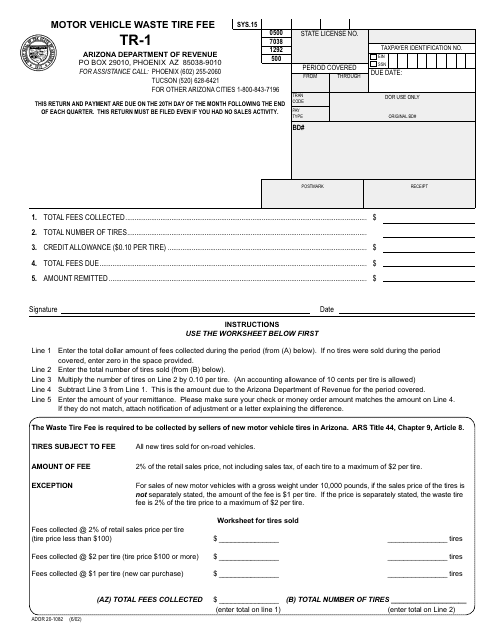

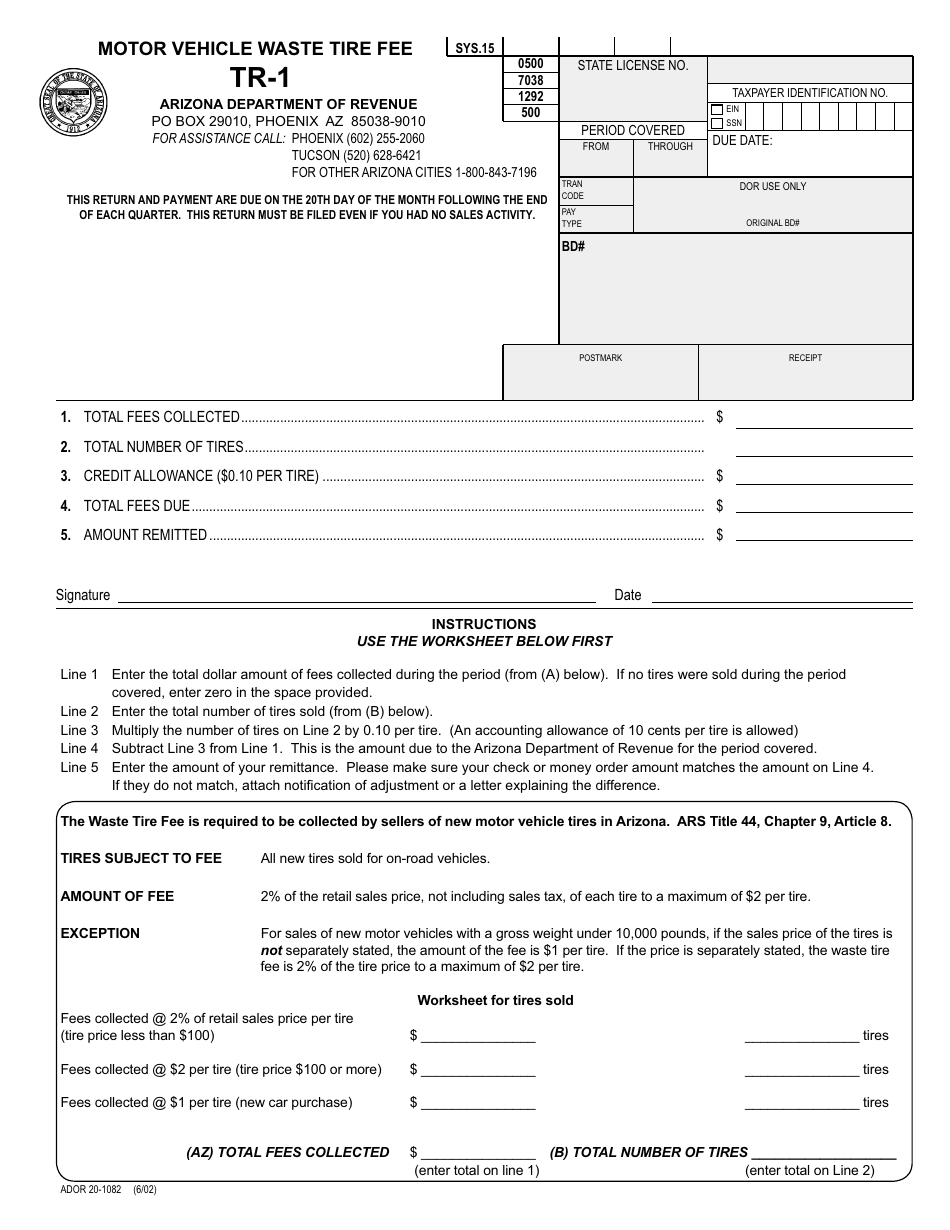

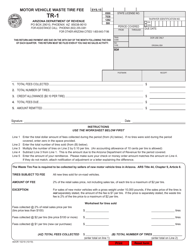

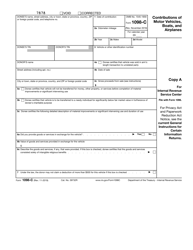

Form ADOR20-1082 (TR-1) Motor Vehicle Waste Tire Fee - Arizona

What Is Form ADOR20-1082 (TR-1)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ADOR20-1082 (TR-1)?

A: Form ADOR20-1082 (TR-1) is a document used to report and pay the Motor VehicleWaste Tire Fee in Arizona.

Q: What is the Motor Vehicle Waste Tire Fee?

A: The Motor Vehicle Waste Tire Fee is a fee imposed on the retail sale of new tires in Arizona to help support tire recycling programs.

Q: Who needs to file Form ADOR20-1082 (TR-1)?

A: Anyone engaged in the retail sale of new tires in Arizona needs to file Form ADOR20-1082 (TR-1) and pay the Motor Vehicle Waste Tire Fee.

Q: How often do I need to file Form ADOR20-1082 (TR-1)?

A: Form ADOR20-1082 (TR-1) needs to be filed and the fee needs to be paid on a monthly basis.

Q: What is the deadline for filing Form ADOR20-1082 (TR-1)?

A: Form ADOR20-1082 (TR-1) and the associated fee are due on or before the 20th day of the month following the reporting period.

Q: What happens if I don't file Form ADOR20-1082 (TR-1) or pay the fee?

A: Failure to file Form ADOR20-1082 (TR-1) or pay the Motor Vehicle Waste Tire Fee can result in penalties and interest being assessed by the Arizona Department of Revenue.

Q: Are there any exemptions or exceptions to the Motor Vehicle Waste Tire Fee?

A: Yes, certain entities and transactions may be exempt from the fee. It is recommended to consult the Arizona Department of Revenue or a tax professional for specific details.

Q: Is there any additional documentation required to be submitted with Form ADOR20-1082 (TR-1)?

A: No, Form ADOR20-1082 (TR-1) does not require any additional documentation to be submitted at the time of filing.

Form Details:

- Released on June 1, 2002;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ADOR20-1082 (TR-1) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.