of certain assets to named beneficiaries upon the owner's death.

Q: What information do I need to provide on OTC Form 771?

A: You need to provide detailed information about the asset(s) you want to transfer on death, the beneficiary(s) you want to name, and other relevant details.

Q: Is there a fee for filing OTC Form 771?

A: Yes, there is a filing fee associated with submitting OTC Form 771. The fee amount can vary, so it's best to check with the Oklahoma Tax Commission for the current fee.

Q: Can I revoke a Transfer on Death (Tod) Notice?

A: Yes, you can revoke a Transfer on Death (Tod) Notice by submitting a written revocation form to the Oklahoma Tax Commission.

Q: What happens to the assets mentioned in the Transfer on Death (Tod) Notice after the owner's death?

A: The assets mentioned in the Transfer on Death (Tod) Notice will be transferred directly to the named beneficiaries without going through the probate process.

Form Details:

- Released on November 1, 2016;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 771 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.