This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 3911

for the current year.

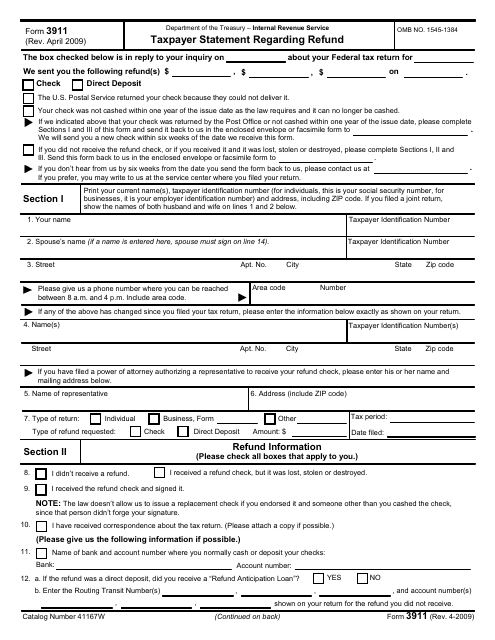

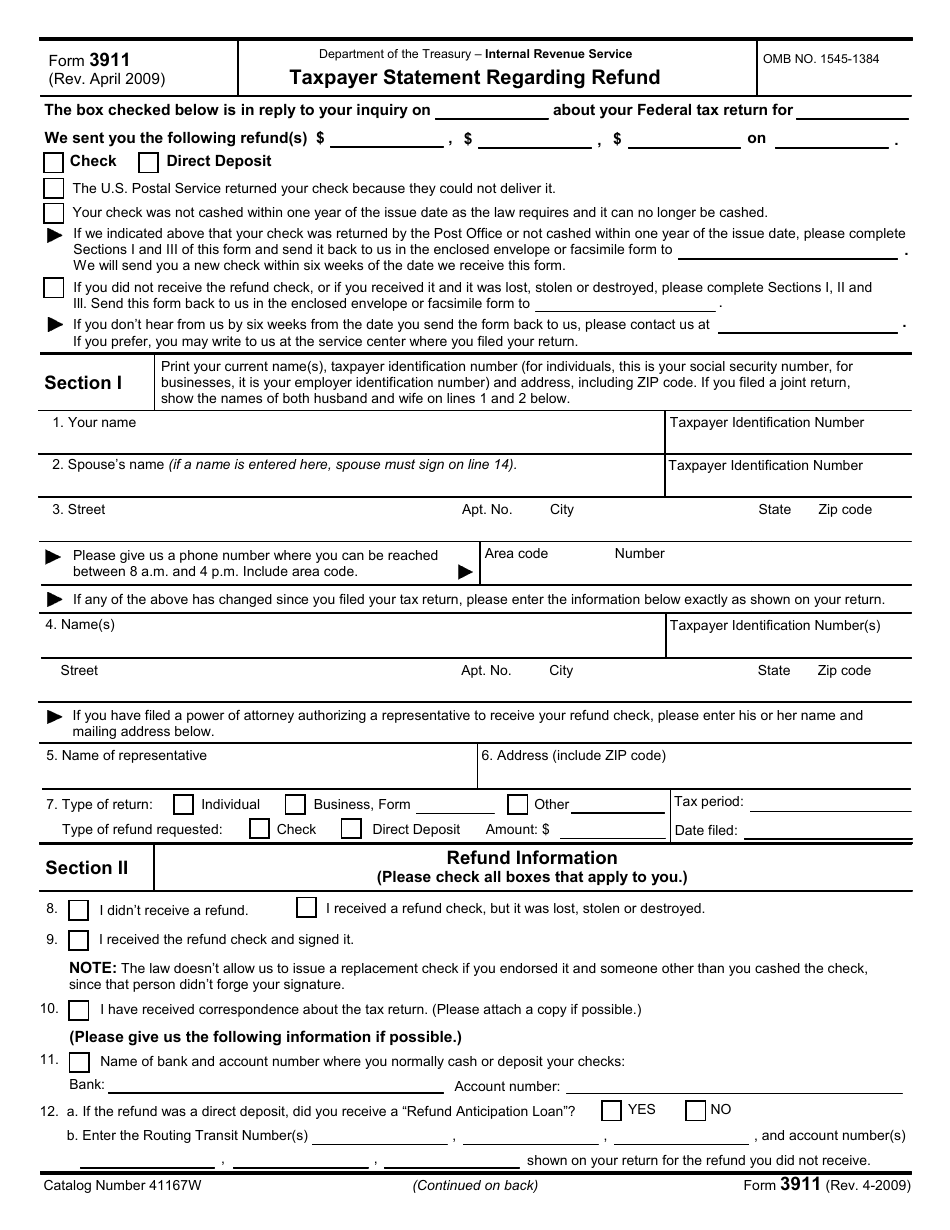

IRS Form 3911 Taxpayer Statement Regarding Refund

What Is IRS Form 3911?

IRS Form 3911, Taxpayer Statement Regarding Refund , is a legal document completed by individuals who want to inquire about the status of an expected refund. Once the Internal Revenue Service (IRS) receives this document from you, they start the replacement process by the information you provided to look into the matter and to confirm you have not received the refund in question. When you file Form IRS 3911, you provide the IRS with an opportunity to trace your refund and replace it if needed.

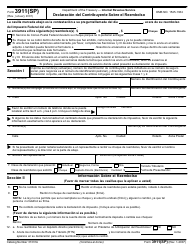

The latest version of the form was issued on April 1, 2009 , with all previous editions obsolete. You can download a fillable Form 3911 through the link below. If you prefer to complete a Spanish version of the document, download IRS Form 3911 (SP), Declaración del Conribuyente Sobre el Reembolso on our website using this link.

How to Fill Out IRS Form 3911?

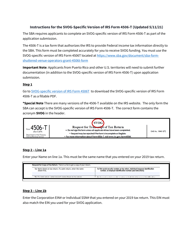

IRS Form 3911 instructions are as follows:

- Write down your full name and taxpayer identification number. If you are married and filing jointly, your spouse's name and taxpayer identification number are also required;

- Indicate your address and daytime telephone number;

- If the representative fills out the document, it is necessary to state the representative's name and address;

- Write down the type of your return and the type of refund you requested. Record its amount, tax period, and the date of filing the initial request;

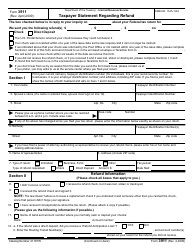

- Describe what happened to your refund - you did not receive it, it was lost, stolen, or destroyed, you received the check and signed it, or you have received correspondence about the tax return. Write down the name of the bank where you normally receive your checks and your account number. Indicate whether you have received a refund anticipation loan and enter the routing transit number and account number from your return for the refund you did not receive. Only provide this information if you did not receive the check or it was lost, stolen, or destroyed;

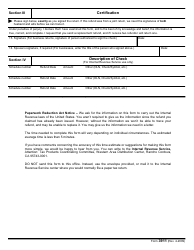

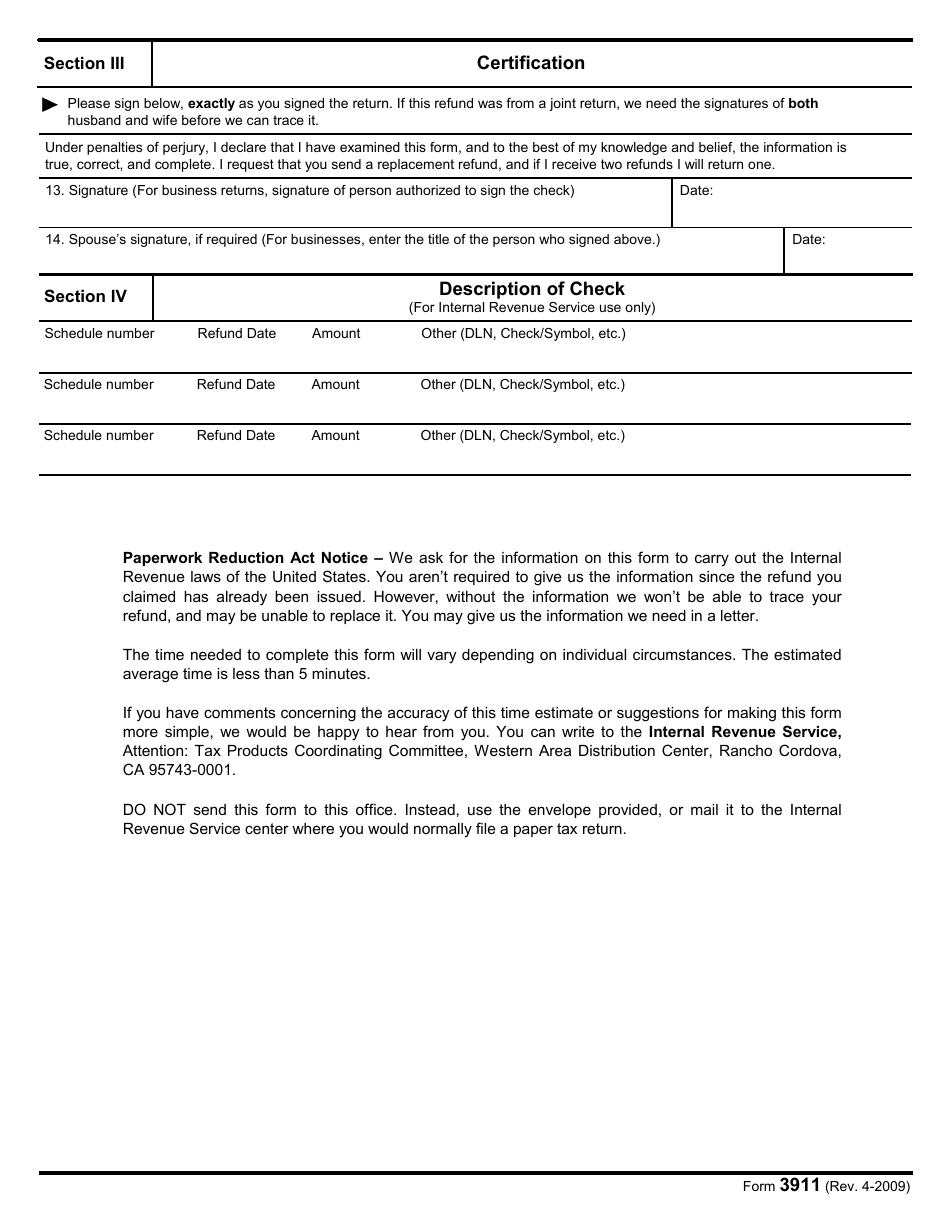

- Certify the statements in the form are true and correct. Sign and date the form. If you file for a business, enter the title of the person who signs the papers.

Where to Mail Form 3911?

Usually, the IRS sends Form IRS 3911 to taxpayers who have contacted the IRS because they have not received their refunds. The IRS will enclose an envelope with the correct return address for the applicant to use to send the form back to the IRS. However, if you have not received these instructions from the IRS, you may direct the form to the IRS center where you normally submit a paper tax return. Some individuals prefer to fax their tax returns and statements, but you can only receive a fax number from the IRS representative who specifically requests information from you. So, unless the IRS provides you with an IRS Form 3911 fax number, you cannot fax it.