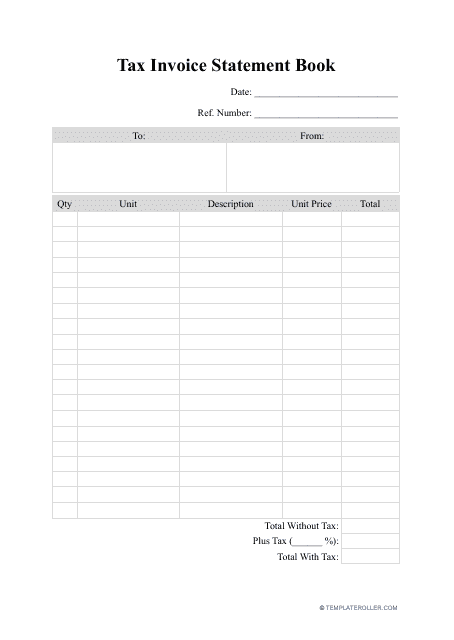

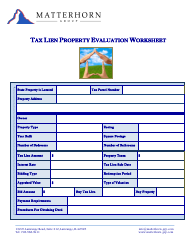

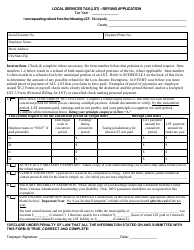

Tax Invoice Statement Book Template

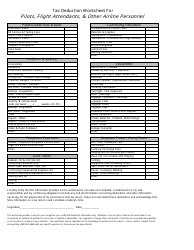

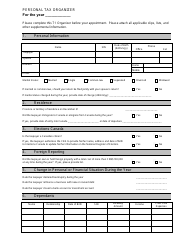

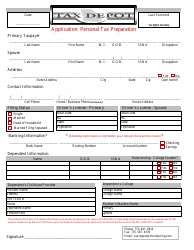

A Tax Invoice Statement Book Template is used to generate invoices for goods and services provided by a business. It provides a standardized format for documenting and tracking sales transactions, including the amount owed by the customer, applicable taxes, and other relevant details. This template helps businesses maintain accurate financial records and ensure compliance with tax laws and regulations. It is essential for businesses to issue tax invoices to their customers for accounting and tax reporting purposes.

In the United States, there is no specific entity or person that files a "Tax Invoice Statement Book Template." The template itself is typically used by businesses to keep track of their invoices and aid in their tax reporting. It is the responsibility of each individual business owner to maintain accurate records and use appropriate templates to comply with tax regulations.

FAQ

Q: What is a tax invoice?

A: A tax invoice is a document that provides details of a sale or service transaction, including the amount of tax charged. It is typically issued by the seller to the buyer for record-keeping purposes and may be required for tax reporting.

Q: What information should a tax invoice include?

A: A tax invoice should typically include the seller's name, address, and contact information, the buyer's name and address, a unique invoice number, the date of the transaction, a description of the goods or services provided, quantity, price per unit, and the total amount including any applicable taxes.

Q: Are tax invoices mandatory for all sales transactions?

A: In the United States, tax invoices are not always mandatory for all sales transactions. However, they are commonly used in business-to-business transactions and may be required for certain types of sales, such as those involving taxable goods or services.

Q: Are there any specific requirements for tax invoices?

A: The requirements for tax invoices can vary depending on the state and the type of transaction. In general, it is important to ensure that the invoice includes all the necessary information to meet the state's tax laws and regulations.