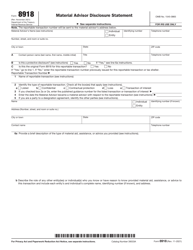

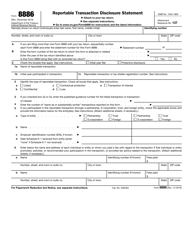

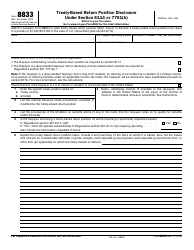

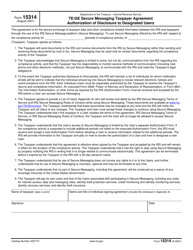

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8275

for the current year.

Instructions for IRS Form 8275 Disclosure Statement

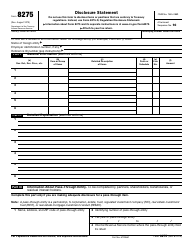

This document contains official instructions for IRS Form 8275 , Disclosure Statement - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8275 is available for download through this link.

FAQ

Q: What is IRS Form 8275?

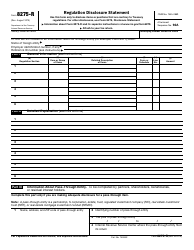

A: IRS Form 8275 is a Disclosure Statement used to disclose positions that are contrary to the tax regulations.

Q: When should I use IRS Form 8275?

A: You should use IRS Form 8275 if you are taking a position on your tax return that goes against the IRS regulations and you want to disclose that position.

Q: What is the purpose of the IRS Form 8275?

A: The purpose of IRS Form 8275 is to provide a disclosure of positions that may not be in compliance with the tax regulations, ensuring transparency and avoiding penalties.

Q: Is it mandatory to file IRS Form 8275?

A: Filing IRS Form 8275 is not always mandatory, but it is strongly recommended if you are taking a position that may be questionable under the tax regulations.

Q: What information is required on IRS Form 8275?

A: On IRS Form 8275, you need to provide your identification information, describe the position you are taking, explain the basis for that position, and disclose any relevant facts or authorities.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.