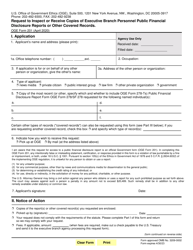

This version of the form is not currently in use and is provided for reference only. Download this version of

OGE Form 450

for the current year.

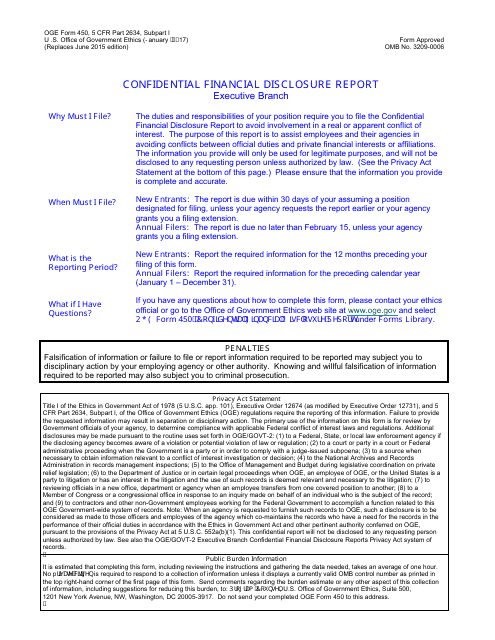

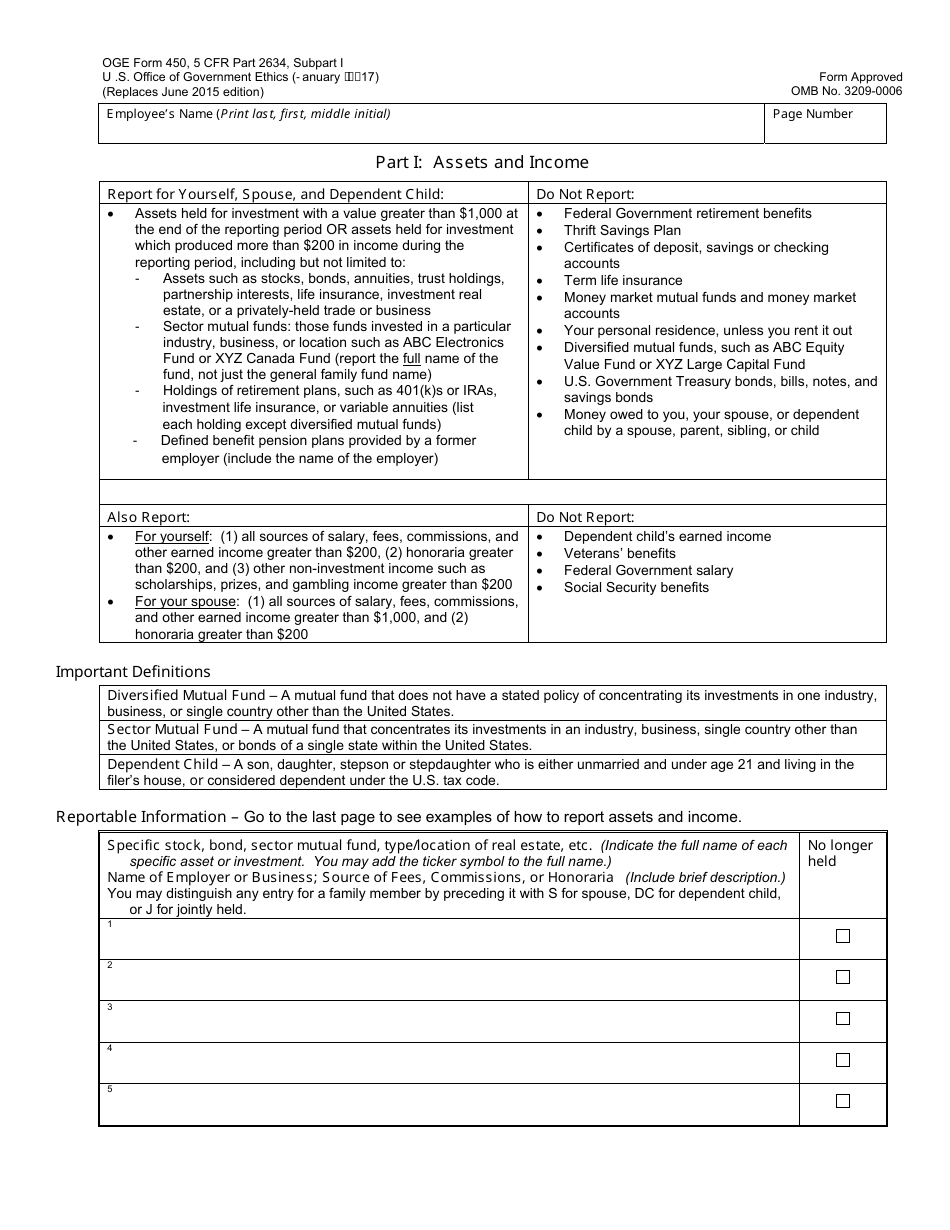

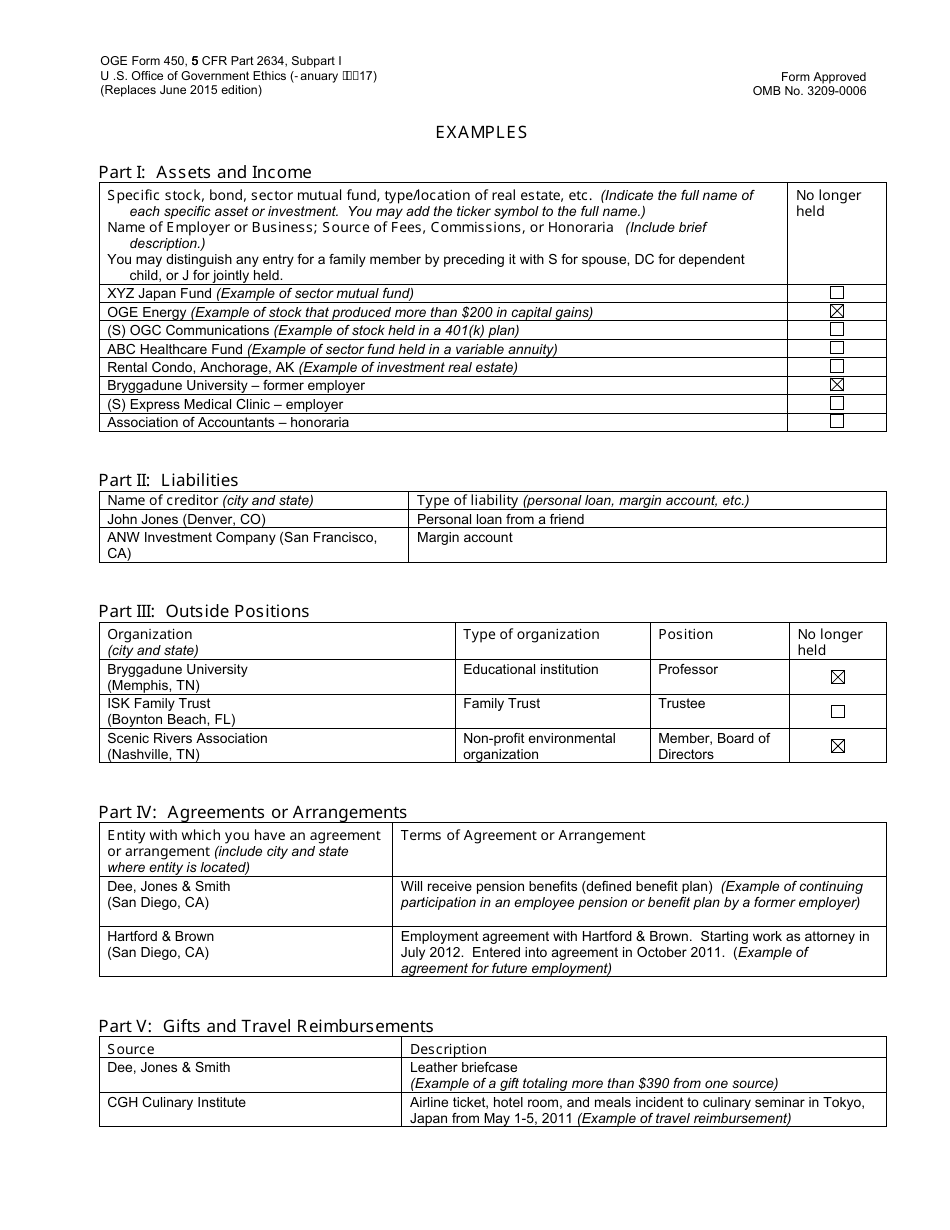

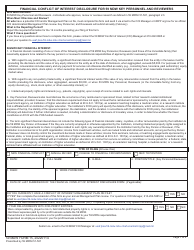

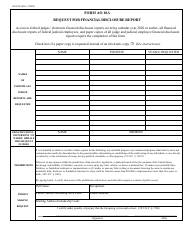

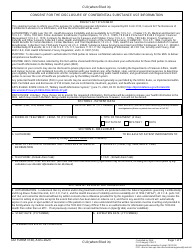

OGE Form 450 Confidential Financial Disclosure Report

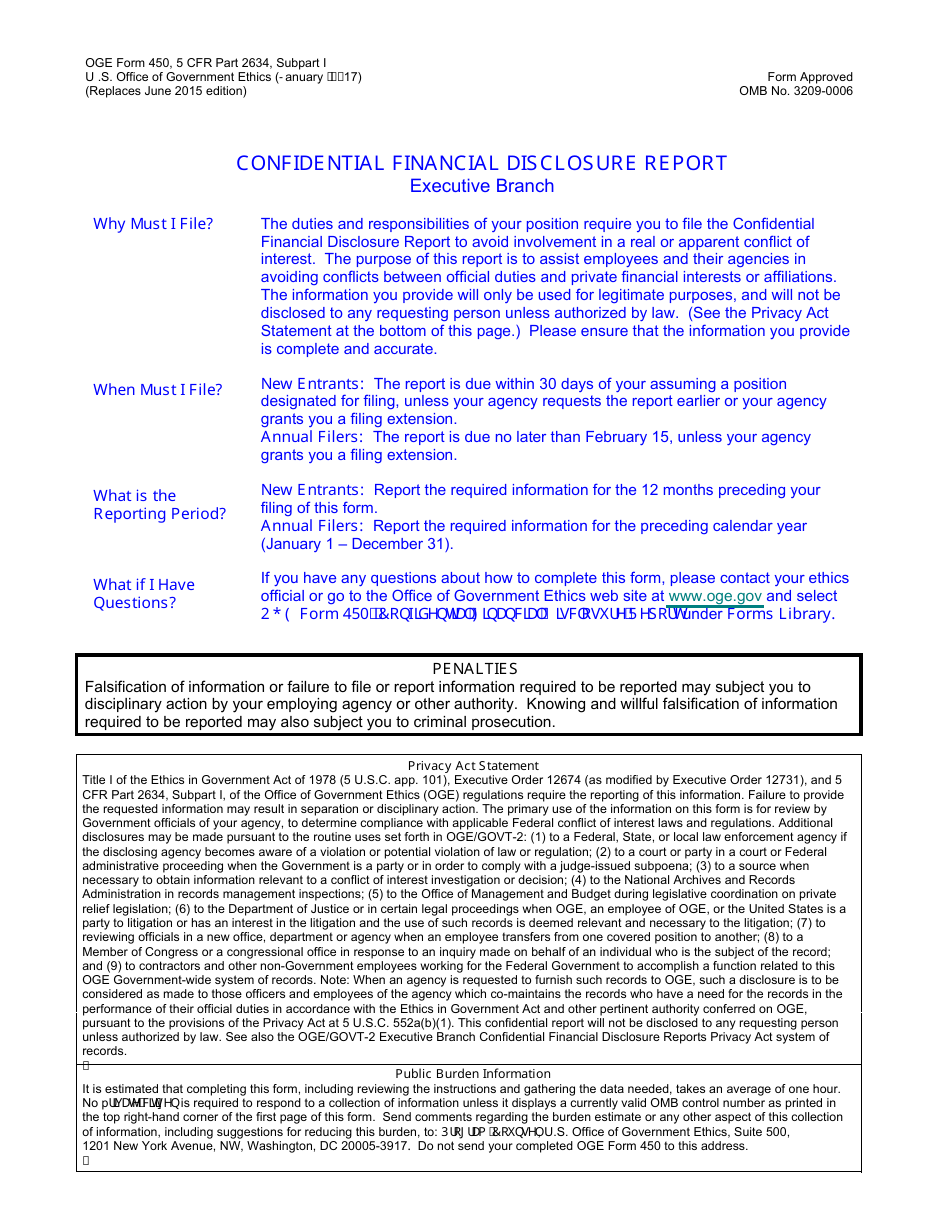

What Is OGE Form 450?

This is a legal form that was released by the U.S. Office of Government Ethics on January 1, 2017 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the OGE Form 450?

A: The OGE Form 450 is a Confidential Financial Disclosure Report.

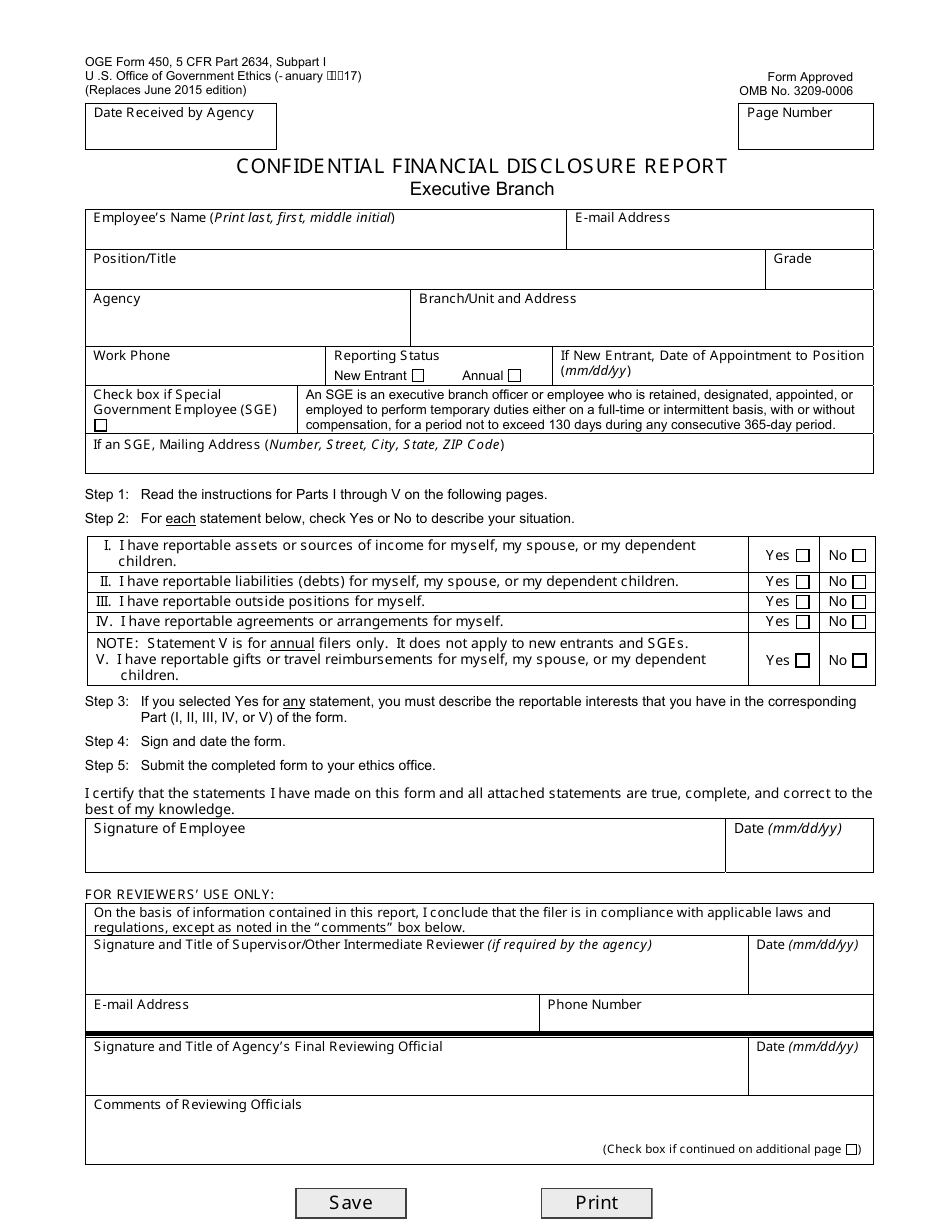

Q: Who is required to file the OGE Form 450?

A: Certain federal employees, including high-level government officials, are required to file the OGE Form 450.

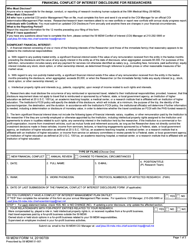

Q: Why is the OGE Form 450 filed?

A: The OGE Form 450 is filed to disclose financial interests that could potentially create conflicts of interest.

Q: Is the OGE Form 450 available to the public?

A: No, the OGE Form 450 is not available to the public. It is considered confidential.

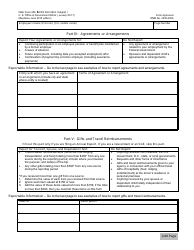

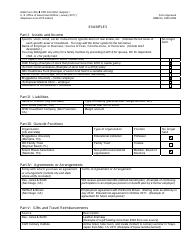

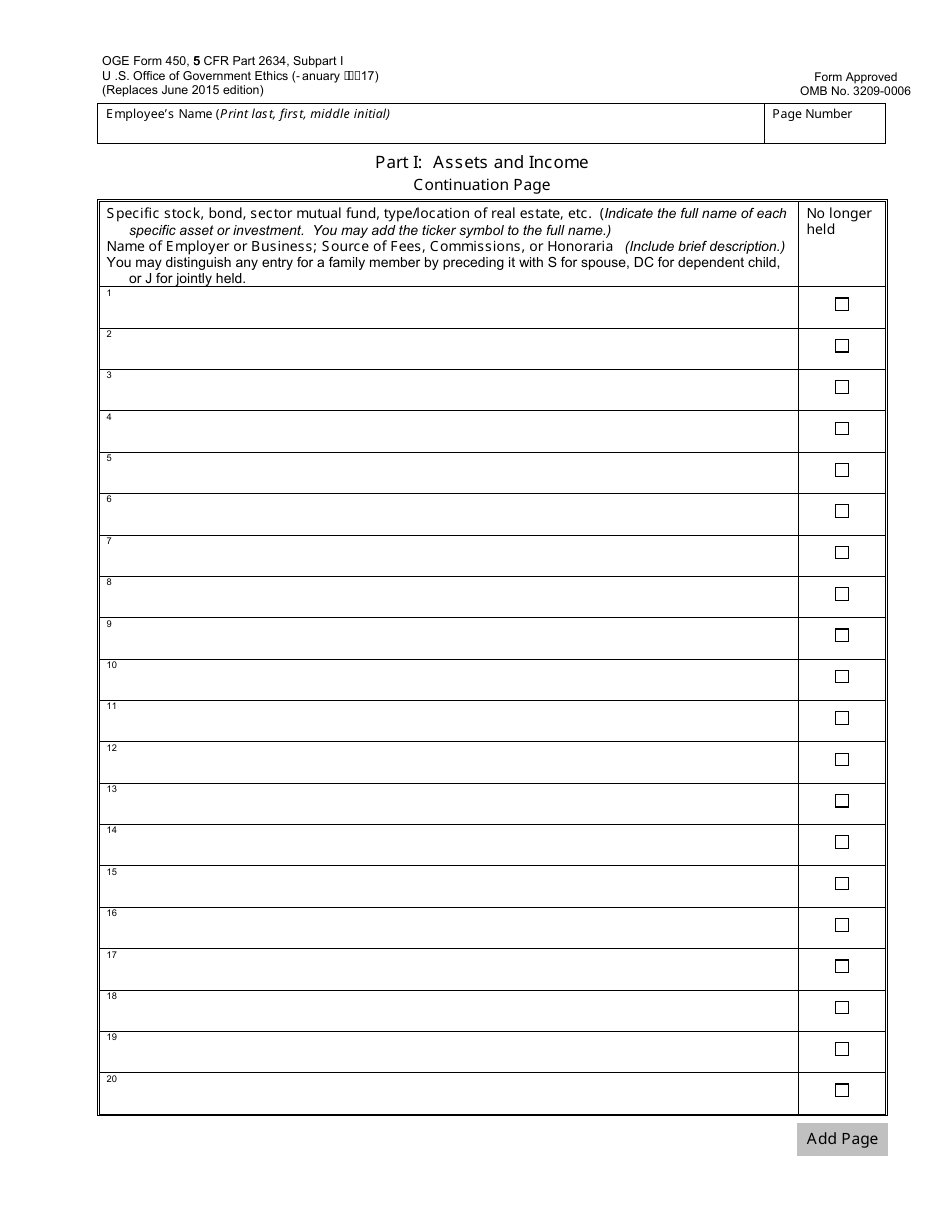

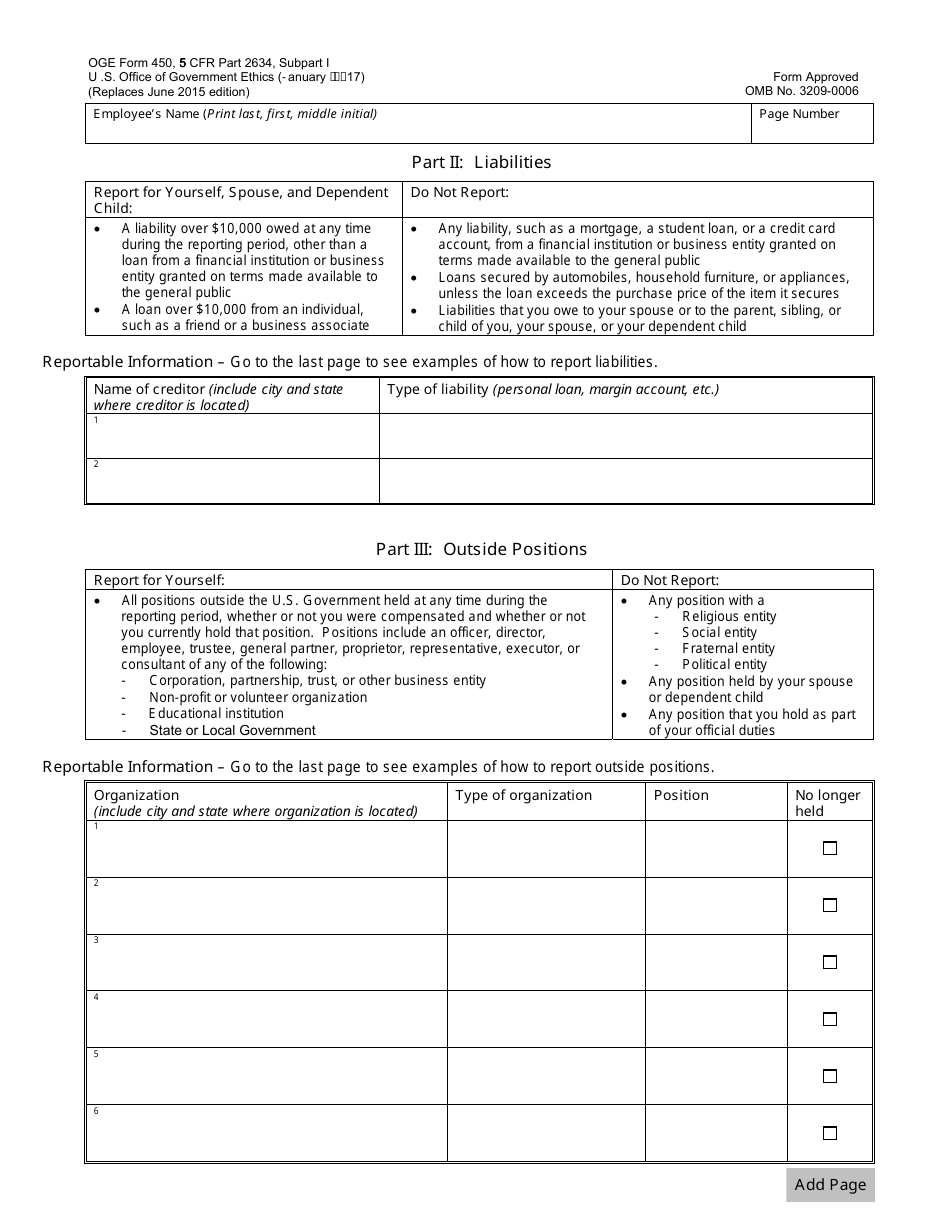

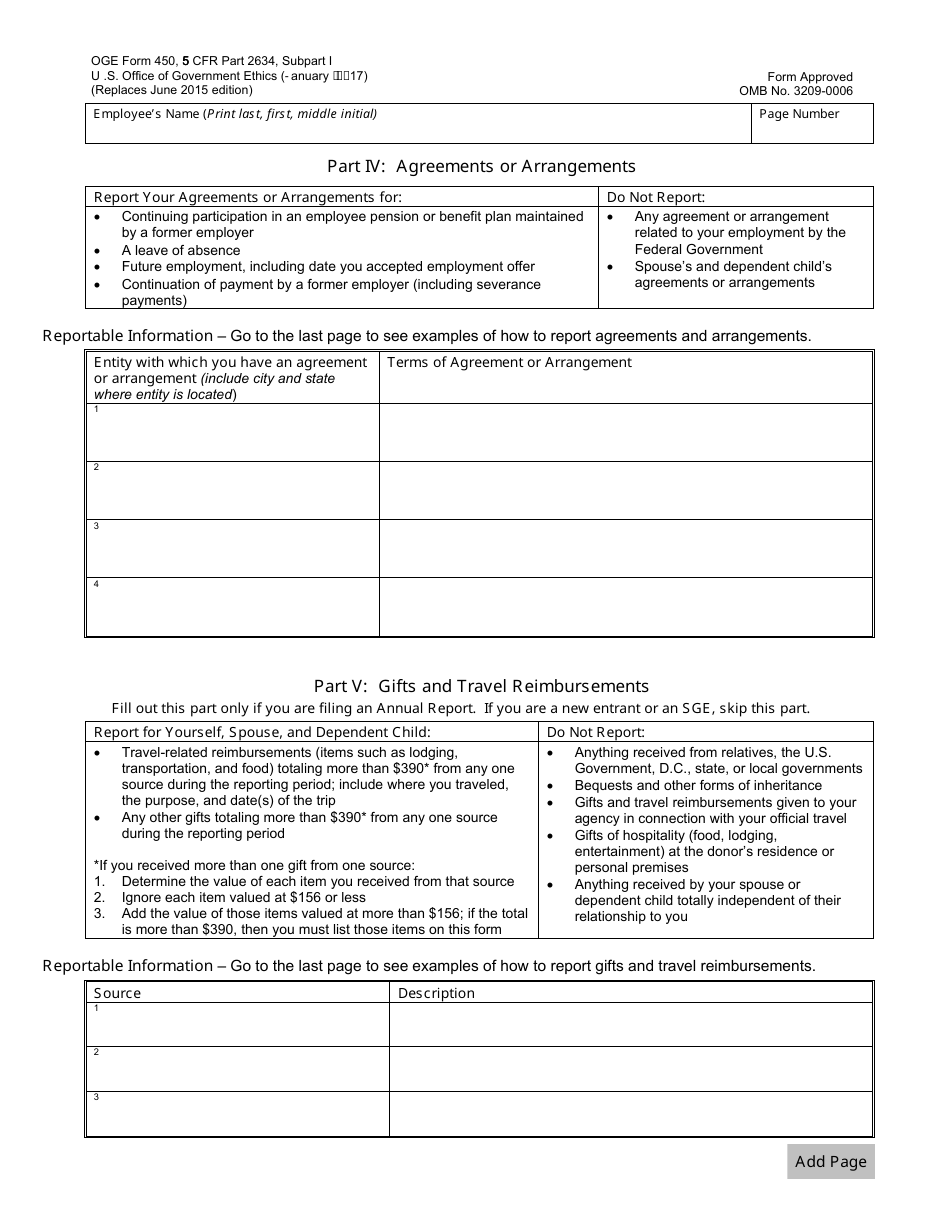

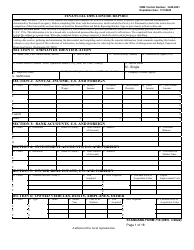

Q: What type of information is disclosed on the OGE Form 450?

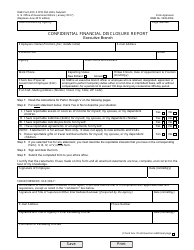

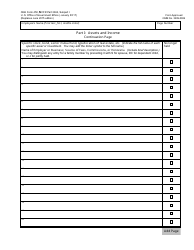

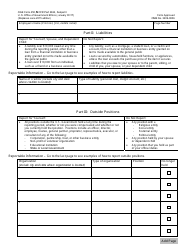

A: The OGE Form 450 requires the disclosure of assets, income, liabilities, and certain outside activities.

Q: What is the purpose of the OGE Form 450?

A: The purpose of the OGE Form 450 is to ensure transparency and prevent conflicts of interest in the federal government.

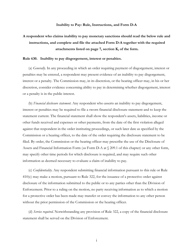

Q: Are there any penalties for not filing the OGE Form 450?

A: Yes, failure to file or filing false information on the OGE Form 450 can result in disciplinary actions or criminal penalties.

Q: Who oversees the filing of the OGE Form 450?

A: The Office of Government Ethics (OGE) oversees the filing and compliance of the OGE Form 450.

Form Details:

- Released on January 1, 2017;

- The latest available edition released by the U.S. Office of Government Ethics;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OGE Form 450 by clicking the link below or browse more documents and templates provided by the U.S. Office of Government Ethics.